*All on-chain data is dated as of 12:00 a.m. EST on Sunday, July 7th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week (June.30-July.6).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #Employment

Traders were recently betting that there is a 78% chance that the Fed will cut rates by its September meeting. PHOTO: TING SHEN/BLOOMBERG NEWS

1 Macro Market Overview

Nasdaq, S&P 500 Extend Record Run After Jobs Report. According to WSJ, The Nasdaq Composite and S&P 500 closed out the week at fresh highs after new data on the labor market shored up confidence that the Federal Reserve can soon cut rates. The gains extended a run of record closes for the two indexes, with the tech-heavy Nasdaq adding 0.9% Friday to bring its weekly advance to 3.5%. The S&P 500 rose 0.5% for the day, and 2% for the week. The Dow Jones Industrial Average edged higher, and was up 0.7% for the week.

The U.S. Department of Labor released data last week showing that non-farm payrolls increased by 206,000 in June, surpassing the expected 190,000 but significantly down from the previous month's 272,000. The unemployment rate rose to 4.1% in June, up from the expected and previous rate of 4%, marking the highest level since November 2021. These employment figures indicate a significant cooling of the labor market.

Last Wednesday, the Federal Reserve released the minutes from the Federal Open Market Committee (FOMC) meeting held on June 11-12.

Policymakers noted that although inflation is moving in the right direction, the pace is still too slow to warrant a rate cut. The minutes revealed a divide among central bank officials involved in setting interest rates, with some indicating a willingness to raise rates further if necessary, while others emphasized the need to be prepared for economic slowdown or a weakening job market. However, the FOMC decided to keep rates unchanged at the end of the meeting. Participants generally agreed that it is not yet appropriate to cut rates and that more favorable data is needed to confirm that inflation is steadily falling towards the 2% target level.

Furthermore, web3-related stocks had a mixed performance last week. COIN and MARA saw slight increases of 0.6% and 1.8%, respectively, while MSTR experienced a decline of 6.9%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

Last week, the U.S. Dollar Index (DXY) began a steady decline from Tuesday, influenced further by cooling inflation data, and closed at 104.875 on Friday. This marked a significant drop from 105.849 seven days earlier.

DXY (Source: TradingView)

According to the latest data from the Chicago Mercantile Exchange (CME), currently, about 8% of investors believe that the Federal Open Market Committee (FOMC) will implement the first rate cut of the year at its next meeting in July, while nearly 92% of investors expect the interest rates to remain unchanged.

Left: EFFR, Right: Target Rate Probabilities for July 2024 Fed Meeting (Source: Federal Reserve Bank of New York, CME FedWatch Tool)

The yield on the benchmark 10-year U.S. Treasury note (US10Y) followed a similar trend to DXY, closing at 4.282% on Friday, down from 4.400% a week earlier.

US10Y (Source: TradingView)

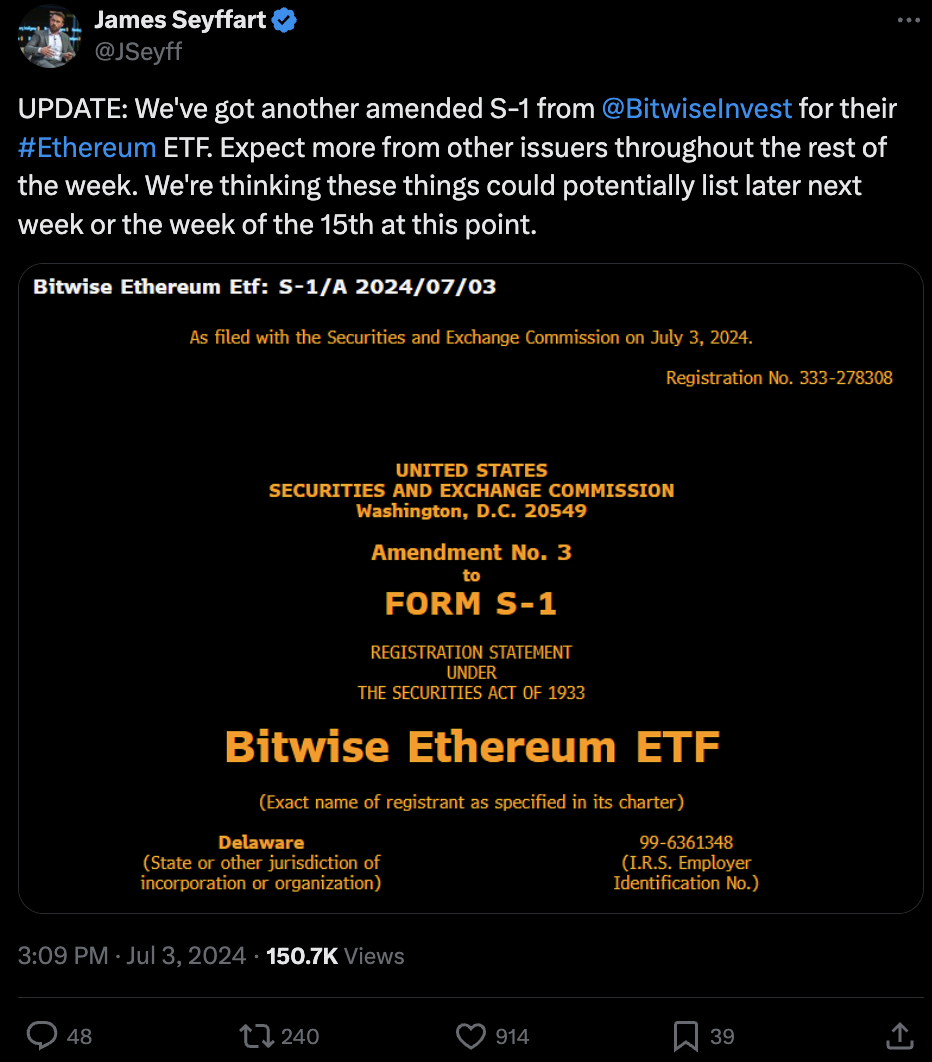

Bloomberg Analyst: Ethereum Spot ETF May Begin Trading on July 15. Bloomberg analyst James Seyffart tweeted that Bitwise Invest has once again submitted a revised Ethereum ETF S-1 form, and more issuers are expected to submit the form this week. Analysts believe that an Ethereum spot ETF product might launch in the latter part of next week or during the week of July 15.

In a filing submitted to the U.S. Securities and Exchange Commission on July 3, Bitwise preemptively amended its S-1 registration statement for its Ethereum spot ETF, which includes a waiver of the sponsorship fees for the first $500 million of trust assets for the first six months. The filing does not specify an exact launch date for listing and trading on the New York Stock Exchange Arca but states that it will commence as soon as practicable after the registration becomes effective.

(Source: Twitter@JSeyff)

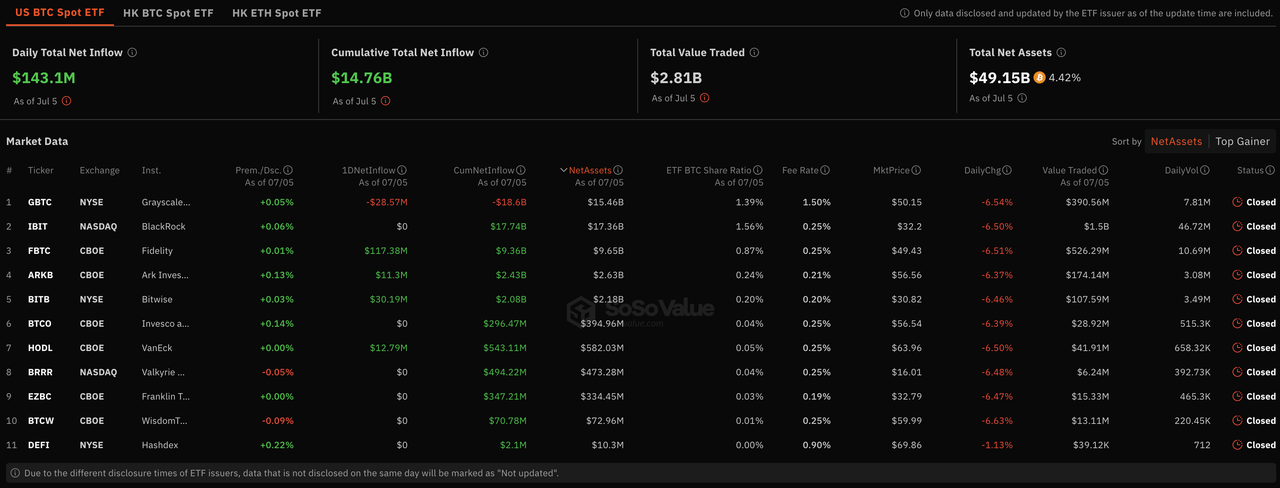

As of last week, the cumulative total net inflow for U.S. Bitcoin spot ETFs stood at $14.52 billion, with a net inflow of over $200 million in the past seven days. Currently, the total net assets of these ETFs amount to $49.15 billion, accounting for 4.4% of Bitcoin's market value. Last week, Bitcoin spot ETFs saw overall net inflows, with only minor net outflows occurring on Tuesday and Wednesday. Looking at the data from last Friday, Grayscale's GBTC experienced a net outflow of $29 million. Fidelity's FBTC saw a net outflow of $117 million. ARK's ARKB had a net inflow of $11 million. The performance of Bitcoin spot ETFs was poor over the past weeks, but after experiencing significant net outflows last Monday, they showed net inflows for four consecutive days, although the inflow amounts were relatively small.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

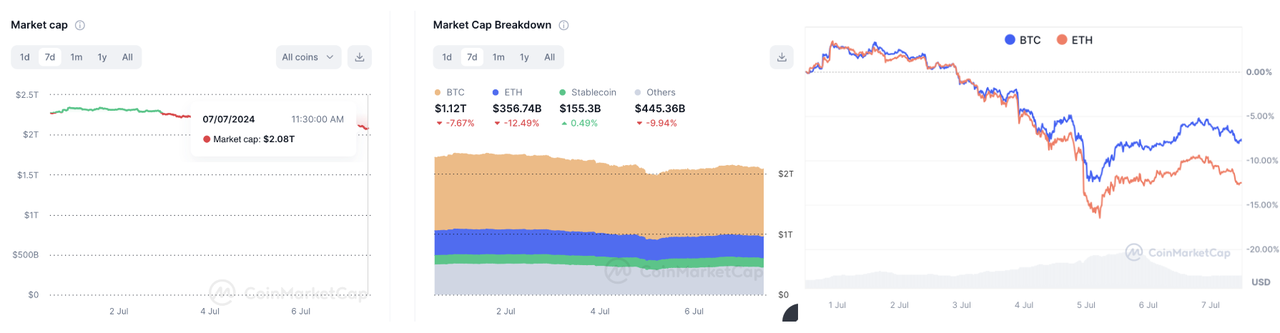

Last week, the total market capitalization of the cryptocurrency market continued to decline, with over $300 billion flowing out over seven days, bringing the current total market cap down to $2.08 trillion. Bitcoin and Ethereum fell steadily at the beginning of the week, with Bitcoin dropping more than 10% on Friday and Ethereum over 15%. The pressure on crypto assets eased slightly with the release of cooling employment data on Friday. As of early July 7th, Bitcoin's spot price was $58,096, down nearly 6% over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,062, down nearly 10% over the same period. Additionally, Bitcoin and Ethereum's market capitalizations were approximately $1.1 trillion and $356.7 billion, respectively, having shrunk by 8% and 12% over the week. They currently account for about 53% and 17% of the total market cap, respectively, with the market share gap between them remaining stable.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

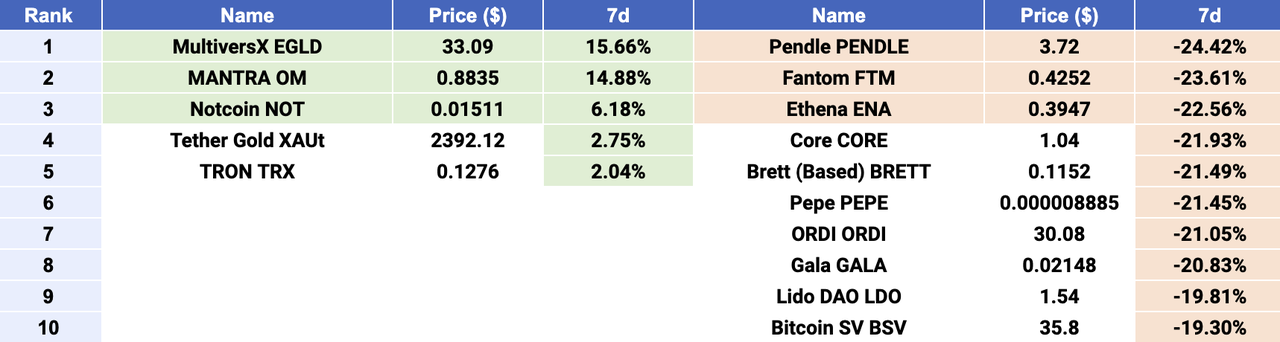

$EGLD, $OM and $NOT emerged as Top 3 gainers, while $PENDLE, $FTA, and $ENA were Top 3 losers. Last week, the top 100 cryptocurrency projects were negatively impacted by the high inflation environment, resulting in poor performance, with only five tokens showing positive growth. Among these, projects in the Real World Assets (RWA) sector stood out. MultiversX ($EGLD) is a blockchain protocol that offers true horizontal scalability by using all aspects of sharding (Network, Transaction & State). Its smart contracts execution platform is reportedly capable of up to 100,000 transactions per second, 6-second latency, and a $0.002 transaction cost. Recently, MultiversX announced a partnership with Entangle to provide interoperability and connectivity for MultiversX, thereby promoting the adoption of general data non-financial use cases such as RWA and DePIN on MultiversX. MANTRA($OM) is a Security first RWA Layer 1 Blockchain, capable of adherence and enforcement of real-world regulatory requirements. Built for Institutions and Developers, MANTRA offers a Permissionless Blockchain for Permissioned applications. The RWA industry benefits from the growing trend of converting physical assets into digital tokens, allowing fractional ownership and broader access. The significant price increase of MANTRA is partly due to successful funding rounds and the launch of programs like the ambassador program and incentivized testnet. Notcoin ($NOT) started as a viral Telegram game that onboarded many users into web3 through a tap-to-earn mining mechanic. Its rise may be partly attributed to a rebound following three consecutive weeks of decline.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

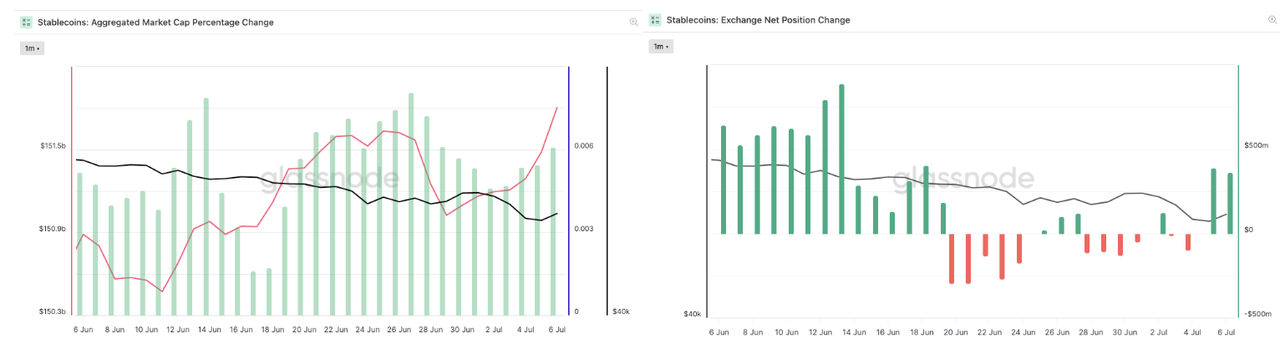

Last week, the growth rate of stablecoin supply accelerated, reaching nearly $1.52 trillion. Over the past seven days, the net change in stablecoin holdings continued to show positive growth, with the net growth rate rebounding. Despite the significant outflows from the cryptocurrency market last week, the stablecoin market cap is at an all-time high. Observing the net holdings of stablecoins on exchanges over the past week, the overall trend oscillated between net inflows and outflows, indicating a lack of momentum in the cryptocurrency market, with crypto assets still under pressure due to high inflation.

Stablecoins Market Cap (Data: Glassnode)

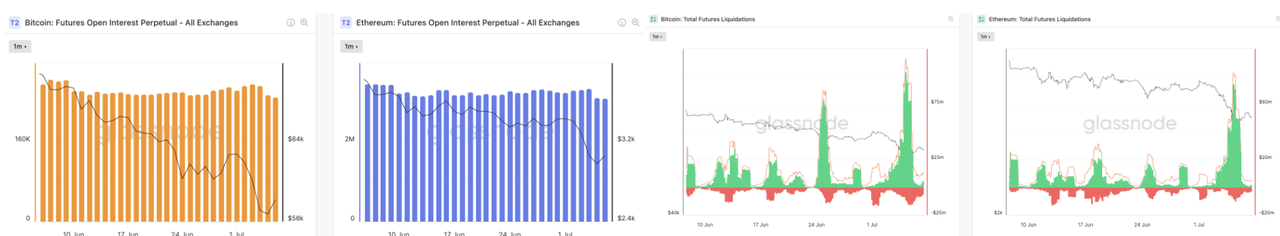

In the derivatives market, the open interest of Bitcoin and Ethereum perpetual contracts decreased over the past seven days. As Bitcoin and Ethereum experienced short-term drops of over 10% and 15%, respectively, last week, the open interest in perpetual contracts significantly declined. The liquidation data for last week aligns with the trends in cryptocurrency prices, with large amounts of long positions being liquidated, peaking at over $100 million for Bitcoin and $75 million for Ethereum. This data suggests significant volatility in the current market.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

In the decentralized finance (DeFi) market, the total value locked (TVL) continued to decline last week, reaching $86 billion. Over the past seven days, the trading volume on decentralized exchanges (DEXs) increased slightly to $38.9 billion, up 16% from the previous week. The market share gap between DEXs and centralized exchanges (CEXs) narrowed, with DEXs now accounting for 19% of total CEX trading volume. Among the top ten blockchain projects by TVL, most experienced significant declines in TVL over the past week. Notably, Solana saw a rebound of over 26% after consecutive declines, making it the only gainer among the top ten last week. In contrast, Blast and Bitcoin saw significant TVL drops of over 18%.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

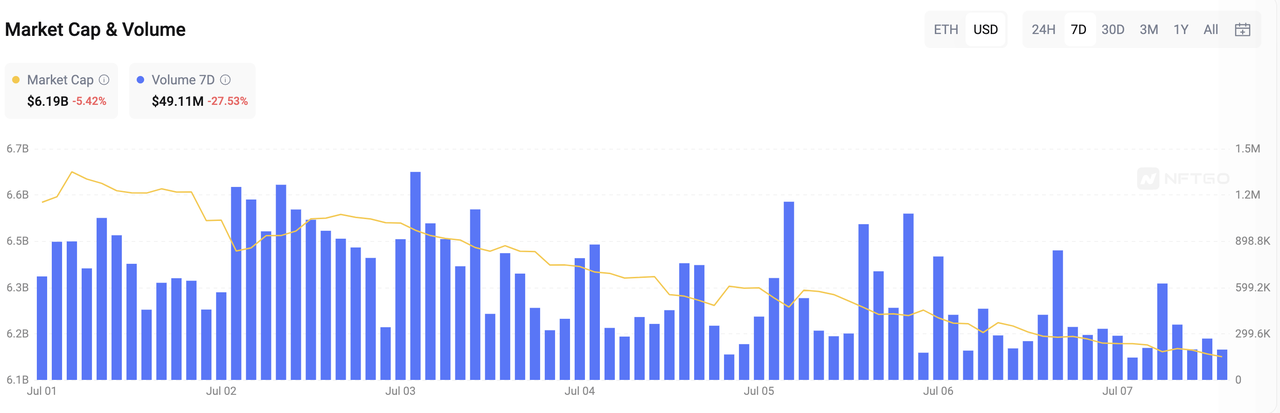

In the Ethereum non-fungible token (NFT) market, total market value continued to decline by 5%, now at $6.2 billion. Meanwhile, total trading volume decreased by 28%, with only $49 million in transactions over the past seven days. Among the leading blue-chip NFT series on Ethereum, CryptoPunks saw its floor price drop by 3% and average price by 6%. The floor price of Bored Ape Yacht Club, ranked second, fell by 5%, though its average price increased by 1%. Pudgy Penguins saw its floor price rise by 2% and its average price rebound by 15%, currently ranking third.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

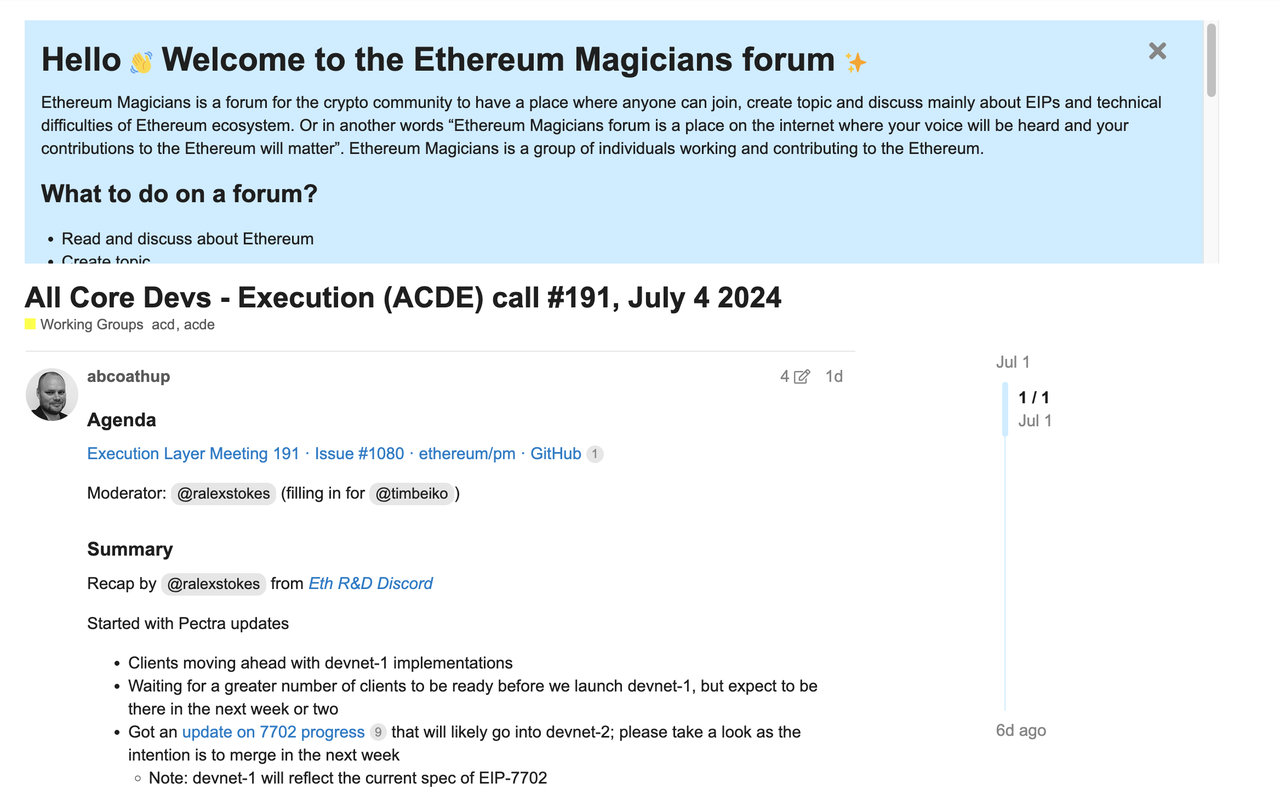

[Ethereum] Summary of the 191st Ethereum Execution Layer Core Developers Meeting (ACDE). According to @ralexstokes' summary of the 191st Ethereum Execution Layer Core Developers Meeting (ACDE), the main topics discussed were: (1) Pectra Upgrade: Expected to release Devnet-1 within the next one to two weeks. New updates for EIP-7702 will be reflected in Devnet-2. (2) Discussion on EIP-7212: A decision on whether to include EIP-7212 in the upgrade will be made at the next meeting. EIP-7212 is the first Rollup Improvement Proposal, aiming for secure and cost-efficient verification of the secp256k1 curve, which will restructure the way signatures work and pave the way for the network to transition to smart contract wallet mechanisms. (3) Cross-Layer Communication for EIP-7002 and EIP-7251: Developers discussed adding events in pre-deployed system contracts to enable cross-layer communication. There was general consensus among the developers. EIP-7251 aims to increase the maximum effective balance, while EIP-7002 allows the execution layer to trigger exits. (4) Deactivation of EIP-158: EIP-158 aimed to reduce state bloat by deleting empty accounts but also risked accidentally deleting stored data. The new account handling approach in EIP-7702 addresses this drawback.

(Source: Ethereum Magicians)

[Bitcoin] Bitcoin Core devs set up new policy aimed at handling ‘critical bugs’. A group of Bitcoin Core developers has launched a “critical bug” disclosure policy aimed at more effectively communicating Bitcoin security vulnerabilities. “The project has historically done a poor job at publicly disclosing security-critical bugs, whether externally reported or found by contributors,” Bitcoin core developer Antoine Poinsot and five others wrote to members of the Bitcoin Development Mailing List on July 3. This has led to a situation where Bitcoin users are led to believe that Bitcoin Core is free of bugs, but Poinsot stressed that this simply isn’t the case.

Bitcoin Core is the software that Bitcoin node operators download to access the Bitcoin blockchain, validate transactions and build blocks. It plays a crucial role in securing more than $1.1 trillion locked in the Bitcoin network. Poinsot said the new policy would allow better communication about the risk of running outdated versions of Bitcoin Core and would provide a standardized disclosure process that would give researchers more incentive to find and responsibly disclose vulnerabilities.

(Source: Twitter@darosior)

[Layer2] Blast Releases Phase2 Rewards Allocation Details, Focus on Blast App's Mobile Dapps. Blast has released the Phase2 rewards allocation details, with 10 billion BLAST allocated for Phase2 rewards. Of this, 50% (5 billion BLAST) is allocated to Blast Points, which users can earn based on their balances of ETH, WETH, USDB, and BLAST; 50% (5 billion BLAST) is allocated to Blast Gold, which will be distributed in the first week of each month (the next distribution is on July 8). Separate allocations will be made for new and existing Dapps, with more Big Bang competitions to incubate new Dapps. Phase2 focuses on mobile Dapps within the Blast App.

(Source: Blast)

[Layer2] ZKsync Launches ZK Rollup Network Elastic Chain. On July 2, ZKsync announced the launch of Elastic Chain, a ZK Rollup network under ZKsync 3.0. The Elastic Chain supports native interoperability with a unified and intuitive user experience. Its elastic architecture allows the blockchain to scale capacity infinitely by adding new instances to meet usage demand.

(Source: Mirror)

[Avalanche] Ava Labs Launches Avalanche Interchain Token Transfer (ICTT) Solution. On July 3, Ava Labs announced the launch of the Avalanche Interchain Token Transfer (Avalanche ICTT) solution. Utilizing the underlying technologies of Teleporter and Avalanche Warp Messaging, this solution supports seamless cross-chain transfers of tokens like USDC and BTC between various L1s (previously referred to as subnets) on Avalanche. Avalanche ICTT also allows developers to use their own ERC-20 tokens as gas tokens to customize their L1.

(Source: Medium)

[Data] Chainlink Collaborates with Fidelity and Crypto Bank Sygnum on On-Chain Asset NAV Data Project. Chainlink announced a collaboration with Fidelity International and crypto bank Sygnum on a project focused on bringing net asset value (NAV) data on-chain. This partnership aims to provide transparency and accessibility for tokenized assets' NAV data, particularly for the recent on-chain representation of Sygnum's $50 million Matter Labs inventory reserves, which are held in Fidelity's $6.9 billion institutional liquidity fund. Chainlink stated that this technology facilitates the secure storage and automatic synchronization of these tokens' NAV data on the ZKsync blockchain. In May this year, the Depository Trust & Clearing Corporation completed a pilot project named Smart NAV with Chainlink, exploring methods to standardize the distribution of NAV data across multiple blockchains.

(Source: The Block)

4 Key Fundraising Data

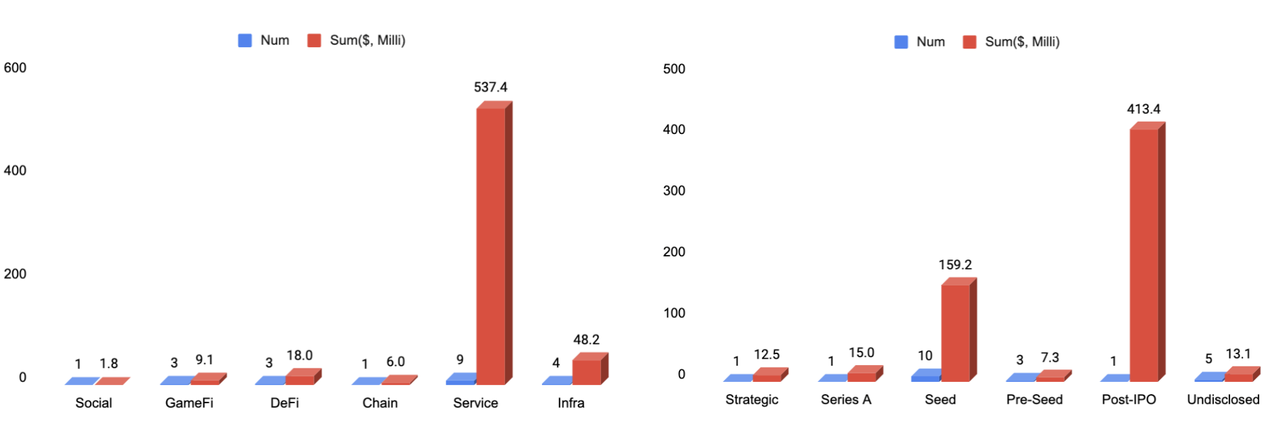

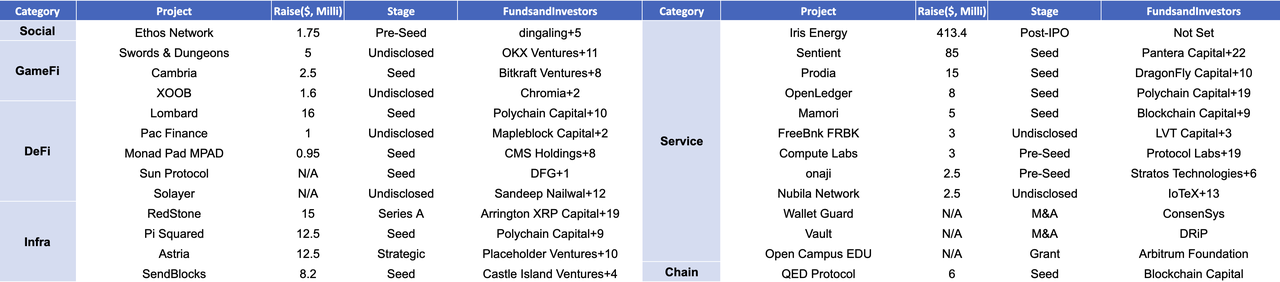

Last week witnessed a total of 26 financing events, raising a substantial amount of over $620.4 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The Blockchain Service sector kept leading with the highest number of financing events, totaling 9. The Blockchain Service sector alsow recorded the highest total funding amount, raising a total of $537.4 million, accounting for 87% of the overall financing. The largest financing event was led by Iris Energy, successfully raising $413 million. Iris Energy are a Bitcoin mining company that builds, owns and operates data center infrastructure with a focus on entry into regions where Iris Energy can access abundant and/or under-utilised renewable energy to power our operations. Iris Energy support local communities, as well as the decarbonisation of energy markets and the global Bitcoin network. More detailed information is as below.

* 5 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1.[Service] Iris Energy raised $413 million to fund bitcoin mining expansion.

Iris Energy, an Australia-headquartered bitcoin mining firm, has recently raised about $413.4 million ̌̌through stock offerings to fund expansion after bitcoin’s halving event. The Nasdaq-listed firm raised funds between May 15 and June 28 from the sale of 39.8 million shares, according to a Monday statement, first reported by TheMinerMag. The business update showed that the company’s 2024 expansion plan is fully funded with $425.3 million in cash reserves — including at-the-market proceeds to be received in July — and no debt.

Iris Energy intends to scale up its operations to reach 30 EH/s in hash rate capacity and 510 MW in data center capacities, according to the release. The additional cash buffer would be used for procurement for expansion extending to 2025, future agreements for additional power capacity, and potential power monetization activities. Many Bitcoin mining firms have been making attempts to expand revenues and mining capacities since April’s bitcoin halving, which reduced miner rewards by 50%.

- Official Link: https://iren.com/

Sentient, an open-source artificial intelligence development platform with Polygon co-founder Sandeep Nailwal as one of its core contributors, has raised $85 million in a seed funding round. Peter Thiel's Founders Fund, Pantera Capital and Framework Ventures co-led the mega round, Sentient said last Tuesday. Other investors in the round included Ethereal Ventures, Robot Ventures, Symbolic Capital, Delphi Ventures, Hack VC, Arrington Capital, HashKey Capital, Canonical Crypto and Foresight Ventures.

Sentient began raising funds for the seed round in March of this year and closed it in May, Nailwal told The Block in an interview. He declined to comment on the structure of the round and valuation. Nailwal is one of Sentient's four core contributors, alongside two distinguished professors and an AI venture development startup. The professors are Pramod Viswanath, the Forrest G. Hamrick Professor of Engineering at Princeton University and co-inventor of Flash OFDM, the technology behind the 4G wireless standard, and Himanshu Tyagi, a Professor of Engineering at the Indian Institute of Science. The startup, Sensys, was founded by Kenzi Wang, co-founder of Symbolic Capital, and aims to support startups within the Sentient ecosystem.

- Official Link: https://sentient.foundation/

The web3 artificial intelligence firm Prodia raised $15 million in seed funding from the venture firm Dragonfly Capital. Additional support in the funding round came from HashKey Capital, Web3.com, Index Ventures, Symbolic Capital, OKX Ventures, EV3, Artichoke, TRGC, Folius, Tangent Capital, Southern Equity, Balaji Srinivasan, Polygon founder Sandeep Nailwal and others, according to a release shared with The Block. The financing brings Prodia's total funding raised to $15.7 million.

Prodia builds a distributed network of graphics processing units (GPUs) to provide more efficient cloud computing services at a lower cost using web3 infrastructure. The firm will use its seed financing to grow the company, add support for generative video and large language models (LLMs) and expand the types of GPU hardware in its roster.

- Official Link: https://prodia.com/

4.[DeFi] Polychain Capital leads $16 million seed round for Bitcoin restaking protocol Lombard.

The Bitcoin restaking platform Lombard raised $16 million in seed funding led by the venture firm Polychain Capital. Additional participants in the fundraise include BabylonChain, Inc., dao5, Franklin Templeton, Foresight Ventures, Mirana Ventures, Mantle EcoFund and Nomad Capital, among others.

Lombard will use the financing to grow out the Bitcoin restaking ecosystem alongside Babylon, a Bitcoin staking protocol. Once a user stakes Bitcoin via Babylon, Lombard issues the liquid and yield-bearing representation of staked Bitcoin using the token LBTC to unlock liquidity. Lombard intends to integrate LBTC across Ethereum DeFi protocols later in the year, according to a company release.

- Official Link: https://www.lombard.finance/

See you next week! 🙌