*All on-chain data is dated as of 12:00 a.m. EST on Sunday, November 4th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Oct.29 — Nov.4).

Author: LBank Labs Research team — Hanze, Johnny

Keywords: #FOMC #ETF #Non-EVM

1 Macro Market Overview

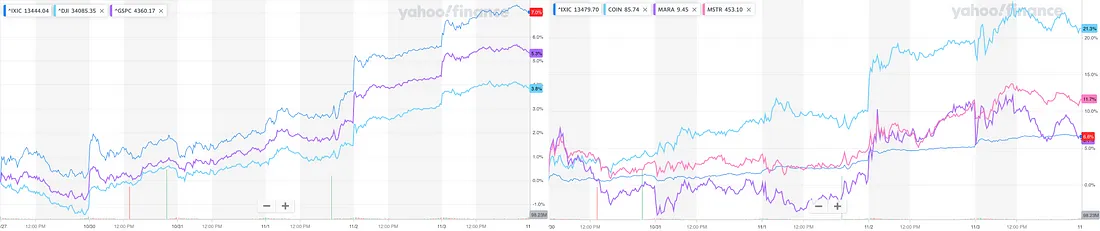

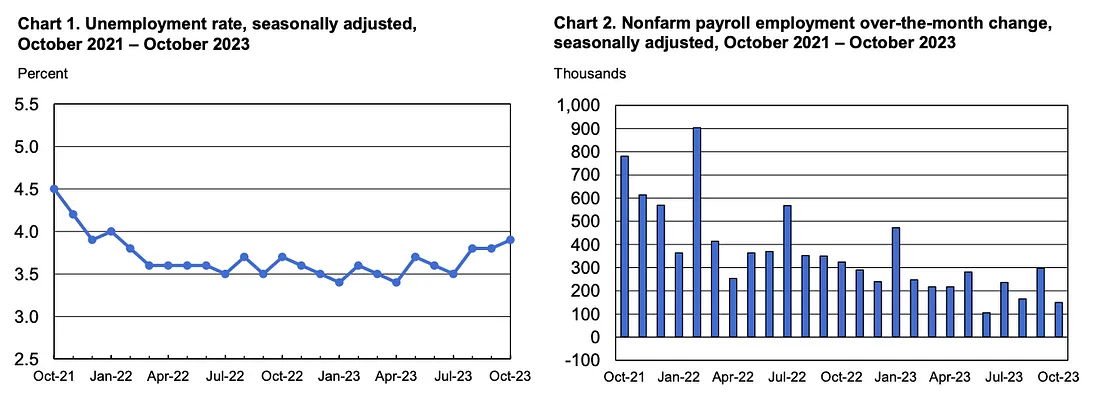

U.S. stocks have climbed with the assistance of the Fed’s pause. According to WSJ, new economic data and the Fed’s latest policy decision gave investors hope that the economy is pulling back enough for inflation to abate without falling into a recession — and that interest rates could be near their peak. The October jobs report showed hiring slowed last month. Employers added 150,000 jobs in October, the Labor Department reported Friday, half the prior month’s gain and below economists’ expectations. The unemployment rate rose to 3.9% and wage growth eased. Furthermore, the September report showed the U.S. economy adding many more jobs than Wall Street expected. The number of Americans seeking unemployment benefits, a proxy for layoffs, held at historically low levels in October, the Labor Department said Thursday. The Treasury Department also gave markets a surprise boost on Wednesday when it announced smaller-than-expected increases to longer-term debt auctions and suggested that it was willing to overstep informal guidelines for how much short-term Treasury bills to issue. Wednesday’s slip in yields opened the door for the so-called Magnificent Seven stocks to climb higher. Facebook-owner Meta and chip-maker Nvidia led the pack by advancing more than 3.5% apiece, while Amazon.com posted a 2.9% gain. Last week, the three major U.S. stock indices posted gains, with the technology-heavy Nasdaq Composite Index leading the way with a 7% increase. The Dow Jones Industrial Average and the S&P 500 also recorded gains of 3.8% and 5.3%, respectively. Web3-related stocks outperformed the broader market last week, with COIN posting a weekly gain of 21.3%, and MSTR and MARA surging by 11.7% and 6.1%, respectively. Coinbase exceeded expectations with its third-quarter revenue, and its USDC interest income rebounded to $172 million. MicroStrategy’s Q3 financial report shows that it currently holds 158,400 bitcoins, with total revenue increasing 3% year-on-year.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

According to WSJ, Job growth slowed sharply last month, a sign the U.S. economy is cooling this fall after a torrid summer. Employers added 150,000 jobs in October, half the prior month’s gain and the smallest monthly increase since June, the Labor Department said Friday. The unemployment rate rose to 3.9%, up a half-point since April, and wage growth slowed. If sustained, a hiring pullback is likely to bring the Federal Reserve’s historic interest-rate increases to an end by providing stronger evidence that higher borrowing costs have slowed the economy. The report could also mollify concerns that brisk consumer spending this summer would lead hiring or wages to reaccelerate.

(Source: bls.gov)

The U.S. announced that last month’s non-farm payroll addition fell below expectations, while the unemployment rate reached a two-year low, reflecting a significant cooling of the labor market. This has increased expectations that the Federal Reserve (Fed) will keep interest rates unchanged in December. On Friday, the U.S. dollar index (DXY) fell to a six-week low, with its worst weekly performance since July. DXY fell by 1% last Friday, reaching 105.07, the lowest since September 20th. It depreciated by 1.4% over the week, marking the largest single-day and weekly decline since July.

DXY (Source: TradingView)

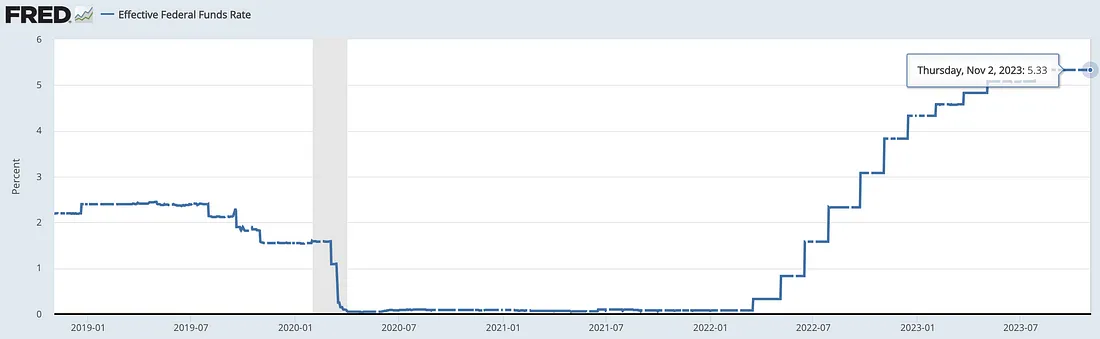

According to WSJ, The Fed on Wednesday left its benchmark interest rate unchanged and hinted the central bank could be done raising rates for now, but didn’t rule out another increase. Traders are pricing in a 95% probability that the Fed will leave rates as is in December, up from 79% a week ago, according to CME Group’s federal-funds futures.

EFFR (Source: Federal Reserve Bank of New York)

The yield on the U.S. 10-year Treasury note (US10Y) ended the week at 4.574%, from 4.846% a week ago. That marked the steepest weekly drop since March. The pullback in bond yields alleviated a pressure point for stocks. Higher yields make borrowing more expensive for companies and households. Elevated rates also make stocks look less attractive because they represent an essentially risk-free return, raising the bar for riskier assets such as equities.

US10Y (Source: TradingView)

ProShares launches ether futures ETF for crypto bears. ProShares announced on Thursday that the company will launch an Ethereum futures ETF that allows investors to take short positions. The ProShares Short Ethereum strategy is designed to provide the opposite daily performance of the S&P CME Ethereum Futures Index. If the index falls by 1%, the ETF will profit by 1%. Similar to other cryptocurrency ETFs, this new product is linked to Ethereum futures contracts rather than the spot price of Ethereum.

(Source: reuters.com)

2 Crypto Market Pulse

Market Data

The cryptocurrency market capital continues to rise. It was boosted by a series of events, including the recent second pause in interest rate hikes by the Federal Reserve, better-than-expected employment data, and earlier expectations for the first Fed interest rate cut next year. As of 12:00 AM on November 5th, the price of Bitcoin stands at $35,290, marking a 2.9% increase compared to the previous week. Ethereum, the second-largest cryptocurrency, currently has a price of $1,883, with a 5.9% increase. The total market capitalization of the entire cryptocurrency market has now reached $1.32 trillion, growing by 5.6% in one week.

Additionally, Bitcoin’s market share in the overall market has slightly retreated to 51.9%, equating to $684.7 billion. On the other hand, Ethereum’s market share has seen a modest increase, reaching 17.3%, with a current market value of $228.2 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

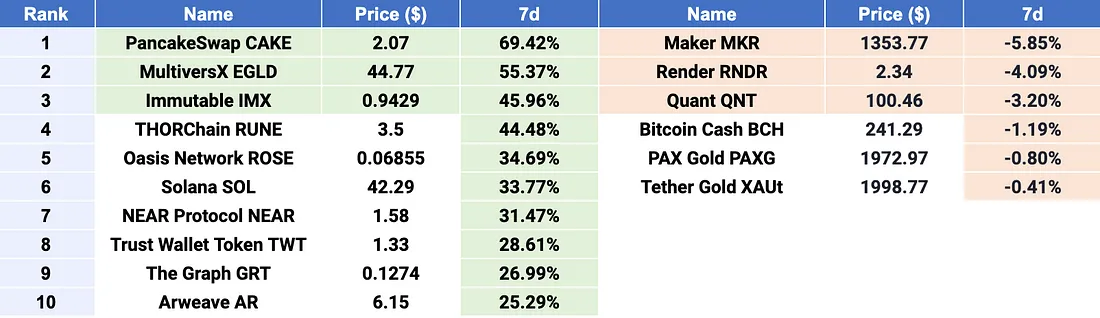

$CAKE, $EGLD, and $IMX emerged as Top 3 gainers, while $MKR, $RNDR, and $QNT were Top 3 losers. The positive trend in Bitcoin prices has brought joy to altcoin investors, as increased capital inflow into altcoins is easily triggered due to low trading volume and thin order books. $CAKE topped the list last week with a 7-day increase of 69.4%, likely influenced by Binance’s launch of CAKE 1–50x U perpetual contracts on November 2, 2023. Similarly, other top gainers in the altcoin market last week included $EGLD and $IMX, both of which have recently seen active trading, indicating higher investor attention and confidence. $IMX’s strong performance may be attributed to its significant presence in the global trading volume on the South Korean exchange Upbit. With the ongoing upward trend in the market, a few cryptocurrencies that didn’t perform well last week might experience short-term fluctuations.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

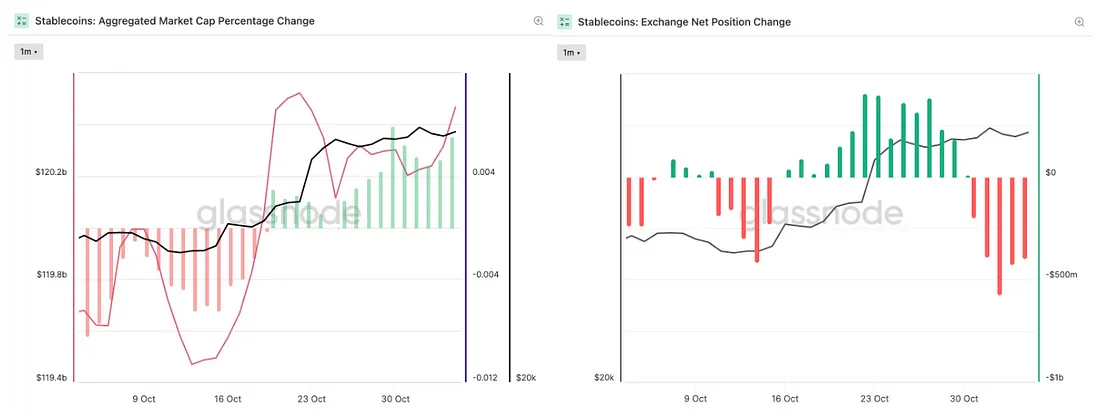

Last week, the total supply of stablecoins began to grow, reaching $120.5 billion. Despite the cryptocurrency market’s continuous rise over the past two weeks, the market capitalization of stablecoins has shown a synchronous increase, indicating a certain degree of lag. During this period, the net positions of exchange-based stablecoins have shifted from a significant net inflow to a net outflow. This, combined with the ongoing upward trend, suggests that the increasing demand for stablecoins is driven by new funds entering the cryptocurrency market.

Stablecoins Market Cap (Data: Glassnode)

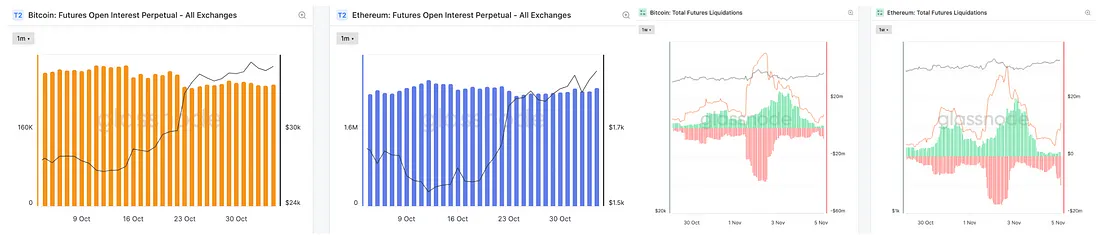

In the derivatives market, the total open interest for Bitcoin and Ethereum futures contracts remained relatively stable compared to the previous week. Over the past few weeks, the total open interest for Bitcoin and Ethereum futures contracts has shown a decreasing trend, indicating waning investor interest in derivative trading. On the other hand, the surge in Bitcoin and Ethereum around the 1st of the month last week led to a wave of liquidations for both long and short positions, but the total liquidation volume was significantly lower compared to the previous week, suggesting a relatively stable market environment at the moment.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Future Liquidations (Data: Glassnode)

In the DeFi market, the Total Value Locked (TVL) continued to grow last week, increasing by 4.9% to reach $434.1 billion. Over the past seven days, decentralized exchanges (DEXs) saw a trading volume of $187 billion, marking a significant increase of 17.2% from the previous week. Furthermore, the market share gap between DEXs and centralized exchanges (CEXs) continued to narrow, with DEXs’ trading volume now accounting for 21.5% of CEXs’ trading volume. Among the top ten blockchain platforms ranked by TVL, Base has seen a decline for three consecutive weeks, with a 3.2% decrease last week. All platforms once again experienced an increase in TVL over the past seven days. Notably, Solana led the pack last week with a 13.6% increase in TVL.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

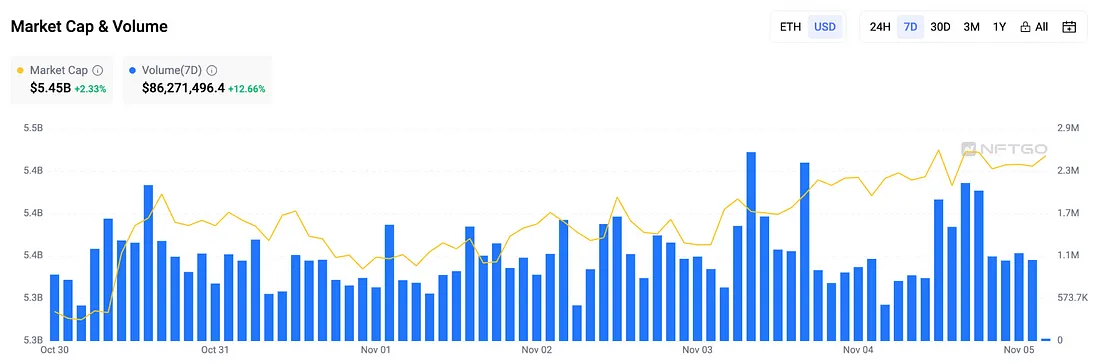

Last week, the NFT market continued to show signs of recovery, with both market capitalization and trading volume experiencing growth. The current NFT market capitalization stands at $5.45 billion, representing a 6.9% increase in one week. Furthermore, the trading volume over the past seven days continued to rise, with a significant increase of 12.7%. Among the top NFT collections, blue-chip NFT series like Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) experienced fluctuations in floor prices and average prices. After experiencing previous highs, the floor prices for these two series fell by 4.8% and 5.5% last week, while the average prices increased by 8.6% and 6%, respectively.

Market Cap & Volume, 7D (Data: NFTGo)

LBank Labs’ Recap

BTC has displayed robust price action, primarily influenced by CME trading volume earlier in the week and sustained momentum from the perpetual market in the latter part of the week. Furthermore, there is a noticeable increase in interest surrounding the ETH/BTC pair, with the perpetual market price premium significantly outpacing the spot market.

This current bullish trend differs from previous ones, as it is predominantly driven by the actions of smaller interest groups, rather than sector-based movements. The market’s reduced liquidity has created an environment conducive to price manipulation by these groups.

Notably, NEO and its associated network controlling token, GAS, have experienced substantial price manipulation, particularly the latter. This manipulation is exacerbated by the fact that a significant portion of tokens is held by a limited number of entities. Current perpetual data on Binance suggests the potential for further price upside, possibly driven by a short squeeze, as the account long/short ratio stands at 0.3, while the position-based ratio is at 1.02.

Conversely, REN has witnessed a rapid price increase, followed by a drop of over 30%. This pattern is indicative of a pump-and-dump scheme, rather than the actions of sophisticated market makers.

In the case of ARKM, trading volume turnover appears to be in a consolidation phase. Considering its high product quality and strong institutional investment, we believe that its current price is undervalued.

- BTC price optimistic: $36500 — $38500

- BTC price neutral: $34500-$36500

- BTC price pessimistic: $32500 — $34500

3 Major Project News

[Sui] Mysten Labs has introduced zkSend. zkSend is a feature that allows users to transfer SUI tokens to others by sharing links. zkSend is built on native encryption technologies zkLogin and Sui, enabling users to create links containing a specific amount of SUI tokens. These links can be sent through various messaging clients such as email and private messages, and they can also be converted into QR codes. Currently, zkSend is in a testing phase, and it will be iterated and updated based on user feedback. Upcoming enhancements will include support for other asset types and developer tools, the ability to send directly to email addresses, batch link creation, recoverable links, and link redirection.

(Source: mystenlabs.com)

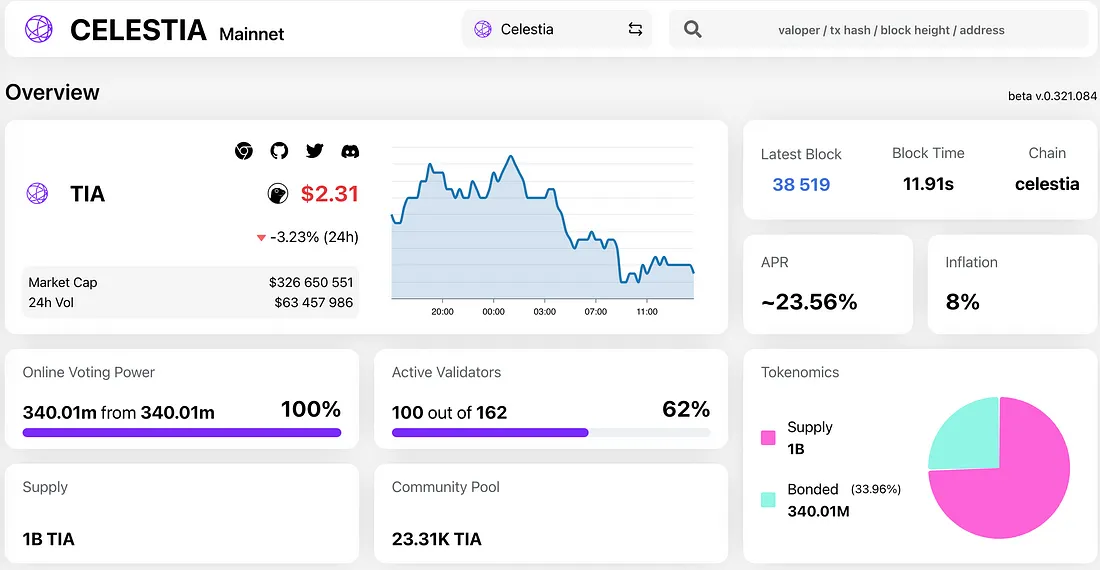

[Celestia] Celestia has successfully deployed its mainnet test version, marking the launch of its modular network. The mainnet test version, codenamed Lemon Mint, introduces Data Availability Sampling (DAS). This technology aims to provide a new scaling approach that allows blockchain nodes to confirm data availability without the need to download the entire dataset of a given block. The TIA Genesis Airdrop has been directly added to eligible addresses and can be queried on the Celestia mainnet by adding it within Keplr.

(Source: celestia.explorers.guru)

[Cosmos] The Interchain Foundation (ICF) of the Cosmos ecosystem has announced that the Inter-Blockchain Communication (IBC) protocol is set to expand to Avalanche. The Landslide Network team is currently working on developing an IBC light client on Avalanche, which will enable seamless interoperability between Avalanche, the Cosmos Hub, and over 100 other blockchains that support IBC.

(Source: interchain_io)

[Solana] Solana blockchain node development blueprints available on AWS. Solana Foundation has announced that Solana nodes can now be quickly deployed on AWS using infrastructure-as-code programs from the AWS Blockchain Node Runners repository. This means that enterprises looking to build on Solana will be able to deploy their own consensus and remote procedure call (RPC) nodes with minimal technical expertise and expenses, connecting their dApps to the blockchain.

Dan Albet of the Solana Foundation stated, “This represents a step forward for the Solana ecosystem. The expertise needed to run a node has dropped sogmofocantly, making it seasier tha ever to deploy on Solana.”

(Source: Solana.com)

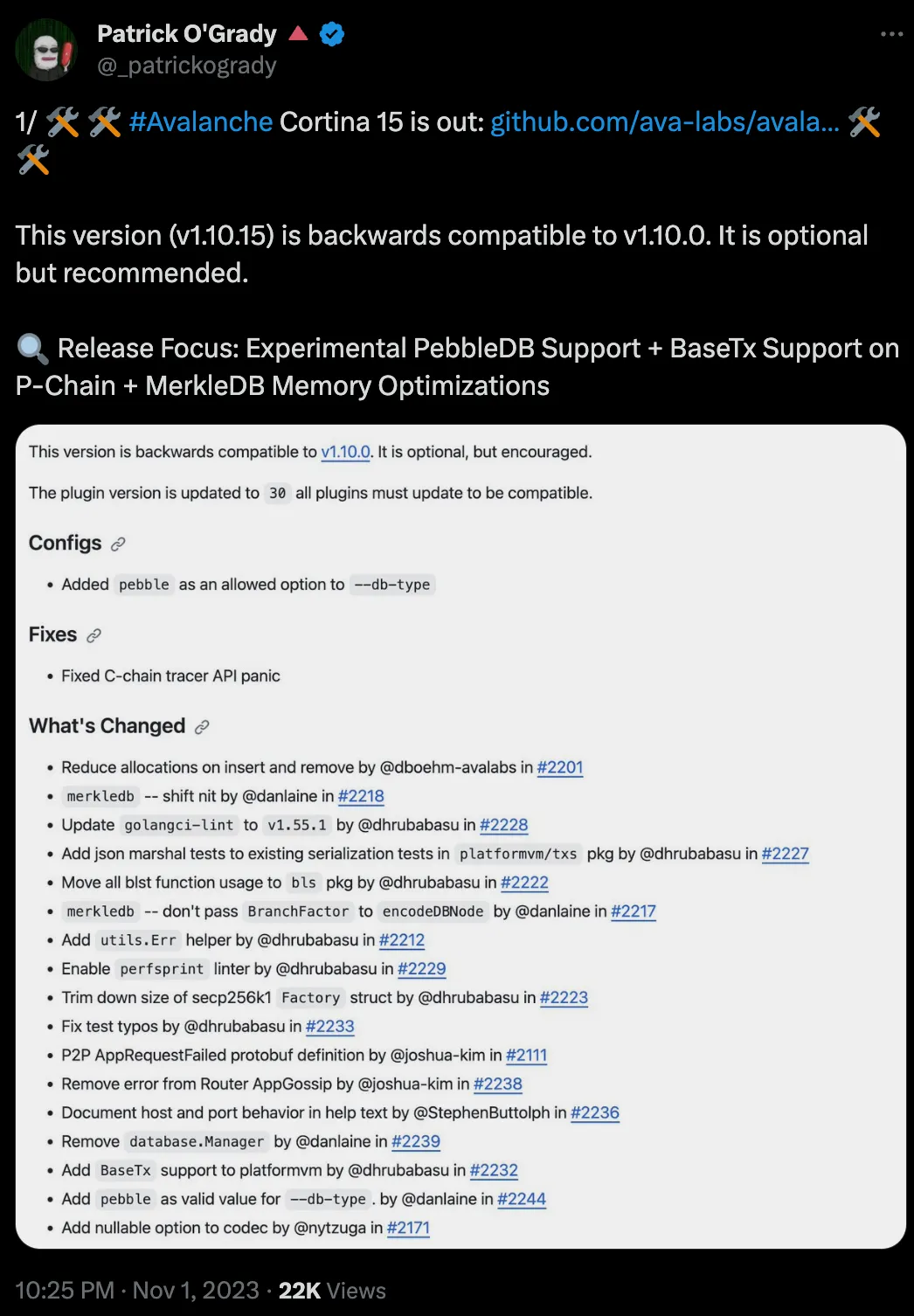

[Avalanche] Avalanche Cortina 15 has been released with added support for Experimental PebbleDB and more. Patrick O’Grady, the Engineering Lead at Ava Labs, announced the release on the X platform. This version (V1.10.15) is backward compatible with V1.10.0 and is optional but recommended for use. The release highlights include Experimental PebbleDB support, BaseTx support based on the P-Chain, and memory optimization in MerkleDB. Compatibility checks involve support for the Virtual Machine Interface (V30), and the removal of “database.Manager” in Cortina 15, with corresponding support removal in the Virtual Machine Interface. Users running custom virtual machines must update them to V30 for compatibility with AvalancheGo V1.10.15.

(Source: Twitter@_patrickogrady)

[Layer2] The zkSync Era Block Explorer API is now live. Developers can access zkSync Era Block Explorer data via HTTP requests, making it compatible with Etherscan API. This enables users to seamlessly transition their existing applications to the zkSync Era network.

(Source: era.zksync.io)

4 Key Fundraising Data

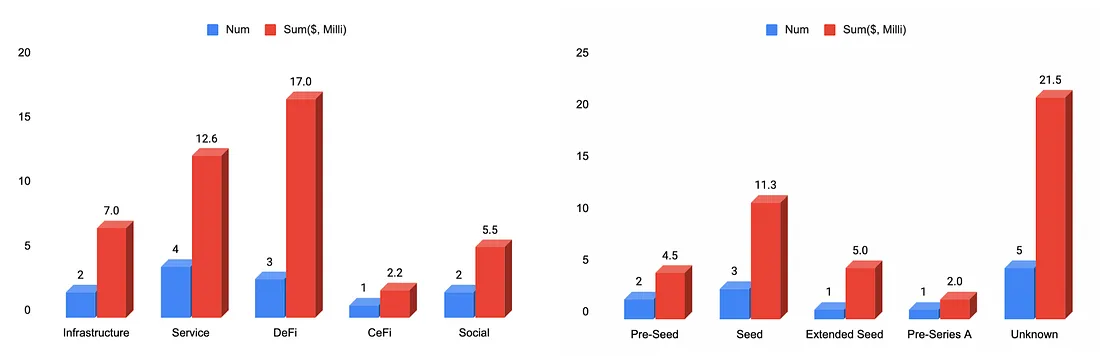

Last week witnessed a total of 15 financing events, raising a substantial amount of over $44.2 million*. Compared to last week, both the number and total amount of funding activities have significantly decreased. The DeFi sector garnered the most attention, with a total of 3 funding activities, accounting for 20% of all funding activities and totaling $17 million, representing 38.5% of the overall funding. The largest fundraising event this week also occurred in the DeFi industry, led by the Ekubo Protocol project, which raised $12 million from Uniswap. Ekubo Protocol is a next-generation AMM built on Starknet. More detailed information is provided below.

*3 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

The Uniswap DAO has express support in a temperature check for a proposal to invest 3 million UNI ($12 million) from its treasury into decentralized exchange Ekubo, in exchange for a 20% share of a potential governance token. “We at Ekubo, Inc. believe this is a vitally important step in the decentralization of Uniswap protocol development, effectively onboarding the Ekubo team as core developers,” said Ekubo founder Moody Salem in the initial proposal.

The vote on Snapshot has 21 million UNI tokens for and 12 million tokens against, meaning 63% of tokens that voted were in favor of the move. Five token holders compromised 97% of the vote in favor of the move. There were more than 3,500 votes in total. Salem said he was a former engineer lead at Uniswap — and the fifth employee at the company — before starting Ekubo and that he contributed considerably to its codebase. Ekubo is a decentralized exchange on Starknet and has $2.5 million of value locked in its smart contracts, per DefiLlama.

- Official Link: https://ekubo.org/

2. [Service] Modulus Labs announced the completion of a $6.3 million seed funding round.

The project Modulus Labs, aiming to integrate artificial intelligence and encryption technologies, raised $6.3 million in its seed round of financing, with Variant and 1Kx leading the investment. Companies like Inflection, Bankless, and Stanford also participated. Angel investors include the Ethereum Foundation, Worldcoin, Polygon, Celestia, and Solana, among others. The concept behind Modulus involves leveraging zero-knowledge proofs, a cryptographic technique that can verify the integrity of certain content without exposing any additional underlying raw data. The project seeks to bridge the gap between the opacity of machine language models running on servers and the transparency of blockchain, thereby allowing for “more advanced decentralized protocols” by minimizing the need for human governance over complex, dynamic functions.

- Official Link: https://www.modulus.xyz/

3. [DeFi] Surf Protocol raises $3M to develop first permissionless perp DEX.

Surf Protocol is pioneering a solution to a significant challenge in the Perp DEX market — the limited range of tradable assets. The protocol is at the forefront of innovation with its unique AMM structure, offering Liquidity Providers (LPs) the flexibility to strike a balance between securing high fees and prioritizing their position for order matching. This distinctive framework paves the way for the creation of a myriad of liquidity curve shapes tailored to the unique characteristics of different assets.

Surf Protocol’s aim is to provide users with a wide variety of tradable Perp assets, all the while maintaining the lowest possible fees. This strategy is expected to enhance the competitiveness of Perp DEXs and increase their market share against centralized exchanges. With its innovative approach, Surf Protocol is poised to redefine the dynamics of the crypto trading landscape.

- Official Link: https://www.surf.one/

Toposware, a pioneer in zero-knowledge technology, is proud to announce the successful completion of its $5 million strategic seed extension round. The round was led by Evolution Equity Partners and featured participation from prominent investors such as Triatomic Capital, K2 Access Fund, Polygon’s Founder and Chairman Sandeep Nailwal, as well as key leaders across global insurance, finance, manufacturing, healthcare, consulting and tech.

Toposware’s CEO, Theo Gauthier, expressed his enthusiasm for the company’s future, stating, “Toposware is entering a new phase of growth and development where we are laser-focused on applying the differentiated utility of zero-knowledge to real-world use cases. We couldn’t be more excited to be supported by this world-class investor group and look forward to leveraging their collective experience to accelerate the execution of our goals — bringing developers, product teams, organizations, and users together to create novel value.”

- Official Link: https://toposware.com/

See you next week! 🙌

🎙Forum: Feel free to leave your comments on our official LBank Labs Twitter account, and don’t hesitate to ask questions about the tokens or projects that interest you. We will diligently gather them and discuss them in the recap section of our weekly digest!

📢 Disclaimer: The weekly crypto market insights are provided for informational purposes only and should not be considered as financial advice. The cryptocurrency market is highly volatile and unpredictable. Prices and trends can change rapidly, and past performance is not indicative of future results. Always conduct thorough your own research and consult with a qualified financial professional before making any investment decisions.