1. Review of hot topics this week:

1.1. The annualized real GDP of the United States in the fourth quarter was unexpectedly revised down to 3.2%, which was lower than expected.

On February 28, data released by the U.S. Department of Commerce showed that the annualized quarter-on-quarter revised value of U.S. fourth-quarter GDP was revised down to 3.2%, which was lower than the expected 3.3%.

The U.S. economy will grow at an annualized rate of 2.5% in 2023, exceeding Wall Street's expectations at the beginning of the year, and growing at an annualized rate of 1.9% in 2022. Personal consumption expenditure growth was revised upward to 3% month-on-month, Exceeded expectations by 2.70%, Become the main driving force of economic growth.

Although the Federal Reserve's interest rate hikes have burdened households and businesses, job growth and falling inflation have provided fuel for consumer spending. Consumers' willingness to spend was reflected in retail performance during the holiday season, with retail sales growing rapidly in December.

On February 29, the latest data from the U.S. Department of Commerce showed that the Fed’s preferred inflation target, excluding food and energy, the core PCE price index growth rate in January fell back to 2.8% year-on-year. It was slightly lower than the 2.9% in the previous month. In line with market expectations, it was the smallest increase since March 2021.

1.2. Morgan Stanley is evaluating whether to offer spot Bitcoin ETFs to clients of its large brokerage platform

On February 28, Wall Street giant Morgan Stanley was conducting due diligence to add a spot Bitcoin ETF product to its brokerage platform, according to two people familiar with the matter.

Morgan Stanley, one of the largest U.S. broker-dealer platforms, has been evaluating offering a spot Bitcoin ETF to clients since the U.S. Securities and Exchange Commission approved its launch in the U.S. in January, one of the people said.

Even though billions of dollars have been invested in these products, before Bitcoin ETFs were offered by large registered investment advisor (RIA) networks and broker-dealer platforms(For example, platforms affiliated with Merrill Lynch, Morgan Stanley, etc.), the investment floodgates may not open.

1.3. Arweave releases super-parallel computer AO, and the founder expresses confidence in competing with Ethereum

On February 28, two weeks after announcing the launch of the super-parallel computer AO, the decentralized storage project Arweave officially launched the AO public test network. From preview to official launch,, the price of Arweave token AR has more than doubled.

Arweave founder Wiliams said that AO has built a super-parallel computer that can run any number of threads in parallel at the same time, and the scalability is incredible. In other words, Arweave, which was originally engaged in decentralized storage, entered the computing and smart contract markets. Although its structure and methods are very different from public chains such as Ethereum, it has actually entered the public chain market and competes with them.

From an end user or developer perspective, AO is essentially simple: AO is a shared computer on which they can run any number of processes. These processes are not hosted on any particular server and are not under the control of any individual or group.

AO claims that it is extremely scalable, which makes people undoubtedly think that it is another "Ethereum killer". AO is still in the test network stage, and all subsequent developments remain to be seen.

1.4. Sam Bankman-Fried asked the court to shorten the prison sentence to 63 to 78 months

On February 27, according to a court document filed, Former FTX boss Sam Bankman-Fried (SBF) was convicted of fraud last year. Due to be sentenced next month, he has asked the court for a "just" sentence of 63 to 78 months.

Bankman-Fried's lawyers objected to the Presentation Report (PSR), which recommended a 100-year prison sentence, calling it "ridiculous."

Lawyers argued that the "appropriate way to achieve a just sentence" was to consider adjusting the offense level on a "zero loss" basis, This would result in a "suggested guideline range of 63-78 months."

Lawyers said that after taking all factors into account, "including Sam's charitable work and demonstrated commitment to others, a sentence that would allow Sam to promptly return to a productive role in society is sufficient, but not more than necessary, to serve the purposes of sentencing."

1.5. TRON founder Justin Sun revealed on X that he holds BTC worth approximately US$1.6 billion.

On February 27, TRON founder Justin Sun revealed to his 3.5 million followers on X (formerly Twitter) that he holds more than 28,000 Bitcoins, worth approximately $1.6 billion. The news was revealed after Bitcoin price surpassed the $55,000 mark, causing significant concern in the crypto industry.

In April 2023, BeInCrypto reported that Sun was accused of trading Tronix and BitTorrent without registering them as securities.

There is also some speculation and mystery surrounding the Huobi exchange owned by Justin Sun. In August 2023, there was speculation that Sun sent $200 million worth of USDT to the exchange amid bankruptcy rumors.

also, He was also accused of failing to disclose payments to celebrities including Lindsay Lohan and Austin Malone. In recognition of their recognition of crypto assets and products.

1.6. Financial Secretary of Hong Kong: The Hong Kong Monetary Authority will launch a “sandbox” to test stablecoins in the short term.

On February 28, Hong Kong Financial Secretary Paul Chan Mo-po disclosed in the latest Budget that The Hong Kong Monetary Authority will launch a "sandbox" in the short term. Allow institutions interested in issuing stablecoins to test the stablecoin issuance process, business model, investor protection and risk management systems within a controllable scope, and communicating on future regulatory requirements.

Paul Chan also mentioned that the Hong Kong government proposed legislation at the end of last year to establish a regulatory system for stablecoin issuers. Consult public opinion, the goal is to establish a regulatory system that safeguards financial stability without stifling innovation.

Paul Chan said that network security and investor and consumer protection are crucial to the development of Web 3.0. Based on the principle of "same business, same risks, same rules", the Hong Kong Securities and Futures Commission implemented the development of a virtual asset trading platform in June last year. The licensing system not only complies with relevant international standards but also provides investor protection, putting Hong Kong ahead of many major jurisdictions. In order to strengthen the protection of investors and consumers, the Hong Kong government is launching a consultation on the supervision of over-the-counter trading services for virtual assets. And will continue to adopt a multi-pronged approach such as timely dissemination of information, comprehensive public education, and strengthening law enforcement. Promote the sound and responsible development of Hong Kong’s virtual market.

1.7. Polygon zkEVM Lianchuang: After the EIP-4844 upgrade, the data capacity of Ethereum rollups will increase significantly.

On February 27, The Block reported that the Ethereum Dencun upgrade is expected to be carried out in mid-March and will bring major improvements in the form of “proto-danksharding” through EIP-4844. Jordi Baylina, co-founder and technical lead of Polygon zkEVM, said that the main challenge facing ZK rollups is the cost of data availability. EIP-4844 may play an important role in reshaping the capacity and gas costs of Polygon zkEVM, After the Dencun upgrade implements EIP-4844, Ethereum’s total data availability capacity will increase by 3 times; When combining EIP-4844 with data compression, the potential cost reduction ranges from 10x to 50x, However, actual cost savings will depend on various factors.

1.8. Matrixport Lianchuang: Bitcoin may undergo a healthy downward adjustment of about 15% in March

On February 28, Daniel Yan, co-founder of Matrixport (Singapore Digital Asset Company), posted on social media that the current market sentiment has reached a level that he believes should be treated with caution. And should see a healthy decline of about 15% by the end of April. Specific adjustments may occur in March, because March is already a tricky month from a macroeconomic perspective (Fed meeting and BTFP).

With the Dencun mainnet upgrade coming to an end and the Bitcoin halving approaching, the market in March may be weak. It is still unknown where the adjustment will start ( which will come first, the all-time high or the correction? ), but long-term holders need not worry.

On January 3, 2020, Matrixport released a report that "SEC will reject Bitcoin spot ETF in January", which is completely contrary to the previous day's view. Bitcoin flashed down nearly 10% that day.

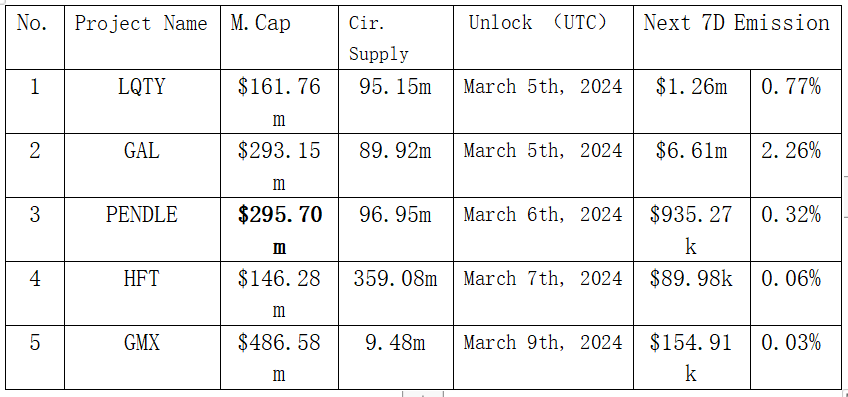

2.Projects to be unlocked next week:

3. Key events next week:

March 5 (Tuesday)

U.S. ISM non-manufacturing index in February;

US February Markit comprehensive PMI final value;

March 6 (Wednesday)

U.S. ADP employment changes in February (10,000 people);

Federal Reserve Chairman Jerome Powell testifies and makes statements before the House Financial Services Committee;

March 7 (Thursday)

The Federal Reserve releases its Beige Book on economic conditions;

The number of people applying for unemployment benefits for the first time in the week of March 2 in the United States (10,000 people);

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee;

Euro area ECB deposit facility rate;

Eurozone ECB main refinancing rate;

European Central Bank President Christine Lagarde held a monetary policy press conference;

March 8 (Friday)

U.S. unemployment rate in February;

Changes in non-farm employment in the United States in February (10,000 people);