1. Review of the market the day before yesterday (data from Coinmarketcap/Coinglass)

The global cryptocurrency market capitalization is $1.27 trillion, an increase of 10.32% in the last day.

- The total cryptocurrency market trading volume in the last 24 hours was $75.18 billion, an increase of 70.38%. The total volume in DeFi currently stands at $5.9 billion, accounting for 7.85% of the total cryptocurrency market 24-hour trading volume. The current trading volume of all stablecoins is $67.17 billion, accounting for 89.35% of the total 24-hour trading volume of the cryptocurrency market.

- Bitcoin’s current total market value is 53.35%, with a full-day increase of 2.15%.

- Bitcoin’s greed and panic index today is: 66 (greed), an increase of 13 from yesterday.

- The long-short ratio of Bitcoin is 1.0721, an increase of 0.0081 from the previous day.

- The open contract position on the Bitcoin exchange was US$14.147 billion, an increase of US$1.062 billion from the previous day.

- The total Bitcoin option holdings on the entire network are US$15.264 billion, an increase of US$2.367 billion from yesterday.

- Bitcoin’s volatility index today is 58.57, which is at a high level in the past month.

- Ethereum’s volatility index today is 54.83, which is at a high level in the past month.

2. Important news (data from PAnews / Golden Finance / Twitter)

#policy information

- U.S. SEC Commissioner Peirce: There is concern that some actions taken by the SEC in the cryptocurrency market will have counterproductive effects.

- The U.S. court officially ruled on the lawsuit between Grayscale and the SEC. The SEC needs to re-examine the ETF conversion application.

- The U.S. SEC has accepted Grayscale’s spot Ethereum ETF filing.

#macro information

- U.S. Treasury yields plunged, with the 10-year U.S. Treasury yield falling 20 basis points after rising above 5.1% during the session; the S&P 500 index fell for five consecutive days; the Nasdaq stopped four consecutive losses, and Microsoft and Google rebounded before the earnings report.

- Bill Ackman, a hedge fund tycoon who accurately shorted long-term U.S. debt, said he had closed his short position, and U.S. stocks and U.S. bonds turned sharply higher.

6.Corning, 3M, General Electric, Coca-Cola, etc. will release performance reports before the U.S. stock market opens; Microsoft, Google, Visa, Snap, etc. will release performance reports after the U.S. stock market opens.

#Coin circle information

- The total cryptocurrency market capitalization returned to above $1.2 trillion for the first time since August 2023.

- In the past 24 hours, the amount of liquidated positions on the entire network reached US$395 million.

- BlackRock’s spot Bitcoin ETF has been registered with DTCC, with the stock code IBTC.

- BlackRock S1 filing hints at preparing Seed Capital for its spot Bitcoin ETF in October.

- GaborGur bacs: Bitcoin’s second decade was mostly about business.

- Bloomberg Analyst: BlackRock may have received the "green light" from the SEC to list ETFs.

- ETF Expert: All spot Bitcoin ETF applications may be approved at the same time.

- Report: Nearly a quarter of global crypto trading activity comes from the United States and Canada.

On the news front, we need to pay attention to the following important news

Bill Ackman, the founder of Pershing Square Asset Management, announced on Monday that he had closed his long-term short position in U.S. Treasuries. The decision quickly drove gains in U.S. stocks and U.S. Treasuries. Ackman said there are too many risks globally and it is no longer appropriate to continue shorting the bond market at current interest rate levels. Additionally, he believes the U.S. economy is slowing down faster than recent data suggests. Ackman's precise market observations have attracted much attention during the new crown epidemic, and his decision to close positions has once again attracted widespread attention. Previously, the 10-year U.S. Treasury yield exceeded the 5% mark, but fell back after Ackman's statement.

In addition, "old bond king" Bill Gross also expressed his opinion, saying that he is buying short-term interest rate futures and predicts that the U.S. economy will decline in the fourth quarter. He pointed to turmoil at regional banks and rising auto loan delinquencies as signs of a significant slowdown in the U.S. economy.

Recently, long-term U.S. bond prices have fallen sharply as the Federal Reserve insists on tightening monetary policy and the U.S. fiscal deficit surges, causing U.S. bond yields to surge. Many institutions predict that U.S. bond prices may hit a bottom, and this view is also widely spread on Wall Street.

UBS believes that the “desperate selling” on October 12th marked the bottom of U.S. Treasury bonds. Institutions such as Morgan Stanley and Goldman Sachs have also expressed bullish views on the U.S. bond market. Michael Hartnett, chief investment strategist at Bank of America, believes that U.S. bonds will be one of the best-performing assets in the first half of 2024.

At present, neither Grayscale nor BlackRock’s ETF has been approved, and there is no obvious progress. Although Grayscale has obtained a court case, the final decision-making power lies with the SEC, and the authorization is still uncertain. The review time range is from 0 to 240 days, and the time limit is unknown. Therefore, the premium of GBTC may trend towards the price of BTC, but whether it can be converted into a BTC spot ETF is still uncertain, and approval is also full of uncertainty. BlackRock also did not receive SEC approval and although funds were prepared, they were not approved. The SEC has not yet issued an official decision, and market expectations are currently focused on ARK’s final deadline, which is January 10 next year.

To be clear, the current rise is mainly due to expectations for the early approval of the BTC spot ETF. This expectation is projected into the market in advance, and prices rise.

3. Technical indicator analysis (chart data from LBank/Coingecko)

BTC

The current price of BTC is US$34,561, an increase of 13.94% in 24 hours; the 24-hour trading volume is US$43.75 billion, an increase of 253.85% compared to one day ago.

In the past 24 hours, BTC has risen strongly, from a low of around $29,700 to a maximum of $35,980, and the current price has retreated to below $35,000.

It can be seen from the daily chart that the support of BTC price has been strong recently. It stepped back to the 7-day moving average and then broke through the previous high. At this time, the MACD long energy column increased its volume, RSI entered the overbought zone, and the current liquidation intensity above $35,000 is relatively Small, there is a greater chance of continuing upward after going sideways at $35,000.

According to the 4-hour chart, the trend of BTC is in a long arrangement, and the MACD energy column has obvious volume. The short-term support level is $33,500. If it can stand firm, there is a greater chance of continuing upward, and the pressure level is $36,000-37,500.

Personal opinion, for reference only.

Click to trade : https://www.lbank.com/en-US/trade/btc_usdt/

ETH

The current price of ETH is US$1,836, with an increase of 9.25% in 24 hours; the trading volume in the past 24 hours was US$5.97 billion, an increase of 35.33% from a day ago.

Judging from the 4-hour chart, ETH's rise is temporarily not as strong as that of BTC. If BTC stabilizes at a high level, ETH will have the opportunity to make up for the increase. The pressure range ahead is $1,900-$2,000.

According to the 1-hour chart, the MACD long energy column continues to increase in volume. In the short term, focus on the 7-day line support. If it stands firm, it is expected to test the pressure range. The short-term pressure level is $1,900 and the support level is $1,780.

Personal opinion, for reference only.

Click to trade : https://www.lbank.com/en-US/trade/eth_usdt/

PEPE

The current price of PEPE is US$0.000001004, an increase of 32.15% in 24 hours; the trading volume in the past 24 hours was US$306 million, an increase of 169.14%.

Judging from the 1-hour chart, PEPE inserted pin above $0.000001 after the market went well. Currently, MACD has a dead cross trend. RSI has pulled back from the overbought zone. The short-term support level is $0.00000095 and the pressure level is $0.0000011. If it can stand If stable, it is expected to test $0.0000014.

Personal opinion, for reference only.

Click to trade : https://www.lbank.com/en-US/trade/pepe_usdt/

4. Research on hot projects (data from LBank / Dextool / OKLINK / Scopescan)

$MOG

The current price is US$0.00000005333. It has been online for 3 months and has increased by 78.24% within 24 hours. The 24-hour trading volume of the largest pool in DEX is US$2.19 million, and the size of the liquidity pool is approximately US$1.18 million.

Judging from the data, there are 4,800 wallet holders, and the chips are well dispersed; some non-exchange wallets among the Top 20 have some changes.

The project has 6,419 Twitter followers, is currently moderately active, and has 773 TG members.

Judging from the daily chart, MACD continues to increase in volume, RSI has reached the overbought zone and is slowing down. There may be a correction in the short term, with the support level at $0.000000046 and the ahead pressure level at $0.00000007.

Personal opinion, for reference only.

Click to trade : https://www.lbank.com/en-US/trade/mog_usdt/

Research on hot projects (data from LBank/Dextool/OKLINK/Scopescan):

$BITCOIN

The current price of BITCOIN is US$0.122, with an increase of 38.56% in 24 hours. The 24-hour trading volume in DEX is US$4.82 million, and the size of the liquidity pool is approximately US$4.13 million. Total trading volume in 24 hours was $7.26 million.

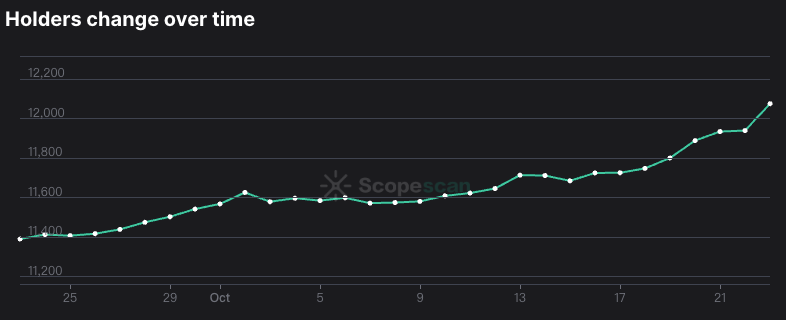

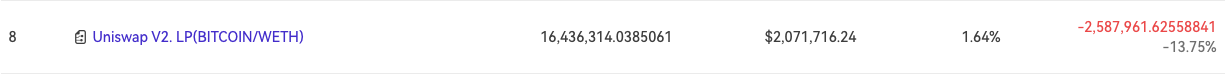

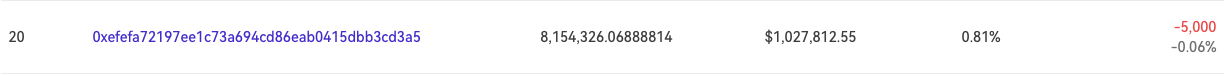

Judging from the data, the number of wallet holders is 12,106, which has continued to grow recently. The chips are currently well dispersed, with the top 10 wallets holding 19.44% of the chips; non-exchange wallets in the Top 20 have seen more outflows.

From the daily chart, the BITCOIN price stands above the front pressure level. At this time, MACD does not show a divergence signal, and RSI slows down in the overbought zone. If it can stand firm, it is expected to continue upward.

Personal opinion, for reference only.

Click to trade : https://www.lbank.com/en-US/trade/bitcoin_usdt/