*All on-chain data is dated as of 12:00 a.m. EST on Sunday, November 12th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Nov.5–11).

Author: LBank Labs Research team — Hanze, Johnny

Keywords: #ETF #Layer2

1 Macro Market Overview

U.S. stocks rise, booking weekly gains. According to WSJ, stocks climbed Friday, notching a winning week, led by the Nasdaq Composite’s best day in more than five months. The tech-heavy index jumped 2%, its biggest one-day percentage gain since May 26. The S&P 500 rose 1.6%. The Dow Jones Industrial Average increased by almost 400 points, or 1.2%. Friday’s gains followed a downbeat Thursday that thwarted the S&P 500’s shot at its longest winning streak since 2004. The S&P 500 had risen for eight consecutive sessions, while the Nasdaq had recorded nine straight positive trading days. Federal Reserve Chair Jerome Powell on Thursday tapped the brakes on the stock market’s run, saying at a conference that it was too early to declare victory against price pressures and leaving the door open for further interest-rate increases. A weak government sale of longer-term debt, meanwhile, pushed up bond yields and weighed on stocks.

Investors brushed off the University of Michigan’s preliminary November survey results, released Friday, which showed weak consumer sentiment and higher inflation expectations. At a press conference following the Fed’s most-recent meeting, Powell said the University of Michigan survey was just one reading the central bank uses to track inflation expectations.

All three indexes closed the week with gains, with the Nasdaq rising by 2.4%, the Dow Jones index up 0.7%, and the S&P 500 up 1.3%. Web3-related stocks continued their upward trend last week, with MARA and COIN gaining 2.2% and 8.3% respectively, while MSTR saw a significant increase of 11.9%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

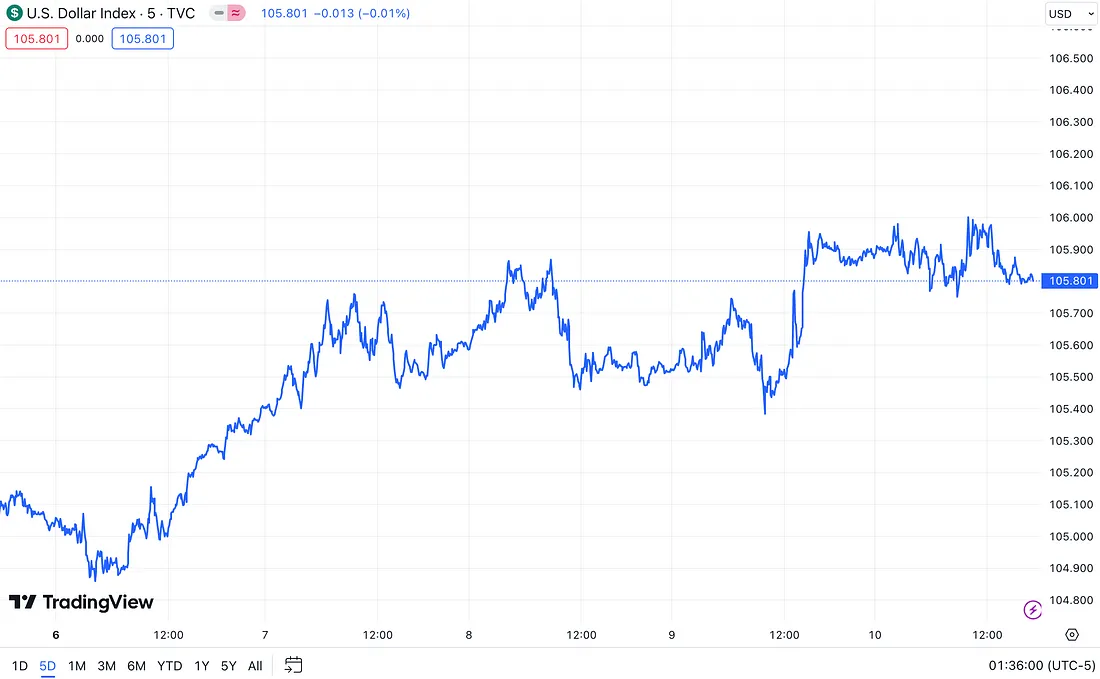

Macro indexes The U.S. dollar (USD) had a relatively flat performance on Friday. The U.S. dollar index (DXY) fell by 0.10% to 105.80, but it recorded a weekly gain of over 0.7%. The drop in the U.S. dollar index has propelled the rise of risk assets such as U.S. stocks and cryptocurrencies.

DXY (Source: TradingView)

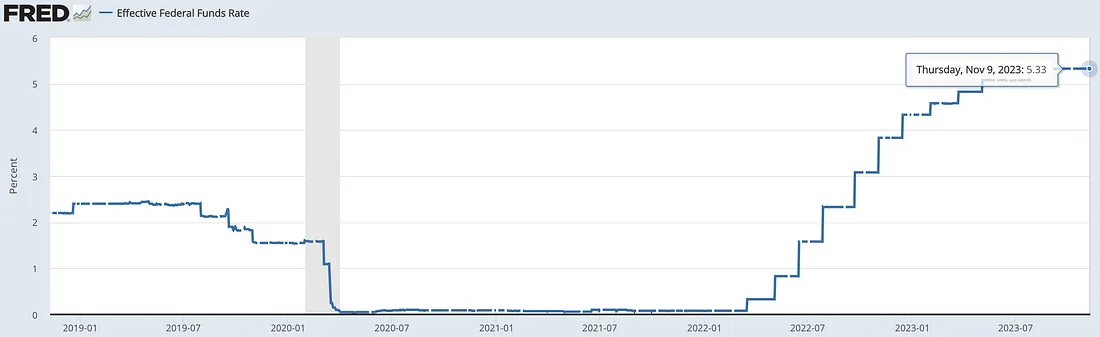

According to WSJ, after Fed officials kept rates unchanged at their policy meeting earlier this month, traders had priced in higher odds that the central bank could start cutting rates early next year, according to CME Group’s federal-fund futures. Traders now see a greater probability of the Fed holding rates steady through at least the first half of the year. The release of the Consumer Price Index (CPI) and retail sales data next week will provide clues regarding the possibility of further interest rate hikes by the Federal Reserve.

EFFR (Source: Federal Reserve Bank of New York)

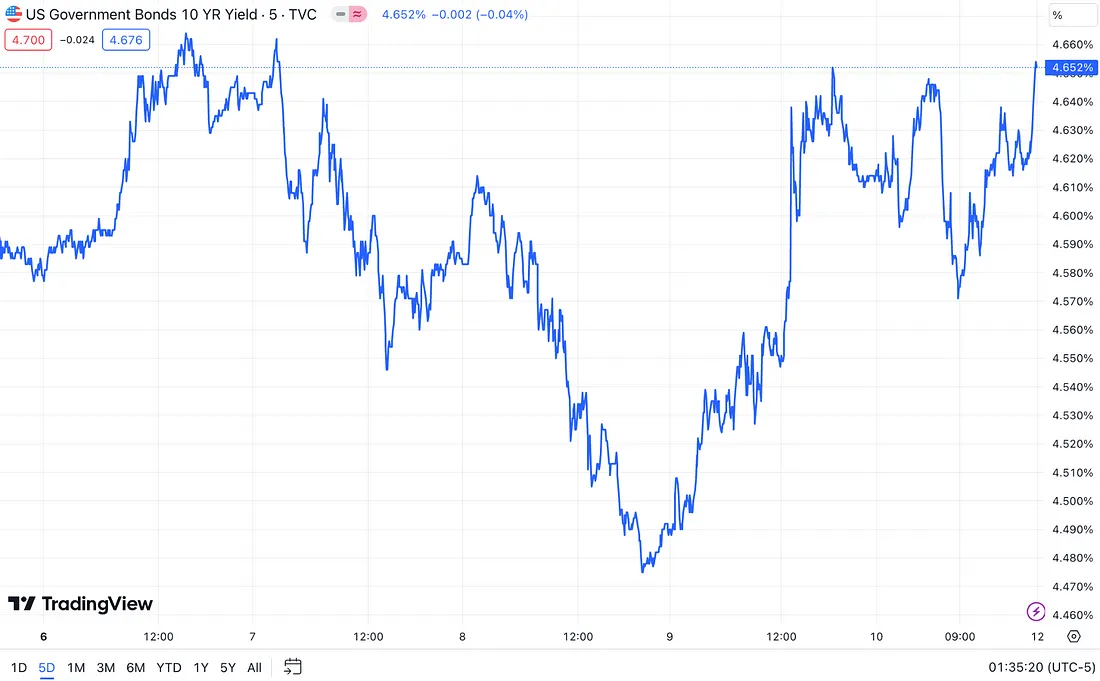

The bond market stabilized on Friday, with the benchmark 10-year Treasury yield (US10Y) settling at 4.652%, from 4.629% the day prior. On Thursday, investors tapped the brakes after a government sale of $24 billion in long-term debt didn’t entice as many buyers as anticipated. Benchmark 10-year yields, which offer practically risk-free returns, ticked higher afterward to 4.629%.

US10Y (Source: TradingView)

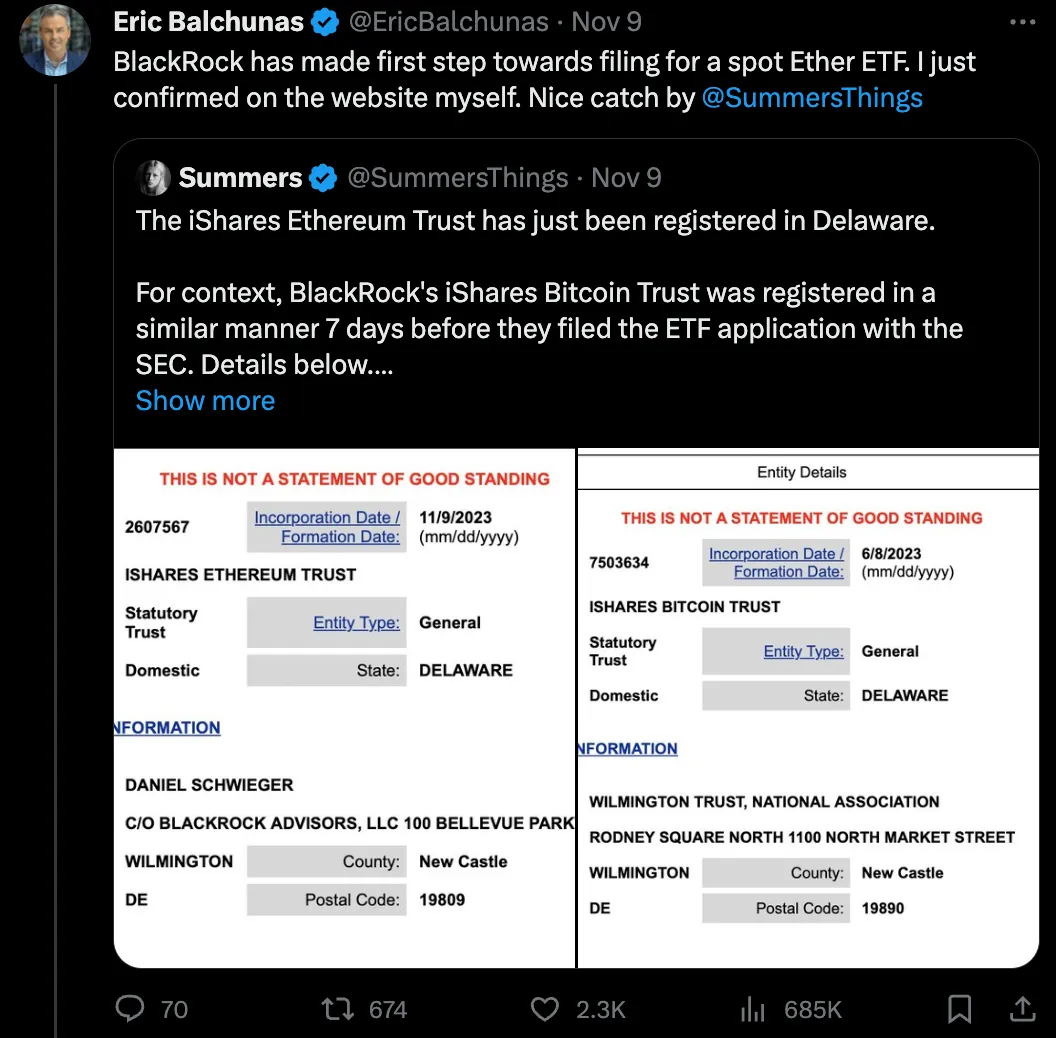

Nasdaq files for BlackRock’s proposed iShares Ethereum Trust ETF.

BlackRock, the world’s largest asset manager, is confirmed to be working on a spot ether ETF, according to a 19b-4 filing made on Thursday afternoon. Nasdaq made that filing for the proposed ETF called the iShares Ethereum Trust, hours after BlackRock filed to register an entity in Delaware. The asset manager has shown increasing interest in crypto over the past months and is currently awaiting a decision on an application for a spot bitcoin ETF from the Securities and Exchange Commission. The proposed ether ETF would use Coinbase Custody Trust Company as custodian, according to the filing. It will use the CME CF Ether-Dollar Reference Rate — New York Variant.

(Source: Twitter@EricBalchunas)

U.S. SEC Said to Open Talks with Grayscale on Spot Bitcoin ETF Push. The U.S. SEC has opened talks with Grayscale Investments on the details of the company’s application to convert its trust product GBTC to a spot bitcoin ETF, according to a person familiar with the back-and-forth, which could have momentous implications for the crypto industry. An SEC approval of one or more ETF applications is keenly awaited by the sector, which sees that moment as a milestone that could ease everyday investors’ path into digital assets. Grayscale has been in contact with both the SEC’s Division of Trading and Markets and the Division of Corporation Finance since winning its court fight, said the person, who requested anonymity because the talks remain private.

2 Crypto Market Pulse

Market Data

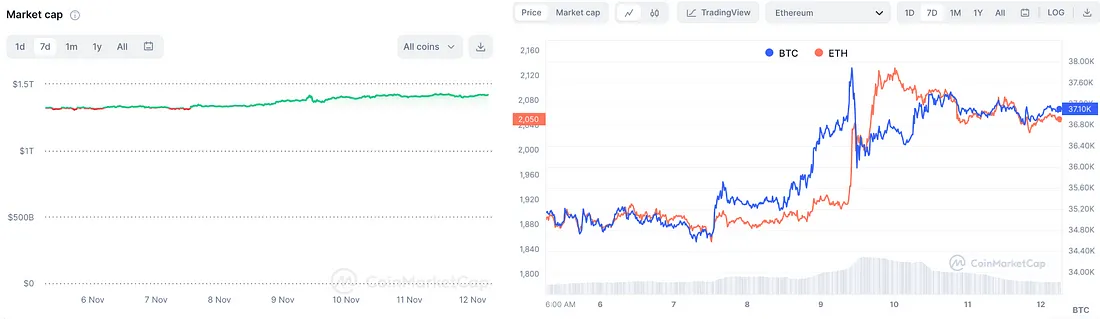

The total market capitalization of the cryptocurrency market continues to rise, increasing by $90 billion in one week. Last week, Nasdaq submitted a Ethereum spot ETF application to the U.S. SEC, and negotiations with the SEC on a Bitcoin spot ETF with Grayscale have started. These events indicate a growing likelihood of Bitcoin and Ethereum spot ETF approvals in the United States, which has excited investors. As of 12:00 AM on November 12th, the price of Bitcoin is $37,100, representing a 5.4% increase from the previous week. Ethereum, as the second-largest cryptocurrency, is currently priced at $2,050, with a gain of 8.9%. The total market capitalization of the entire cryptocurrency market has reached $1.41 trillion, marking a 6.8% increase in one week. Furthermore, Bitcoin’s market share in the overall market has slightly decreased to 51.3%, with a market value of $723.1 billion. In contrast, Ethereum’s market share has slightly increased to 17.5%, with a current market value of $246.5 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

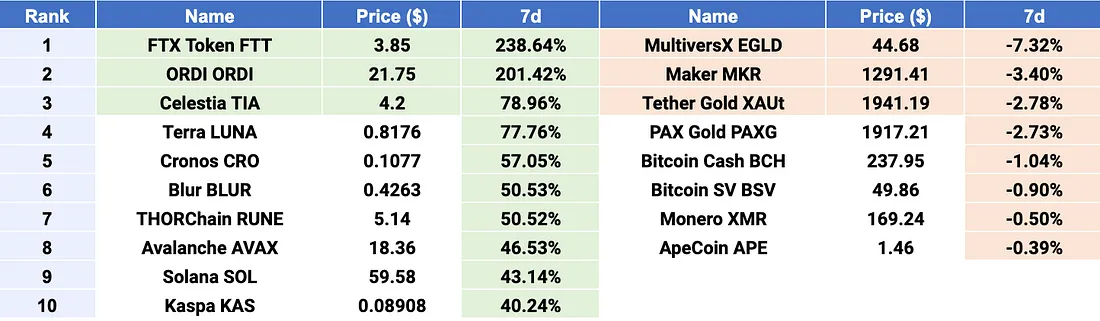

$FTT, $ORDI, and $TIA emerged as Top 3 gainers, while $EGLD, $MKR, and $XAUt were Top 3 losers. As the bankruptcy situation at the cryptocurrency exchange FTX continues to unfold, Gary Gensler, the Chairman of the SEC, has expressed conditional support for the possible relaunch of the exchange, emphasizing the importance of legal compliance. In the wake of the recent “reboot news,” $FTT, as the top gainer last week, continued to surge, with some people anticipating that after the reboot, holding $FTT could potentially be converted into equivalent equity. On November 7th, the Bitcoin Ordinals trading market saw a trading volume exceeding $15.3 million, reaching an all-time high, and the price of $ORDI also skyrocketed with increased trading volume and speculation. Similarly, the token $TIA from Celestia saw a surge in price along with rising trading volume. Further data shows a significant increase in TIA’s futures open interest contracts and short liquidations, indicating increased demand for this token among investors in the recent period. While some tokens had a less favorable performance last week, it was mostly due to retracements after previous gains. Overall, demand for tokens in the cryptocurrency market is on the rise amid the current bullish trend.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

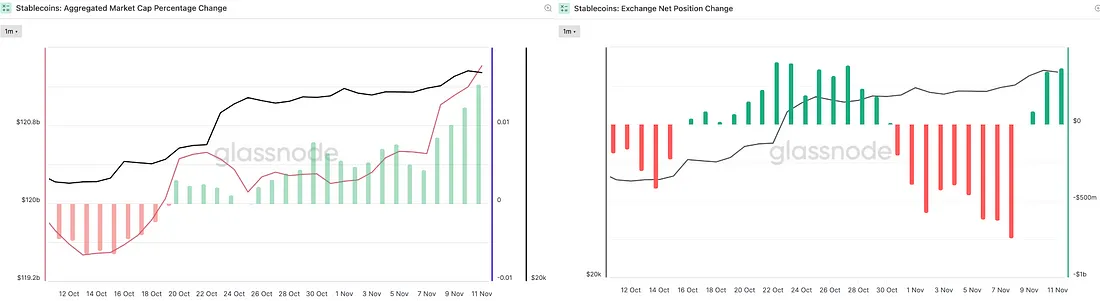

Last week, the total supply of stablecoins continued to steadily grow, reaching $121.5 billion. With the Federal Reserve nearing the end of its interest rate hiking cycle, it is expected that interest rates will decrease, which is favorable for capital flowing into the cryptocurrency market. At the same time, net positions of exchange-based stablecoins shifted from significant net outflows to net inflows in the past week, indicating a reduction in selling pressure on cryptocurrency assets. In summary, these developments suggest a growing interest from investors in the rise of cryptocurrency assets and a bullish trend in the market.

Stablecoins Market Cap (Data: Glassnode)

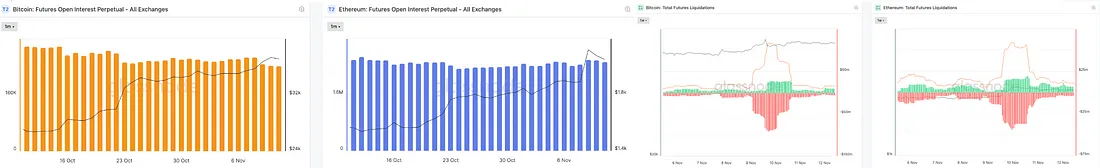

In the derivatives market, the total open interest in Bitcoin and Ethereum futures contracts has remained relatively stable. Over the past few weeks, there hasn’t been a significant increase in the total open interest of Bitcoin and Ethereum futures contracts, indicating that new significant funds have yet to enter the derivatives market. On the other hand, last week’s rally in Bitcoin and Ethereum, starting on the 9th, resulted in a significant number of short positions being liquidated, with the total liquidation amount reaching nearly $100 million and $50 million, respectively. This suggests that the current market has exhibited volatility within its upward trend.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Future Liquidations (Data: Glassnode)

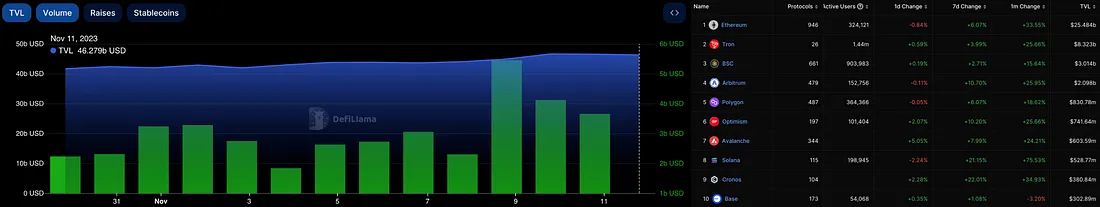

In the DeFi market, the total value locked (TVL) continued to grow last week, increasing by 6.6% to reach $46.3 billion. Over the past seven days, decentralized exchanges (DEXs) saw a significant 40% increase in trading volume, reaching $24.4 billion compared to the previous week. Furthermore, the market share gap between DEXs and centralized exchanges (CEXs) continues to narrow, with DEXs now accounting for 31% of the total trading volume on CEXs. Among the top ten blockchains ranked by TVL, all platforms experienced further TVL growth in the past seven days. It’s worth noting that Solana and Cronos led the way last week, with TVL increasing by 21% and 22%, respectively, and layer 2 solutions also performed well, with over 10% gains.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

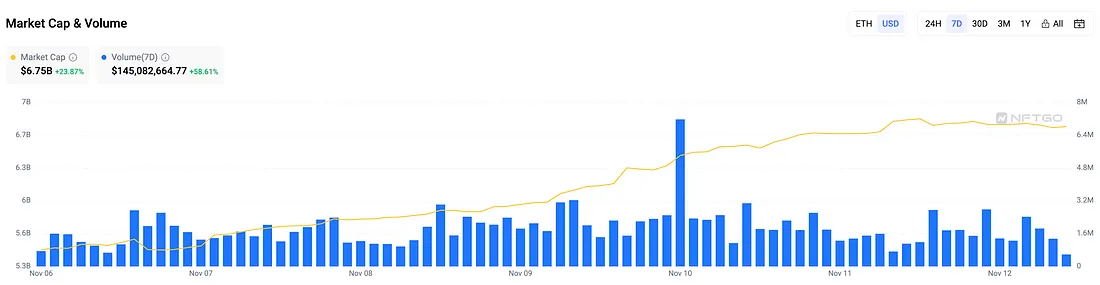

Last week, the NFT market experienced a significant surge, with increases in both market capitalization and trading volume. The current NFT market capitalization has reached $6.8 billion, representing a 23.9% increase within one week. Furthermore, the trading volume over the past seven days continued to rise, with a remarkable growth of over 58.6%, reaching the highest trading volume in the past three months. In the top NFT collections, the floor prices and average prices saw considerable increases last week. The floor price and average price of the Bored Ape Yacht Club (BAYC) rose by 8.5% and 3.2%, respectively. Similarly, the floor price and average price of the Mutant Ape Yacht Club (MAYC) also increased by 12% and 3%.

Market Cap & Volume, 7D (Data: NFTGo)

LBank Labs’ Recap

The bullish momentum persisted throughout the week, with notable trading volume emanating from institutional players. Of particular interest is the premium of CME BTC futures over CEX platforms such as Binance. While we are technically in the initial stages of the bullish cycle, confirmation of a sustained trend change necessitates observing price stability over the coming months.

SOL experienced a significant surge, surpassing the $60 mark, propelled by the Grayscale Solana Trust reaching $200. This development underscores the heightened interest of TradFi investors in crypto assets, suggesting potential upward momentum in the future. It is noteworthy that Solana currently holds the position of the largest asset on FTX’s balance sheet, with recent weeks witnessing selling activity. However, no direct evidence of price manipulation has been observed.

The market maker has realized profits on GAS token, preempting a 50% decline. The future price had been 30% below the spot price, attributed to a significant short position taken by a pump group concurrently selling GAS in the spot market.

ORDI consistently secures a position among the top gainers as retail investors pour funds into BRC-20. As the original token of the ecosystem, ORDI demonstrates substantial buying pressure.

Arbitrum ecosystem tokens (MAGIC, RDNT, etc.) exhibited strong performances in the final days of the week, albeit appearing ephemeral. Once regarded as the king of Layer 2, the ecosystem now grapples with challenges in establishing new narratives to captivate investor interest.

Binance Launchpad projects briefly commanded attention, yet the speculative nature of the funds invested in these projects is evident. Our ongoing research aims to discern patterns in pumping cycles, examining whether an increase in volume within one sector triggers heightened trading activity in another. Unlike previous bull cycles, the current trend diverges, with no apparent leading growth sector. Notably, CEX stablecoin APY has surged to as high as 60% on OKX, indicating increased interest and potential shifts in market dynamics.

- BTC price optimistic: $38000 — $39500

- BTC price neutral: $36500-$38000

- BTC price pessimistic: $34500 — $36500

3 Major Project News

[Ethereum] Ethereum All Core Developers Execution Call #174 Writeup. According to Christine Kim’s summary of the 174th Ethereum Execution Layer All Core Developers’ Meeting (ACDE), the meeting primarily covered the following topics: 1) The status of the Ethereum testnet Goerli’s Shadowfork 0, which is running normally. There are plans to increase the number of validators in the future to more accurately assess block and Blobs data latency. 2) Modifications to the Execution Layer API to provide data for regular transactions and Blob transactions. This includes adding eth_blobGasPrice and updating eth_feeHistory. 3) Discussion on adding a precompiled contract to assist in smart contract verification of Verkle proofs.

(Source: galaxy.com)

[Layer2] Optimism will activate the Canyon network upgrade on the testnet on November 14 at 17:00 UTC. Optimism has announced that its first network upgrade, Canyon, following the Bedrock, is scheduled to activate on the testnets (OP Goerli, OP Sepolia, Base Goerli, Base Sepolia, PGN Sepolia, Zora Sepolia) on November 14 at 17:00 UTC. This network upgrade has been built and implemented in collaboration with Base. To activate the Canyon hard fork on the OP mainnet, Base, and other Superchain mainnets, it still needs to go through the Optimism governance process.

The Canyon upgrade includes support for the Shanghai and Capella hard forks and some minor bug fixes. Users should not be affected by this testnet upgrade, as they can access the latest Ethereum mainnet features on all OP testnets. Following the Canyon upgrade, node operators will need to update their nodes.

(Source: blog.oplabs.co)

[Layer2] The Starknet Foundation has announced the establishment of a DeFi Committee. This committee consists of six members and its primary purpose is to guide and promote the development of the DeFi ecosystem on Starknet. The committee has a budget of 50 million $STRK. The six members of the DeFi Committee are as follows: Damian, an administrator of the Starknet Foundation; Itamar Lesuisse, co-founder and CEO of Argent; Jane Ma, co-founder of zkLend; Mentor Reka, co-founder and CEO of AVNU; Richard Thomas-Pryce, Head of Product at Nostra; and Vitaly Yakovlev, CTO of ZKX.

Furthermore, Starknet’s development team has announced the release of Juno V0.7.4, which brings improvements to scalability. In a post on the X platform, the Nethermind Starknet development team stated that this version enhances scalability by allowing Juno nodes to connect to the main node’s database via gRPC, enabling them to service RPC requests without the need for synchronization.

(Source: Twitter@StarknetFndn, Twitter@NethermindStark)

[Layer2] Kraken Said to Seek Partner to Help Build It a Layer 2 Blockchain Network. Cryptocurrency exchange platform Kraken is actively seeking partnerships to build its own Layer 2 network, with potential collaborators including Polygon, Matter Labs, and Nil Foundation. Insiders have revealed that Kraken is considering these companies to use their technology as the basis for its new network.

This move aligns Kraken with its competitor Coinbase, which has also taken steps to launch its own Layer 2 network. Recently, Kraken posted job listings on its website, looking to hire a “Senior Cryptography Engineer” with expertise in “modern cryptography, including ZK proofs,” suggesting potential involvement in designing and implementing Layer 2 solutions.

Kraken Chairman Jesse Powell (Source: CoinDesk)

[Polygon] NEAR Foundation and Polygon Labs join forces to build Zero-Knowledge Solution for WASM Chains. The NEAR Foundation and Polygon Labs have announced a collaboration to build zkWASM. The zkWASM verifier will bring the NEAR Protocol closer to Ethereum and enable WASM chains to tap into Ethereum liquidity. The zkWASM verifier is expected to be launched next year. zkWASM will ultimately become one of the three verifiers available for developers to use with the Polygon Chain Development Kit (CDK). The Polygon CDK is an open-source code library designed to kickstart ZK support for Ethereum-based L2 chains.

Furthermore, the Near Foundation has introduced Near DA (Data Availability) last week, which aims to provide data availability for Ethereum Rollups. It serves as an alternative product capable of handling data generated by Ethereum, sidechains, or Layer 2 solutions in large volumes. Initial users of Near DA include Starknet’s Madara, Caldera, and Movement Labs.

(Source: Twitter@0xPolygonLabs)

[Polkadot] Cardano is set to build a “partner chain” project using the Substrate implementation based on the Polkadot SDK. Polkadot announced on the X platform that Cardano will utilize the Polkadot SDK’s Substrate to create this project. The development organization behind Cardano, IOG, has stated that Substrate is a validated open-source modular framework that can be used to build sovereign blockchains that operate independently of Polkadot, such as Polygon’s Avail project.

(Source: Twitter@Polkadot)

4 Key Fundraising Data

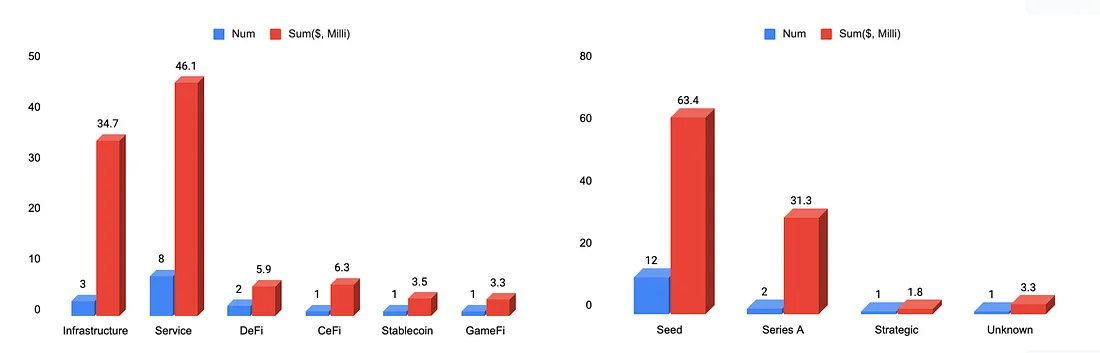

Last week witnessed a total of 18 financing events, raising a substantial amount of over $99.8 million*. Compared to last week, there has been a slight increase in the number and total amount of financing activities. The Service sector attracted the most attention with 8 financing activities, accounting for 44.4% of all financing activities, with a total amount of $46.1 million, representing 46.2% of the overall financing. The largest fundraising activity this week also occurred in the Blockchain Infrastructure sector, led by the Ritual project, which raised $25 million. Ritual is a decentralized AI compute platform. More detailed information is provided below.

*2 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [Infrastructure] Decentralized AI compute platform Ritual closes $25 million fundraise.

Ritual, a decentralized AI compute platform, landed a $25 million capital injection in a round led by Archetype, with Accomplice and Robot Ventures also participating. Amid the proliferation of consumer-friendly AI technologies in the past year, spearheaded by OpenAI’s ChapGPT, Ritual aims to create an “incentivized network” that will pave the way for distributed computing devices to power different aspects of artificial intelligence, according to an announcement last week. The startup said that as things stand, access to chips, computing power and the models powering AI tools lie in the hands of a small group of companies.

The cash injection will be used to build network infrastructure, grow the team of 15 people and to grow the Ritual’s ecosystem. The firm did not disclose a valuation for the round.

The startup plans to launch its alpha platform early next year.

- Official Link: https://ritual.net/

2. [Service] Ingonyama Raises $20 Million from Samsung to Develop ZK Crypto Chips.

Semiconductor company Ingonyama successfully raised $20 million in a seed funding with key investors including Samsung Next participating in the round. The company is developing a programmable parallel computing processor, akin to a GPU — that will specifically accelerate zero-knowledge proofs and fully homomorphic encryption, pushing the boundaries of advanced cryptography.

The funding round attracted notable venture capital funds, including Walden Catalyst, Geometry, Blue Yard Capital and others, signaling strong market confidence in Ingonyama’s technology. These investors, including those relying on zero-knowledge proof technology like StarkWare, recognize the potential impact of the company’s work in the field of privacy and security.

- Official Link: https://www.ingonyama.com/

3. [CeFi] Galactic Holdings Secures $6.25M Series-A to Boost Crypto Ecosystem in Latin America.

Digital financial firm Galactic Holdings has announced the completion of its recent Series A funding round, raising a total of $6.25 million. The funding was led by Galaxy Interactive and Dragonfly, with participation from several institutions including SHK. The infusion of funds will further drive the development of Galactic Holdings’ subsidiary brands in the Latin American market, including the TruBit wallet, TruBit Pro exchange, and the Mexican stablecoin MMXN, while also accelerating the expansion of cross-border payment services into other countries.

- Official Link: https://galacticblock.com/

4. [Service] The smart contract platform Llama has successfully raised $6 million in seed funding.

Llama, an access control and governance platform for smart contracts, is designed to address inefficiencies and security vulnerabilities that could lead to subpar performance and potential vulnerabilities to hacking and exploitation. The latest round of financing saw participation from investors including Founders Fund, Electric Capital, Polygon co-founder Sandeep Nailwal, and Aave founder Stani Kulechov. Llama aims to enhance blockchain protocol governance and enable the encoding of roles and permissions for executing on-chain actions like fund transfers or protocol parameter changes, making the governance process more efficient.

- Official Link: https://llama.xyz/

See you next week! 🙌

🎙Forum: Feel free to leave your comments on our official LBank Labs Twitter account, and don’t hesitate to ask questions about the tokens or projects that interest you. We will diligently gather them and discuss them in the recap section of our weekly digest!

📢 Disclaimer: The weekly crypto market insights are provided for informational purposes only and should not be considered as financial advice. The cryptocurrency market is highly volatile and unpredictable. Prices and trends can change rapidly, and past performance is not indicative of future results. Always conduct thorough your own research and consult with a qualified financial professional before making any investment decisions.