1. Review of hot topics this week:

1.1. Powell’s congressional testimony: The Fed needs to be more confident about inflation before it can cut interest rates

On Wednesday, March 6, Federal Reserve Chairman Powell’s semi-annual testimony to the U.S. Congress kicked off.

Powell said he has some confidence that inflation will fall to the target. He wants to see more data before cutting interest rates and does not want inflation to reach 2% before easing.

Fed officials need to be "more confident" that inflation will fall back to 2% before deciding to cut interest rates. There is currently no reason to believe that there is a risk of recession in the short term, and the U.S. economy is expected to continue to grow steadily.

Commentators said there was nothing new in Powell’s testimony. As the market expected, he was in no rush to cut interest rates.

On Thursday, March 7, Federal Reserve Chairman Jerome Powell began his second day of semiannual congressional testimony.

Powell said that if inflation is as expected, interest rates can and will begin to be cut this year; interest rates are highly restrictive, but it is far from neutral; new bank capital regulations will be based on evidence and fair, and if a consensus is reached, the Fed will not hesitate to modify them Proposal for new regulations; the final version of the new bank capital regulations is expected to be released within this year, and the regulations will not be modified for climate change;

While considering new methods of liquidity supervision; reiterated that the U.S. real estate market has a structural shortage, believing that supply shortages are pushing up housing costs; the real estate market is in a very difficult situation, with previously low interest rates limiting the current supply of housing; reiterated that the problem of commercial real estate loans is controllable, mainly due to small and medium-sized banks problem, the Federal Reserve has touched banks with severe problems; to get the finances back on track for long-term sustainability, the Fed will not pay for fiscal deficits; the United States is far from launching a central bank digital currency.

1.2. U.S. ADP employment increased by 140,000 in February but lower than expected

On March 5, data released by ISM showed that the expansion of the U.S. ISM service industry slowed down in February, which was partly due to employment indicators. The price paid index also fell significantly, and orders and business activities increased.

The ISM services index in the United States in February was 52.6, lower than the expected 53. The value before January was 53.4. The U.S. ISM non-manufacturing index fell more than expected in February, The expansion of service industry companies, which contribute the majority of U.S. GDP, has slowed more than expected.

On Wednesday, March 6, the U.S. ADP employment report showed that the U.S. ADP employed 140,000 people in February, which was less than the expected 150,000 people, but exceeded the revised previous value of 111,000, marking the largest increase since December 2023.

While employment growth rebounded, wage growth for those staying employed continued to slow, reaching 5.1%, the smallest increase since August 2021. For those changing jobs, wages increased 7.6% year-on-year, the first acceleration since November 2022.

1.3. Singapore’s Temasek plans to invest in OpenAI, but has not yet reached an agreement on the investment scale.

On March 5, the media quoted people familiar with the matter as saying that senior managers of Singapore’s Temasek Holdings had held multiple meetings with OpenAI CEO Sam Altman in recent months to discuss investment matters.

Another person familiar with the matter said that Temasek initially showed interest in investing in Hydrazine Capital, a venture capital fund managed by Altman, but more recently discussions have turned to investing in OpenAI itself. The person also pointed out that although the negotiations are still in the preliminary stage and the specific investment scale has not yet been determined, discussions between the two parties are still ongoing.

Neither OpenAI nor Temasek have publicly commented on this investment negotiation.

Although OpenAI's revenue has grown dramatically since the release of ChatGPT in November 2022, Altman said the company is still losing money due to huge modeling and training costs. He estimates that the cost of building artificial intelligence infrastructure may range from tens of billions of dollars to as high as $7 trillion, a figure that is far beyond the scope of traditional technology venture capital.

1.4. Grayscale launched its first multi-collateral active private equity fund (GDIF), initially including nine tokens including APT

On March 5, Grayscale once again promoted its active private equity fund to earn income through the pledge of multiple cryptocurrencies. The fund, called Grayscale Dynamic Income Fund (GDIF), aims to earn income by staking cryptocurrencies and will distribute rewards in U.S. dollars on a quarterly basis.

GDIF will initially include assets from nine blockchains: Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), SEI Network (SEI) and Solana (SOL).

Grayscale CEO Michael Sonnenshein said: “As our first actively managed fund, GDIF is an important expansion of our product suite, allowing investors to participate in multi-asset staking through the convenience and familiarity of a single investment vehicle.”

1.5. The US SEC accused Binance.US in a new document of failing to provide relevant materials as required.

On March 6, the US SEC and Binance.US submitted a joint status report on Tuesday detailing the ongoing investigation. SEC lawyers said in the filing that Binance.US did not fully comply with requests for information about its customers’ assets and other matters, and that Binance.US employees did not provide all requested discovery materials and provides limited assistance in answering questions or otherwise resolving.

The SEC said Binance.US failed to prove to it that Binance Global employees did not have access to U.S. customers’ assets. Binance.US said in the same joint report that it had “fulfilled its obligations” by answering all of the SEC’s questions and that further disclosure requests exceeded the limits of the consent order.

Christopher Blodgett, chief operating officer of Binance.US, revealed that since June last year, Binance.US had to lay off more than 200 employees, equivalent to two-thirds of its total workforce. Binance.US trading volume and business in general have collapsed, the trading platform's revenue fell by about 75%.

1.6. DeFi TVL exceeded US$100 billion for the first time since May 2022

On March 6, according to data from The Block, the total value locked (TVL) of the decentralized finance (DeFi) protocol exceeded US$100 billion for the first time since May 2022, reaching US$101.36 billion.

Among them, the loan sector is US$32.62 billion (32.2%), the decentralized exchange is US$19.97 billion (19.7%), the mortgage debt position is US$12.22 billion (12%), and the re-staking is US$10.06 billion (9.9%). The last time DeFi’s TVL exceeded $100 billion was on May 11, 2022, when DeFi TVL was $112.67 billion.

1.7. African currencies are under pressure. Egypt officially announced "surrender" and the exchange rate plummeted 40%.

In order to save the endangered economy and exchange for loans provided by the IMF, the Egyptian Central Bank finally decided to abandon exchange rate intervention.

On Wednesday, March 6, the Egyptian Central Bank announced that it would allow the Egyptian pound exchange rate to float freely and raise interest rates by 600 basis points to combat growing inflationary pressures. Subsequently, the Egyptian pound exchange rate plummeted rapidly. The Egyptian pound plunged nearly 40% against the US dollar, hitting the 50 Egyptian pound mark per US dollar for the first time, which was already equivalent to the black market exchange rate. Over the past year, the official exchange rate of the Egyptian pound has been controlled at around 31 Egyptian pounds to the dollar.

The combination of the Federal Reserve's interest rate hikes and the expansion of U.S. debt has led to the continued strength of the U.S. dollar against non-U.S. currencies. Egypt and other African countries, which have large foreign debt denominated in US dollars, have fallen victim to the spillover from US monetary policy.

The simultaneous Palestinian-Israeli conflict and the Houthi armed attack on the Red Sea caused a 55% to 60% drop in transportation volume in the Suez Canal, Egypt's key source of foreign exchange. Coupled with the civil war in neighboring Sudan, the Egyptian economy, which was in the midst of a geopolitical crisis, suffered heavy losses.

The naira, the currency of Africa's largest economy, has lost 74% of its value against the U.S. dollar since January 2022, while inflation has soared by double digits.

1.8. Senior trader at Goldman Sachs: Before the technology bubble burst in 2000, the market also believed that Cisco could continue to rise.

On March 7, Goldman Sachs trader and managing director Bobby Molavi warned that if you compare Nvidia’s stock price trend from 2020 to the present with Cisco’s trend from 1996 to 2002, there are striking similarities between the two. Back then, Cisco was regarded as the darling of the Internet era, and the Internet had high hopes. At that time, it was generally believed that the entire Internet would rely on Cisco routers to operate, and these routers had a high gross profit margin of 50%. But in the end it wasn't.

Nearly one-fifth of the distance has been traveled in 2024 and it saw the S&P 500 gain 7.7%, while the relatively small European market performed even better, rising 8.2%. Japan's Nikkei continued its stunning performance, rising 19%.

The U.S. stock market seems to be filled with fear of missing out (FOMO), All-or-nothing (YOLO) and momentum-chasing (momo market) emotions. "Hold the position unchanged, plan to continue to hold the position, but feel a little uneasy", this sentence may best describe the current mentality of many investors.

Market crowding and concentration may become the new normal. The only question is whether the Fed's interest rate cuts will begin in March or later. However, as time went on, expectations for March were pushed back to May, and even a rate cut in June is now a possibility.

1.9. SEC postpones decision on BlackRock spot Bitcoin ETF options product

On March 7, the U.S. SEC postponed the decision on BlackRock’s spot Bitcoin ETF options trading application to April 24, at which time it will decide whether to “approval or disapproval, or continue discussions.”

The U.S. SEC has previously sought public opinions on whether Nasdaq would allow options trading on the BlackRock Spot Bitcoin ETF. The SEC also delayed a decision on whether to allow Cboe Exchange, Inc. and Miax Pearl LLC to list and trade spot Bitcoin ETF options, according to documents filed Thursday. The next deadline is also April 24, the SEC said.

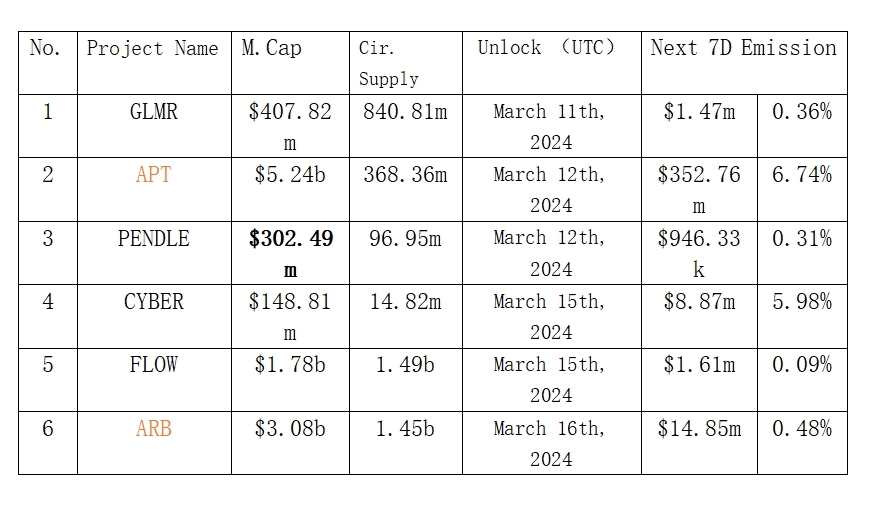

2. Projects to be unlocked next week:

3. Key events next week:

March 12 (Tuesday)

U.S. February core CPI year-on-year data;

U.S. February CPI year-on-year data;

March 14 (Thursday)

Number of people applying for unemployment benefits for the first time in the week of March 9 in the United States (10,000 people);

U.S. February core PPI year-on-year data;

US February PPI year-on-year data;

US February retail sales (excluding automobiles) month-on-month data;

March 15 (Friday)

Preliminary value of the University of Michigan consumer expectations index in March.