*All on-chain data is dated as of 12:00 a.m. EST on Sunday, June 30th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week (June.23-29).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #PCE #GDP #VanEck Solana Trust

Nvidia’s ascent is a big reason the S&P 500 has climbed this year. PHOTO: JUSTIN SULLIVAN/GETTY IMAGES

1 Macro Market Overview

AI Frenzy Propels Stocks to Monster First Half. According to WSJ, The AI fervor powering the stock market shows no sign of cooling down. Much as in 2023, investors piled into bets in the first half of this year that the artificial intelligence boom is just getting started. They sent Nvidia NVDA -0.36%decrease; red down pointing triangle shares soaring 149%, propelling the graphics-chip maker’s market value above $3 trillion and briefly making it the most valuable company in the world. Nvidia’s ascent is a big reason the S&P 500 has climbed 14% this year—nearly as much as in last year’s standout first half—even as a series of hot inflation readings damped investors’ hopes that the Federal Reserve would soon begin to cut interest rates. Entering the second half, many investors are feeling good. Corporate profits have been strong, and signs of easing inflation have bolstered hopes that the Fed will cut rates this year. Still, there are reasons the rally could stall. Markets could lose patience if the central bank continues to leave rates unchanged. The election season pitting President Biden against former President Donald Trump could spark volatility, with traders racing to discount the shifting likelihood of policy changes. Elevated valuations could make stocks susceptible to disappointments of any kind.

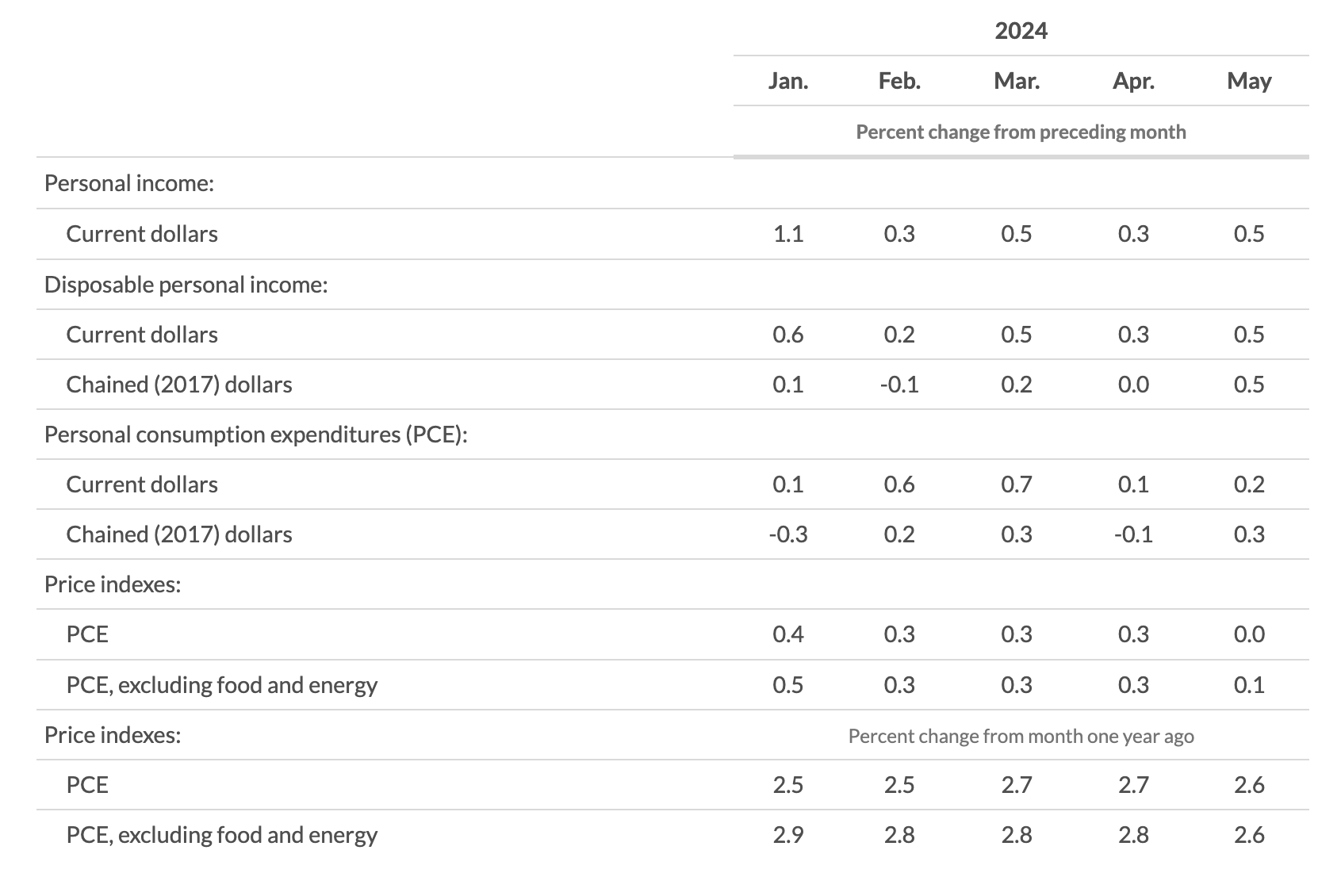

The inflation indicator favored by the Federal Reserve (Fed) saw a comprehensive slowdown in May, with the annual increase hitting a more than three-year low and the monthly increase reaching a six-month low, providing strong support for the expectation of a rate cut in September this year. The month-on-month growth rate of the core PCE price index for May was 0.1%, the lowest record since December 2023. Additionally, the final value of the University of Michigan Consumer Sentiment Index for June was 68.2, compared to an expected 65.8 and a previous value of 65.6.

The three major U.S. stock indexes showed mixed performances last week. The tech-centric Nasdaq Composite Index rose by 0.2%, while the S&P 500 and the Dow Jones Industrial Average were basically flat. Stocks related to Web3 also lacked upward momentum. MARA increased by 4.3%, while COIN and MSTR fell by 0.6% and 6.6%, respectively.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

Data released by the Bureau of Economic Analysis (BAE) of the U.S. Department of Commerce on Friday (28th) showed that the core Personal Consumption Expenditures (PCE) price index, excluding volatile food and energy items, increased by 0.1% month-on-month in May, marking the smallest increase in six months. This met market expectations and was lower than the revised previous value of 0.3%. On a non-rounded basis, the index rose by only 0.08%, the slowest pace since November 2020.

(Source: U.S. Bureau of Economic Analysis)

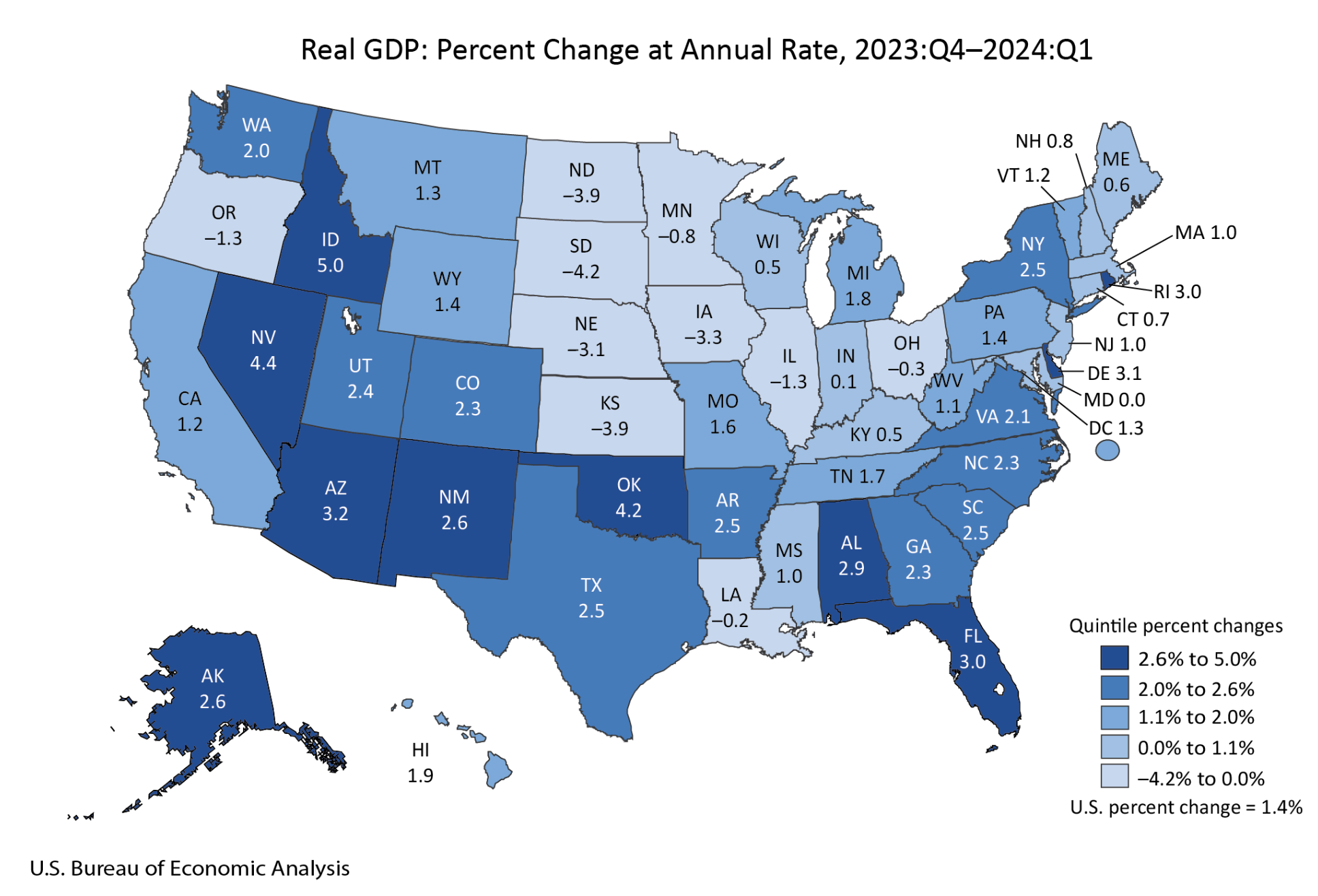

Real gross domestic product increased in 39 states and the District of Columbia in the first quarter of 2024, with the percent change ranging from 5.0 percent at an annual rate in Idaho to –4.2 percent in South Dakota, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA).

Current-dollar gross domestic product (GDP) increased in 45 states and the District of Columbia, with the percent change ranging from 7.8 percent at an annual rate in Delaware to –4.0 percent in North Dakota.

Personal income, in current dollars, increased in all 50 states and the District of Columbia, with the percent change ranging from 9.5 percent at an annual rate in South Carolina to 0.6 percent in North Dakota.

(Source: U.S. Bureau of Economic Analysis)

Last week, the U.S. Dollar Index (DXY) rose steadily amid market volatility, closing at 105.849 on Friday. This marks a slight increase from the previous week's closing value of 105.832.

DXY (Source: TradingView)

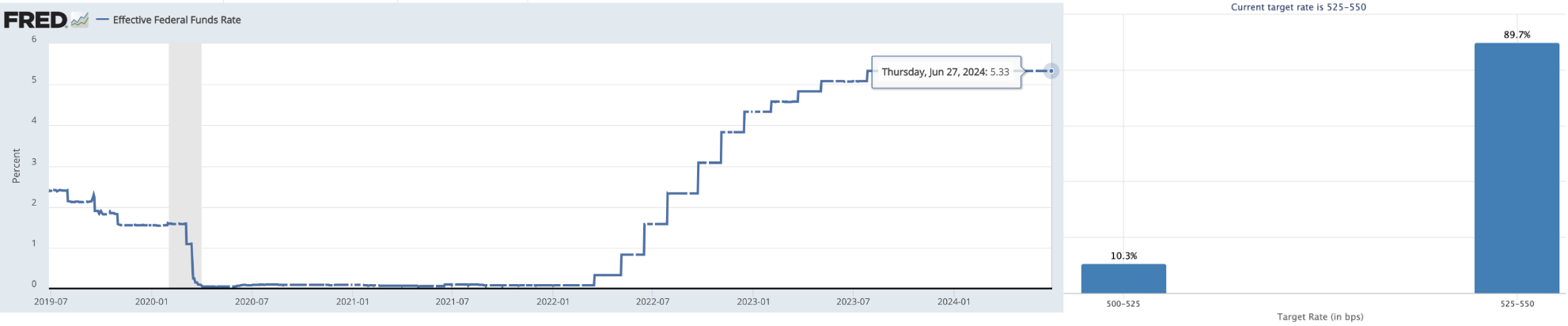

According to the latest data from the Chicago Mercantile Exchange (CME), currently, about 10% of investors believe that the Federal Open Market Committee (FOMC) will implement the first rate cut of the year at its next meeting in July, while nearly 90% of investors expect the interest rates to remain unchanged. This data has remained almost unchanged compared to the previous week.

Left: EFFR, Right: Target Rate Probabilities for July 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

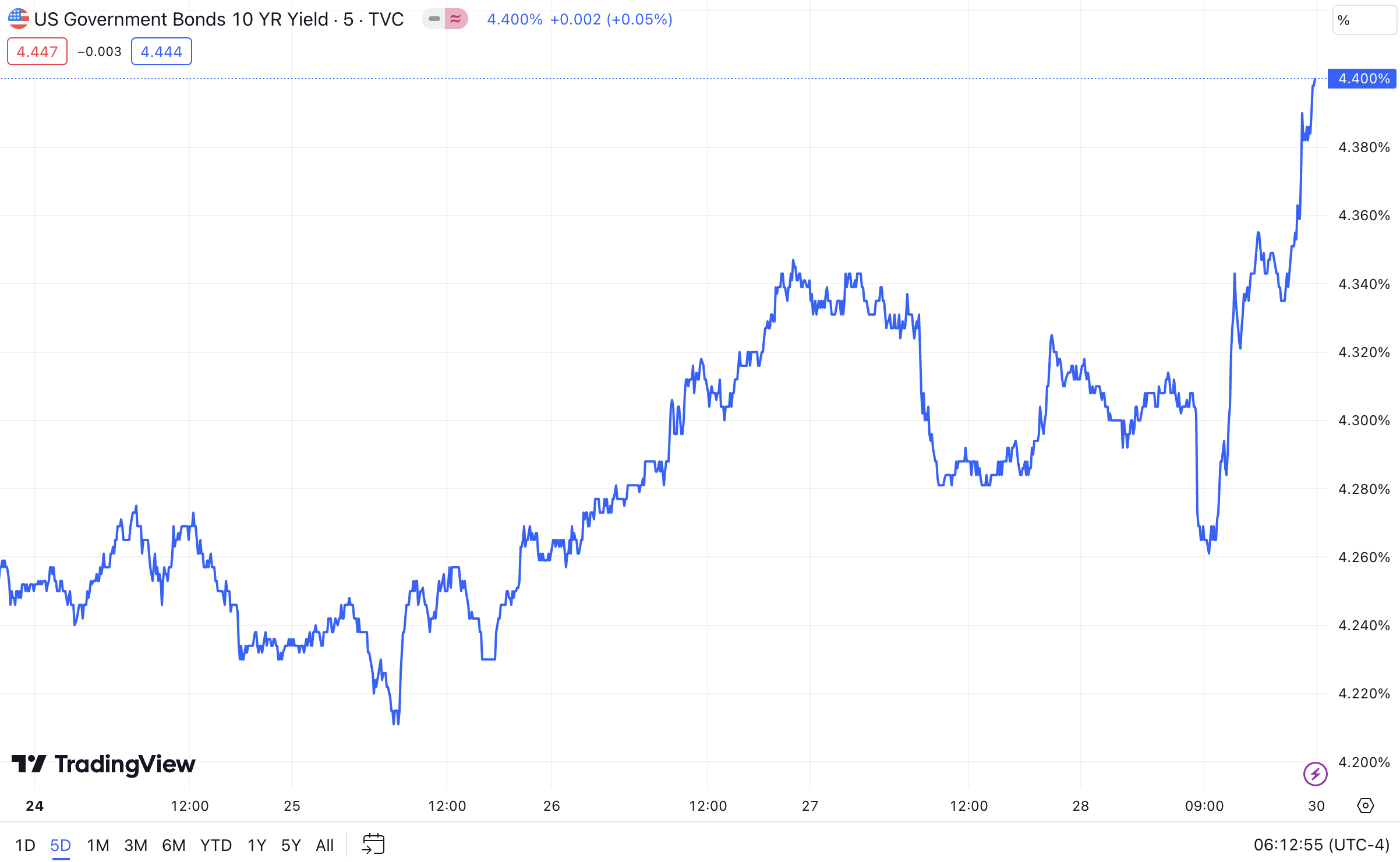

The yield on the benchmark 10-year U.S. Treasury note (US10Y) ticked up to 4.400% on Friday, from the previous week's closing value of 4.225%. Yields rise as prices fall.

US10Y (Source: TradingView)

VanEck announced the first submission of a Solana ETF application in the United States. VanEck announced the first submission of a Solana spot exchange-traded fund (ETF) application in the United States. VanEck believes that Solana is a commodity whose blockchain offers high throughput, low fees, and strong security, making it suitable for various applications such as payments, trading, gaming, and social media. VanEck also emphasized that Solana combines the Proof of History and Proof of Stake mechanisms, supporting thousands of transactions per second and providing a better user experience compared to Ethereum. As early as 2021, Grayscale had already launched its sixteenth product, the Solana Trust Fund, aimed at institutional investors and high-net-worth individuals.

(Source: SEC.gov)

US regulators could approve spot ether ETFs for launch by July 4, sources say. According to Reuters, the U.S. Securities and Exchange Commission could approve exchange traded funds (ETFs) tied to the spot price of ether as soon as July 4, as talks between asset managers and regulators enter the final stages, industry executives and other participants told Reuters.

Eight asset managers, including BlackRock, opens new tab, VanEck, Franklin Templeton, opens new tab and Grayscale Investments, are seeking SEC approval for the funds. Most of them had rolled out spot bitcoin ETFs in January, the culmination of a decade-long tussle with regulators. Grayscale again hopes to convert an existing trust into an ETF.

(Source: Reuters)

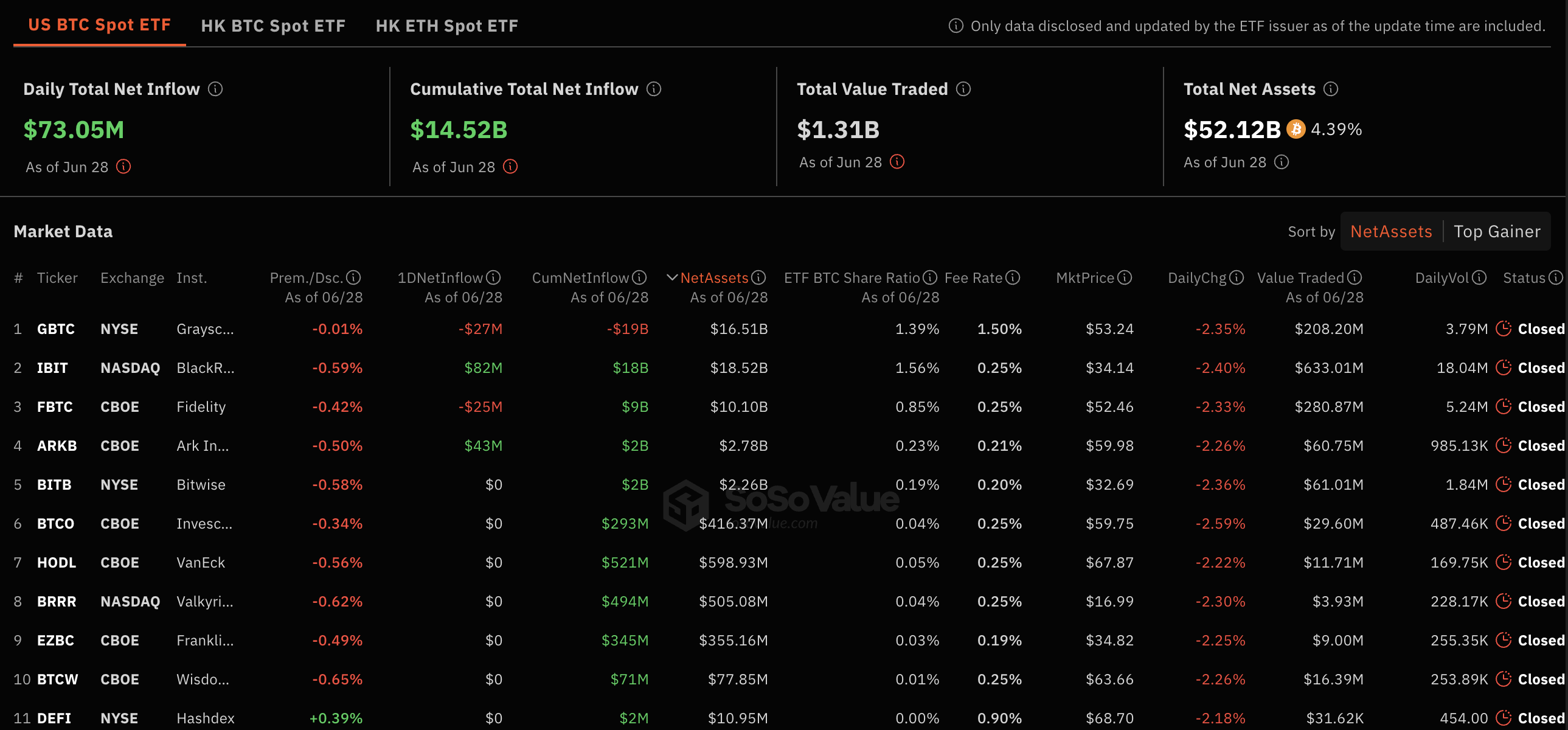

As of last week, the cumulative total net inflow for U.S. Bitcoin spot ETFs stood at $14.52 billion, with a net outflow of over $40 million in the past seven days. Currently, the total net assets of these ETFs amount to $52.12 billion, accounting for 4.4% of Bitcoin's market value. Looking at the data from last Friday, Grayscale's GBTC experienced a net outflow of $27 million. BlackRock's IBIT had a net inflow of $82 million. Fidelity's FBTC saw a net outflow of $25 million. ARK's ARKB had a net inflow of $43 million. The performance of Bitcoin spot ETFs was poor over the past weeks, but after experiencing significant net outflows last Monday, they showed net inflows for four consecutive days, although the inflow amounts were relatively small.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

Last week, the total cryptocurrency market capitalization showed a fluctuating downward trend, currently standing at $2.26 trillion, with an outflow of $90 billion over the past seven days. Due to sustained high inflation pressures, Bitcoin experienced a brief sudden drop last Monday, briefly falling below the $60,000 mark, a decrease of over 8%, before seeing a slight rebound. This temporary drop indicated significant selling pressure, attributed in part to positions awaiting liquidation and miners selling assets to manage expenses. As of early morning on June 30th, the spot price of Bitcoin was $60,887, marking a nearly 4% decline over the past seven days. Ethereum, as the second-largest cryptocurrency, was priced at $3,387, experiencing a nearly 3% decline over the same period. Additionally, Bitcoin and Ethereum's market caps were approximately $1.21 trillion and $407 billion, respectively, representing declines of 4% and 5%, with their combined share of total market cap at around 54% and 18%, respectively. The gap between Bitcoin and Ethereum's market shares has narrowed compared to recent periods.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

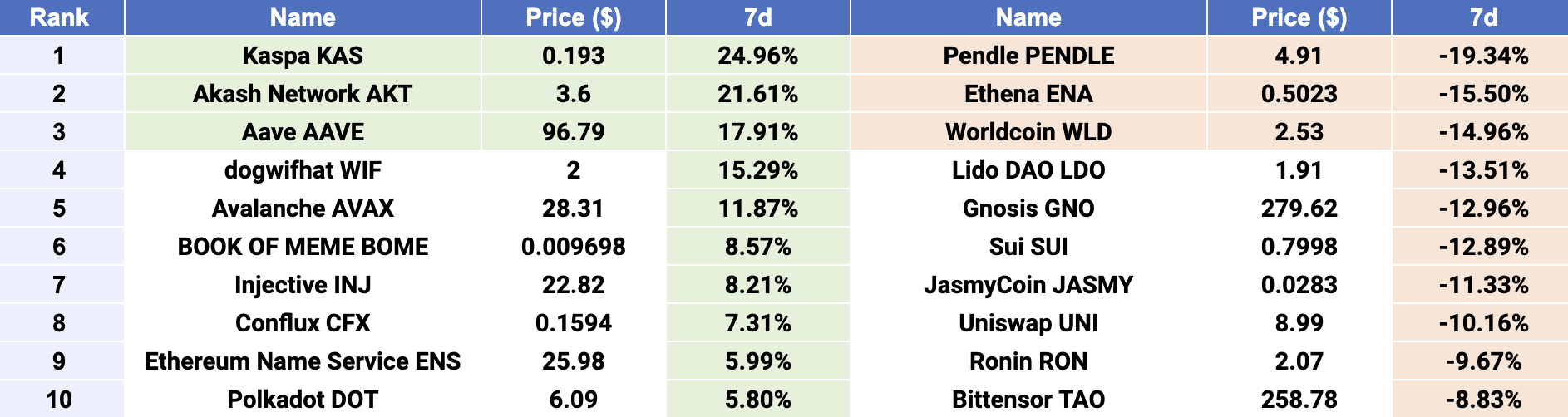

$KAS, $AKT and $AAVE emerged as Top 3 gainers, while $PENDLE, $ENA, and $WLD were Top 3 losers. Kaspa ($KAS) is a proof-of-work (PoW) cryptocurrency that implements the GHOSTDAG protocol. Unlike traditional blockchains, GHOSTDAG does not orphan blocks created in parallel but rather allows them to coexist and orders them in consensus. With a 25% increase over seven days, $KAS became the best-performing digital asset among the top 100 by market cap. This performance surge follows Marathon Digital's (MARA) decision to diversify its revenue streams by increasing $KAS mining. The company reported mining 93 million $KAS since September. Akash Network ($AKT) is a Supercloud leading a paradigm shift in cloud computing, disrupting conventional cloud services and pioneering a revolution in access to essential cloud resources. $AKT, as a leader in the DePin sector, has garnered increased interest from investors amid the recent AI boom. Aave ($AAVE) is a decentralized protocol for creating non-custodial liquidity markets. Users can supply tokens to the Aave pool to earn interest and use their assets as collateral to borrow cryptocurrencies. Recently, $AAVE's price has been driven by positive community factors, such as the proposal to add dlcBTC to Aave V3 on Ethereum and Arbitrum, enabling Bitcoin holders to participate in DeFi protocols.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

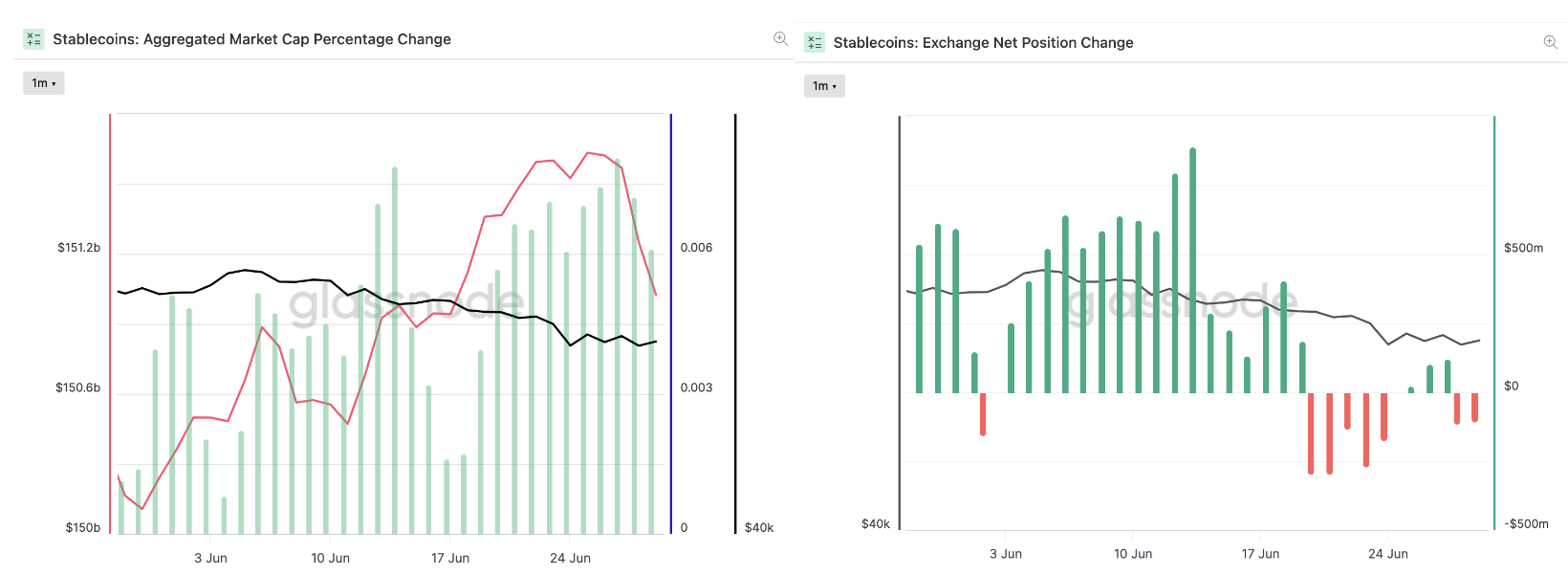

Last week, the growth rate of stablecoin total supply tapered off, maintaining around $151.1 billion. Over the past seven days, the net change in stablecoin holdings continued to grow, albeit at a slowing rate. The total supply of stablecoins remains close to historical highs. However, observing the net stablecoin holdings on exchanges over the past week, the overall trend shifted from net inflows to net outflows, indicating increased selling pressure on crypto assets and suggesting a market correction phase.

Stablecoins Market Cap (Data: Glassnode)

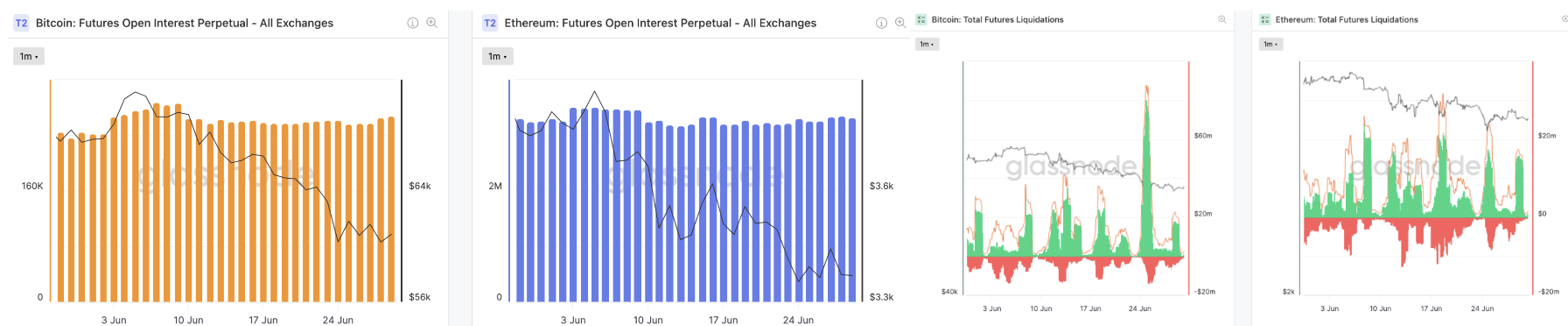

In the derivatives market, the open interest for Bitcoin and Ethereum perpetual contracts saw slight increases over the past seven days. The brief price drops of Bitcoin and Ethereum last Monday led to significant outflows of funds in the perpetual contract market, with many long positions being liquidated. However, there was a subsequent rebound in open interest for perpetual contracts, with overall positions seeing a slight rise. Liquidation data supported this trend, with peak liquidations of long positions in Bitcoin and Ethereum exceeding $80 million and $17 million, respectively. Bitcoin's sudden price drop had an unexpectedly profound impact on futures market long positions.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

In the decentralized finance (DeFi) market, the total value locked (TVL) saw a decline last week, falling below $100 billion to reach $94 billion currently. Over the past seven days, decentralized exchange (DEX) trading volumes continued to decrease, reaching $32.2 billion, down 9% from the previous week. The gap in trading volume market share between DEX and centralized exchanges (CEX) continued to widen, with DEX now accounting for only about 12% of CEX trading volume. Among the top ten blockchain projects ranked by TVL, almost all experienced declines last week, with Blast and Solana being the hardest hit, losing over 25% and 18% of their TVL, respectively. Avalanche was the only gainer last week, with a modest 4% increase, securing its position in the top ten rankings.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

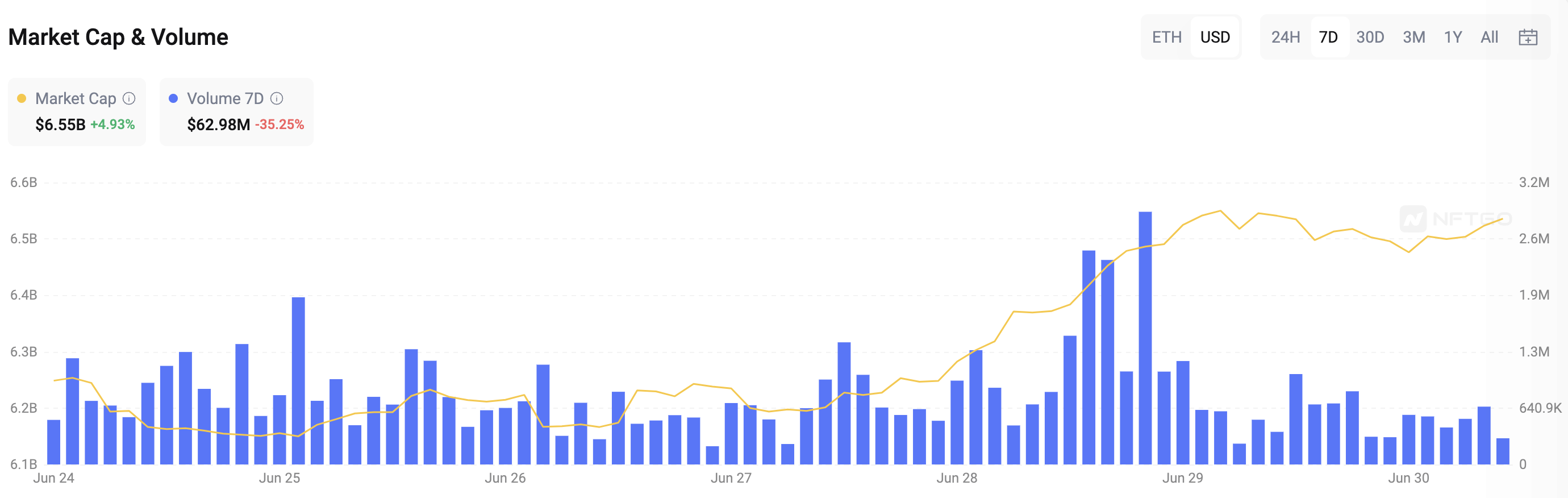

In the Ethereum non-fungible token (NFT) market, the total market value continued to rise by 5%, reaching $6.6 billion. Meanwhile, total trading volume plummeted by over 35%, with trading volume over the past seven days amounting to only $63 million. In Ethereum's leading blue-chip NFT series, there were improvements: CryptoPunks saw a 7% increase in floor price and a 14% increase in average price. Bored Ape Yacht Club, ranked second, saw a 17% increase in floor price and a 4% increase in average price. Currently ranked third, Pudgy Penguins saw a 15% increase in floor price and a 12% increase in average price.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] Ethereum All Core Developers Consensus Call #136 Writeup: Pectra Devnet 1 is about to be ready. Christine Kim, Vice President of Research at Galaxy, summarized the key points from the 136th ACDC call, which involved discussions on client diversity data collection and new research on multi-client block validation. Nethermind researcher Jorge Arce-Garro shared his team's latest work aimed at improving the way node operators report client diversity data. Funded by the EF, the research provides three different methods to facilitate the communication of client types by validator node operators, evaluating each method based on complexity, security, and the ability to protect the anonymity of node operators. Arce-Garro requested feedback on his team's research, which has been published on Ethresearch.

Developers also shared the latest progress on the Pectra upgrade, noting that Pectra Devnet 1 is about to be ready, with the EF DevOps team waiting for the execution layer (EL) clients to be prepared. Teku developer Mikhail Kalinin provided updates on the EIP 6110 specification; PeerDAS Devnet 1 has been launched, supporting deployments of three different CL clients. There were also discussions about the work on SSZ code changes, with EIP 7688 and EIP 6493 ongoing, although developers have not yet decided whether to include these two additional EIPs in Pectra.

(Source: Galaxy)

[Layer2] The second phase of ZK token airdrop claims is now live, and ZKsync introduces the new 'elastic chain' architecture. ZK Nation has announced that the second phase of ZK token airdrop claims is now live. Members of Protocol Guild, contributors to external projects, or those nominated by projects within the ZKsync ecosystem can immediately check their eligibility to claim. This phase constitutes 1.91% of the total airdrop supply and will conclude on January 3, 2025.

In addition, ZKsync has introduced the "elastic chain" architecture in its 3.0 roadmap, transitioning ZKsync from a single ZK-Rollup to a network composed of multiple ZK chains. This architectural change includes resetting the native bridge of ZKsync to a token vault to enhance connectivity between ZK chains. Transactions will require only one wallet confirmation, eliminating the need for network switches or manual cross-chain asset transfers. The project plans to have over 20 chains operational on the mainnet by the end of 2024.

(Source: Twitter@TheZKNation)

[Blast] BLAST tokens are now available for open claim, and Blur Season 4 has commenced. On June 26th, Blast announced on X that the BLAST token is now available for open claim, with users having 30 days to participate in the Phase 1 airdrop. Simultaneously, Blast Foundation outlined plans for the next phase, including the development of a full-stack chain and the launch of desktop and mobile wallets designed for crypto users. Phase 2 aims to accelerate the market shift from off-chain to on-chain economies through community collaboration. On the day of the airdrop, Blast network transaction fees reached a record high of $1.237 million, while active addresses peaked at 169,000, also a historical high. Following the initial airdrop, the retention levels of users and network activity on the future Blast network remain to be observed.

On the same day, Blur announced that Season 4 had commenced, distributing 500 million $BLAST tokens over 12 months. Users can earn points by bidding, placing orders, and borrowing on Blur.io. Top users can receive up to a 2.5x points boost. Loyalty is crucial for earning maximum rewards, with 100% loyalty maintained by placing orders exclusively on Blur. Borrowing points are based on the maximum loan amount and annualized return rate, with points deducted for early loan closure. BLUR holders will receive allocations of 1 billion BLAST tokens from Season 3.

(Source: Blast)

[Solana] Solana Foundation unveils tools that turn any website or app into starting point for crypto transactions. On June 25, according to The Block, the Solana Foundation launched the "Actions" tool, enabling users to complete on-chain transactions on websites, social media platforms, and through QR codes.

The foundation also announced the introduction of "blinks," a combination of blockchain and links, which can turn any "action" into a shareable link. This means that any digital path capable of displaying a URL can become a starting point for crypto transactions on the Solana blockchain.

(Source: The Block)

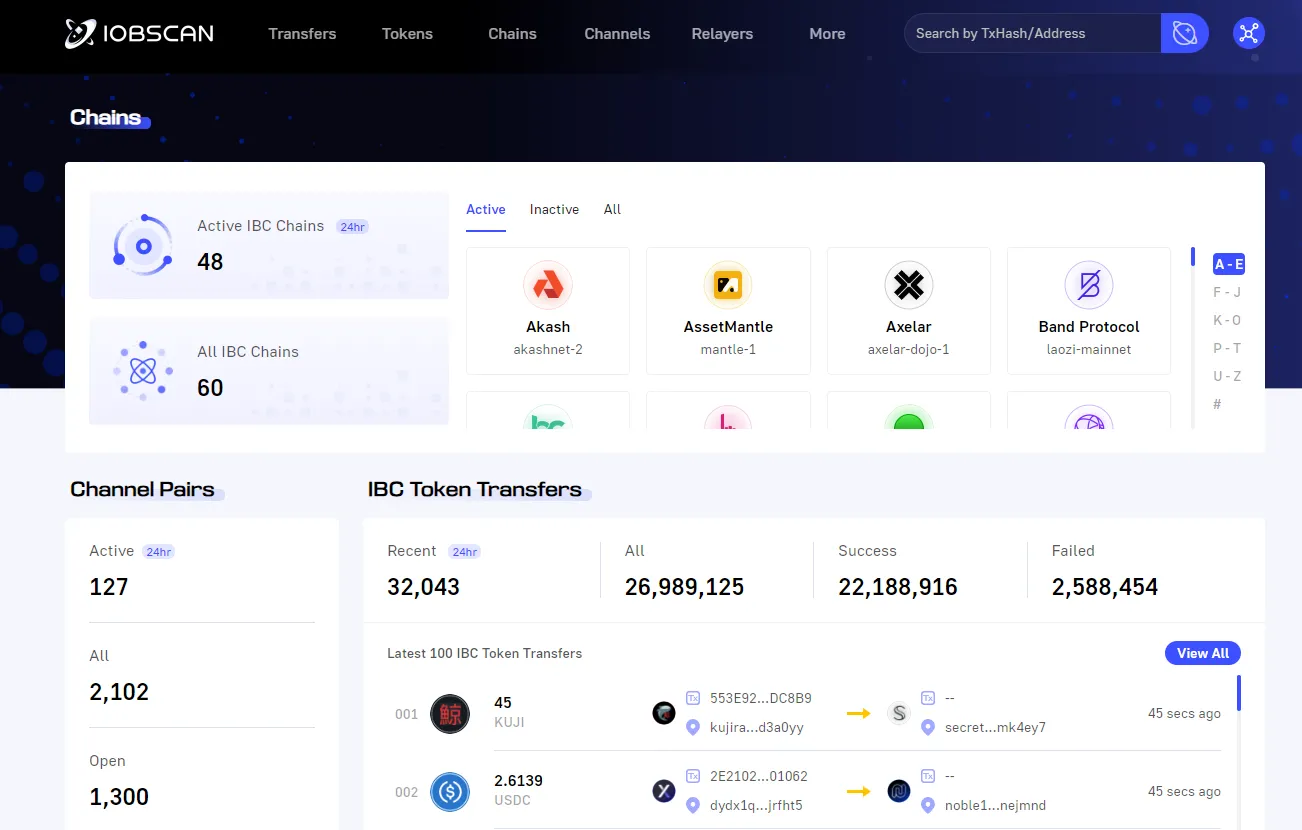

[Cosmos] Cosmos officially launches interchain aggregator IOBScan, offering token tracking and account aggregation capabilities. On June 25, according to official Cosmos news, Cosmos launched the interchain aggregator IOBScan, which seamlessly integrates 60 chains supporting IBC (Inter-Blockchain Communication). IOBScan provides comprehensive tracking of IBC tokens, chains, channels, and relayers. It features account aggregation capabilities, offering an overview of all addresses associated with the same public key to simplify the complexity of multi-chain interactions. IOBScan also offers API services, allowing users to access detailed blockchain data through its APIs.

(Source: Medium)

[Worldcoin] Worldcoin partners with Alchemy ahead of World Chain launch. Worldcoin announced a partnership with Alchemy to leverage its Web3 development platform to provide infrastructure support for the upcoming World Chain blockchain. The new Layer 2 blockchain, World Chain, will serve as the new platform for World ID and World App. It is expected to launch this summer and is optimized to offer prioritized block space and free gas subsidies for human users.

(Source: The Block)

4 Key Fundraising Data

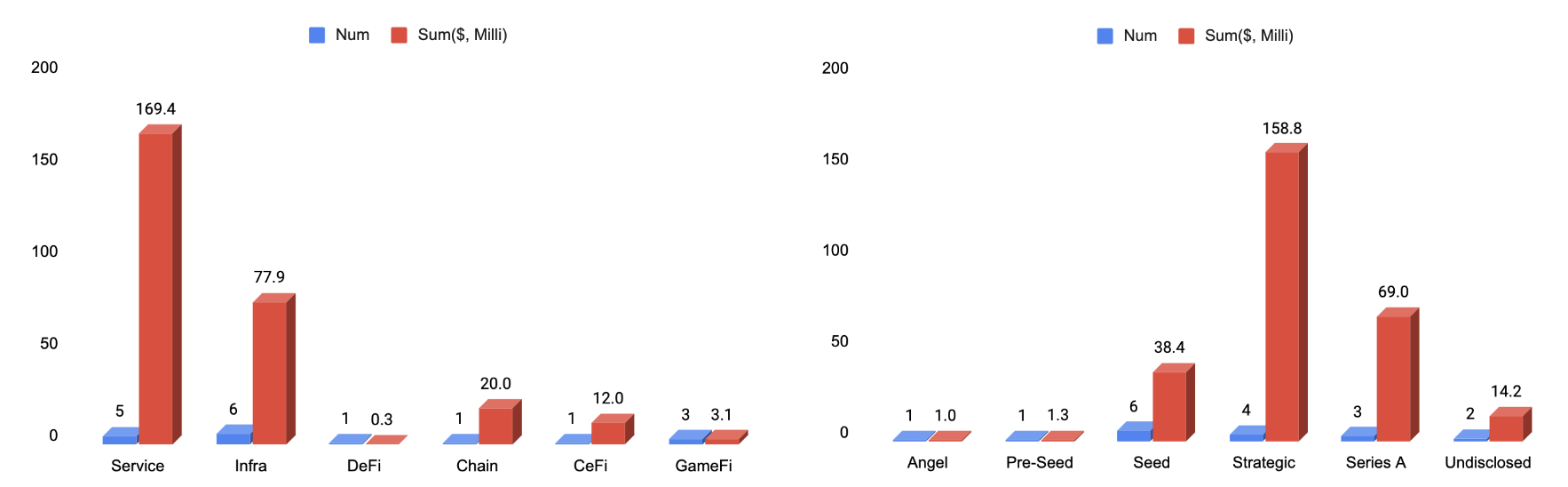

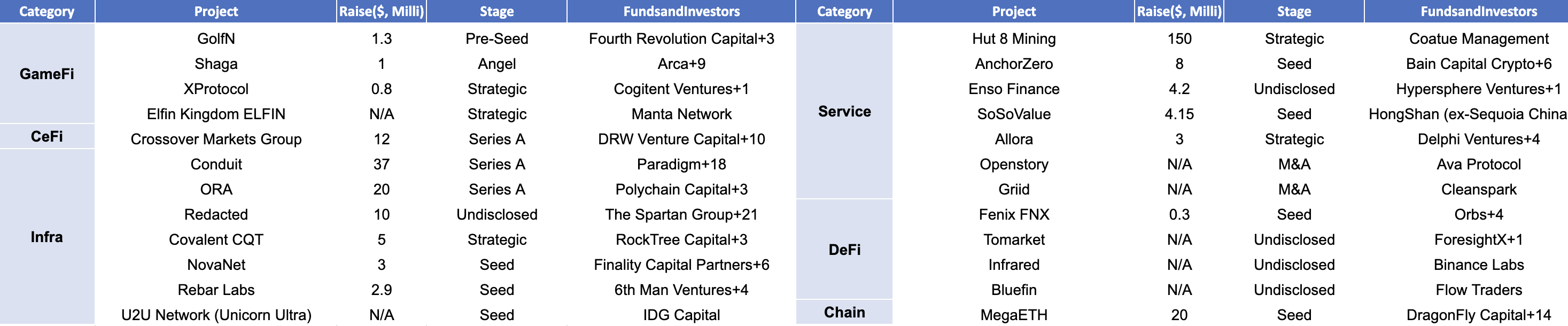

Last week witnessed a total of 24 financing events, raising a substantial amount of over $282.7 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The Blockchain Infrastructure sector kept leading with the highest number of financing events, totaling 6. The Service sector recorded the highest total funding amount, raising a total of $169 million, accounting for 60% of the overall financing. The largest financing event was led by Hut 8 Mining, successfully raising $150 million. Hut 8 is one of North America's largest digital asset miners, boasting 36,000 square feet of geo-diverse data center space and cloud capacity. These facilities are connected to electrical grids powered by renewable and emission-free resources. More detailed information is as below.

* 7 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

MegaLabs, the developer of a new blockchain called MegaETH, has raised $20 million in a seed funding round. MegaLabs began raising funds for the seed round last December and closed it in May, co-founder and chief business officer Shuyao Kong told The Block. The round was structured as equity plus token warrants and brought MegaETH's fully diluted token valuation to a "9-figure" amount, Kong said, meaning at least $100 million.

Dragonfly led the seed round, with Figment Capital, Robot Ventures, Big Brain Holdings and others participating, MegaLabs said Thursday. Angel investors, including Ethereum co-founder Vitalik Buterin, ConsenSys founder and CEO Joseph Lubin, EigenLayer founder and CEO Sreeram Kannan, ETHGlobal co-founder Kartik Talwar, Helius Labs co-founder and CEO Mert Mumtaz, Santiago Santos, Hasu and Jordan Fish, aka Cobie, also joined the round.

• Official Link: https://megaeth.systems/

Bitcoin mining company Hut 8 today announced that it has entered into a definitive agreement with funds managed by Coatue Management, LLC ("Coatue"), under which Coatue will invest $150 million in the company through convertible notes. Hut 8 intends to leverage this funding, along with Coatue's expertise in developing and operating complex energy infrastructure, to significantly expand into the AI infrastructure market.

“We are thrilled to be partnering with Coatue, given the firm’s deep expertise and long track record of investments in the AI ecosystem. We believe this partnership will allow us to unlock significant opportunities and connectivity to the broader space as we enter this next phase of growth." - Asher Genoot, CEO of Hut 8

• Official Link: https://hut8.com/

3. [Infra] Conduit Announces Completion of $37M Series A led by Paradigm and Haun Ventures.

Rollup deployment platform Conduit announced the completion of a $37 million Series A funding round, co-led by Paradigm and Haun Ventures, with participation from Bankless Ventures, Coinbase Ventures, and others. The founder of Conduit aims to make on-chain computation as accessible as cloud computing, enabling cryptocurrency developers to build without restrictions. The new funding will help Conduit go beyond typical Rollup deployment use cases. Since its launch, Conduit has already assisted teams like Degen and Proof of Play in building their first Layer 3 solutions.

• Official Link: https://www.conduit.xyz/

4. [Infra] ORA Raises $20M in Funding to Tokenize AI Models and Enable Decentralized AI Oracles.

ORA, a verifiable oracle protocol that enables AI on blockchains, has recently announced $20M in funding from investors such as Polychain Capital, HF0, Hashkey Capital, SevenXand more. This funding will allow ORA to continue developing its technology and infrastructure for tokenizing AI models and bringing decentralized AI to the Ethereum ecosystem, including L2s of Arbitrum, Optimism, Base, Linea, and other EVM-compatible chains.

Crypto and AI have always been destined to converge. Until recently, however, there was no practical way to integrate one with the other despite many developers wanting to do so. ORA offers a solution to overcome smart contract limitations. The tech enables the team the capability to deliver accountable and sustainable products that allow smart contracts to interact with AI natively.

• Official Link: https://www.ora.io/

See you next week! 🙌