*All on-chain data is dated as of 12:00 a.m. EST on Sunday, June 16th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week (June.9-15).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #CPI #PPI #FOMC

Inflation slowed in May, even while the U.S. economy added a surprisingly strong 272,000 jobs for the month. PHOTO: DAVID PAUL MORRIS/BLOOMBERG NEWS

1 Macro Market Overview

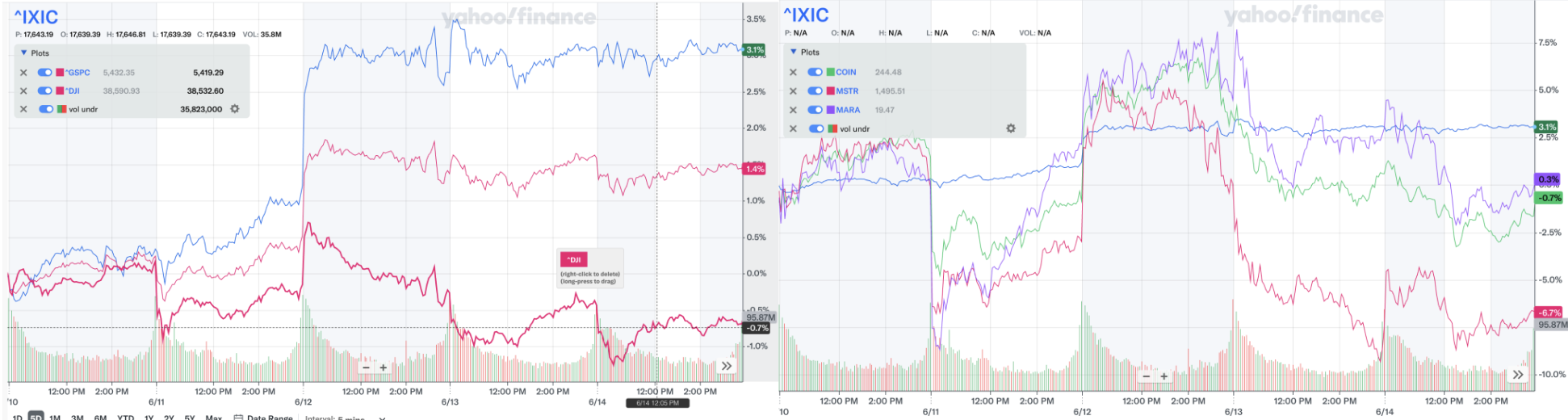

Cooling Inflation Powers S&P 500, Nasdaq to Weekly Gains. According to WSJ, U.S. stocks held their ground Friday, capping a week of strong gains on a cautious note. The Nasdaq Composite rose 0.1% to a fresh high, bringing its weekly gain to 3.1%. The S&P 500 slipped from its record, but logged a weekly gain of 1.4%. The Dow Jones Industrial Average also declined, shedding 0.7% for the week. A steady trickle of recent economic data has continued to suggest the economy is cooling, but at a gradual pace and without any signs of serious deterioration. Inflation slowed in May, even while the U.S. economy added a surprisingly strong 272,000 jobs for the month. Federal Reserve officials penciled in just one interest-rate cut for this year, even after the Labor Department reported the consumer-price index—a measure of goods and services costs across the economy—was essentially flat from the month before and up 3.3% from one year earlier. On Thursday, the department said producer prices fell 0.2% in May from the prior month, surprising economists who predicted a rise. Another report showed jobless claims rising more than anticipated.

Despite the Federal Reserve keeping interest rates unchanged as expected during last week's FOMC meeting, web3-related stocks underperformed compared to the broader market. COIN and MARA declined by 0.7% and 0.3%, respectively, while MSTR dropped by 6.7%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

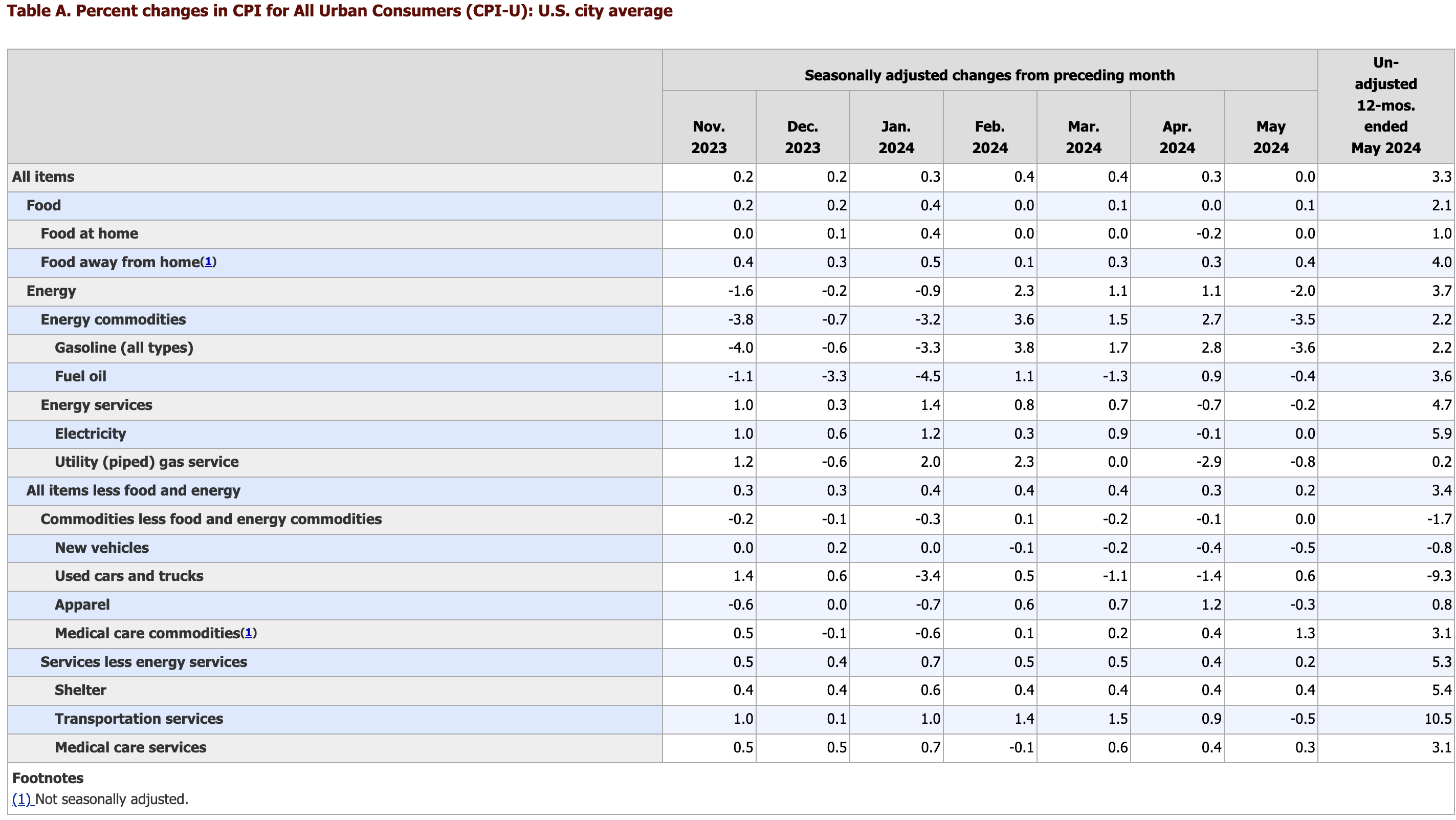

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in May on a seasonally adjusted basis, after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported last week. Over the last 12 months, the all items index increased 3.3 percent before seasonal adjustment.

(Source: U.S. Bureau of Labor Statistics)

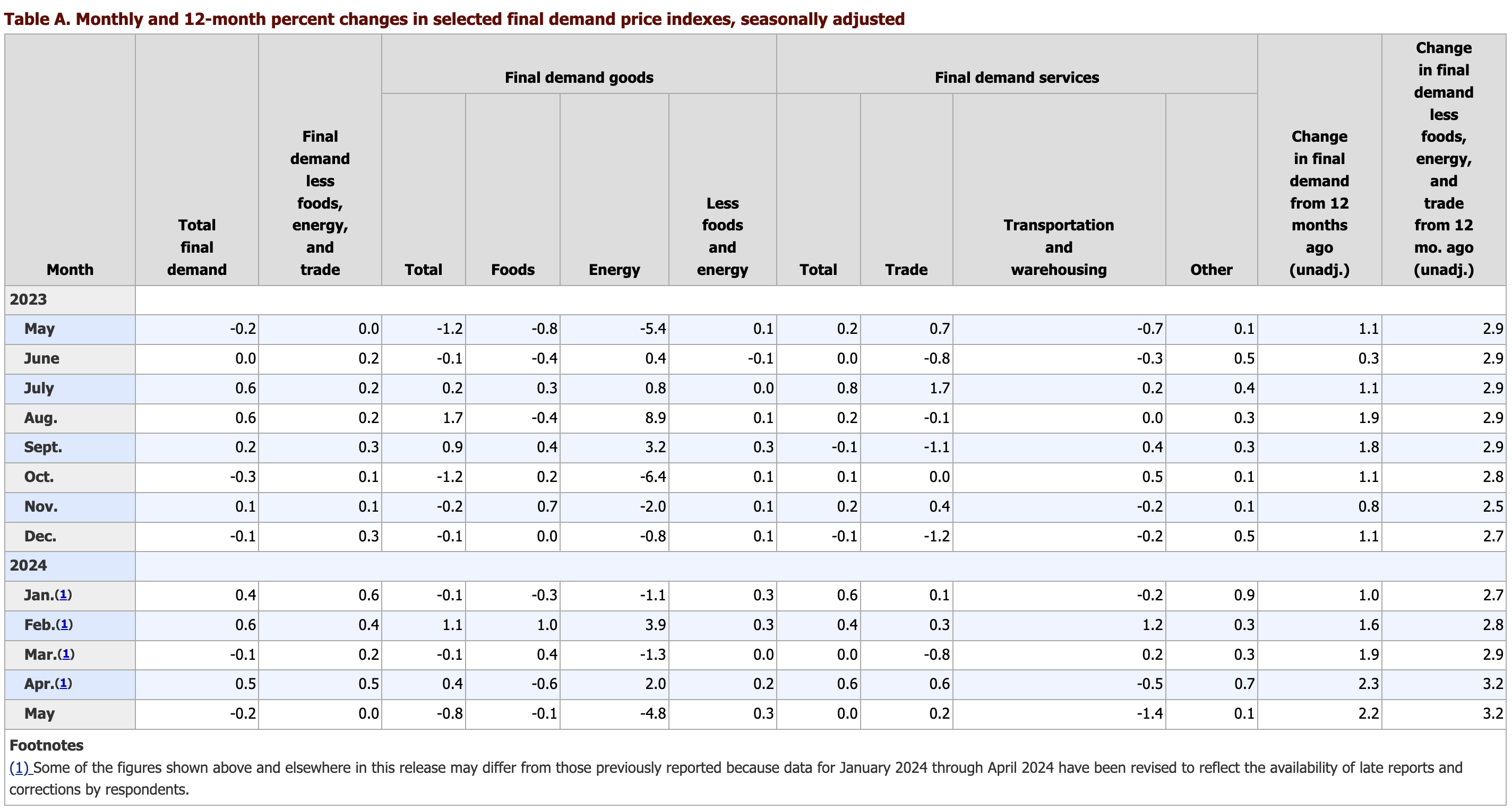

The Producer Price Index for final demand declined 0.2 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported last week. Final demand prices increased 0.5 percent in April and edged down 0.1 percent in March. (See table A.) On an unadjusted basis, the index for final demand advanced 2.2 percent for the 12 months ended in May.

(Source: U.S. Bureau of Labor Statistics)

Last week, the U.S. Dollar Index (DXY) reversed its downward trend following the release of an overheated employment report on Friday, closing at 104.934. This marks an increase from the previous week's closing value of 104.625.

DXY (Source: TradingView)

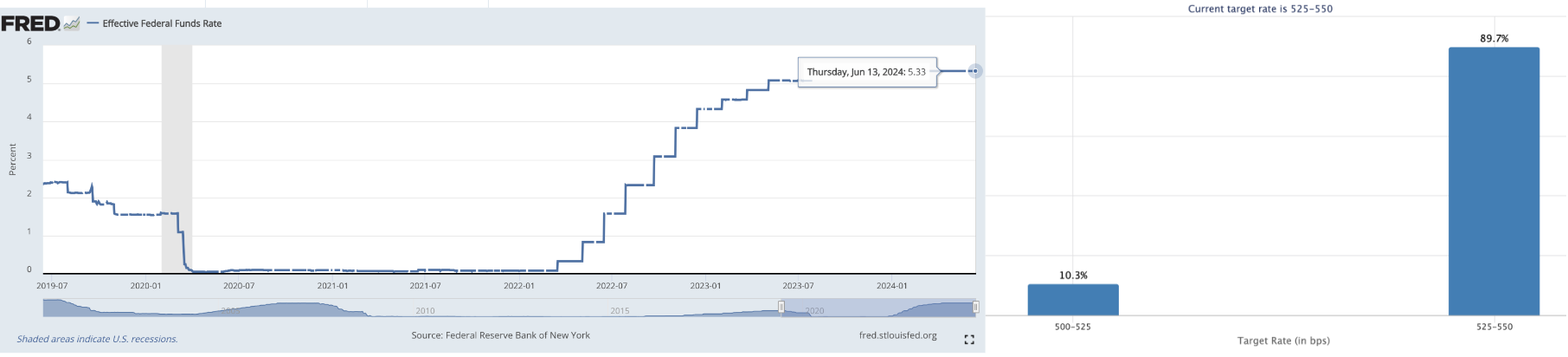

According to the latest data from the Chicago Mercantile Exchange (CME), following last week's decision by the Federal Reserve to maintain current interest rates and the release of cooling inflation data, about 10% of investors believe there will be the first rate cut of the year at the next FOMC meeting in July. However, nearly 90% of investors think that the interest rates will remain unchanged.

Left: EFFR, Right: Target Rate Probabilities for July 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

Though the Fed indicated it isn’t in a hurry to cut interest rates, investors stepped up their bets that the central bank will lower them. They have been buying U.S. government bonds and pushing their yields lower. The benchmark 10-year Treasury note (US10Y) settled at 4.223% Friday, falling for the 10th time in 12 trading sessions.

US10Y (Source: TradingView)

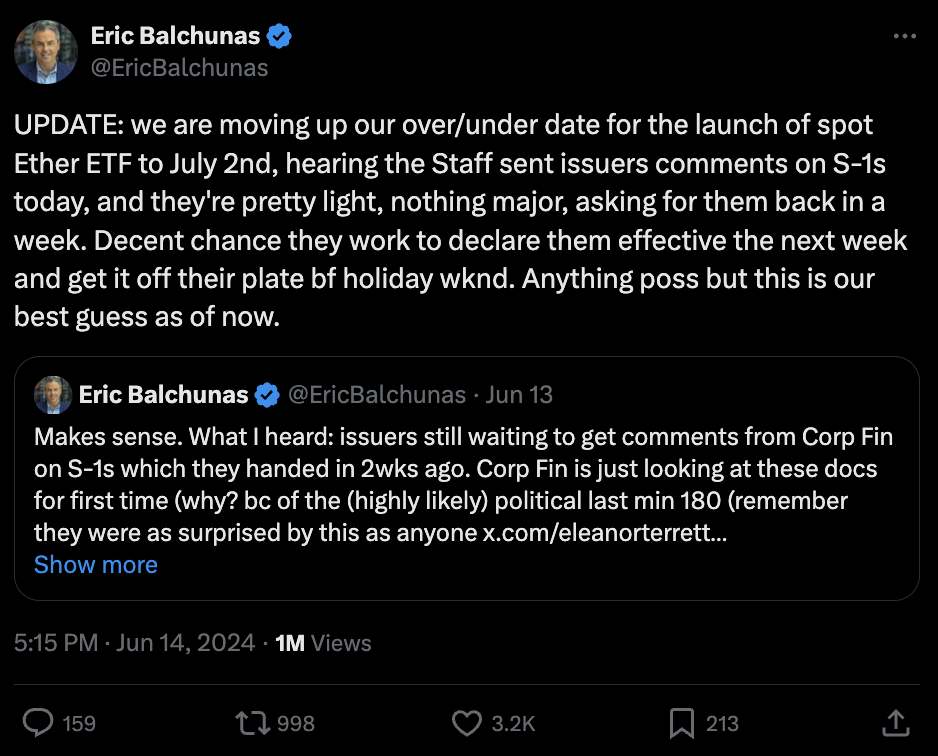

Bloomberg Analysts: Ethereum Spot ETF Expected to Launch Ahead of Schedule on July 2. Bloomberg ETF analyst Eric Balchunas posted on social media that the Bloomberg analyst team has moved up the projected launch date of the Ethereum spot ETF to July 2. This adjustment is based on information that staff sent comments to the issuers about the S-1 on June 14. The comments were "nothing major", and a response is requested within a week. It is likely that the ETF will be approved next week and resolved before the holiday. While this is currently their "best guess as of now".

(Source: Twitter@EricBalchunas)

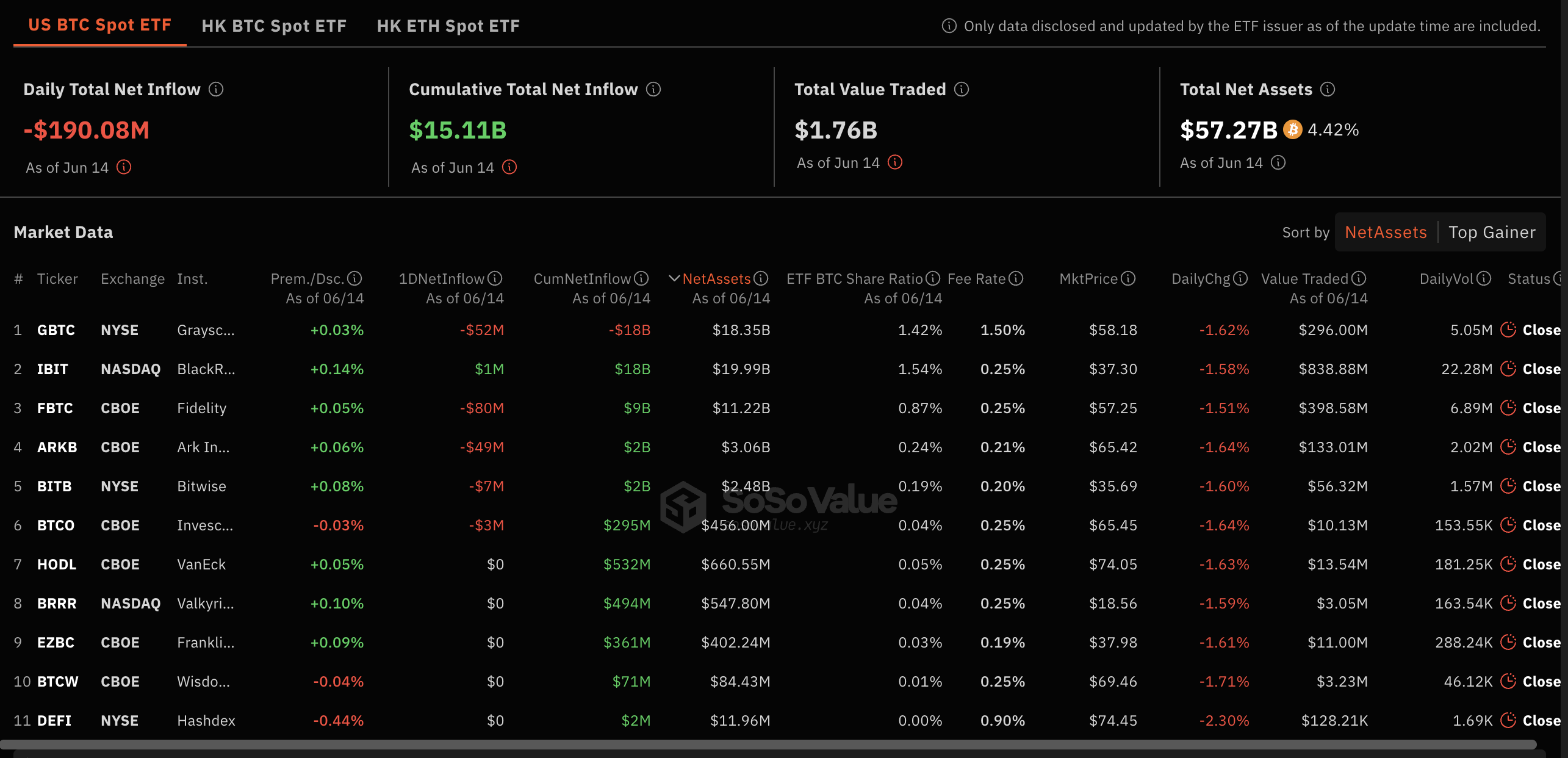

As of last week, the cumulative total net inflow for US BTC spot ETFs was $15.11 billion, with over $580 million outflow over the past seven days. These ETFs had total net assets of $57.27 billion, representing 4.4% of BTC's market value. Over the past week, BTC spot ETFs performed poorly, with four trading days seeing significant net outflows. Examining single-day data from last Friday: Grayscale's GBTC experienced a net outflow of $52 million. BlackRock's IBIT had a net inflow of only $1 million. Fidelity's FBTC saw a net outflow of $80 million. ARK's ARKB had a net outflow of $49 million. These figures indicate a challenging week for BTC spot ETFs, with substantial investor movement away from these products.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

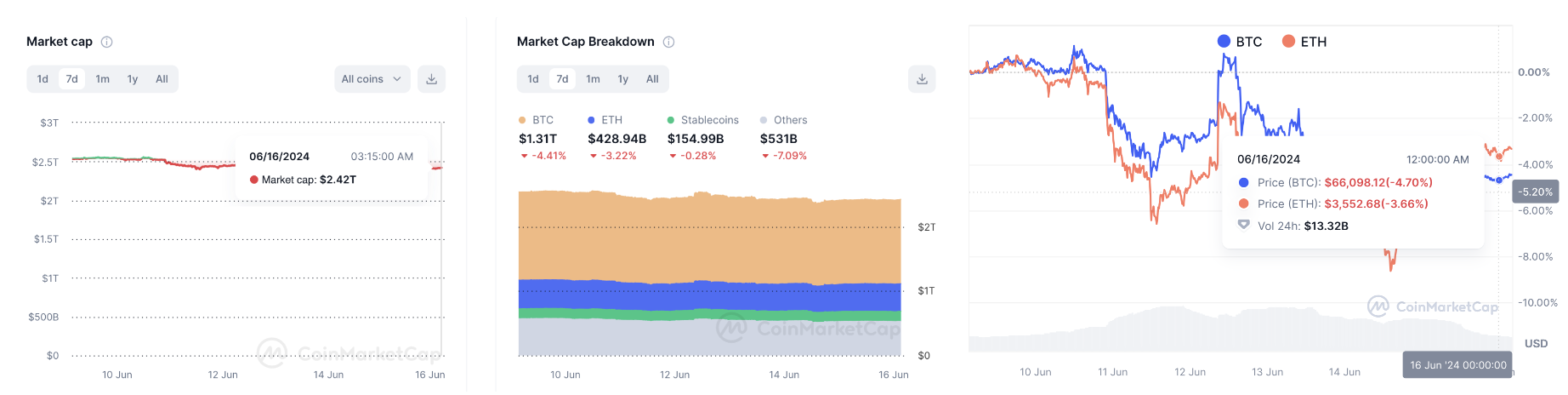

Last week, the total market capitalization of the cryptocurrency market showed a volatile downward trend, currently standing at $2.42 trillion. Bitcoin and Ethereum experienced a downward trend earlier in the week, but this was temporarily alleviated and followed by a rebound after the release of CPI data, which was lower than expected. However, the persistent high interest rates ultimately prevented them from maintaining their original levels, with Bitcoin and Ethereum falling to $66,000 and $3,500, respectively.

As of the early hours of June 16th, the spot price of Bitcoin was $66,098, down 4.7% over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,553, down nearly 3.7% over the same period. Additionally, the market capitalizations of Bitcoin and Ethereum were approximately $1.31 trillion and $429 billion, respectively, shrinking by 4.4% and 3.2%, and accounting for about 54% and 18% of the total market capitalization. The market share gap between Bitcoin and Ethereum narrowed compared to last week.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

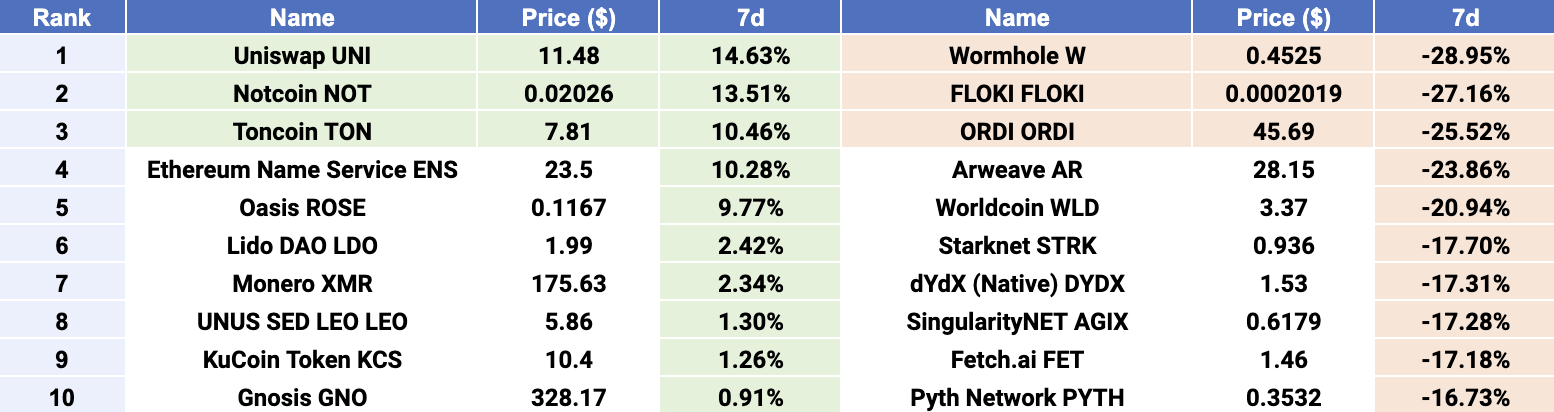

$UNI, $NOT, and $TON emerged as Top 3 gainers, while $W, $FLOKI, and $ORDI were Top 3 losers. In the top 100 cryptocurrencies by market capitalization last week, the overall performance of altcoins was weak, with $UNI being the top winner with a gain of just over 14%. Uniswap ($UNI) is a popular decentralized trading protocol, known for its role in facilitating automated trading of decentralized finance (DeFi) tokens. With the recent increase in trading volume on the Uniswap platform, more funds and users have been flowing into Uniswap, boosting the demand for $UNI tokens and driving up their prices.

$TON is the native cryptocurrency of the decentralized layer-1 blockchain, The Open Network (TON). Last week, projects within the TON ecosystem performed exceptionally well. $TON and $NOT both saw gains of over 10%, becoming the third and second top performers, respectively. Notcoin ($NOT) started as a viral Telegram game that onboarded many users into web3 through a tap-to-earn mining mechanic. Recently, the number of active users on the TON blockchain surpassed Ethereum. The seamless integration between Telegram's vast user base and the TON ecosystem has led to frequent wealth creation within the TON, driving up the demand for $TON tokens. Additionally, TON ecosystem projects have been gaining widespread attention from on-chain users. With the wealth effects generated by $NOT, users have become more focused on gaming projects on TON.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

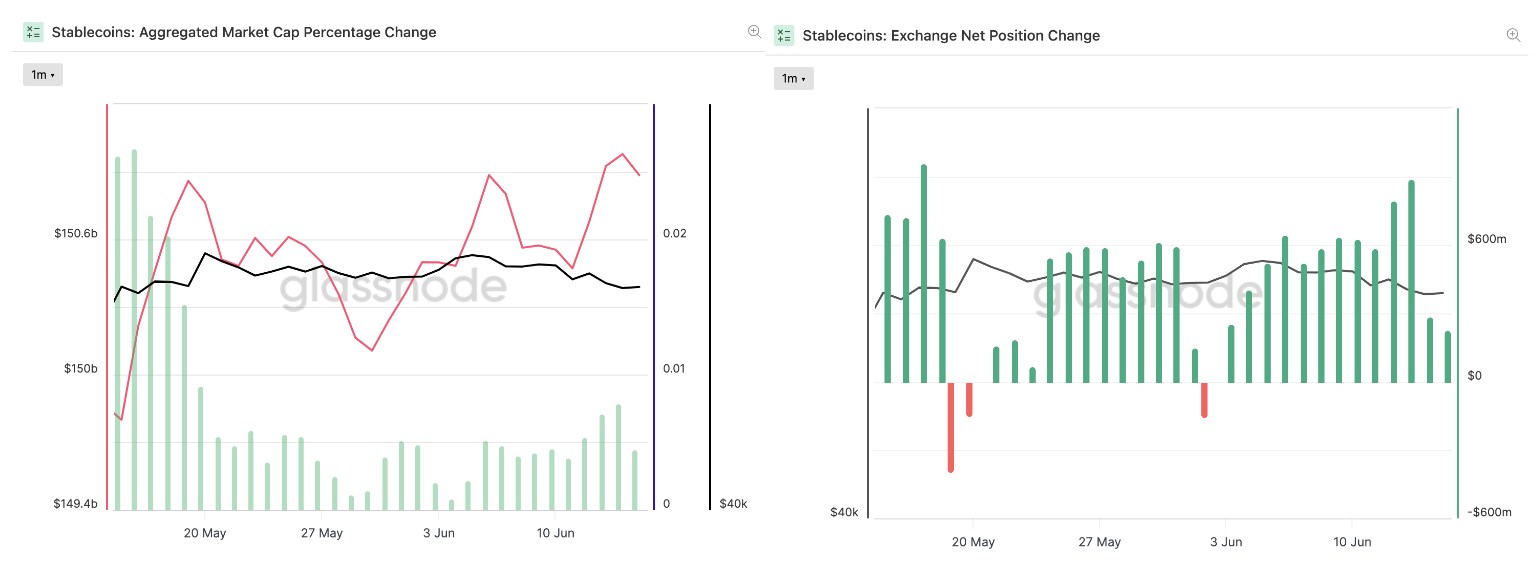

Last week, the growth rate of the total supply of stablecoins slowed, maintaining around $150.9 billion. Over the past seven days, the net change in stablecoin holdings continued to show a positive growth trend, with the growth rate recovering compared to recent periods, reaching its highest point since the beginning of June. Additionally, observing the net stablecoin holdings on exchanges over the past week, the overall trend remained stable, showing a net inflow with the total amount continuously rising, indicating reduced selling pressure on crypto assets and a market that is still in an upward phase.

Stablecoins Market Cap (Data: Glassnode)

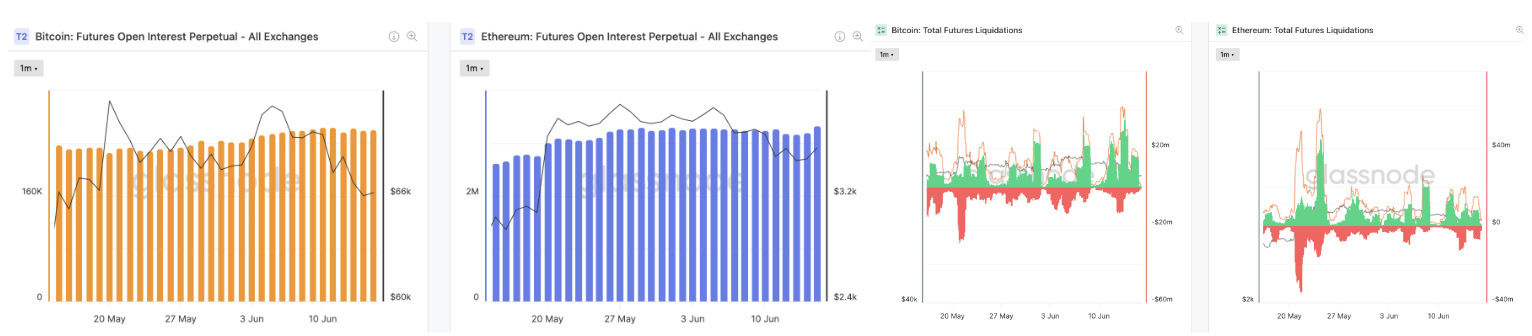

In the derivatives market, the open interest of Bitcoin and Ethereum perpetual contracts remained relatively stable over the past seven days. Despite the volatile price movements of Bitcoin and Ethereum, with temporary drops, rebounds, and further declines, the amount of capital in perpetual contracts did not decrease. The futures market activity remained at its peak for the past month. Liquidation data shows that Bitcoin's total liquidation volume last week was significantly higher than Ethereum's, around $40 million, primarily in long positions. This indicates that Bitcoin's price was more affected by market factors than expected. Nevertheless, the perpetual contracts market remained active.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

In the decentralized finance (DeFi) market, the total value locked (TVL) remained stable last week, staying at around $100 billion, currently at $102.7 billion. Over the past seven days, trading volume on decentralized exchanges (DEXs) slightly increased to $39.9 billion, up 9% from the previous week. The market share gap between DEXs and centralized exchanges (CEXs) slightly widened, with DEXs now accounting for about 17% of the total CEX trading volume. Among the top ten blockchain projects ranked by TVL, performance was generally poor last week. Solana and BSC chains continued their previous week's poor performance with declines exceeding 6%, while Bitcoin's Layer 2, Merlin Chain, was the only winner with an increase of less than 1%.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

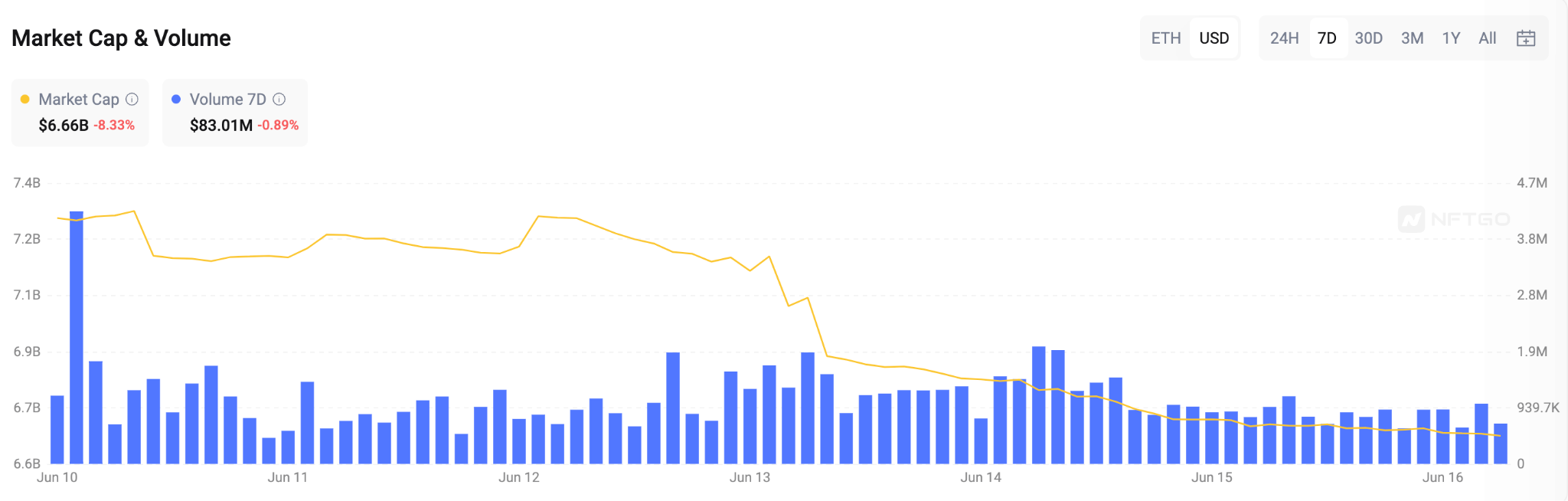

In the Ethereum non-fungible token (NFT) market, the total market value continued to decline by 8%, falling below $6.7 billion. Meanwhile, total trading volume decreased by 1%, with only $83 million in transactions over the past seven days. Among Ethereum's leading blue-chip NFT series, the floor price of CryptoPunks decreased by 7%, with the average price dropping significantly by 30%. The floor price and average price of the second-ranked Bored Ape Yacht Club both fell by 10% and 9%, respectively. Currently, the third-ranked Pudgy Penguins saw its floor price rise by 3%, with the average price remaining unchanged.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] Ethereum All Core Developers Consensus Call #135 Writeup. According to Christine Kim's summary of the 135th Ethereum All Core Developers Call (ACDC), the main topics discussed included: two major announcements (the ethPandaOps team taking over maintenance and development of the Kurtosis module, which is a software package to assist developers in launching test networks and related tools; Tim Beiko introducing the new process for EIPs entering stages), the upcoming release of Electra v1.5.0-alpha.3, discussions on the launch timing of Pectra Devnet 1 in the coming weeks, progress on the PeerDAS implementation (PeerDAS and Pectra EIPs are currently progressing in parallel but will be activated on different devnets to avoid testing interference, with PeerDAS Devnet 1 possibly launching 2 to 4 weeks later), discussions on raising the Blob limit (how to decouple modifications from the dependency between EL & CL, whether there is coupling between the activation of PeerDAS and raising the Blob limit, and whether these modifications should be merged or separated), updates on EIPs related to SSZ (Simple Serialize), and discussions on naming the next consensus layer upgrade after the Electra upgrade (it may start with the letter "F", and the name for the next execution layer upgrade has already been decided as Osaka).

(Source: Galaxy)

[Layer2] Optimism: Fault Proofs Now Live on OP Mainnet. On June 10, Optimism announced on social media that open-source, permissionless fault proofs are now live on the OP Mainnet, marking the first phase of decentralization for the OP Stack. This feature allows the extraction of ETH and ERC-20 tokens from OP Mainnet without the need for a trusted third party, enabling users to challenge and remove invalid withdrawals. The plan is to extend fault proofs to other OP Stack-based chains, including Base, Metal, Mode, and Zora. The second phase for OP Mainnet is to achieve complete permissionless operation and decentralization, managed solely through smart contracts.

(Source: Twitter@Optimism)

[Layer2] StarkWare: L3 on Starknet is Launching Soon. On June 13, StarkWare announced on the X platform that it is offering a range of scaling solutions to meet various needs. Starknet's L3 is set to launch soon, which is similar to an Appchain but offers greater cost reductions for developers and users.

(Source: Twitter@StarkWareLtd)

[Polygon] Kicking Off the Polygon Governance Hub, a Unified and Transparent Interface for Community Governance. According to official sources, Polygon has launched the Governance Hub, a unified and transparent community governance interface. Built by Aragon, the Polygon Gov Hub will serve as the community's comprehensive governance solution and user interface. The initial version of the Governance Hub will focus on two of the three pillars of Polygon governance: protocol governance and system smart contract (SSC) governance.

Builders and community members can submit Polygon Improvement Proposals (PIPs) for upgrades to either the protocol or system smart contracts. For SSC governance, the protocol council will publish transparent reports after the PIPs are put on-chain. As long as tokens are staked, token holders can vote on the protocol council's actions or delegate their votes to community representatives who act in their interests.

(Source: polygon.technology)

[Sui] Sui Bridge Goes Live on Testnet with Incentive Program. Sui Bridge, a native bridge purpose-built for bridging assets and data to and from Sui, launched on Testnet today. As a native protocol, Sui Bridge enables effortless and secure transfers of ETH, wBTC, USDC, and USDT between Ethereum and Sui, making it a key piece of Sui infrastructure. Leveraging the inherent security and speed of Sui, Sui Bridge offers a new path onto Sui powered by Sui network validators.

As the Sui ecosystem progresses, diverse, secure, and dependable bridging options make up a fundamental component of a healthy DeFi ecosystem. Bridges facilitate interoperability between different blockchains, enabling assets and data to move across networks. This enhances liquidity and expands the utility of digital assets, making it easier for users to engage in various blockchain activities, such as DeFi and gaming.

(Source: blog.sui.io)

[XRPL] Ripple to use Axelar as bridge protocol for EVM sidechain. XRP Ledger, the blockchain network backed by the payments firm Ripple, revealed the official name of its upcoming sidechain, calling it the “XRPL EVM sidechain,” and stated that it would launch with Axelar serving as the exclusive bridge protocol. The interoperability platform Axelar will allow users to swap their XRP into wrapped XRP (eXRP), which will also be used as the native token for gas fees on the sidechain. The sidechain is being developed by Ripple and Peersyst, leveraging evmOS — a modular and customizable tech stack offered by Evmos. Ripple said that using Axelar would “simplify” the user experience and enhance security, and went on to praise Axelar’s track record and integrations with major projects like Uniswap and Microsoft. By shifting to Axelar, Ripple is moving away from its proposed XLS-38 cross-chain bridge, stating that the current process with XLS-38 is “arduous.”

Furthermore, according to official sources, Ripple has announced an expanded partnership with UK crypto exchange platform Archax. Over the next year, they plan to introduce hundreds of millions of dollars worth of tokenized real-world assets (RWAs) onto the XRP Ledger (XRPL), establishing XRPL as a leading blockchain for RWA tokenization. Archax is the first UK digital asset exchange, broker, and custodian to be regulated by the Financial Conduct Authority (FCA). Archax assists financial institutions in tokenizing their financial RWAs.

(Source: The Block)

[Infrastructure] Celestia Announces Data Proof Bridge Blobstream is Live on Ethereum Mainnet. On June 11, the modular blockchain network Celestia announced on the X platform that Blobstream is now live on the Ethereum mainnet. Developed by Succinct Labs, Blobstream streams the commitment of Celestia data roots to on-chain Ethereum light clients. It provides permissionless, high-throughput data availability (DA) for Ethereum Layer 2 (L2) and ensures security through cryptoeconomic guarantees rather than reputation or hidden trust assumptions. Blobstream can also be accessed on celenium.io, allowing anyone to track the on-chain commitments of Celestia data roots.

Previously known as the Quantum Gravity Bridge (QGB), Blobstream acts as a bridge between Celestia and Ethereum (or its EVM-compatible L1 chains), enabling data and asset transfers between the two networks.

(Source: Twitter@CelestiaOrg)

4 Key Fundraising Data

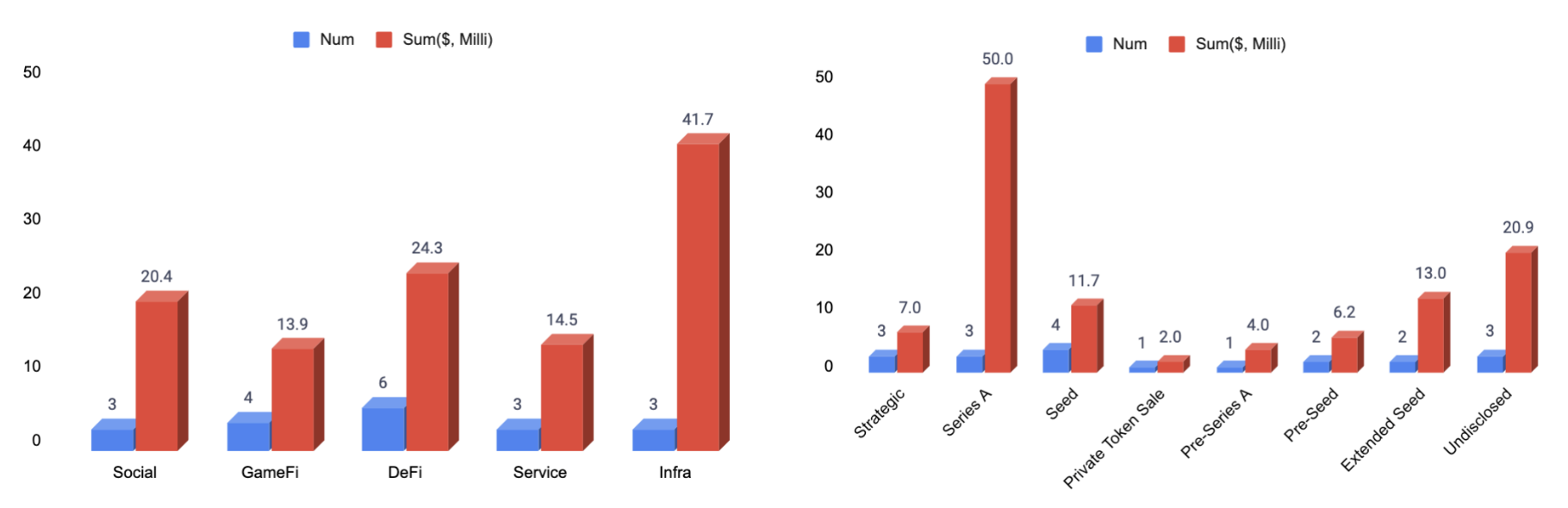

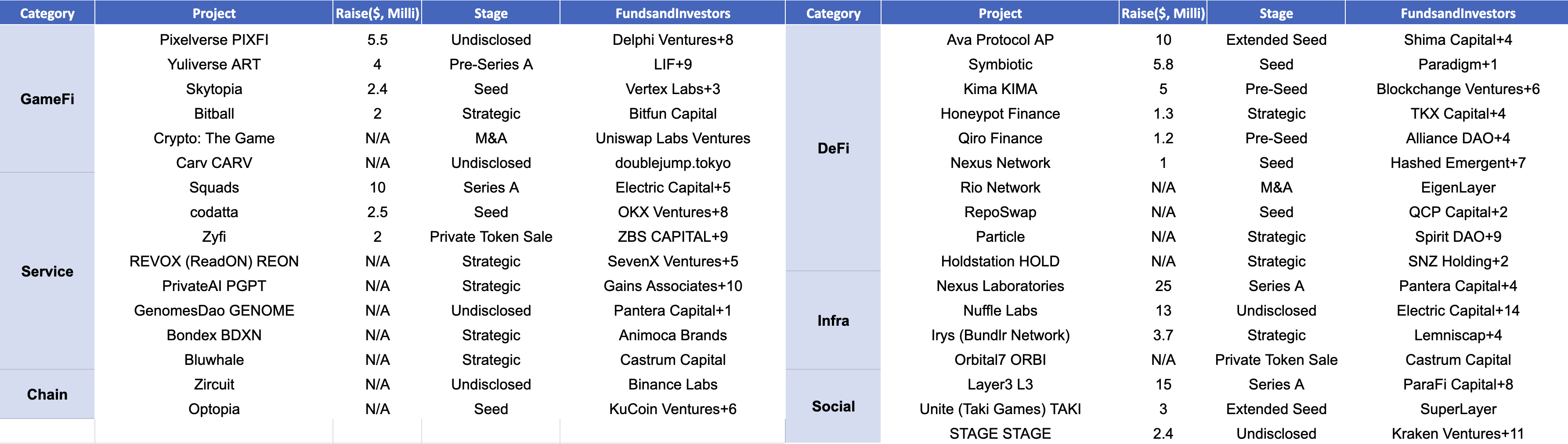

Last week witnessed a total of 33 financing events, raising a substantial amount of over $114.8 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The DeFi (Dentralized Finance) sector kept leading with the highest number of financing events, totaling 6. The Blockchain Infrastructure sector recorded the highest total funding amount, raising a total of $41.7 million, accounting for 36% of the overall financing. The largest financing event was led by Nexus Laboratories, successfully raising $25 million. Nexus is open-source, modular, and extensible, optimizing prover performance and supporting custom computations. It aims to enhance digital interactions with a focus on correctness, transparency, and security, making large-scale verifiable computing accessible and efficient. More detailed information is as below.

* 14 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

Nexus Labs recently announced the completion of a $25 million Series A funding round. The round was led by Lightspeed Venture Partners and Pantera Capital, with participation from Dragonfly Capital, Faction Ventures, and Blockchain Builders Fund. Nexus Labs plans to use the new funding to expand its team and develop additional products. The company is focused on building zero-knowledge privacy tools that support technologies such as artificial intelligence, cybersecurity, and cloud computing.

• Official Link: https://nexus.xyz/

2. [Social] Layer3 raises $15 million Series A ahead of token launch and airdrop.

Layer3, a token distribution protocol, has raised $15 million in a Series A funding round ahead of its token launch and airdrop in the coming months. ParaFi and Greenfield Capital co-led the round, with Electric Capital, Immutable, Lattice, Tioga, Leadblock Bitpanda Ventures, Amber and others participating, Layer3 said Wednesday. The project began raising funds for the round in April and closed it in May, Layer3 co-founder Brandon Kumar told The Block. The round was structured as equity with token warrants, Kumar said, declining to comment on the valuation.

Layer3 also revealed its previously unannounced strategic funding round of $3.7 million from Electric, ParaFi, Polygon's Sandeep Nailwal and others, raised in 2022. The Series A round brings Layer3's total funding to $21.2 million, having also raised a $2.5 million round in 2021.

• Official Link: https://layer3.xyz/

3. [DeFi] Ava Protocol lands $10M funding to develop 'super transactions'.

Ava Protocol, formerly known as OAK Network, closed a $10 million seed funding round as it looks to expand its operations and technology stack, according to an emailed announcement shared with Investing.com last Tuesday. The recent financing comprises an initial $5.5 million round followed by a subsequent $4.5 million seed+ round. Ava Protocol won support from notable names in the venture capital and cryptocurrency spaces. Specifically, the seed+ round was bankrolled by Electric Capital, Taisu Ventures, Bloccelerate VC, BingX Exchange, and Shima Capital. These investors join earlier backers such as Polygon founder Sandeep Nailwal, Greylock, Foundation Capital, and GSR.

The fresh capital injection will support Ava Protocol’s development of an intent-centric, event-driven Eigenlayer AVS developed to support private autonomous transactions on Ethereum and beyond. This summer, the main goal is to launch their protocols as an EigenLayer AVS and a Polkadot parachain, along with introducing the AP token.

• Official Link: https://avaprotocol.org/zh-CN

Squads Labs, the main developer of the Solana-based multisig protocol Squads, has raised $10 million in a Series A funding round and launched its retail-focused iOS wallet app called Fuse on public TestFlight. Electric Capital led the funding round, with Coinbase Ventures, Placeholder VC, RockawayX, L1 Digital and Mert Mumtaz, co-founder and CEO of Helius and founder of Odyssey Ventures, participating in the round, Squads Labs said Monday. The firm began fundraising in March and closed it earlier this month, Stepan Simkin, CEO of Squads Labs. The round was structured as equity with token warrants similar to Squads' seed round, Simkin said, declining to comment on the valuation. The Series A round brings Squads' total funding to $22.5 million, having previously raised $12.5 million in three funding rounds.

• Official Link: https://squads.so/

See you next week!