*All on-chain data is dated as of 12:00 a.m. EST on Sunday, October 29th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week (Oct.22–28).

Author: LBank Labs Research team — Hanze, Johnny

Keywords: #BTC #PCE #GDP #DTCC #ETF

Macro Market Overview

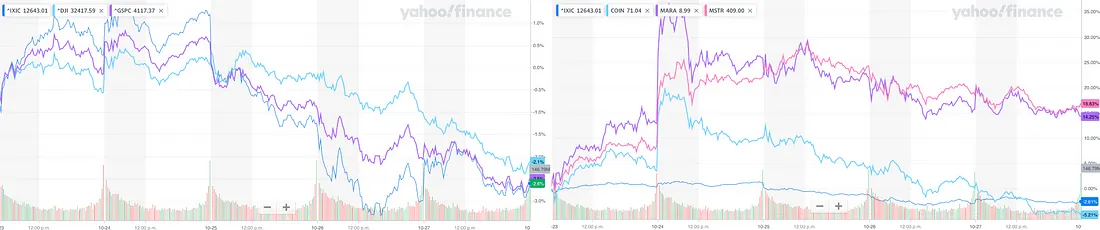

Major indexes on track to fall for three straight months. According to WSJ, the autumn pullback in the stock market worsened Friday, pushing the S&P 500 into a correction and to its worst two-week decline of the year. The Nasdaq Composite eked out a 0.4% gain, though the tech-heavy index finished well off its session highs. The index entered a correction earlier in the week and has fallen for three consecutive weeks. A recent round of quarterly earnings reports has tamped down this year’s rally in big-tech shares. Third-quarter results from tech giants this week have mostly failed to impress investors, injecting volatility into the stock market. The S&P 500’s year-to-date gains have shrunk to 7.8%.

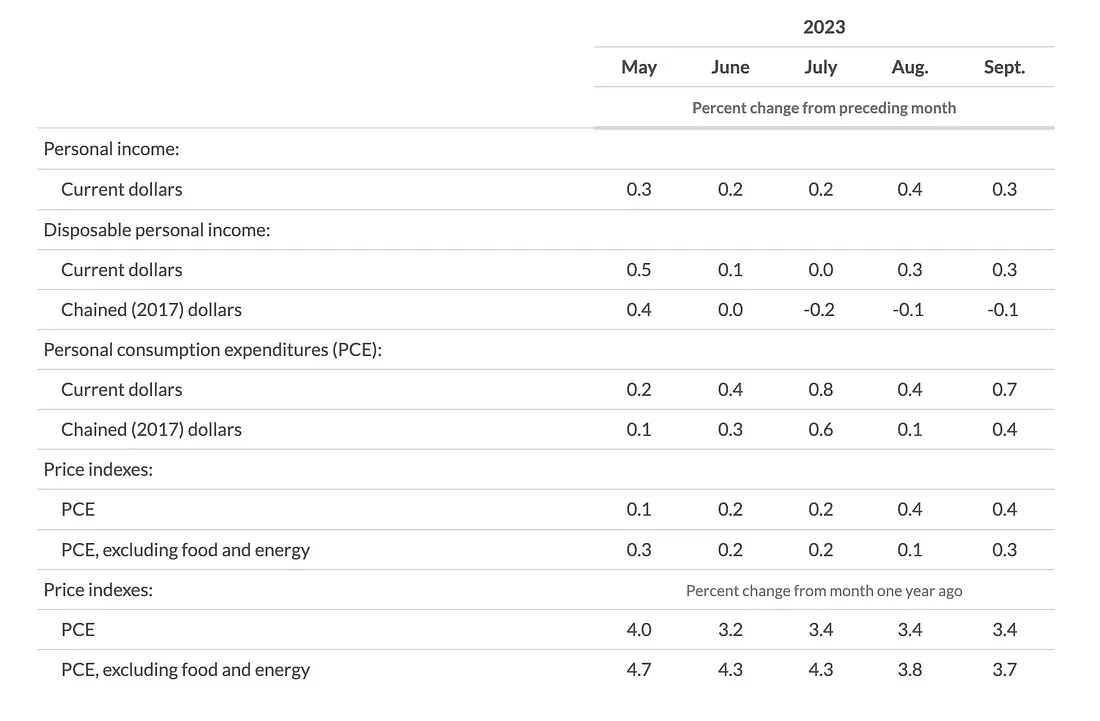

The personal-consumption expenditures price index, the Fed’s preferred inflation gauge, rose 0.4% in September from the prior month, the same pace as in August. Next week, investors will be closely parsing the latest jobs report. Investors parsed the U.S. gross domestic product report for clues about the trajectory of the economy. Third-quarter GDP rose 4.9% from the year prior adjusting for seasonality and inflation, topping economists’ forecast. The stronger-than-expected GDP figure suggested consumers are keeping the economy churning, holding a recession at bay. Still, some investors wondered whether the third quarter marked a peak in growth. The report showed Americans saved less and their incomes fell when adjusted for inflation. Business investment stalled, too. Last week, all three major indexes closed lower. The tech-heavy Nasdaq Composite Index fell by 2.6%, while the S&P 500 and Dow Jones Index dropped by 2.5% and 2.1%, respectively. However, web3-related stocks performed well last week. Despite a 5.2% decline in COIN, MSTR and MARA surged by 16.8% and 14.3%, respectively.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

According to U.S. Bureau of Economic analysis, personal income increased $77.8 billion (0.3 percent at a monthly rate) in September, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $56.1 billion (0.3 percent) and personal consumption expenditures (PCE) increased $138.7 billion (0.7 percent).

The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI decreased 0.1 percent in September and real PCE increased 0.4 percent; goods increased 0.5 percent and services increased 0.3 percent.

Personal Income and Outlays, September 2023 (Source: bea.gov)

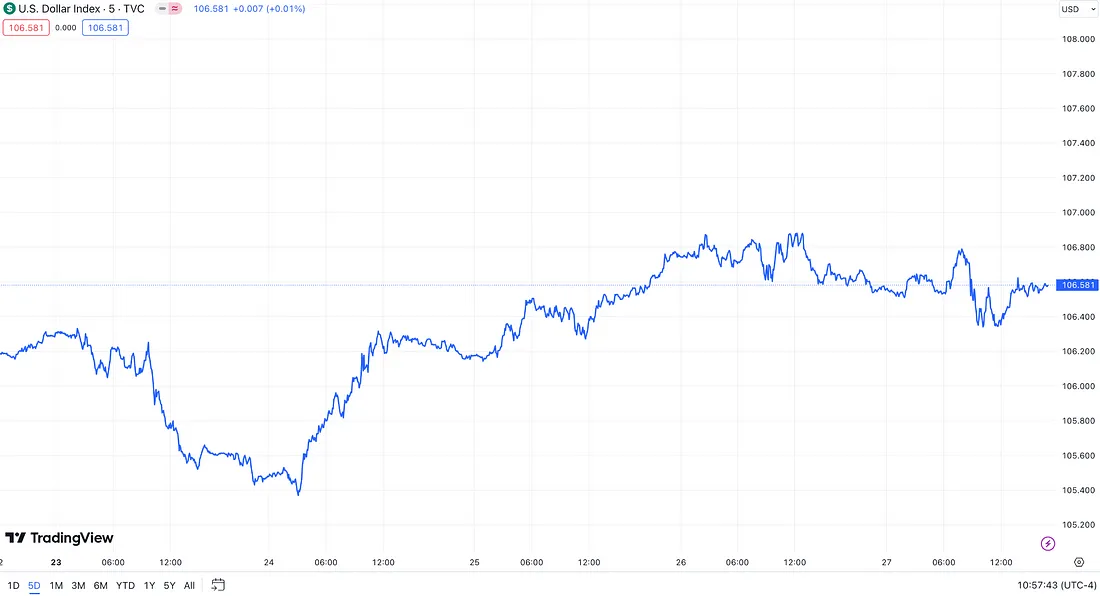

Due to fund movements related to portfolio rebalancing at the end of the month, the U.S. dollar (DXY) softened on Friday. However, it still recorded a weekly gain, as the latest data from the past few days indicated the continued strength of the U.S. economy. Investors are closely watching the upcoming meetings of the Federal Reserve next week. DXY reported 106.581 on Friday, marking a 0.4% increase for the week.

DXY (Source: TradingView)

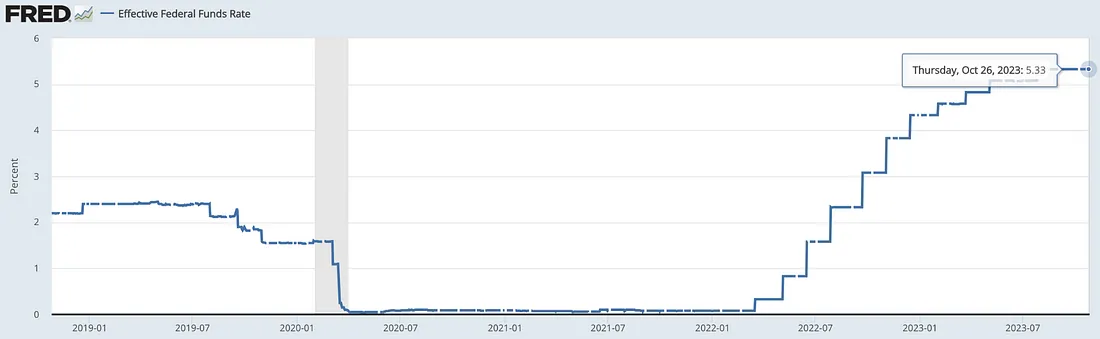

According to WSJ, next week, investors will be closely parsing the latest jobs report. Some investors said that more positive news on the economy might be bad news for investors concerned about interest rates, and how long they will stay elevated. Many investors expect the Fed to hold rates steady at its meeting next week, though the central bank’s path beyond that remains murky.

EFFR (Source: Federal Reserve Bank of New York, CME Group’s FedWatch Tool)

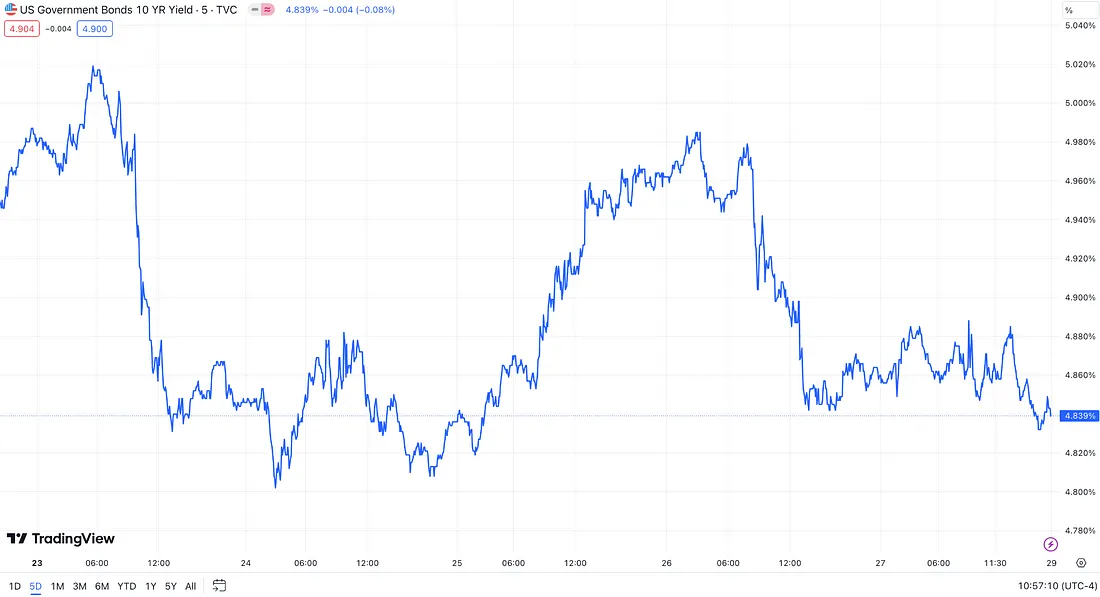

The yield on the 10-year Treasury note (US10Y) breached 5% for the first time in 16 years in early trading Monday, keeping many investors glued to the bond market throughout the week. It settled at 4.839% on Friday.

US10Y (Source: TradingView)

BlackRock bitcoin ETF added to eligibility file, says clearing house DTCC.

Bloomberg’s ETF analyst Eric Balchunas tweeted that BlackRock subsidiary iShares’ Bitcoin Trust had been listed on the Depository Trust & Clearing Corporation (DTCC). The ticker symbol would be IBTC, which is part of the process to introduce a physical Bitcoin ETF to the market. However, later in the day, BlackRock’s iShares Bitcoin Trust (IBTC) was removed from the DTCC website, only to be relisted the following day. Subsequently, a Reuters report stated that a DTCC spokesperson indicated that BlackRock’s iShares Bitcoin Trust ETF had actually been added to the eligibility file as early as August 2023.

(Source: Twitter@EricBalchunas)

Crypto Market Pulse

Market Data

Cryptocurrency market capitalization continued to rise last week. Encouraged by recent events related to BTC spot ETFs, the crypto market has seen an influx of more assets. Bitcoin climbed to $35,000, reaching its highest point since 2022. As of 12:00 on October 29th, Bitcoin’s price is $34,000, marking a 13.6% increase from the previous week. Ethereum, the second-largest cryptocurrency, also reached a two-month high at $1,860 last week and is currently priced at $1,778, representing a 9.0% increase. The total market capitalization of the entire cryptocurrency market has now reached $1.25 trillion, with a 9.6% increase in one week.

Furthermore, Bitcoin’s market share in the overall market continues to rise, reaching 53.2%, with a market capitalization increase of $80 billion to reach $665 billion in one week. Ethereum’s market share, on the other hand, continues to decline, now at 17.1% with a current market capitalization of $214 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

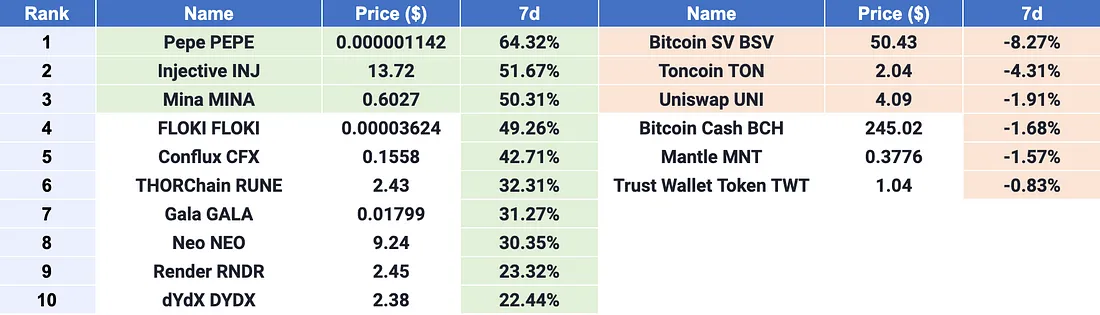

$PEPE, $INJ, and $MINA emerged as Top 3 gainers, while $BSV, $TON, and $UNI were Top 3 losers. The significant gains among the top gainers in the top 100 cryptocurrencies by market capitalization last week were influenced not only by the overall upward trend in the crypto market but also by some individual factors. $PEPE experienced a substantial surge over the past week, with a 64% increase in value after burning 69 trillion tokens. This strategic move, aimed at creating scarcity and value, piqued investor interest and propelled it to multi-month highs. $INJ began to see price gains over the past week, currently trading at $13.72. This growth is attributed to the positive impact of Injective’s partnership with Google and Helix Exchange launching new products to strengthen its market position. The successful price increase of $MINA may be due to the announcement that South Korea’s leading exchange, Upbit, will list $MINA in Korean won trading pairs. In contrast, the top losers last week did not perform as well, but given the overall market environment, they didn’t fare too poorly, mostly experiencing short-term price corrections.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

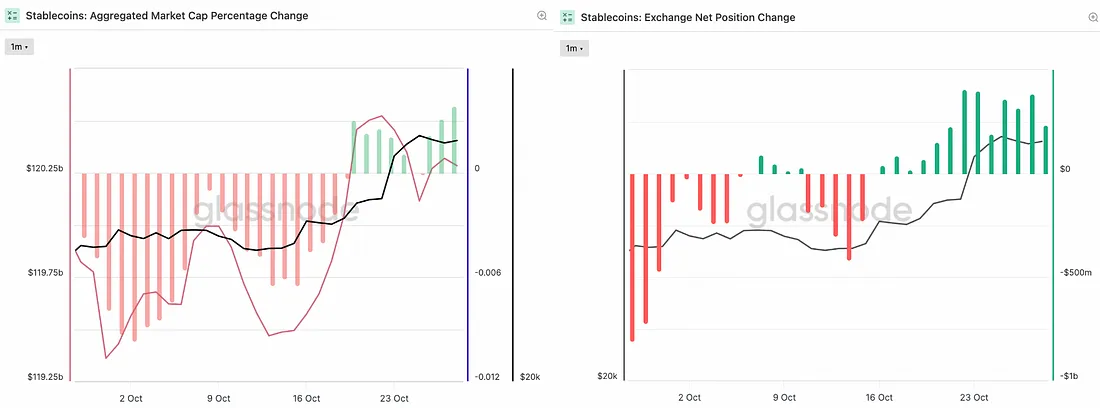

Last week, the total supply of stablecoins saw a slight decrease, reaching $120.3 billion. Despite a significant influx of funds into the crypto market over the past week, the supply of stablecoins contracted slightly. The overall supply level remained relatively unchanged during the market’s upswing, reflecting a certain lag in response. Net position changes for exchange-based stablecoins have started to shift towards significant net inflows. This phenomenon indicates that the recent rise in the crypto market has boosted investor confidence.

Stablecoins Market Cap (Data: Glassnode)

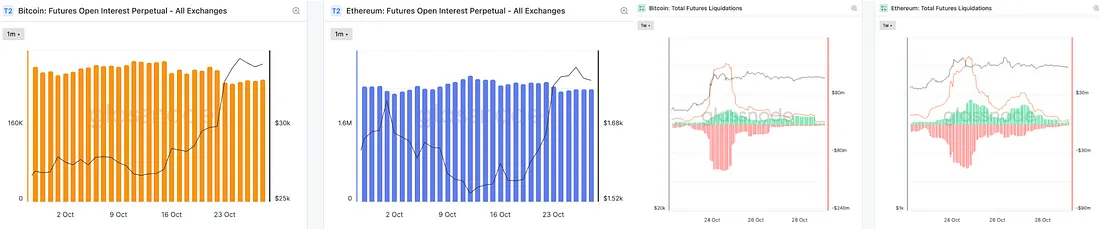

In the derivatives market, the total open interest in Bitcoin and Ethereum futures contracts continued to decline last week. Looking at the total open interest in Bitcoin and Ethereum futures contracts over the past three weeks, it suggests a gradual reduction in the capital flowing into the derivatives market, indicating a decrease in investor interest in derivative trading. On the other hand, the recent uptrend in both Bitcoin and Ethereum led to a wave of liquidation for short positions, with significant liquidation amounts exceeding 120 million for Bitcoin and 40 million for Ethereum near the 24th. The bullish market trend has dispelled some of the bearish expectations among investors.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Future Liquidations (Data: Glassnode)

In the DeFi market, the total locked value (TVL) saw a significant increase last week, growing by 9.8% to reach $413 billion. Over the past seven days, decentralized exchanges (DEXs) recorded a trading volume of $194 billion, marking a substantial 61% increase from the previous week. Additionally, the market share gap between DEXs and centralized exchanges (CEXs) did not noticeably widen, with DEXs and CEXs maintaining a dominant position of 16.2%. Furthermore, among the top ten blockchain platforms by TVL, all platforms, except Base (experienced a slight 1.7% decrease), experienced an increase in TVL over the past seven days. It’s worth noting that Binance Smart Chain (BSC) saw a 17.9% growth in TVL last week, which could be attributed to recent updates in the BNB ecosystem.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

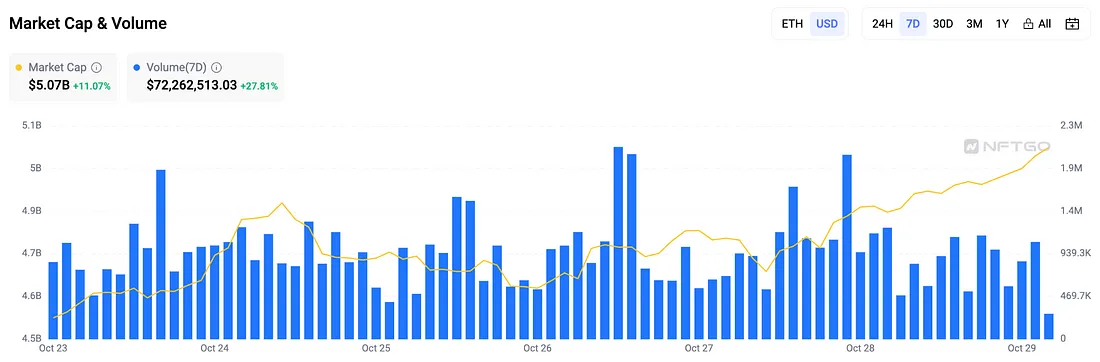

The NFT market saw an improvement last week, with both market capitalization and trading volume on the rise. The current NFT market cap stands at $5.1 billion, marking an 11% increase in one week. Furthermore, the trading volume over the past seven days continued to surge, with a significant 27.8% increase. In the Top NFT Collections, blue-chip NFT series like Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) experienced a rebound in floor prices and average prices. The floor prices of these two series increased by 8.7% and 9.6%, respectively, while the average prices rose by 6.1% and 5.5%, respectively.

Market Cap & Volume, 7D (Data: NFTGo)

LBank Labs’ Recap

BTC has exhibited a degree of price stability following a confluence of events and algorithm-driven price increases in the preceding week. Notably, there has been a noteworthy absence of substantial sell volume in BTC, suggesting that it is likely to continue trading within its current range, with a range of approximately plus or minus $1,500.

In the case of XRP, there has been a consistent uptick in long positions in the futures market. This increase is correlated with the influx of favorable news regarding XRP, which has generated positive sentiment among investors.

NEO, in its pursuit of integrating with the EVM, has garnered significant attention. Notably, NEO’s gas token has become a focal point for market participants. Retail investors are increasingly shorting NEO in the futures market, while larger institutional investors are adopting long positions. This divergence in sentiment suggests the potential for a short squeeze in the near future.

Tokens within the data sector, specifically FET, AGIX, and RNDR, have demonstrated strong upward momentum, supported by robust spot buying activity.

BNT has recently entered our monitoring scope. It exhibits a discernible bull flag pattern, characterized by relatively low buying volume in recent days. This pattern suggests that a level of support has been established in the market.

Meme tokens have not witnessed significant price increases during this modest bullish phase. However, the imminent launch of $MEME on Binance’s Launchpad is expected to inject new momentum into the meme token market in the coming weeks.

MKR has experienced a robust bull run, primarily due to the attractiveness of its RWA yield, particularly in comparison to US Treasury yields. As a result, risk-averse investors have favored MKR. The increased trading volume in various assets has also led to speculative investors diversifying their investment portfolios.

Tokens we anticipate price growth in coming weeks(NOT FINANCIAL ADVICE, please do your own research):

FET, BNT, TOKEN, XRP, AGIX, TOMO, MEME, ARK, GMX, RDNT

Tokens we anticipate price decrease in coming weeks(NOT FINANCIAL ADVICE, please do your own research):

LOOM, MKR, LINK, FLOKI, WLD

- BTC price optimistic: $35500 — $28500

- BTC price neutral: $33500-$35500

- BTC price pessimistic: $30500 — $33500

Major Project News

[Ethereum] Core devs rule out Dencun fork this year. Ethereum client developers confirmed on Thursday that the anticipated Dencun upgrade will not be implemented in a network hard fork before the end of 2023. Already last month, when the new Holešky testnet was successfully launched behind schedule, the consensus was that putting the upgrade through its paces by the time December holidays rolled around was unlikely.

When an optimistic scenario was put forward on the latest All Core Developers call, the consensus was evidently with pseudonymous Prysm developer Potuz, who commented, “there is no way we are forking mainnet in 2023.” He pointed to consistent consensus issues arising on the 10 developer networks (devnets) that have been spun up so far to test the upgrade over the past few months, adding that “not a single one went well.”

Ethereum clients are divided into two main camps, one for the execution layer and the other the consensus layer, with the distinction reflected in the name of the upgrade — consensus teams use cities where Ethereum’s major conference, Devcon, has been held (e.g. Cancun), while execution client developers opt for star names (e.g. Deneb) — hence “Dencun.” In contrast to the consensus teams, execution layer client teams reported being in good shape for the upcoming testnets.

(Source: galaxy.com)

[Layer2] Starknet Decentralization: A Roadmap in Broad Stroke. StarkWare has unveiled the decentralized roadmap for Starknet. The roadmap aims to ensure that the Starknet protocol transitions to a decentralized proof-of-stake protocol and includes two main paths: the development of various components necessary for running a decentralized protocol and the gradual transition of operational control to Starknet stakers. The transition of operational control to Starknet stakers consists of four key steps: transitioning to a decentralized network architecture while keeping sequencer operations centralized, ensuring the availability of a fully open-source software stack, developing increasingly widespread testing and integration networks, and attracting stakers to join before the sequencers make their final transition to proof-of-stake.

Furthermore, Cairo V2.3.0 has transitioned from a candidate release to an official release. This new version includes performance improvements, bug fixes, and new inline macros to help handle component dependency relationships.

(Source: starkware.co, Twitter@Starknet)

[Polygon] Polygon’s native token has been launched on the Ethereum mainnet. Polygon announced on the X platform that POL is the next-generation token designed to power the extensive ecosystem of ZK-based Layer 2 chains. It achieves this through a native staking protocol that enables POL holders to validate multiple chains and perform various roles on each chain, making POL an efficient token.

Additionally, Polygon Labs recently released and officially launched the open-source gateway called the “Chain Indexer Framework” for building scalable dApps. This framework assists users in developing scalable dApps, seamlessly handling blockchain events, and implementing real-time EVM chain data integration. The Chain Indexer Framework provides a comprehensive set of Node.js packages to simplify the development of event-driven data pipelines.

(Source: Twitter@0xPolygonLabs, polygon.technology)

[BNB] The Fermat Hardfork of opBNB testnet is approaching. BNB Chain has announced the opBNB testnet Fermat hard fork plan to be activated at block height 12,113,000. This hard fork aims to establish interoperability between opBNB and BNB Greenfield by adding new precompiled contracts that enable BLS signature verification and cometBFT light client verification. Additionally, Fermat will stabilize L1 gas prices for opBNB Layer 2 transactions’ L1 data costs. Developers are advised to upgrade to opNode V0.2.0 and opGeth V0.2.0 before the hard fork. This ensures that their nodes are compatible with the new precompiled contracts and will continue to operate smoothly after the hard fork.

(Source: bnbchain.org)

[dydx] dYdX Chain has officially released its V1.0 version. dYdX founder Antonio Juliano announced on the X platform that the dYdX Chain V1.0 version has been officially launched, marking a step towards full decentralization.

dYdX also announced on Tuesday that it is open-sourcing its code, signaling the beginning of the V4 upgrade and the transition from the Ethereum Layer 2 network to an independent blockchain within the Cosmos ecosystem. The developers behind dYdX, known as dYdX Trading Inc., stated that the V4 upgrade will make the DEX fully decentralized and community-operated, meaning the company will no longer control the protocol and will not charge transaction fees.

(Source: Twitter@AntonioMJuliano)

[Polkadot] Astar Network: The Astar zkEVM testnet, zKatana, is now live.

The Polkadot ecosystem’s smart contract platform, Astar Network, announced on the X platform that the Astar zkEVM testnet, zKatana, has been launched. Earlier on October 10th, Astar Network disclosed the progress of the Astar zkEVM environment construction: zkEVM provisional environment and Sepolia provisional bridging have been completed. The user interface for the cross-chain bridge is under development, and the Astar zkEVM testnet is set to be launched soon. Pre-registration is currently open.

(Source: Twitter@AstarNetwork)

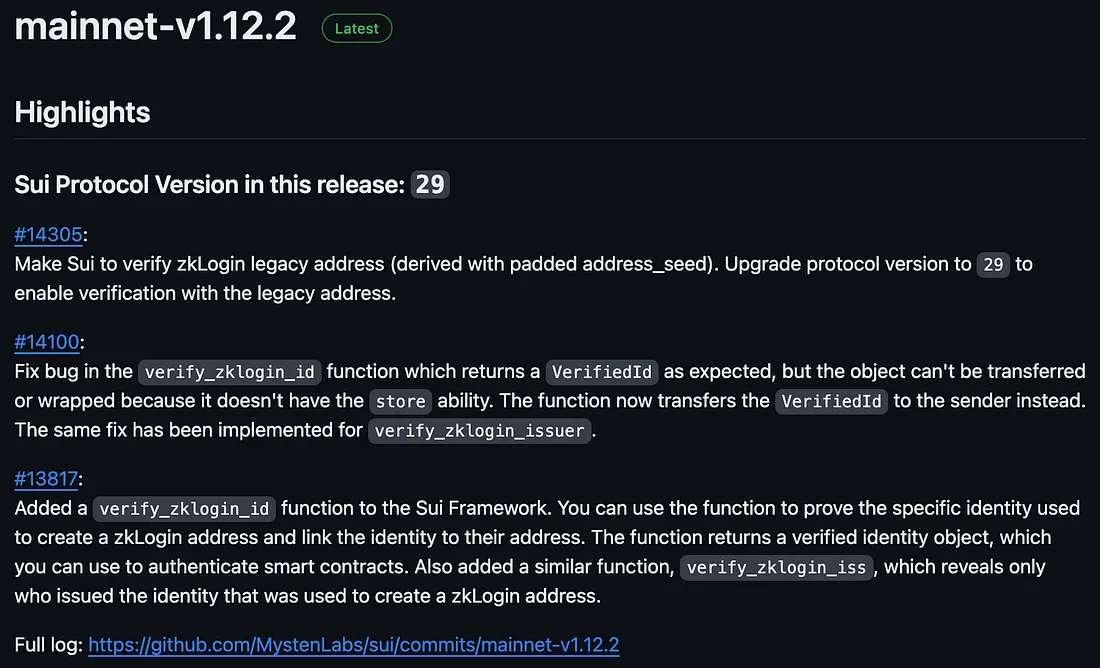

Here are some of the key upgrades: 1) Enable Sui to verify zkLogin historical addresses (derived from pre-filled address_seed). The protocol version has been upgraded to 29 to enable verification of historical addresses. 2) Fixed an error in the verify_zklogin_id function, which was expected to return a VerifiedId as intended, but this object lacked storage capability and couldn’t be transmitted or wrapped. After the fix, the function now transmits the VerifiedId to the sender. The same fix has been applied to verify_zklogin_issuer. 3) Added the verify_zklogin_id function to the Sui framework, allowing users to prove the specific identity used to create a zkLogin address, associate the identity with the address, and also use it for contract verification.

(Source: github.com)

Key Fundraising Data

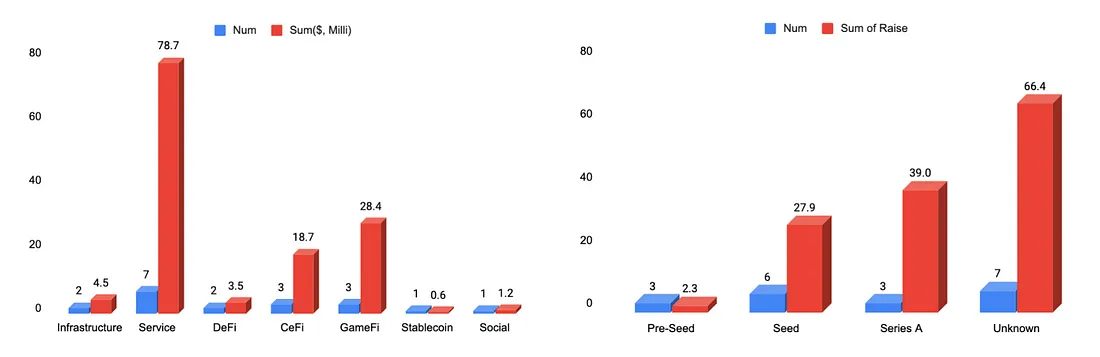

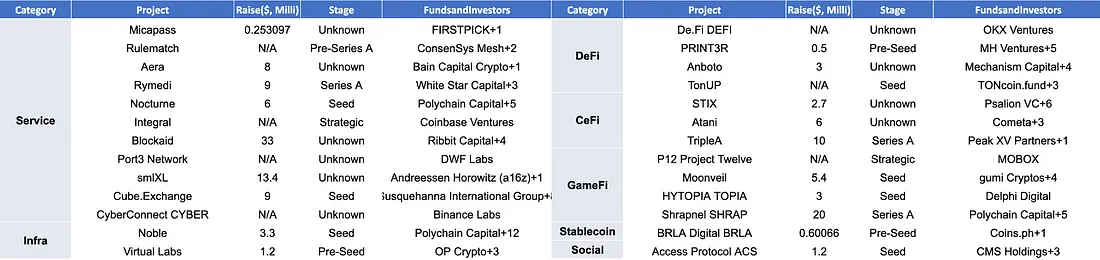

Last week witnessed a total of 26 financing events, raising a substantial amount of over $135.6 million*. Compared to last week, there has been a significant increase in both the number of financing activities and the total funding amount. The Service sector attracted the most attention, with a total of 7 financing activities, representing 26.9% of all financing activities, and a funding amount of $78.7 million, accounting for 58.0% of the total funding. The largest fundraising activity this week also occurred in the Service sector, led by the Blackaid project, which raised $33 million. Blockaid is a Web3 security tools stop malicious transactions before they happen, protecting web3 users from scams, phishing, and hacks. More detailed information is provided below.

*7 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events (Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [Service] Emerging from stealth with $33M in funding to secure web3.

Blockaid offers security tools to web3 builders. Founded by experts with military and cyber intelligence backgrounds, Blockaid boasts a team of over 20 top-notch security engineers. Their unique architecture, which scans and validates dApps and transactions, has already protected over $500 million of user funds and prevented 1.2 million malicious transactions in the past six months.

Blockaid’s proactive detection ensures the security of web3 users, enabling the industry to grow and innovate securely. With $33 million in funding from prominent investors like Ribbit, Variant, Cyberstarts, Sequoia, and Greylock, Blockaid is poised to expand its team and offerings to safeguard more companies in the web3 space from fraud, phishing, and hacks, propelling the industry forward.

- Official Link: https://www.blockaid.io/

Cryptocurrency startup smlXL has announced the completion of a $13.4 million seed funding round with support from a16z crypto, Greylock, and others. The funds raised will be used to establish a 16-person team and develop products, including EVM.code and evm.storage.

smlXL introduced its first product, an interactive guide to EVM opcodes, evm.codes, last year and has officially launched its website today. smlXL’s mission is to make blockchain more transparent, useful, and accessible. They are currently expanding their coverage to unverified Solidity contracts and are in the process of launching a trading page.

- Official Link: https://smlxl.io/

Global digital currency payment institution Triple-A announced their US$10 Million Series A funding round last week. Leading the round are repeat investors Peak XV Partners (formerly known as Sequoia India & South East Asia), along with the strategic backing of Shorooq Partners, one of MENA’s leading technology investors. Founded in 2017 by serial fintech founder Eric Barbier, Triple-A has pioneered digital, stablecoin and blockchain-led payments, enabling global businesses to pay and get paid faster, 24/7, and without any currency volatility risk, all while upholding the highest regulatory compliance standards. The company’s mission is to build a more efficient global payment ecosystem by bridging the gap between traditional finance and blockchain backed payments.

- Official Link: https://triple-a.io/

4. [GameFi] ‘Shrapnel’ Game Studio Neon Machine Raises $20 Million Led by Polychain.

Neon Machine, the Seattle-based game studio behind upcoming first-person shooter Shrapnel, has raised $20 million in Series A funding, the company announced Wednesday. Polychain Capital led the round, with Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, and Tess Ventures also participating.

The funds will be used to further develop Shrapnel at a “critical time,” according to a statement, as the game team prepares to ship an early-access version in December ahead of a full launch sometime in 2024. The Shrapnel team currently has over 70 employees, CEO Mark Long said in a statement.

- Official Link: https://www.shrapnel.com/

See you next week! 🙌

🎙Forum: Feel free to leave your comments on our official LBank Labs Twitter account, and don’t hesitate to ask questions about the tokens or projects that interest you. We will diligently gather them and discuss them in the recap section of our weekly digest!

📢 Disclaimer: The weekly crypto market insights are provided for informational purposes only and should not be considered as financial advice. The cryptocurrency market is highly volatile and unpredictable. Prices and trends can change rapidly, and past performance is not indicative of future results. Always conduct thorough your own research and consult with a qualified financial professional before making any investment decisions.