*All on-chain data is dated as of 12:00 a.m. EST on Sunday, June 17th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week (June.16-22).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #ZK

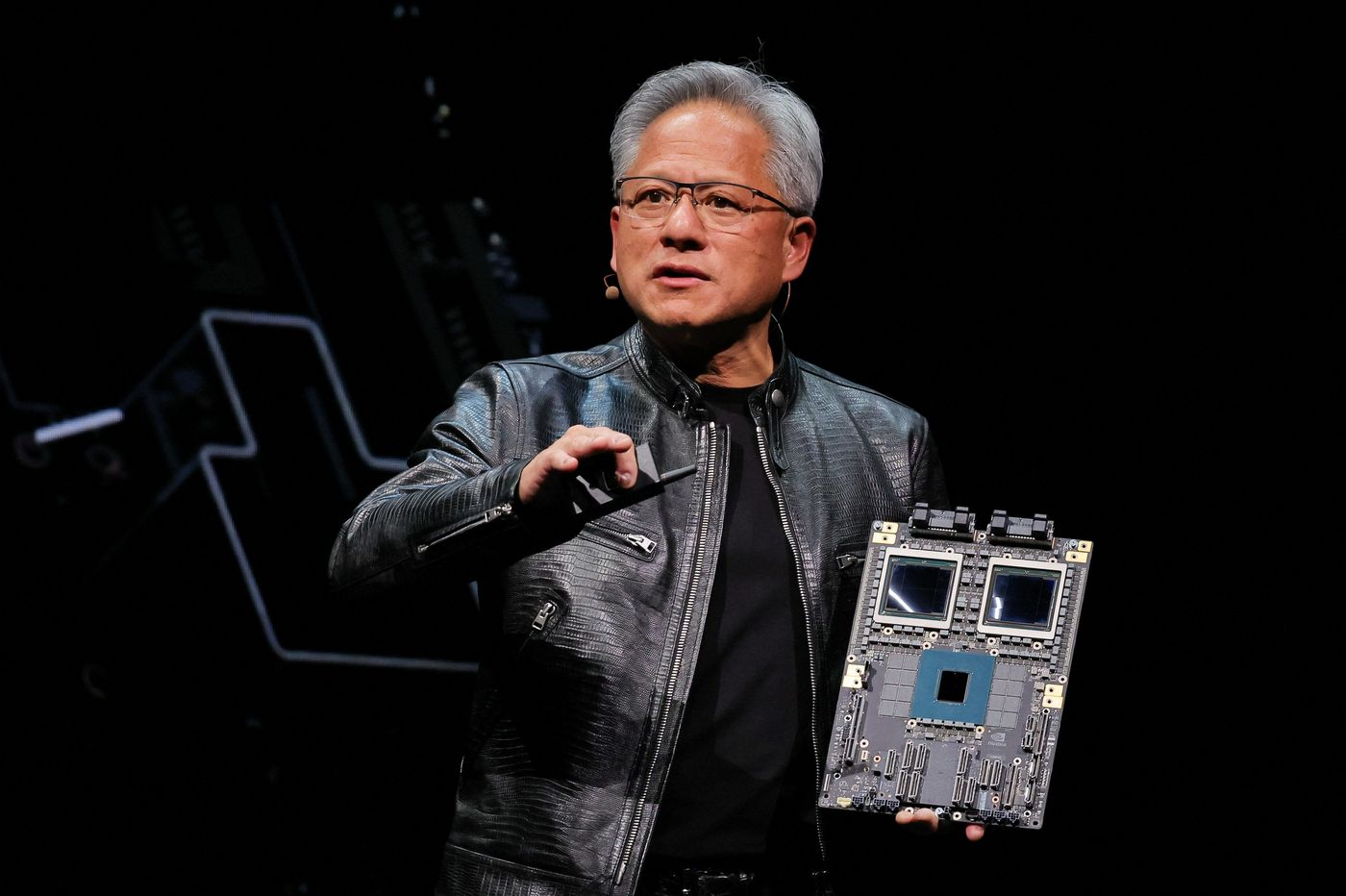

Nvidia, run by CEO Jensen Huang, surpassed Microsoft as the most valuable listed U.S. company. PHOTO: ANN WANG/REUTERS

1 Macro Market Overview

Nasdaq, S&P 500 Pull Back From Records. According to WSJ, since the S&P 500 and Nasdaq Composite are weighted by market value, moves in megacap stocks like Nvidia have a big influence on their performance. Shares of Nvidia fell 3.2% on Friday, capping the stock’s first weekly decline since April. Data Friday showed home sales slowed in May, reflecting continued tightness in the housing market. Sales of previously owned homes fell 0.7% from the prior month, the third consecutive monthly decline, according to the National Association of Realtors. From a year ago, sales were down 2.8%.

Stocks have climbed in recent weeks, driven in large part by excitement around artificial intelligence. Both the S&P 500 and Nasdaq Composite closed at new records ahead of Wednesday’s Juneteenth holiday. Nvidia, whose chips power AI technology, also on Tuesday dethroned Microsoft as the most valuable public company in the world, with a market capitalization of more than $3 trillion.

Last week, the three major U.S. stock indices all recorded gains. The tech-heavy Nasdaq Composite Index rose by 0.2%, while the Dow Jones Industrial Average and the S&P 500 increased by 1.6% and 0.8%, respectively. In contrast, web3-related stocks performed poorly last week, with Coinbase (COIN) experiencing a 6.6% decline, MicroStrategy (MSTR) dropping by 0.7%, and Marathon Digital Holdings (MARA) falling by 0.5%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

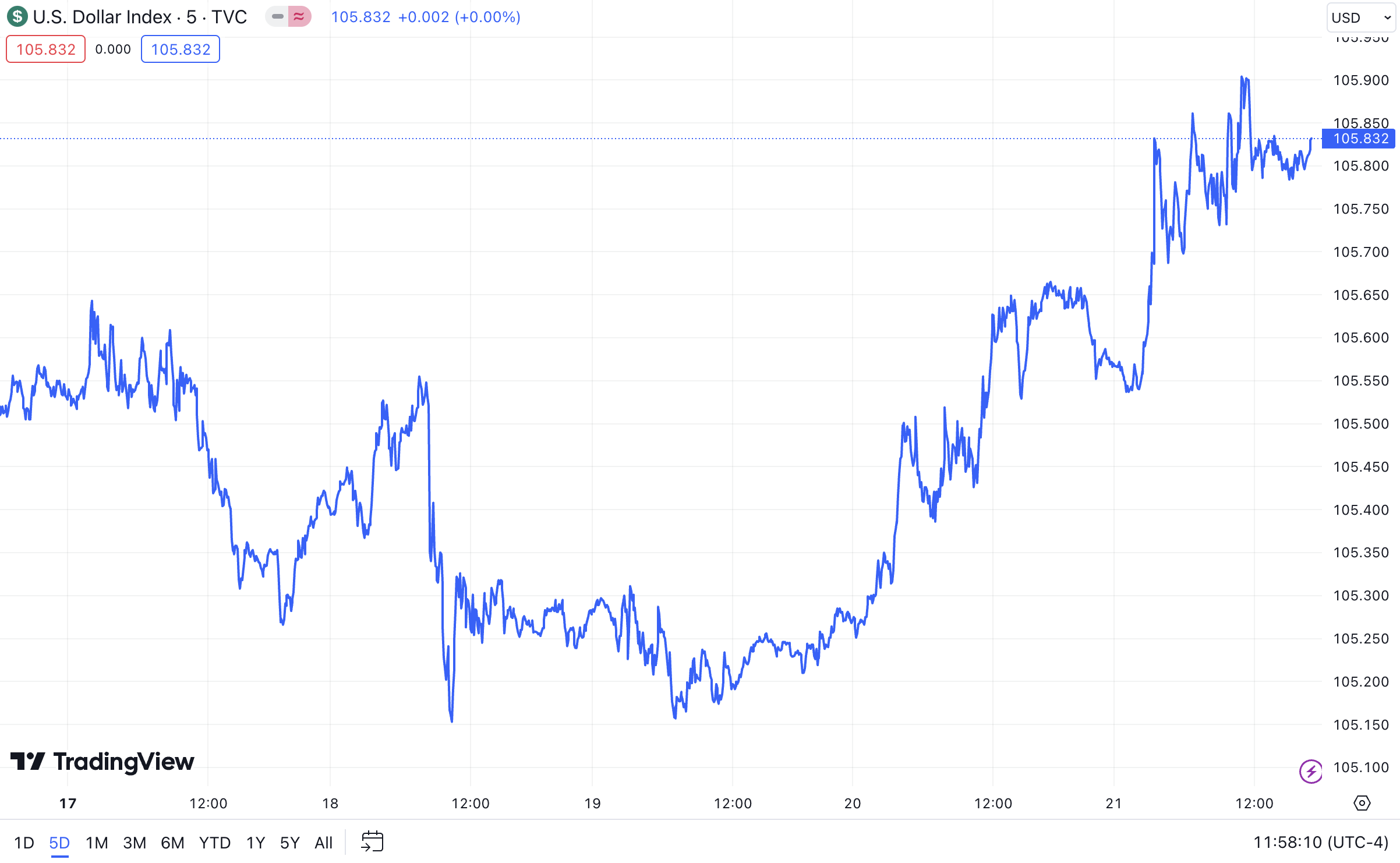

Last week, the U.S. Dollar Index (DXY) rose steadily amid market volatility, closing at 105.832 on Friday. This marks an increase from the previous week's closing value of 104.934.

DXY (Source: TradingView)

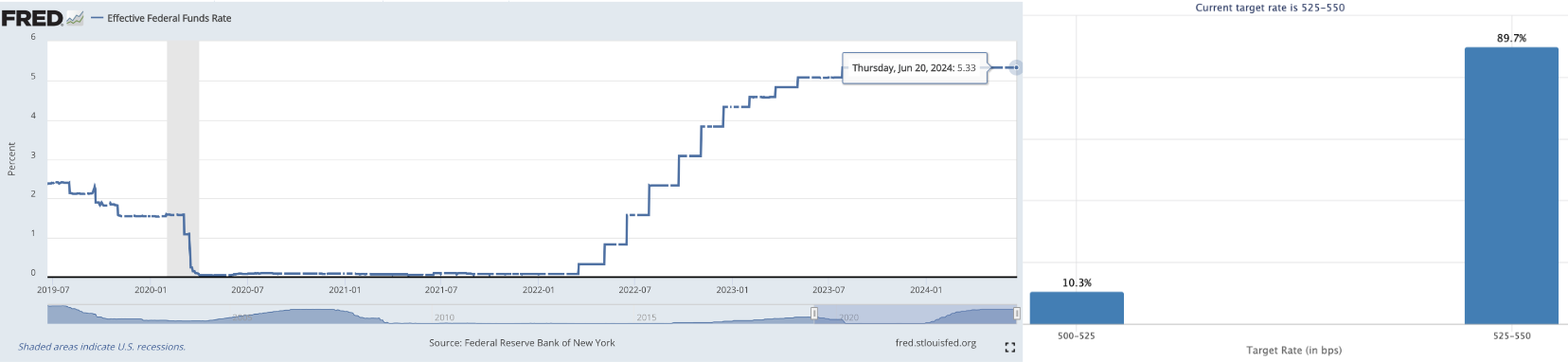

According to the latest data from the Chicago Mercantile Exchange (CME), currently, about 10% of investors believe that the Federal Open Market Committee (FOMC) will implement the first rate cut of the year at its next meeting in July, while nearly 90% of investors expect the interest rates to remain unchanged. This data has remained almost unchanged compared to the previous week.

Left: EFFR, Right: Target Rate Probabilities for July 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

The yield on the benchmark 10-year U.S. Treasury note (US10Y) ticked up to 4.257% on Friday, from the previous week's closing value of 4.223%.

US10Y (Source: TradingView)

Consensys: ETHEREUM SURVIVES THE SEC. Consensys has announced that it has received notification from the SEC indicating the conclusion of the investigation into Ethereum 2.0. This suggests that the SEC will not charge the sale of $ETH as securities trading. Consensys had written to the SEC on June 7, seeking confirmation that the approval of an ETH ETF based on $ETH as a commodity in May would signify the end of the investigation into Ethereum 2.0. Additionally, Consensys stated that the struggle continues as they seek a declaration in litigation that providing user interface software like MetaMask Swaps and Staking does not violate securities laws.

It is worth noting that in the lawsuit brought by the SEC against Kraken, the SEC claims that 11 tokens, including $SOL, $ADA, and $ALGO, are securities.

(Source: Twitter@Consensys)

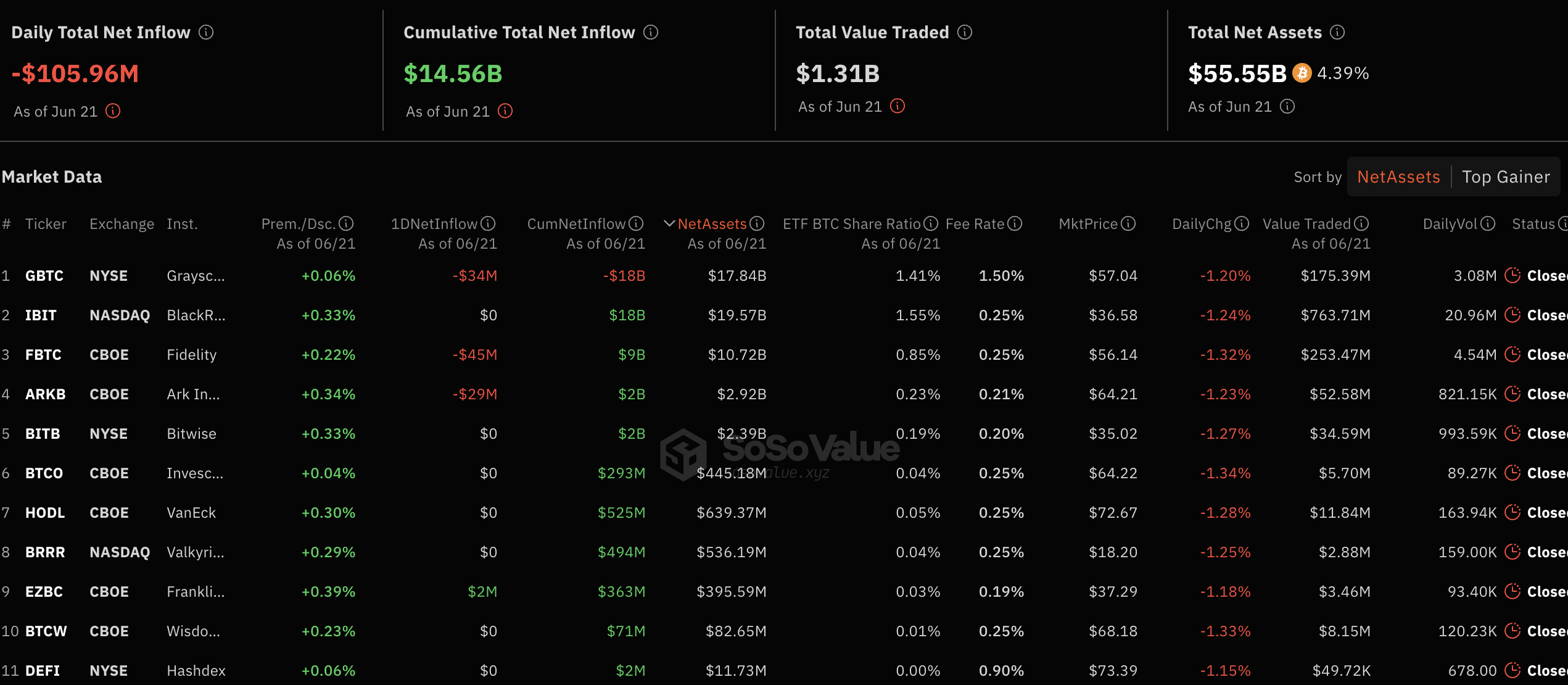

As of last week, the cumulative total net inflow for U.S. Bitcoin spot ETFs stood at $14.56 billion, with a net outflow of over $550 million in the past seven days. Currently, the total net assets of these ETFs amount to $55.55 billion, accounting for 4.4% of Bitcoin's market value. The performance of Bitcoin spot ETFs was poor over the past week, with significant net outflows exceeding $100 million for five consecutive trading days.

Looking at the data from last Friday, Grayscale's GBTC experienced a net outflow of $34 million. BlackRock's IBIT had no net inflow or outflow. Fidelity's FBTC saw a net outflow of $45 million. ARK's ARKB had a net outflow of $29 million. These figures indicate that last week was a difficult period for Bitcoin spot ETFs, with a substantial amount of funds being withdrawn by investors.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

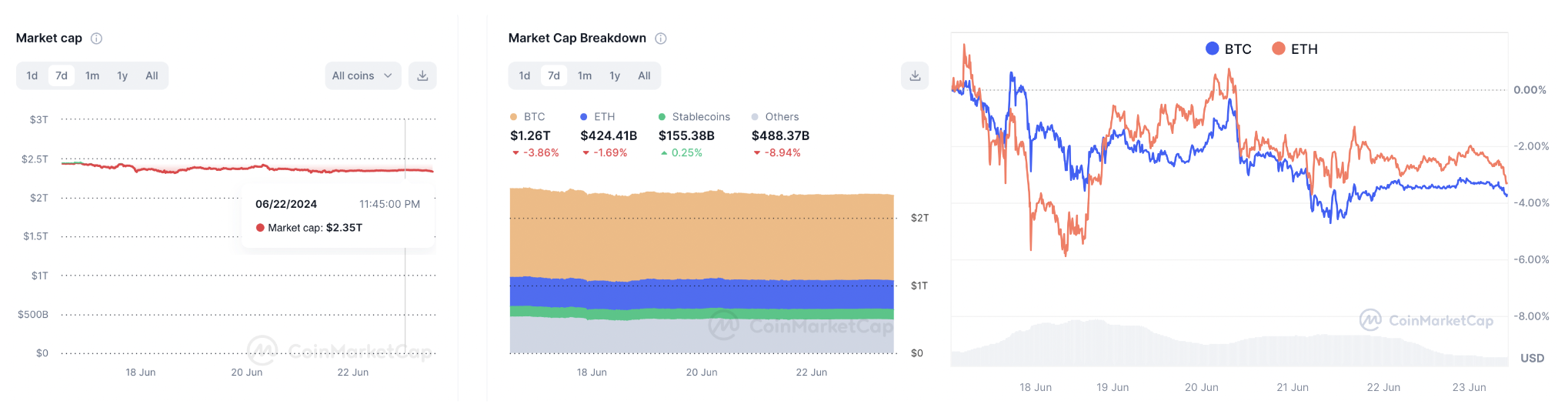

Last week, the total market capitalization of the cryptocurrency market showed a volatile downward trend, currently standing at $2.35 trillion. Due to continued high inflation pressure, Bitcoin and Ethereum experienced a brief drop early last week, followed by a slight rebound. As of the early hours of June 23rd, the spot price of Bitcoin was $64,000, down nearly 4% over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,500, down nearly 3.7% over the same period. Additionally, the market capitalizations of Bitcoin and Ethereum were approximately $1.26 trillion and $424 billion, respectively, shrinking by 3.9% and 1.7%, accounting for about 54% and 18% of the total market capitalization. The market share gap between Bitcoin and Ethereum has narrowed compared to recent times.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

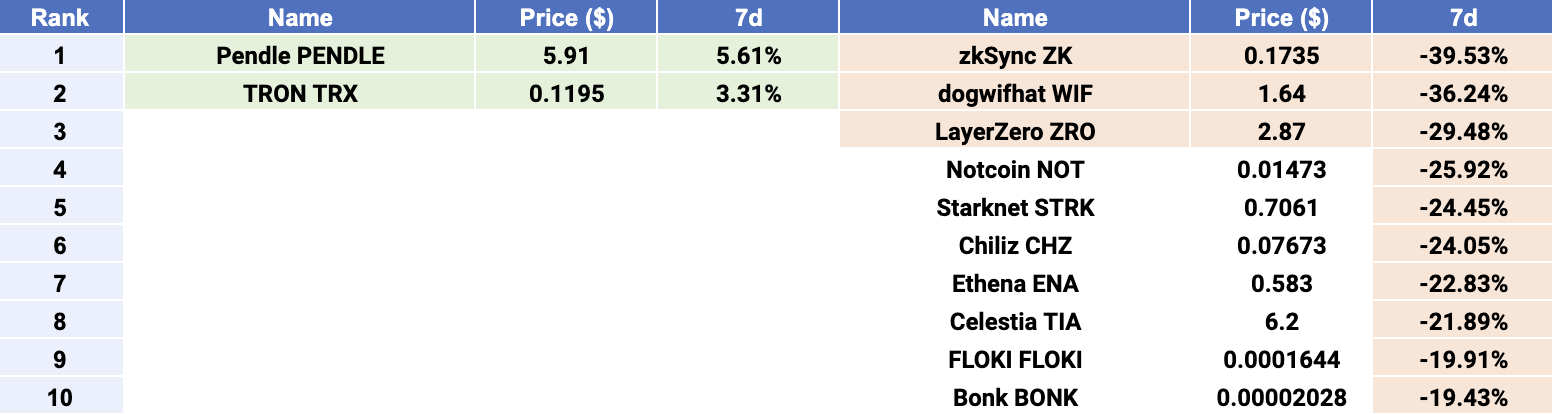

$PENDLE, $TRX emerged as Only 2 gainers, while $ZK, $WIF, and $ZRO were Top 3 losers. In the top 100 cryptocurrencies by market capitalization last week, altcoins as a whole had a tough week. $PENDLE and $TRX were the only gainers, while most altcoins experienced significant pullbacks, with meme coins being particularly hard hit. Pendle ($PENDLE), the top gainer, is a protocol that enables the tokenization and trading of future yield. With the creation of a novel AMM that supports assets with time decay, Pendle gives users more control over future yield by providing optionality and opportunities for its utilization. Starting from June 18, $PENDLE rebounded from a low point and saw another increase on June 21. During this period, it was announced that Coinbase International Exchange and Coinbase Advanced added support for perpetual futures for Altlayer, Lido DAO, and Pendle. Previously, Pendle's TVL (Total Value Locked) exceeded $6.6 billion, hitting a record high. TRON ($TRX), the second gainer, is a decentralized blockchain-based operating system developed by the Tron Foundation and launched in 2017. Originally, $TRX tokens were ERC-20-based tokens deployed on Ethereum, but a year later, they were moved to their own network. Recently, it was announced that the number of new daily accounts reached nearly 320,000, a one-year high, and the community developers proposed a reduction in the cost of TVM's OP code operations.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

Last week, the growth rate of the total supply of stablecoins increased, maintaining around $151.6 billion. Over the past seven days, the net change in stablecoin holdings continued to show a positive growth trend, with the growth rate rebounding after a brief decline. Notably, the total supply of stablecoins is currently at an all-time high, reflecting the lagging performance of stablecoins and aligning with the influx of funds under the positive impact of the ETH Spot ETFs. However, observing the net stablecoin holdings on exchanges over the past week, the overall trend shifted from net inflow to net outflow, indicating increased selling pressure on crypto assets and a market in a correction and consolidation phase.

Stablecoins Market Cap (Data: Glassnode)

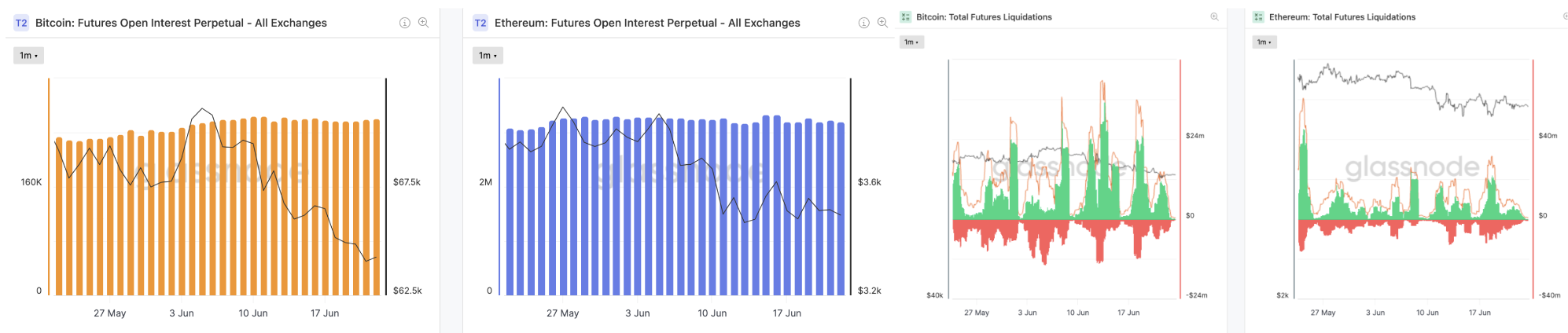

In the derivatives market, the open interest of Bitcoin and Ethereum perpetual contracts slightly decreased over the past seven days. The brief price drops of Bitcoin and Ethereum last Monday led to a significant reduction in capital in the perpetual contracts market, with substantial long positions being liquidated. Liquidation data supports this phenomenon, with peak liquidation volumes for Bitcoin and Ethereum long positions exceeding $20 million. These investors made incorrect bets regarding the recent Federal Reserve interest rate policies.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

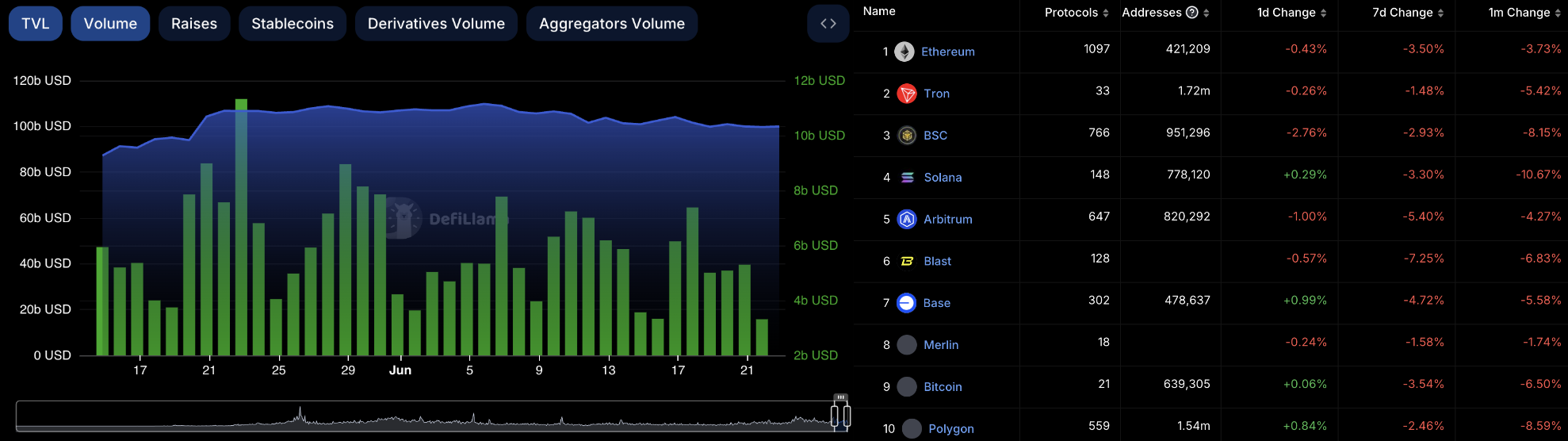

In the decentralized finance (DeFi) market, the total value locked (TVL) decreased last week, falling below $100 billion. Over the past seven days, trading volume on decentralized exchanges (DEXs) continued to decline, reaching $35.5 billion, down 11% from the previous week. The market share gap between DEXs and centralized exchanges (CEXs) continued to widen, with DEXs now accounting for about 14% of the total CEX trading volume. Among the top ten blockchain projects ranked by TVL, all experienced declines last week, with Blast and Arbitrum suffering the most, each losing over 7% and 5% of their TVL, respectively.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

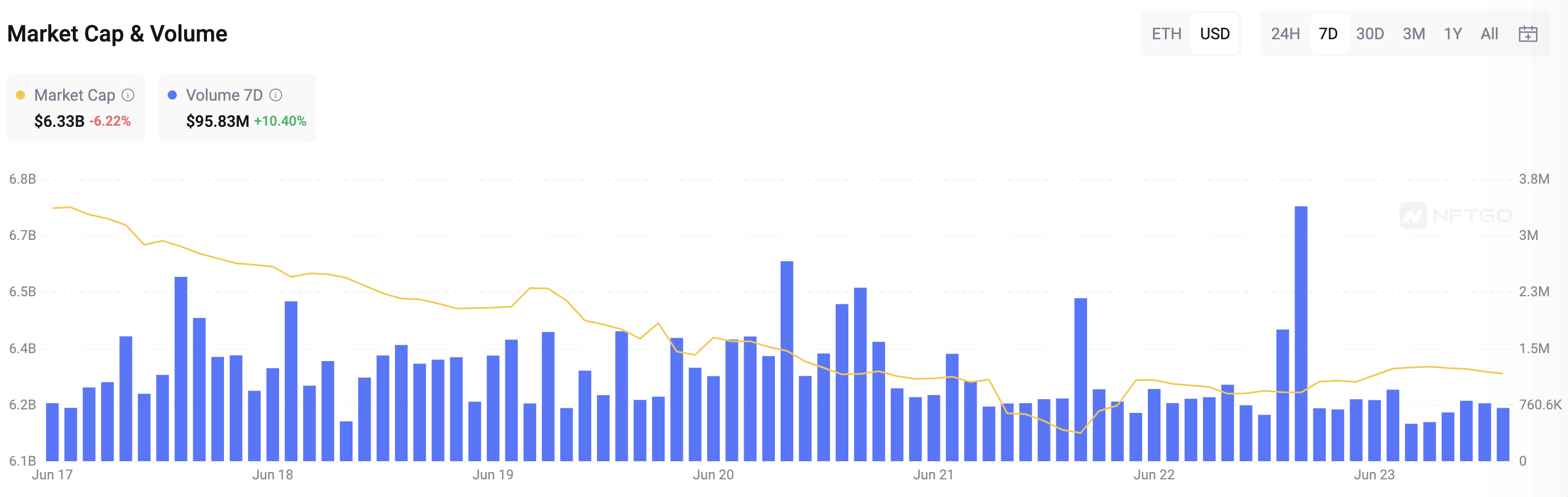

In the Ethereum non-fungible token (NFT) market, the total market value continued to decline by 6%, reaching $6.3 billion. Meanwhile, total trading volume increased by 10%, but the past seven days' trading volume remained below $100 million, specifically $95.8 million. Among Ethereum's leading blue-chip NFT series, the floor price of CryptoPunks decreased by 2%, while the average price rebounded by 29%. The floor price and average price of the second-ranked Bored Ape Yacht Club both fell by 11% and 16%, respectively. Currently, the third-ranked Pudgy Penguins saw its floor price drop by 11% and its average price decrease by 19%.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] Ethereum All Core Developers Execution Call #190 Writeup. On June 20, 2024, Ethereum developers gathered on Zoom for the All Core Developers Execution (ACDE) call #190. The ACDE calls are a bi-weekly series of meetings hosted by Tim Beiko, Protocol Support Lead at the Ethereum Foundation, where developers discuss and coordinate changes to the Ethereum execution layer (EL). During last week's call, developers provided updates on their progress in implementing various code changes, including Ethereum Improvement Proposals (EIPs) 7251 and 7702, as well as the Ethereum Object Format (EOF) and PeerDAS.

Beiko also shared a proposed template for EIP discussions, and EF DevOps engineer Parithosh Jayanthi introduced a new GitHub page named "eth-clients," which is intended for Ethereum mainnet and testnet configurations. Finally, Beiko reminded the team that the next ACDE call would take place on July 4th, during the US holiday. Although he will not attend the meeting, EF researcher Alex Stokes will host it in his place.

(Source: Galaxy)

[Layer2] Optimism: Alt-DA Mode is now available for the OP Stack in beta. On June 19, Optimism announced on social media that the Alt-DA mode is now available in the OP Stack beta. The Alt-DA mode is built upon core contributions from the Ethereum application development company Lattice. Inspired by Plasma, Lattice launched the first chain using the initial version of the Alt-DA mode, named Redstone, last year. This mode allows OP Stack chains to submit transaction batches to a centralized DA layer. Now, any DA layer can build its own DA server to integrate with the OP Stack. Currently, three decentralized DA layers have been launched: Celestia, EigenDA, and Avail.

The day before, the Layer 2 network Kroma announced its integration into Optimism's Superchain. By joining this chain, Kroma aims to expand the adoption of game-based DApps, enabling developers to build and deploy applications more efficiently across different layers. To further grow the Kroma ecosystem, Kroma also introduced a foundation grant program to promote the development of game DApps on Kroma and offer native account abstraction, providing users with a seamless gaming experience.

(Source: Twitter@Optimism)

[BNB Chain] BEP 336: Revolutionizing BNB Smart Chain with Blob Transactions. On June 18, BNB Chain announced the upcoming launch of BEP-336, inspired by Ethereum's EIP-4844. This proposal aims to optimize data storage and processing on the blockchain, significantly reducing transaction costs by up to 90%. BEP-336 will be officially introduced through the Haber hard fork, scheduled for June 20, 2024. BEP-336 introduces "Blob-Carrying Transactions" (BlobTx), a concept designed to streamline the transaction validation process on the network. A Blob is a temporary and cost-effective memory segment capable of capturing large data chunks, with each chunk being up to 128 KB. Instead of validating each transaction within a block individually, the network only needs to validate the data within the attached Blob.

The following day, on June 19, BNB Chain announced the launch of TVL Incentive Plan #3. This plan aims to enhance the locking of BNB/liquid staking BNB (lstBNB) and to increase TVL in the ecosystem through competitive challenges with generous rewards.

(Source: BNB Chain)

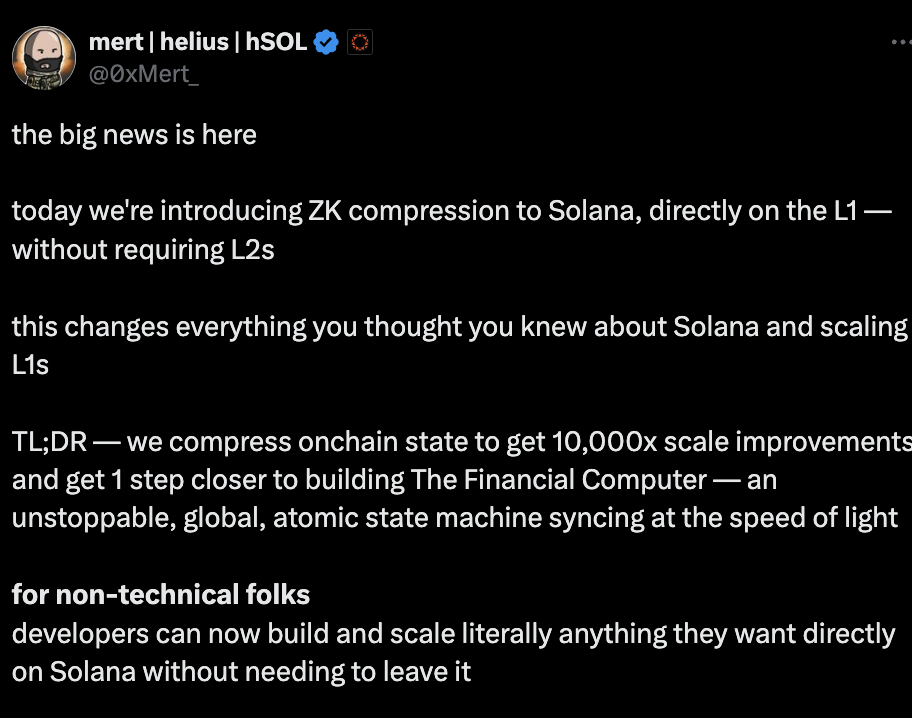

[Solana] Helius CEO: Introducing ZK Compression to Solana to Greatly Enhance Network Scalability. On June 23, Mert Mumtaz, CEO of Solana ecosystem development platform Helius, announced on the X platform that they are introducing ZK compression to Solana. This ZK compression will be implemented directly on L1 without the need for L2. Mumtaz stated, "We compress on-chain state to get 10,000x scale improvements and get one step closer to building The Financial Computer — an unstoppable, global, atomic state machine syncing at the speed of light."

(Source: Twitter@0xMert_)

[Polygon] Polygon Labs Completes Spinout of ID Solution as 'Privado'. Polygon Labs, primary developer behind Ethereum scaling project Polygon, has completed its spinout of its ID solution as "Privado ID," according to a press release. The "protocol-agnostic design, from the team behind the Iden3 Protocol and Polygon ID, is posed for expansion beyond the Polygon networks.... Privado ID is actively establishing strategic partnerships with onchain and institutional organizations alike. These include notable proof-of-concepts (PoC) with several multinational banking and financial service companies, aimed at establishing the technical groundwork for interoperable and compliant identity frameworks.... The PoCs also explore leveraging Privado ID’s verifiable credentials (VCs) as the access control point for permissioned financial transactions." (MATIC)

(Source: Twitter@PrivadoID)

[Ankr] Ankr Launches Electroneum RPC for EVM-Compatible L1 Blockchain. Web3 infrastructure provider Ankr has launched Electroneum RPC, an EVM-compatible L1 blockchain designed to enhance speed, security, and energy efficiency. Developers can access Ankr's public and premium Electroneum RPC to make requests and receive node information returns. Currently, Ankr offers RPC services for 57 blockchains. Additionally, Electroneum will host a hackathon in Q3 2024 to encourage developers to build new dApps and utilities on the Electroneum L1 chain.

(Source: Ankr)

4 Key Fundraising Data

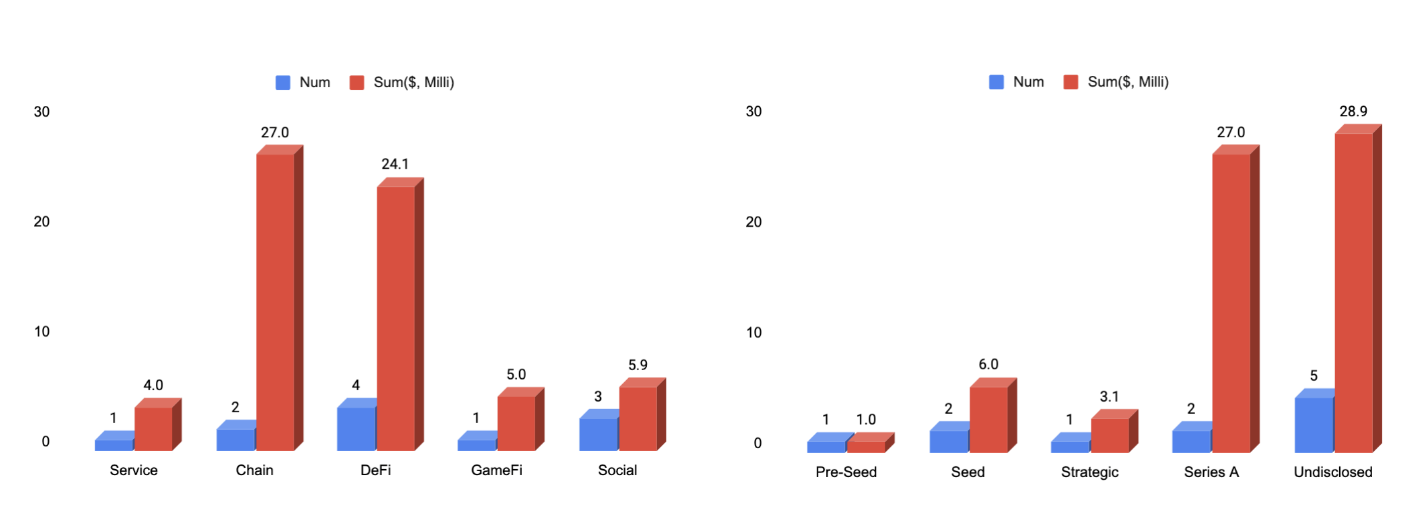

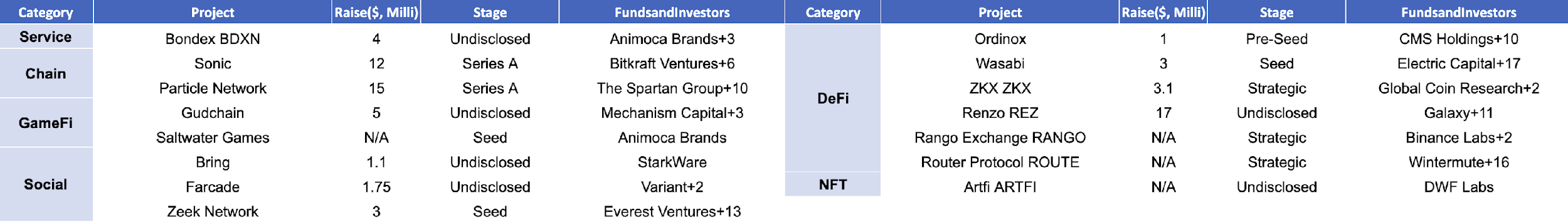

Last week witnessed a total of 15 financing events, raising a substantial amount of over $66 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The DeFi (Dentralized Finance) sector kept leading with the highest number of financing events, totaling 4. The Chain sector recorded the highest total funding amount, raising a total of $27 million, accounting for 41% of the overall financing. The largest financing event was led by Particle Network, successfully raising $15 million. Particle Network is a Web3 infrastructure project, featuring key offerings such as zkWaaS (Zero-Knowledge Proof Wallet as a Service) and the Intent Fusion Protocol. With a focus on developing an Intent-Centric Modular Access Layer for Web3, Particle Network aims to revolutionize the industry by shifting from engineer-friendly finance to consumer-friendly markets. More detailed information is as below.

* 4 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

Particle Network, a modular blockchain developer focused on chain abstraction technology, has completed a $15 million Series A funding round, co-led by Spartan Group and Gumi Cryptos Capital. Other participants include SevenX Ventures, Morningstar Ventures, Flow Traders, and HashKey Capital.

This Series A round brings Particle's total funding to $25 million. Currently, Particle Network is in the first phase of its testnet, which reportedly has registered around 1.3 million universal accounts and processed over 114 million transactions.

The second phase of Particle Network's testnet is expected to launch this week, with the mainnet scheduled for launch in the third quarter of this year. The Particle token (PARTI) will also be launched simultaneously with the mainnet.

• Official Link: https://particle.network/

2. [Chain] Sonic has completed a $12 million Series A funding round led by Bitkraft.

Sonic, a Solana-atomic SVM Layer 2, has announced the completion of a $12 million Series A funding round led by Bitkraft. The round saw participation from Galaxy Interactive, Big Brain Holdings, Matt Sorg (from the Solana founding team), and Nom (Bonk), among other institutions and individuals. This round of funding will be used to drive Sonic's product upgrades and ecosystem expansion. As the first SVM Layer 2 to achieve atomic interoperability with Solana, Sonic enables rapid synchronization between its Layer 2 network and the Solana mainnet state. Developers can share mainnet programs, state, and data without needing to redeploy contracts. Additionally, Sonic has integrated infrastructure tailored for Solana game development and deployment, including sandbox environments, customizable game development modules, and expandable data types. Combined with the Solana Virtual Machine (SVM)'s parallel execution model and the localized transaction fee market, Sonic provides faster transaction speeds and lower, more stable transaction fees for on-chain gamers, enhancing the overall gaming experience.

• Official Link: https://www.sonic.game/

3. [DeFi] Renzo has completed a $17 million financing round led by Brevan Howard Digital and Galaxy.

Renzo, a liquidity re-staking protocol, has announced the completion of a $17 million financing round. The financing consisted of two rounds, with Galaxy Ventures leading the first round and Nova Fund - BH Digital, based in Abu Dhabi, leading the second round. Previously, Renzo had secured $3.2 million in investments from Maven11, Figment Capital, and Binance Labs. The new funds will be used to expand the project's re-staking services, including increasing support for ERC-20 tokens.

• Official Link: https://www.renzoprotocol.com/

4. [Service] Crypto-fueled LinkedIn rival Bondex says it's raised over $10 million.

Branding itself as a would-be web3 rival to LinkedIn, Bondex announced it has raised more than $10 million. The company said that the capital comes from "over $4 million in funding led by Animoca Brands, Morningstar, Dext Force Ventures, iAngels, and more" in addition to over $6.5 million from a "community sale on CoinList in March 2024," according to a statement. Bondex aims to be a gamified version of the professional social networking LinkedIn, a platform best known for providing a digital space where job candidates, recruiters and companies connect. The Bondex platform is "powered" by its BDXN token, the company said.

"The app provides referral bounties to users on the platform, allowing them to act as extended recruitment arms to hiring companies," the company said in a statement. "Referrers on the Bondex platform receive U.S. dollar or token-gated referral bounties of up to $10,000 for successful hires by recruiters."

• Official Link: https://bondex.app/

See you next week! 🙌