*All on-chain data is dated as of 12:00 a.m. EST on Sunday, October 8th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Oct.1–7).

Author: LBank Labs Research team — Hanze, Dannie

Keywords: #ETF #ZK #layer2

1 Macro Market Overview

U.S. Stocks Rally After Investors Digest Jobs Report. According to WSJ, stocks rallied to end the week on a high note after investors warmed to an unexpectedly robust U.S. jobs report. On Friday, the Labor Department said U.S. employers added 336,000 jobs in September, the highest tally since January. The news initially rattled markets, briefly sending bond yields to their highest level in 16 years and pushing major U.S. stock indexes down in early trading. But Treasury yields came off their highs and stocks rallied after many analysts and portfolio managers concluded that the report continued a recent trend of softening wage growth. That is important because economic data has often come in stronger than Wall Street expected in recent months, leading investors to rethink whether the Federal Reserve is done lifting interest rates and how long it will keep them at a restrictive level.

Earlier last week, stocks were down in Thursday morning trading as data revealed that weekly initial jobless claims had inched up to 207,000, falling below the economists’ forecast of 210,000. An intensifying bond selloff sparked new losses on Wall Street on Tuesday, wiping out what was left of the Dow Jones Industrial Average’s gain for the year and pushing the yields on U.S. Treasurys to fresh multiyear highs. Furthermore, employment data Tuesday showed job openings increased to 9.6 million in August, from 8.9 million in July, a sign that the labor market remains resilient in the face of the Federal Reserve’s efforts to cool the economy and ease inflation with higher interest rates.

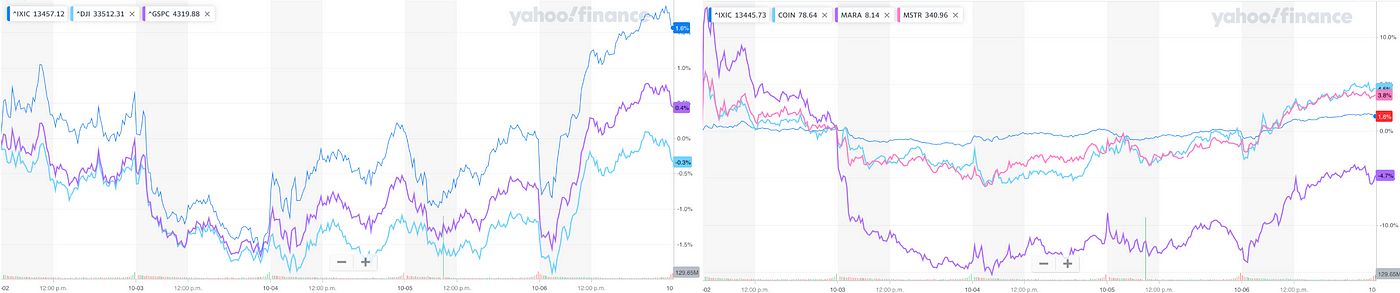

In general, the three major indices experienced slight gains last week after a period of continued volatility. The Dow Jones index fell by 0.3%, while the tech-heavy NASDAQ Composite index and the S&P 500 rose by 1.6% and 0.4%, respectively. Web3-related stocks, on the other hand, performed relatively well. MARA saw a 4.7% decline last week, but both COIN and MSTR recorded gains, with increases of 4.5% and 3.8%, respectively.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

According to TradingView data, last Friday, the U.S. Dollar Index (DXY) closed the day at 106.101 remaining largely unchanged compared to the previous week. This marked the end of its 12-week streak of gains. However, DXY traded as high as 107.35 on Tuesday and the strong performance of the U.S. dollar continues, exerting pressure on the stock market.

DXY (Source: TradingView)

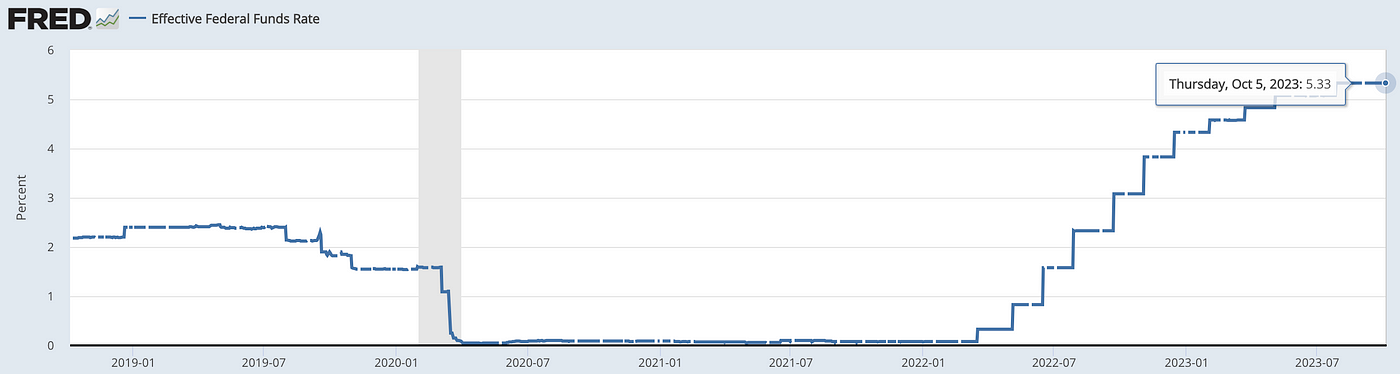

On October 3rd, Cleveland Fed President Loretta J. Mester delivered a speech stating that, despite progress, inflation rates remain too high, and the risks to inflation forecasts still lean towards the upside. However, medium-term inflation expectations remain reasonably stable within the Federal Reserve’s 2% inflation target range. She expressed doubts that there may be a need for another interest rate hike later this year, followed by keeping it in place for a while. There is significant uncertainty in the outlook, particularly regarding whether the favorable progress in inflation over the past three months can be sustained and whether labor market conditions will remain healthy as the pace of growth slows.

EFFR (Source: Federal Reserve Bank of New York, CME Group’s FedWatch Tool)

Last week, the yield on the 10-year Treasury note (US10Y) surpassed 4.8% for the first time since August 2007, closing at 4.805 on Friday. Notably, the US10Y briefly reached a peak of 4.88% last Wednesday. The long-term high yields on government bonds have had a significant impact on the stock market.

US10Y (Source: TradingView)

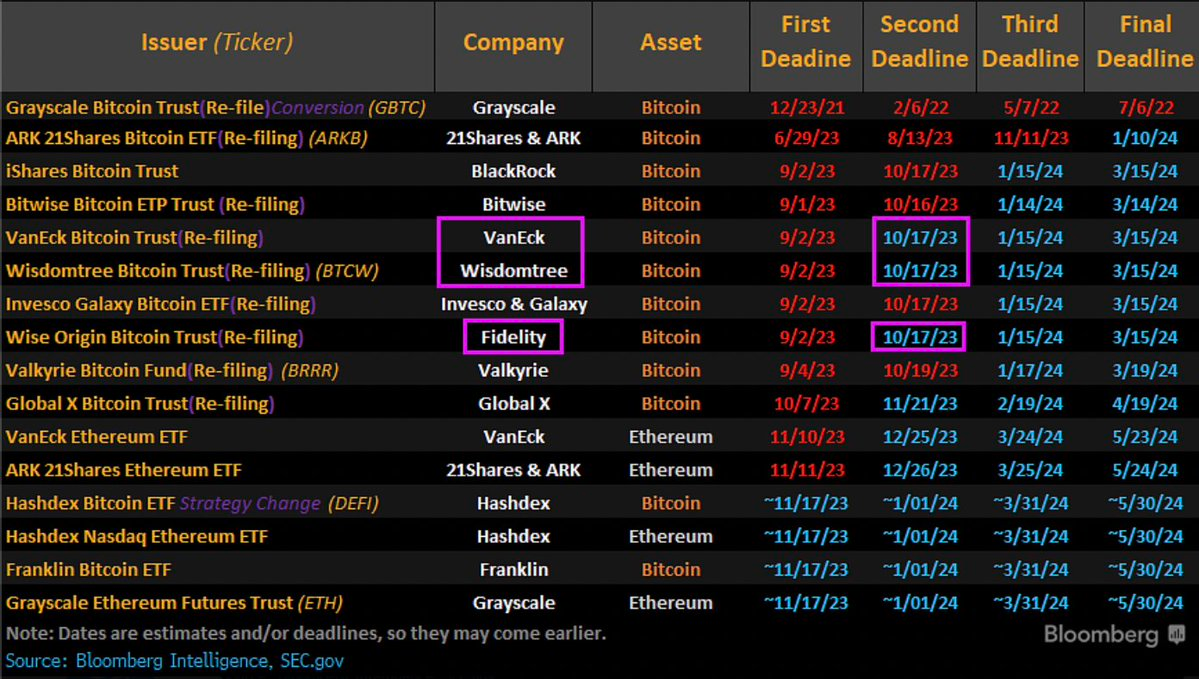

SEC likely to approve all spot bitcoin ETFs at once, says former BlackRock executive. On October 6th, former BlackRock executive Martin Bednall, speaking at the CCData Digital Asset Summit, suggested that the SEC might approve all pending applications for physically-backed Bitcoin ETFs simultaneously. Steven Schoenfeld, CEO of MarketVector Indexes under VanEck, also expressed agreement and suggested that approval could happen within the next 3 to 6 months. This anticipation stems from the SEC’s recent approach of seeking public input rather than outright rejecting ETF applications. Schoenfeld added that the SEC’s recent loss in the Grayscale case could imply that they may have to allow Grayscale’s Bitcoin Trust to convert into a physically-backed Bitcoin ETF.

Furthermore, regarding the performance of Ethereum Futures ETFs that launched last week, a senior ETF analyst at Bloomberg described the volume as “Pretty meh” for the Ether Futures ETFs as a group, totaling a little under $2 million. This level of volume is considered normal for a new ETF launch, but in comparison to $BITO (which achieved $200 million in the first 15 minutes of trading), it is relatively low. There appears to be a competitive race between VanEck and ProShares in the single Ethereum lane.

(Source: Twitter@EricBalchunas, Bloomberg, SEC.gov)

2 Crypto Market Pulse

Market Data

Last week, the cryptocurrency market experienced volatility but continued to rise. Bitwise’s Ether Futures ETFs were launched on Monday, along with seven other Ether ETFs from companies such as Valkyrie, VanEck, ProShares, and VolShares. Ether briefly reached a weekly high of $1,736 on Monday before dropping below the $1,700 mark on the same day. Bitcoin also rose to a nearly five-week high of $28,434 on Monday, up 4.1%, before falling to $27,500 on Tuesday. On Friday, concerns about interest rates remaining high for an extended period intensified after the release of the U.S. jobs report, causing Bitcoin’s price to drop by 1.3% within an hour. As of October 8th, at 12:00 AM, Bitcoin was priced at $28,000, up 3.5% for the week. Ethereum, on the other hand, dropped to $1,636 per unit, a decline of 2.3%. The total market capitalization of the cryptocurrency market increased by 2% to reach $1.1 trillion. Furthermore, Bitcoin’s market share in the overall market stands at 50%, totaling $548 billion, while Ethereum’s market share has dropped to 18%, currently at $197 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

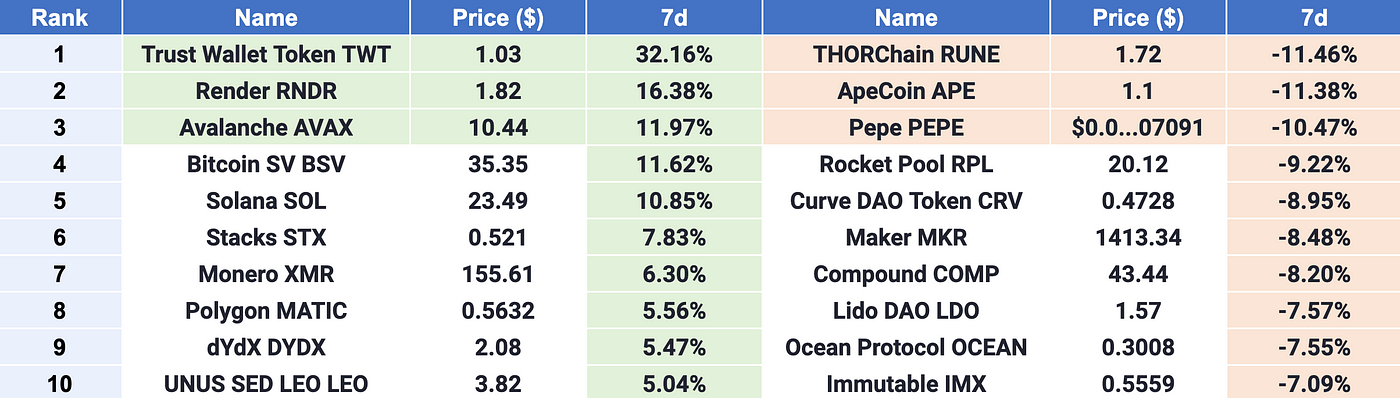

$TWT, $RNDR, and $AVAX emerged as Top 3 gainers, while $RUNE, $APE, and $PEPE were Top 3 losers. Last week, $TWT, the utility and governance token native to Trust Wallet, experienced the highest price gain among tokens. This surge coincided with the team’s recent announcement of updates coming to the X platform. Additionally, Trust Wallet’s trading volume has surged recently, with a 1429% increase in trading volume within 24 hours. $RNDR, the native token of Render, an Ethereum-based GPU rendering network, ranked as the second highest gainer of the week as other CryptoAI tokens lost traction. This increase in price may be driven by SocialFi hype, which could potentially push RNDR prices to new highs in the coming weeks. The rise in $AVAX’s price may be attributed to Avalanche’s recent release of updates to its software development kit, “Hyper SDK,” which enables users to create blockchains capable of processing 143 thousand TPS. This significantly surpasses Solana’s claim of 50 thousand TPS and far exceeds Ethereum’s estimated 200–300 TPS.

For the top losers, the reasons for the sell-offs vary: The recent decline in $RUNE’s value has been influenced by security concerns related to hacks targeting the DEX within its ecosystem. Security issues have been the primary driving factor behind the sell-off. $APE appears to have been impacted by the overall sluggishness in the NFT sector over an extended period, with bearish sentiment putting pressure on the token and leading to sell-offs. As a Meme Coin, the recent decline in $PEPE’s value is primarily attributed to overbought conditions leading to a corrective pullback.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

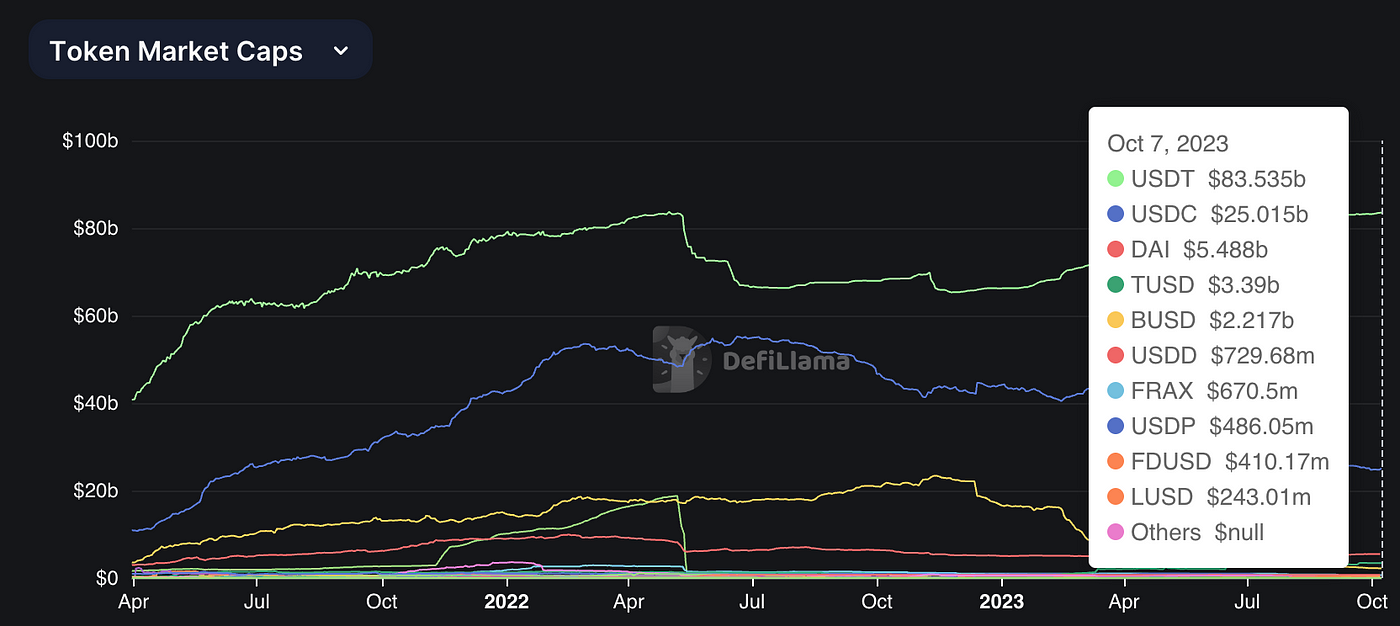

Last week, the total supply of stablecoins reached $124.4 billion, marking a 0.35% increase. In the market, $USDT had a supply of $83.5 billion, constituting 67.2% of the total market, slightly up from last week’s 66.8%. $TUSD and $BUSD both saw a decrease in supply by 0.8% and 2.0%, respectively. Meanwhile, the supply of $DAI and $USDC both increased, with a growth of 0.1% and 1.0%, respectively.

Stablecoins Market Cap (Data: DefiLlama)

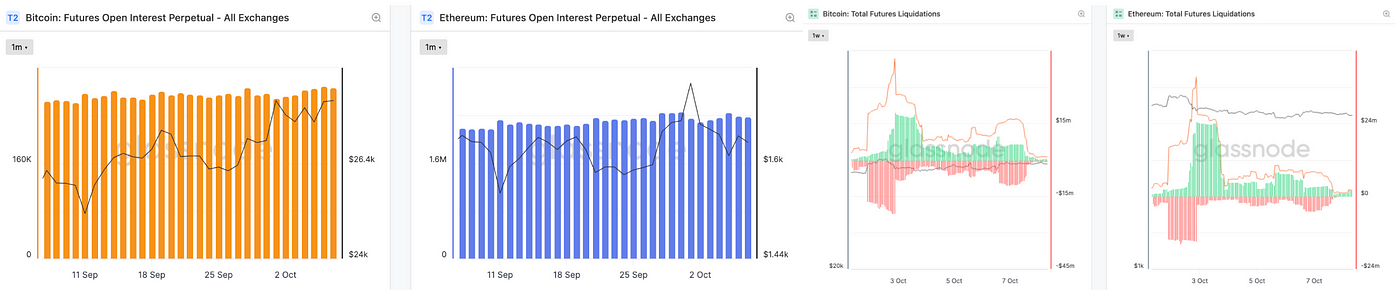

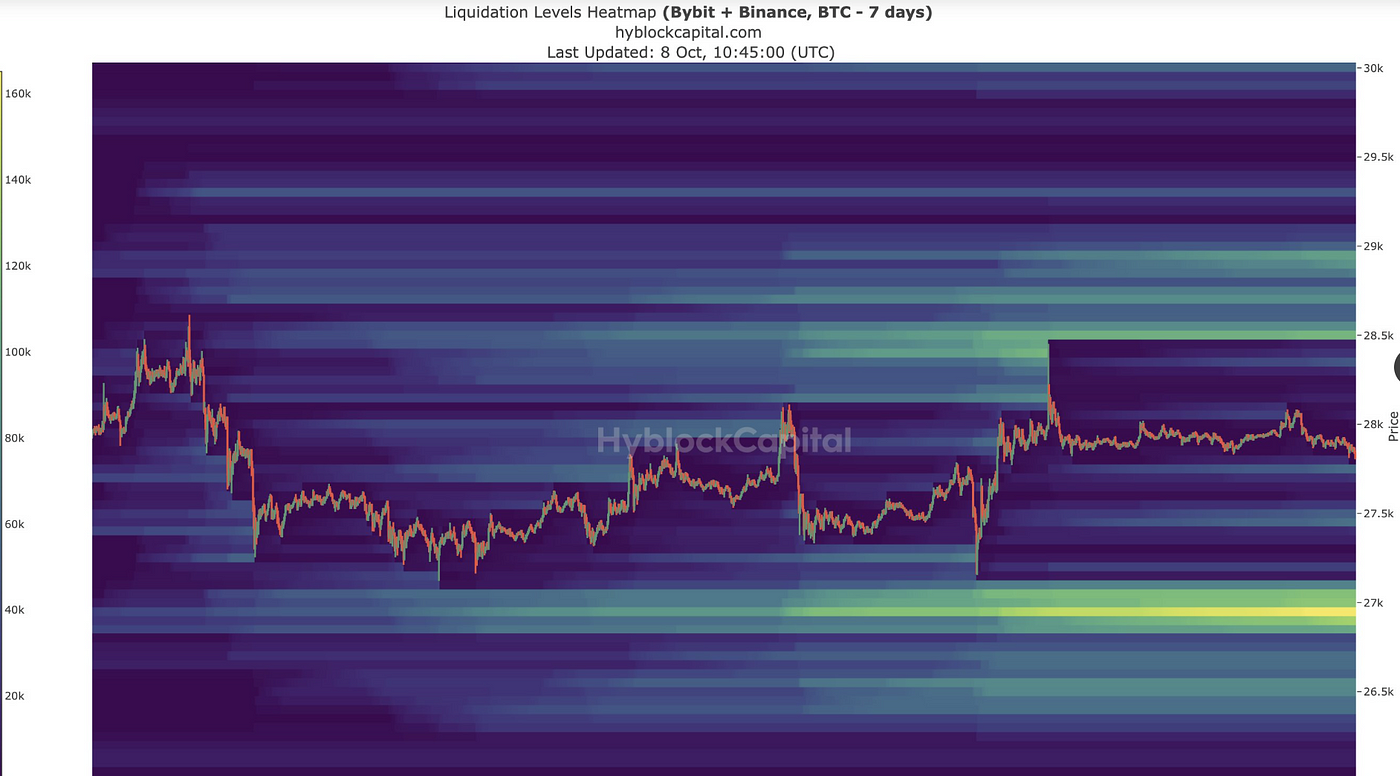

In the derivatives market, the total open interest for Bitcoin futures contracts remained relatively stable last week, while Ethereum saw a significant decrease. This suggests that new inflows of capital may still be lacking. Market activity peaked around October 5th, aligning with the upward trend in Bitcoin and Ethereum prices during the same period. Liquidation results indicated that a significant number of both long and short positions were liquidated at the beginning of last week, reflecting the recent volatility and uncertainty in the market.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Future Liquidations (Data: Glassnode)

In the DeFi market, the TVL remained relatively stable last week, currently standing at $38.5 billion. The seven-day trading volume for DEXs reached $12.5 billion, marking a 23% increase compared to the previous week. Furthermore, the market share gap between DEXs and CEXs continued to slightly widen, now at 16%, reflecting further expansion of DeFi’s share of trading activity. Moreover, among the top 10 blockchain platforms in TVL rankings, fewer than half of them experienced growth in TVL over the past seven days. Avalanche saw the largest increase at 4.25%, while Optimism experienced the largest decline with a 3.16% drop.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

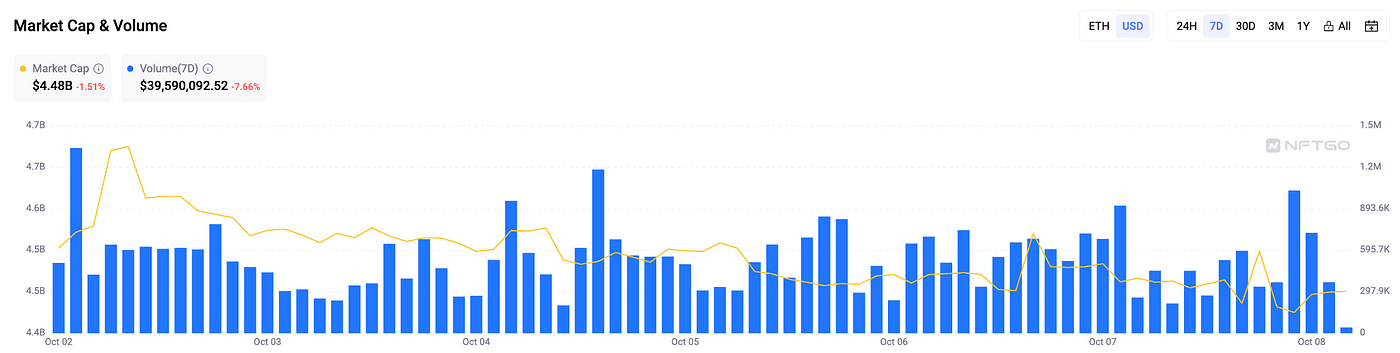

Last week, the NFT market continued to experience a slight decline. The total market capitalization decreased by 2.1%, reaching $4.4 billion, while the seven-day trading volume also dropped by 7.66%. Blue-chip NFT collections like Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) continued to rise, with increases of 6.13% and 2.13%, respectively. However, the overall NFT market remains subdued.

Market Cap & Volume, 7D (Data: NFTGo)

LBank Lab’s Recap

Heading into the second week of October, we anticipate an increase in market volatility. Contrary to historical trends, the first week did not align with the typical “Uptober” pattern observed in Bitcoin’s price behavior during October. Traders had anticipated a bullish trend, but global economic and political uncertainties have cast a shadow over the market. Key factors contributing to this uncertainty include the ongoing rise in the US 10-year treasury yield and geopolitical tensions in Israel.

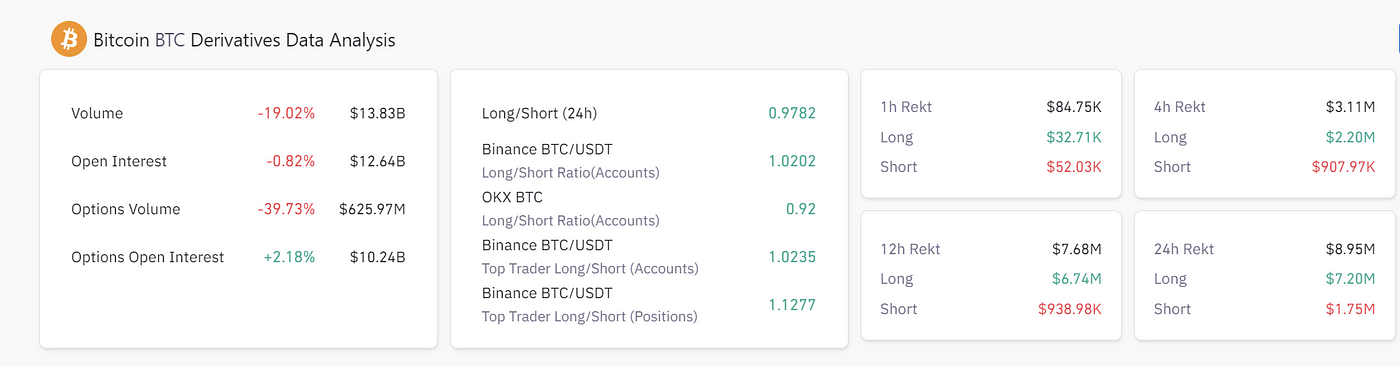

- Spot trading activity remains subdued, with both institutional and retail traders favoring long positions in Bitcoin futures. This positioning suggests that there could be further downside potential if the market experiences a downturn, providing market makers with opportunities to acquire Bitcoin at lower prices.

- Tokens like TRB, LEVER, and TOMO, which have been targeted by institutional investors at the expense of retail users, are witnessing reduced trading activity. Analysis of their charts indicates that significant capital has already exited these markets.

- A closer look at the 7-day liquidation map reveals a higher number of liquidations for long positions in the $27,000 range. This data reinforces the notion that the market may experience further declines in the near future.

- Additionally, there has been no significant inflow of stablecoins into exchanges, indicating a lack of fresh capital entering the market.

The upcoming week presents the possibility of continued volatility, albeit with uncertainty about its magnitude. This uncertainty stems from the release of major economic data in the latter half of the week, which could influence the Federal Reserve’s decision on interest rate adjustments. Market participants will closely monitor these developments as they shape the market’s direction in the coming days.

- BTC price optimistic: $2800 — $29500

- BTC price neutral: $26500-$28000

- BTC price pessimistic: $24000 — $26500

3 Major Project News

[Ethereum] Ethereum All Core Developers Consensus Call #119 Writeup. According to Christine Kim’s summary of the 119th Ethereum Consensus Layer Core Developers Meeting (ACDC), the meeting primarily discussed the following: 1) Progress of Devnet-9 (Current network participation rate approaching 90%, testing of MEV-related tools, updates to execution layer (EL) block generators through deliberate “bad” block data generation for validator resilience testing). 2) Discussion on the launch timing of Devnet-10 (If known issues are fixed, it could potentially launch next week. This is likely to be the final developer testnet, with subsequent phases moving into the public testnet stage. The main purpose is to test EIP-7514, which sets the Max Epoch Churn Limit to 8 to slow down the growth of ETH staking rate, allowing more time to design a better validator rewards scheme). 3)Discussion on the timeline for Dencun testing (In the previous meeting, it was agreed to test Dencun on Goerli before Holesky, and several developers also support releasing Dencun on the public testnet before the Ethereum developer conference Devconnect, which is scheduled for mid-November. Currently, developers are uncertain if this timeline can be met).

(Source: galaxy.com)

[Layer2] The OP Stack’s Fault Proof System is live on OP Goerli. The OP Labs team has announced the deployment of the first fraud-proof system (fault proofs) on the Optimism Goerli testnet, which includes three core components: Fraud Proof Prover (FPP), Fault-Resistant Virtual Machine (FPVM), and the Dispute Game. Its modular design lays the foundation for future enhancements, including multi-proof systems that incorporate ZK proofs and further stages of decentralization technology. It also provides developers with the opportunity to build additional fraud-proof components to ensure system security.

(Source: Twitter@OPLabsPBC)

[Layer2] Immutable plans to launch the zkEVM mainnet between December of this year and January of the next year. Immutable has officially released its mainnet launch roadmap, with plans to upgrade the Immutable zkEVM over the coming months in preparation for the mainnet release. In November 2023, there is a plan to rebuild the Immutable zkEVM testnet, upgrading its first EVM client from Polygon Edge to Geth to ensure that Immutable zkEVM closely aligns with Ethereum and remains fully compatible with the entire Ethereum tooling ecosystem. From December to January of the following year, the zkEVM mainnet is scheduled to go live, with developers being invited in batches before opening to the public.

In 2024, Immutable will provide a dedicated application chain with a technology stack and features similar to Immutable zkEVM but with a unique level of customization. A key future milestone for Immutable will be the introduction of zk-prover, marking the moment when Immutable zkEVM truly becomes a “zk” EVM, providing a trustless Ethereum-to-Immutable zkEVM cross-chain bridge.

(Source: Twitter@Immutable)

[Bitcoin] ZeroSync implements first Stark-based ZK client for Bitcoin. Blockchain developer ZeroSync has successfully implemented the first client system based on Stark proofs for the Bitcoin network. This project is built using Starkware’s Cairo programming language and will enable Bitcoin users to verify the network’s state without the need to download the entire blockchain or trust third parties using Starks (a type of ZK proof developed by StarkWare).

ZeroSync has achieved a significant milestone by releasing validators for the Bitcoin network’s header chain as part of its network ZK client. ZeroSync’s next steps include providing validation for the entire blockchain to nodes without requiring them to download and process data. The ultimate goal is to establish a zero-knowledge proof validator on the Bitcoin mainnet.

(Source: Twitter@ZeroSync_)

[Solana] Solana’s latest update brings native support for private blockchain transactions. Solana’s v1.16 update has introduced “Confidential Transfers,” enhancing user privacy through encrypted SPL token transactions. According to a blog post from Helius Labs, a Solana infrastructure provider, and after ten months of development and an audit by blockchain security company Halborn, the v1.16 update for Solana Layer 1 Proof of Stake blockchain has recently garnered adoption from over half of the validators. The v1.16 version has been running on the test network since June. One of the most anticipated updates is the introduction of “Confidential Transfers,” a new token program introduced by Token2022, aimed at enhancing Solana’s existing token functionality. This allows people to conduct blockchain transactions without revealing critical transaction details, such as transaction amounts.

(Source: helius.dev)

[Sui] Sui Reclaims 117 Million SUI for Ecosystem and Community Development. Sui Foundation announced that it will take 117 million $SUI from external market makers and redirect them into a variety of channels supporting the growth of the Sui Network. As these tokens had been released previously, their redistribution will not affect the circulating supply of $SUI. These amounts are in addition to 25 million $SUI earmarked for awarding the winners of its liquid staking hackathon who were announced this week on Tuesday, October 3rd. These amounts are in addition to 25 million SUI earmarked for awarding the winners of its liquid staking hackathon who were announced this week on Tuesday, October 3rd.

In general, the newly repatriated resources will be aimed towards supporting Sui’s burgeoning ecosystem, including offering grants to developers to build the next generation of decentralized applications on Sui, and supporting Sui’s state-of-the-art DeepBook CLOB, automated market makers and liquid staking and lending protocols on the network.

(Source: Twitter@SuiNetwork)

4 Key Fundraising Data

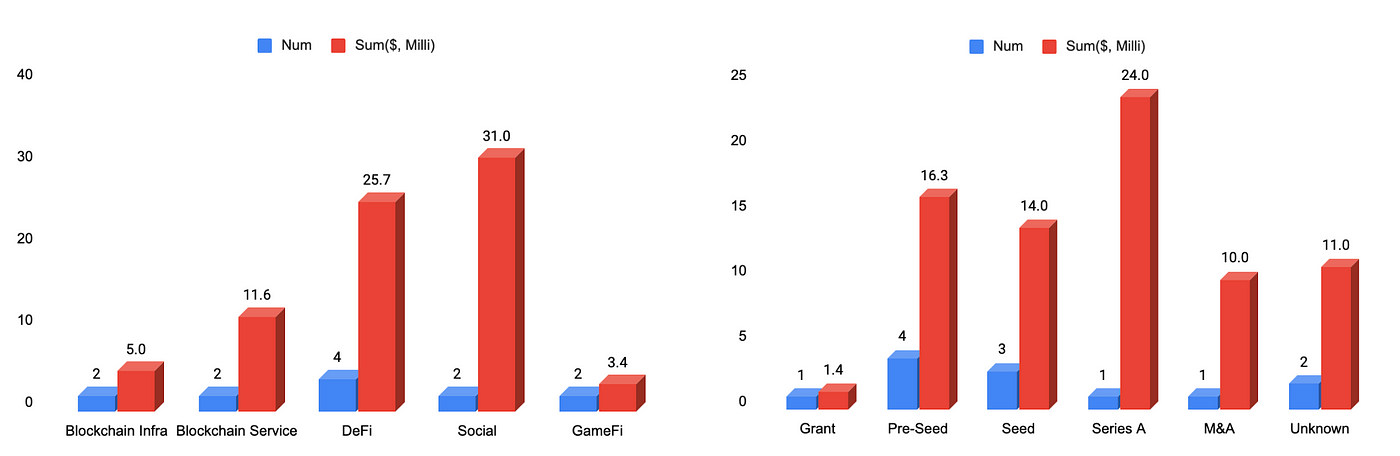

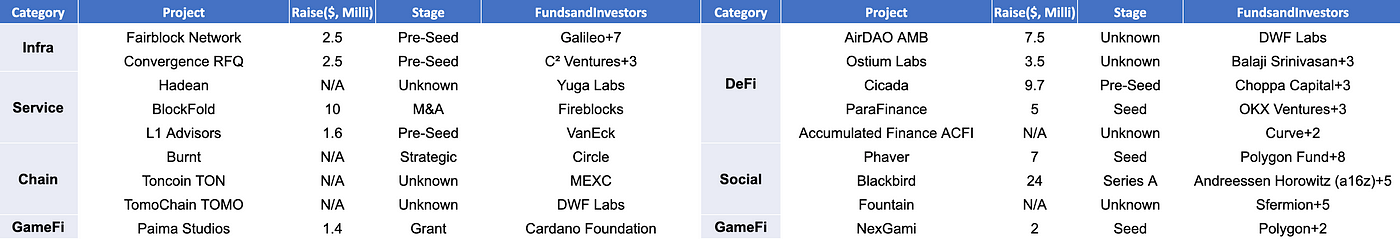

Last week witnessed a total of 18 financing events, raising a substantial amount of over $76.7 million*. Financing activity remained relatively stable compared to the previous week. The Social and DeFi sectors garnered the most attention, accounting for 33.3% of total fundraising activities, with a total financing amount of $56.7M, representing 73.9% of the total fundraising amount. The largest fundraising activity last week occurred in the Social sector, led by the Blackbird project, which raised $24M. Blackbird Labs is a loyalty, memberships, and payments platform. Further details are below.

*6 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events (Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1.[Social] Resy co-founder Ben Leventhal raises $11 million for new web3 hospitality platform.

Serial entrepreneur Ben Leventhal has raised $11 million in a seed round for his new web3 hospitality platform Blackbird. The round for Blackbird is co-led by Union Square Ventures, Shine Capital and Multicoin Capital, Leventhal said. Other backers include Variant, Circle Ventures and IAC, according to a statement from the company. Leventhal previously co-founded two startups that have shaped the restaurant industry: the food publication Eater and restaurant discovery platform Resy.

Blackbird is a web3 platform purpose-built for the hospitality industry with a focus on creating a direct connection between the restaurant and their guests through loyalty and membership services.

- Official Link: https://www.blackbird.xyz/

2. [Service] Custody tech firm Fireblocks beefs up tokenisation abilities with $13.6m acquisition.

Custody technology provider Fireblocks, whose regional headquarters is in Singapore, has acquired a Melbourne-based smart contract development firm for US$10 million (S$13.6 million) as it moves to build up its offerings. The purchase of BlockFold, completed on Sept 1, will beef up Fireblocks’ tokenisation capabilities to provide services such as advisory services, token customisation, orchestration, and distribution through its network.

BlockFold has helped entities — including the Bank for International Settlements, Singapore’s Ministry of Finance and the Tel Aviv Stock Exchange — with tokenisation of deposits, issuance of stablecoins and central bank digital currencies, as well as tokenisation of real-world assets such as carbon credits, real estate and investment funds.

- Official Link: https://blockfold.com/

3. [DeFi] Cicada Secures $9.7m in Pre-Seed Capital Commitments.

Cicada Partners, a non-custodial credit risk management company bringing greater transparency and accountability to institutional lending over public blockchain infrastructure, announced a $9.7m funding round with equity and debt capital commitments led by Choppa Capital with participation from Bitscale, Bodhi Ventures, Shiliang Tang, and others.

The investment will enable Cicada to seed multiple new non-custodial lending pools and fund research and development on new blockchain-enabled lending use cases.

- Official Link: https://www.cicada.partners/

4. [DeFi] DWFLabs invests $7.5M in AirDAO for ecosystem growth.

DWF Labs has invested $7.5 million in AirDAO to promote greater adoption of the AirDAO ecosystem. This represents a continuation and expansion of the partnership between DWF Labs and AirDAO, following DWF Labs’ previous $2 million investment in September 2022. The latest investment includes a one-year cliff and a 36-month vesting schedule. In connection with the $7.5 million investment, DWF Labs has obtained a loan of 1.5 billion AMB, also with a 3-year term.

The AirDAO Council is keenly aware of areas where improvements can be made in their social media presence. They are committed to allocating a significant budget to enhance their global brand presence. With a substantial operational runway ahead, their aim is to ensure the long-term sustainability of AirDAO and to onboard the next generations of AirDAO users.

- Official Link: https://airdao.io/

See you next week! 🙌

📢 Disclaimer: The weekly crypto market insights are provided for informational purposes only and should not be considered as financial advice. The cryptocurrency market is highly volatile and unpredictable. Prices and trends can change rapidly, and past performance is not indicative of future results. Always conduct thorough your own research and consult with a qualified financial professional before making any investment decisions.