1. Review of hot topics this week:

1.1. The initial value of U.S. real GDP in the fourth quarter increased by 3.3%, higher than expected

On January 26, data released by the U.S. Department of Commerce showed that U.S. real GDP in the fourth quarter increased by 3.3% year-on-year on an annualized basis compared to the initial value. The growth rate was slower than the 4.9% in the previous quarter, but far exceeded market expectations of 2%.

The U.S. economy will grow at an annualized rate of 2.5% throughout 2023, exceeding Wall Street's expectations at the beginning of the year, and will grow at an annualized rate of 1.9% in 2022.

In terms of quarterly inflation data released at the same time, the personal consumption expenditures (PCE) price index rose 2.8% year-on-year, which was slower than the previous value of 3.1%, but exceeded the expected 2.5%; the core PCE price index excluding food and energy annualized Quarter-on-quarter growth was 2%, in line with the previous value and expectations.

1.2. The SEC Chairman’s approval of spot Bitcoin ETF is limited to this non-securities commodity and should not be over-interpreted.

On January 25, U.S. Securities and Exchange Commission Chairman Gary Gensler was asked about his views on the Ethereum ETF in an interview today. He responded: “As I said two weeks ago, everything we do with the spot Bitcoin ETF is limited to This is a non-security commodity and should not be construed as anything other than that."

Gensler said that investors now have better information about Bitcoin ETFs, mentioning: “From that perspective, there is also better disclosure, they are now listed on stock exchanges instead of trading on the over-the-counter market. At the time, There are 10 or 11 lauching at the same time, which brings a level of competition. You're already seeing some competition and investors are benefiting from lower fees."

1.3. FTX affiliate Alameda Research drops lawsuit against Grayscale

FTX sister company Alameda Research dropped its lawsuit against Grayscale Investments after it converted its flagship trust product into an exchange-traded fund (ETF), a new court filing revealed on January 23.

A lawsuit filed in March 2023 claimed that more than $9 billion of investor funds were trapped in Grayscale’s Bitcoin Trust (GBTC) following the collapse of FTX.

According to private data reviewed by CoinDesk and according to two people familiar with the matter, since January 11, FTX’s bankruptcy and liquidation department has sold off 22 million shares of GBTC trust, reducing FTX’s GBTC holdings to zero (valued at nearly $1 billion).

1.4. OKX: The platform will fully compensate users for additional losses caused by abnormal liquidation

On January 24, 6, KX Chinese stated on social media that due to the downward trend of the overall market on January 23, the price of OKB fluctuated simultaneously. After the currency price touched 48.36USDT at 17:07:26 (HKT), it triggered multiple major The liquidation of leverage positions, coupled with the impact of market conditions, caused the currency price to fall, which further triggered the liquidation of pledged lending, margin trading and cross-currency transactions, ultimately causing the price to fall to 25.1USDT in a short period of time. The currency price has now returned to normal.

Regarding the losses and impacts caused by the above problems, OKX deeply apologizes and has formulated the following solutions:

1. The platform will fully compensate users for additional losses caused by abnormal liquidation, including pledge lending, margin trading, and cross-currency transactions. The specific compensation plan will be announced within 72 hours.

2. OKX will further optimize spot leverage gradient levels, pledged lending risk control rules, liquidation mechanisms, etc. to avoid similar problems from happening again.

1.5. SEC confirmed that the Twitter account was attacked by SIM card swapping and has restarted multi-factor authentication.

On January 22, the U.S. Securities and Exchange Commission (SEC) posted a fake tweet on Twitter on the eve of the approval of a Bitcoin spot ETF. An SEC spokesperson explained the incident that day.

A spokesman for the U.S. SEC pointed out: The SEC’s Twitter account’s multi-factor authentication was disabled in July 2023 because there was a problem accessing the Twitter account at that time, and it was therefore disabled until the false post appeared. The account was compromised on January 9 before SEC staff reactivated it.

The spokesperson also mentioned that all SEC social platform accounts have enabled multi-factor authentication mechanisms.

1.6. There is “internal resistance” to the U.S. SEC’s forcible rejection of the idea of an Ethereum spot ETF.

According to Fox Business reporter Eleanor Terrett, ETF issuers, investment management companies and sources close to the SEC have many different views on the potential Ethereum spot ETF approval timetable. One source said the SEC's position at this moment is a "hard no" but that there is currently "some internal resistance" to the idea.

Additionally, the CFTC’s view that ETH is a commodity, coupled with Ripple’s partial court victory over secondary market trading of XRP that is not a security, will give “Gensler an uphill battle.” SEC Commissioner Hester Peirce said that the agency does not want to repeat the same delay mistake with the ETH ETF.

1.7. The U.S. government will sell $130 million in Bitcoin

On January 25, the U.S. government announced that it planned to sell approximately $130 million worth of Bitcoin. The cryptocurrencies were previously seized in the high-profile Silk Road investigation.

The move to sell over 2,930 BTC follows the ruling of the U.S. District Court for the District of Maryland in the case “United States v. Joseph Farace.” The tokens were initially seized from Ryan Farace and Sean Bridges. The decision marks an important step forward in the government's approach to dealing with digital assets implicated in criminal activity.

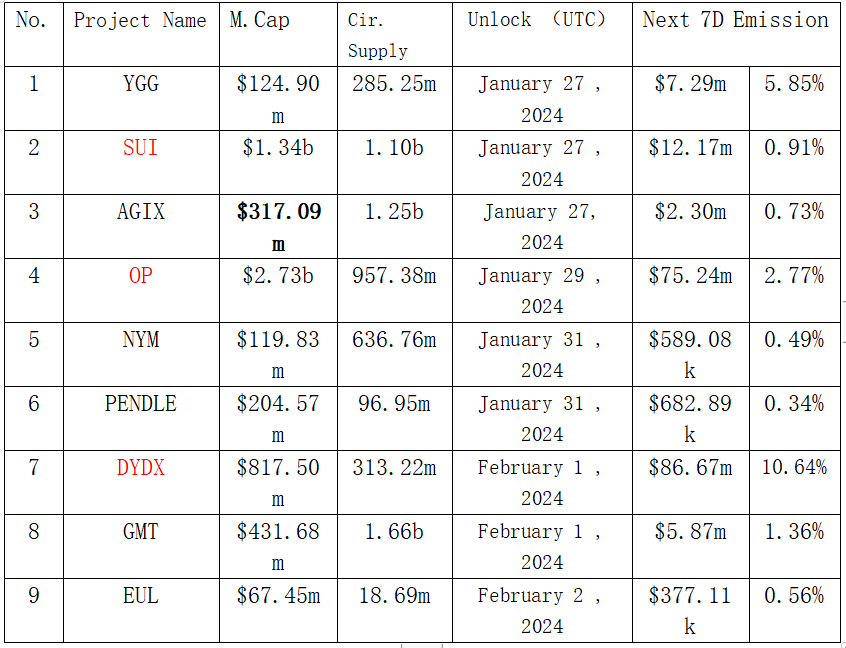

2. Projects to be unlocked next week:

3. Recent key events:

January 29 (Monday)

U.S. Dallas Fed Business Activity Index for January;

January 31 (Wednesday)

Changes in U.S. ADP employment in January (10,000 people);

February 1 (Thursday)

US FOMC interest rate decision;

Federal Reserve Chairman Powell holds a monetary policy press conference;

The number of people filing for unemployment benefits for the first time in the week of January 27 in the United States;

U.S. ISM manufacturing index in January;

Bank of England policy rate;

Eurozone's January core-reconciled CPI initial year-on-year value;

February 2 (Friday)

U.S. unemployment rate in January;

Changes in non-farm employment in the United States in January (10,000 people);