1. Review of hot topics this week:

1.1. The U.S. SEC officially approved spot Bitcoin ETF

On January 9, the former Internet Enforcement Director of the US SEC issued a document stating that the SEC will approve a Bitcoin spot ETF.

On January 10, the U.S. Securities and Exchange Commission (SEC) official Twitter account announced that all 12 Bitcoin ETF spot proposals have been approved. However, just a few minutes later, U.S. SEC Chairman Gary Gensler issued a denial on his Twitter account, saying that the SEC had been hacked and the post about the approval of the Bitcoin spot ETF was fake. The SEC chairman said the regulator has not approved any Bitcoin ETF spot proposals so far.

On the market side, Bitcoin prices rose to nearly $48,000 as the SEC announced approval of a Bitcoin ETF spot, but then dropped by $44,800 when Gary Gensler himself denied the information.

Social networking platform X announced that it has completed the U.S. Securities and Exchange Commission’s (SEC) preliminary investigation into the account theft. During a preliminary investigation, the SEC's account was hacked due to a lack of two-factor authentication. This breach was not due to a compromise of System X; Instead, an unidentified individual took control of the phone numbers associated with the SECGov account through a third party. The reason is that the SEC's account did not have two-factor authentication enabled at the time of the breach.

On January 11 (Asia time), according to the SEC official website, U.S. SEC Chairman Gary Gensler issued a handwritten letter stating the approval statement for Bitcoin spot ETFs, stating that the SEC committee has officially approved the listing and trading of some spot Bitcoin ETPs (including ETFs).

According to official documents from the U.S. Securities and Exchange Commission (SEC), the regulatory agency has officially approved: Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity and 11 Bitcoin spot ETFs including Franklin.

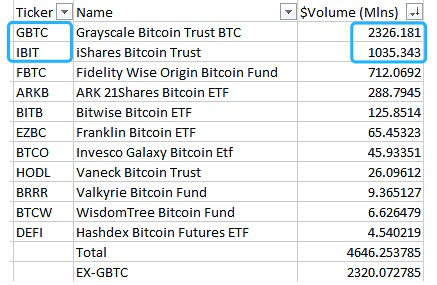

On the same day (US time), 11 Bitcoin spot ETFs officially began trading. Total first-day trading volume now exceeds $4.6 billion, according to the latest data compiled by Bloomberg analyst James Seyffart. Among them, Grayscale’s GBTC ranked first in trading volume, accounting for about half (2.32 billion U.S. dollars), and BlackRock’s IBIT ranked second with 1 billion U.S. dollars, Fidelity’s FBTC ranked third with $710 million in trading volume.

1.2. Coinbase: ETF will provide cryptocurrency to millions of new investors

On January 11, Coinbase published an article stating that U.S. households hold more than $154 trillion in wealth, more than one-third of which (approximately $58 trillion) is managed by financial advisors, banks, and broker-dealers, and most of the capital pools There is still a lack of direct access to investing in spot cryptocurrencies; nearly half of U.S. financial advisors personally own Bitcoin, but only 12% recommend it to clients, mainly due to the lack of ETFs; ETFs will provide crypto to millions of new investors currency and further solidify Bitcoin’s status as a mainstream asset.

1.3. World Bank: The global economy is expected to experience its worst five-year growth in 30 years

On January 9, the World Bank released its latest Global Economic Prospects report stating that the global economy is facing its worst five-year growth in 30 years. In other words, it is weaker than the 2008 global financial crisis, the Asian financial crisis in the late 1990s, and the dot-com bubble in the early 2000s.

The World Bank predicts that global economic growth will slow down for the third consecutive year in 2024, from 2.6% last year to 2.4% this year. Economic growth is expected to pick up slightly next year, rising to 2.7%.

1.4. Binance, Kraken, and KuCoin applications have been removed from the Indian Apple App Store

On January 10, Binance, Kraken, Mexc, Kucoin and five other cryptocurrency exchanges labeled as operating "illegally" in India were removed from Apple's App Store in India.

This comes after the Financial Intelligence Unit, an Indian government agency tasked with scrutinizing financial transactions, issued show-cause notices to all nine companies two weeks ago, claiming they were not complying with India's anti-money laundering rules. The Financial Intelligence Unit has asked India's Ministry of Information Technology to block the websites of all nine services in India.

1.5. Ethereum Core Developer Meeting: The timing of the three testnets is reconfirmed

Ethereum will usher in the Dencun hard fork upgrade in the first quarter of 2024, and Ethereum core developers have drawn up a Dencun hard fork upgrade schedule.

Recently, according to Christine Kim's summary of the 178th Ethereum Execution Layer All-Core Developers Conference Call (ACDE), this meeting mainly discussed: Reconfirmation of the three testnet times (although there was more controversy, it was finally decided Use the original time plan, that is:

Goerli is January 17, 06:32:00 UTC,

Sepolia is January 30, 22:51:12 UTC,

Holesky on February 7, 11:34:24 UTC).

This will be the last time Goerli is included in a test scenario as the network is about to be deprecated. The move is part of the strategy to activate Dencun on the Ethereum network in January 2024, Marking a significant advancement in its technological capabilities.

At the same time, discussions for the next upgrade of Prague/Electra were also confirmed. Talking about many topics, such as whether to focus on a single large upgrade such as Verkle or multiple small upgrades, opponents believe that focusing on Verkle may take too long; the discussion of decoupling the execution layer EL upgrade and the consensus layer CL upgrade; whether Implement EOF, which stands for EVM Object Format, which makes some changes to Ethereum's code execution environment and discusses other EIPs.

1.6. The U.S. SEC will review decisions on five Ethereum spot ETFs before the end of May.

According to news on January 11, the U.S. SEC will conduct a decision review on five Ethereum spot ETFs before the end of May. They will conduct a decision review on the iShares Ethereum Trust and Fidelity Ethereum Fund launched by Balckrock and Fidelity before January 21 and January 25, but can postpone the final decision until August.

In addition, the final decision deadline for three Ethereum spot ETFs that have applied is the end of May 2024. Before that, the US SEC needs to make a final decision on whether to approve or not. They are VanEck Ethereum ETF, Ark 21Shares Ethereum ETF and Hashdex Ethereum ETF respectively, with final deadlines on May 23, May 24 and May 30.

1.7. U.S. inflation exceeded expectations: overall CPI accelerated to 3.4% year-on-year in December, and core CPI did not cool down again month-on-month.

On Thursday, January 11, data released by the U.S. Bureau of Labor Statistics showed that the U.S. CPI rose by 3.4% year-on-year in December, rebounding from 3.1% in November and exceeding expectations of 3.2%. It was the highest increase in three months; The month-on-month growth rate rose to 0.3%, higher than the 0.1% in November and the expected 0.2%, suppressing market expectations for the first interest rate cut in March.

After the CPI was announced, the "swap contract pricing" showed that The market's expected probability of interest rate cuts by the Federal Reserve in March and May has declined, and investors still expect to start cutting interest rates no later than May. The expected total rate cut this year has dropped back to about 140 basis points. After the CPI was announced before the U.S. stock market opened, U.S. Treasury bond prices fell sharply and yields rose during the session. The yield on the benchmark 10-year U.S. Treasury note quickly returned to 4.0%, once rising about 10 basis points from its daily low. The yield on the interest-rate-sensitive two-year U.S. Treasury note also erased the day's decline and turned higher.

Analysis points out that despite the rebound, it is unlikely to shake the Federal Reserve's policy stance, and the general trend of interest rate cuts this year will be difficult to reverse. This report does not really support the Fed's March interest rate cut. Between now and the January 31 policy statement and Powell press conference, There will also be some other data. For now, the CPI is still too high and is not conducive to the Federal Reserve signaling a rate cut in March.

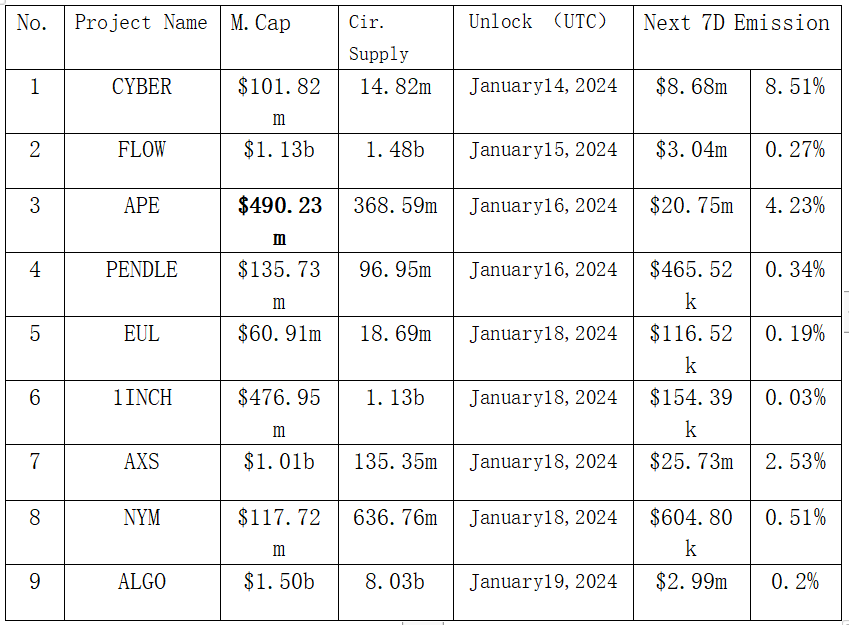

2. Projects to be unlocked next week:

3. Recent key events:

January 15 (Monday)

U.S. financial markets were closed for one day for Martin Luther King Jr. Day;

January 16 (Tuesday)

US New York Fed manufacturing index in January;

January 18 (Thursday)

Number of people applying for unemployment benefits for the first time in the United States in the week of January 13 (10,000 people)

U.S. Philadelphia Fed Manufacturing Index for January

New housing starts in the United States in December (10,000 households);

U.S. new housing starts in December month-on-month;

January 19 (Friday)

Preliminary value of the University of Michigan consumer confidence index in the United States in January;

Annualized total number of existing home sales in the United States in December (10,000 households);

The total number of existing home sales in the United States in December was annualized;