1. Review of hot topics this week:

1.1. Federal Reserve meeting minutes: Officials are worried about cutting interest rates too quickly and worrying about stagnant decline in inflation.

On February 21, the minutes of the Federal Reserve meeting showed that at the Federal Reserve’s monetary policy meeting at the end of last month, Federal Reserve policymakers generally believed that the current policy interest rate may have reached the peak of this week’s interest rate hike cycle, admitting that the risk of inflation continuing to rise was reduced, but They remain vigilant about future interest rate cuts, emphasizing that they are not sure how long they will maintain high interest rates. Most Fed officials also mentioned the risk of cutting interest rates too quickly.

The Federal Reserve continued to maintain high interest rates at its interest rate meeting at the end of January. The decision statement after the meeting deleted language suggesting further interest rate increases in the future, leaving the door open to cutting interest rates, but hinted that it would not act soon. It said the Fed does not expect to cut interest rates until it is more confident that inflation will fall to its target. Federal Reserve Chairman Powell said in a press release after the meeting that the Fed remains open to cutting interest rates, but is in no rush to act and does not believe a rate cut is possible in March. The minutes of this meeting did not release a signal that the Fed intends to cut interest rates soon.

After the minutes were released, reporter Nick Timiraos, known as the "New Federal Reserve News Service," wrote, At last month’s meeting, the concerns most Fed officials signaled were: Premature rate cuts and price pressures become entrenched, interest rates will remain high for a long time. only two officials highlighted the risks of keeping interest rates high for an extended period.

1.2. Ripple CEO: Multiple ETFs around different tokens are inevitable

On February 20, Ripple CEO Brad Garlinghouse discussed XRP ETF rumors and the need for clearer cryptocurrency regulation in an interview with Bloomberg.

Brad Garlinghouse said Ripple’s recent legal victory against the U.S. Securities and Exchange Commission (SEC) was a turning point and highlighted the need for clearer rules for the industry.

In addition, Garlinghouse believes that the emergence of other ETFs also makes sense. Garlinghouse expressed Ripple’s support for the XRP ETF and we would certainly welcome it.

1.3. Circle will terminate support for USDC on the TRON network in stages

On February 20, Circle announced that it would end support for USDC on the TRON blockchain in phases. Effective immediately, Circle will no longer mint USDC on TRON.

As of February 2025, Circle Mint customers can transfer USDC to other blockchains or exchange USDC on TRON for fiat currency directly through Circle. Retail USDC holders and non-Circle customers can use hundreds of available global services, including retail trading platforms, brokers and entry and exit channel providers, to transfer USDC between blockchains or exchange their USDC for fiat currency .

According to news on February 22, stablecoin issuer Tether did not clearly respond whether it would stop supporting the Tron network. Tether stated in a statement that it retains the ability to freeze transactions on various directly supported transport layers to fulfill compliance responsibilities, and the security of each supported transport layer is continuously monitored. Additionally, the Tron network holds over $51.8 billion in USDT, accounting for more than half of the nearly $101 billion in USDT tokens issued across multiple blockchains.

1.4. Cesay, founder of Ordinals: comprehensive introduction to the Runes protocol for the first time

On February 20, Cesay, the founder of the Ordinals and Runes protocols, introduced in detail for the first time the homogeneous token protocol Runes that will be launched on the occasion of the Bitcoin halving in April in the latest episode of hellmoneypod.

Runes is a protocol for fungible tokens issued on the Bitcoin network. In Casey's words, Runes does not issue "junk" coins, it just provides a place to issue "junk" coins. The core of the protocol is based on #UTXO and the design is very simple and clear.

Casey believes that the key to the success of Brc20 is that it pioneered the open mint model, giving everyone the opportunity to participate in the casting process. Casey recognized the success of Brc20 and said that Runes should learn from its advantages while avoiding its technical shortcomings (mainly the problem of garbage UTXO swelling).

1.5. The number of MetaMask monthly active users rebounded and exceeded 30 million, which is close to the highest record in history.

On February 21, crypto wallet app MetaMask said it now has almost the same number of active users as it did at the peak of the last bull market. The number of monthly active users grew 55% in four months, jumping from 19 million in September last year to more than 30 million in January this year.

It is reported that MetaMask's monthly active data reached an all-time high in January 2022, when the number of monthly active users was 31.7 million.

1.6. Binance’s latest Launchpool——Chain Games Pixels

On February 19, Ronin ecological chain game Pixels was launched on Binance. The project has 150,000 daily active users, and Binance’s opening price reached a maximum of $0.598, before falling back to around $0.5.

Pixels is a P2E-focused free-to-play Web3 farming game. It allows players to engage in familiar farming activities such as resource cultivation, food preparation, and goods trading, with the unique opportunity to own and develop individual farmland plots. The game recreates the atmosphere of a classic 16-bit role-playing adventure, allowing players to navigate a pixel art world, interact with each other, farm land, play mini-games and earn token rewards. Additionally, it allows holders of select NFT Profile Picture (PFP) collectibles to use their own avatars in the game. Adds to the fun of the game.

In February 2022, Pixels completed a US$2.4 million seed round of financing led by Animoca Brands and PKO Investments, with participation from OpenSea and others. Recently, Pixels made a strategic move to migrate from Polygon to Sky Mavis’ Ronin network. Pixels’ popularity on the Ronin network has grown dramatically, with over 1.5 million monthly on-chain transactions. This high level of activity is a testament to the game's appeal and its ability to attract a large user base.

As of February 8, 2024, $4.8 million has been raised through 3 rounds of private token sales, in which 14% of the PIXEL token supply has been privately sold at prices of $0.005, $0.009, and $0.012. The total supply of PIXEL is 5,000,000,000, with a post-listing circulating supply of 771,041,667 (approximately 15.42% of the total token supply).

1.7. Coinbase elaborates on three major reasons and recommends that the SEC approve the Grayscale Spot Ethereum ETF.

On February 21, Coinbase responded to the SEC’s request for comment on the conversion of Grayscale Ethereum Trust (ETHE) into a spot ETF. The exchange provided legal and technical reasons for the SEC’s approval in a 27-page comment letter, and economic reasons:

1. ETH is not a security. In fact, before and after the merger, the SEC, CFTC and the market no longer regarded ETH as a security, but as a commodity.

2. ETH’s proof of equity has obviously strong governance capabilities and shows strong characteristics in terms of ownership concentration, consensus, liquidity and governance, thus reducing the risk of fraud and manipulation.

3. Economics shows that ETH is as resilient as BTC in meeting the committee’s ETP approval standards. Coinbase said it is committed to continuing dialogue and research. Urges the SEC to make informed regulatory decisions in the rapidly evolving cryptocurrency environment, Support innovation and foster a transparent, secure and inclusive financial ecosystem.

1.8. a16z: Why we invested US$100 million in EigenLayer

Crypto VC a16z announced that it has led EigenLayer’s Series B financing, investing US$100 million in the liquidity re-pledge protocol EigenLayer.

EigenLayer is a set of smart contracts on Ethereum that creates a two-sided market for raw cryptoeconomic security: on the demand side, it allows creators of custom decentralized services to write code that effectively extends Ethereum’s capabilities. And, on the supply side, validators participating in the Ethereum consensus (if they happen to have the power and the required hardware) can choose to run these decentralized services by re-mortgaging ETH to them. The end result is EigenLayer, a decentralized and market-based mechanism for extending the capabilities of Ethereum.

1.9. Worldcoin management hinted that a “big announcement” is coming

On February 22, Tiago Sada, head of product, engineering and design of the Worldcoin development team Tools for Humanity, hinted at some big news coming soon. When asked about the future iterations of orb they mentioned, Sada said: “We are excited about the upcoming Very excited about several other big announcements but keeping some suspense for now.”

Market data shows that the market value of Worldcoin tokens has exceeded US$1 billion, and its price has reached a record high. It rose 300% last month and soared 40% in the past 24 hours.

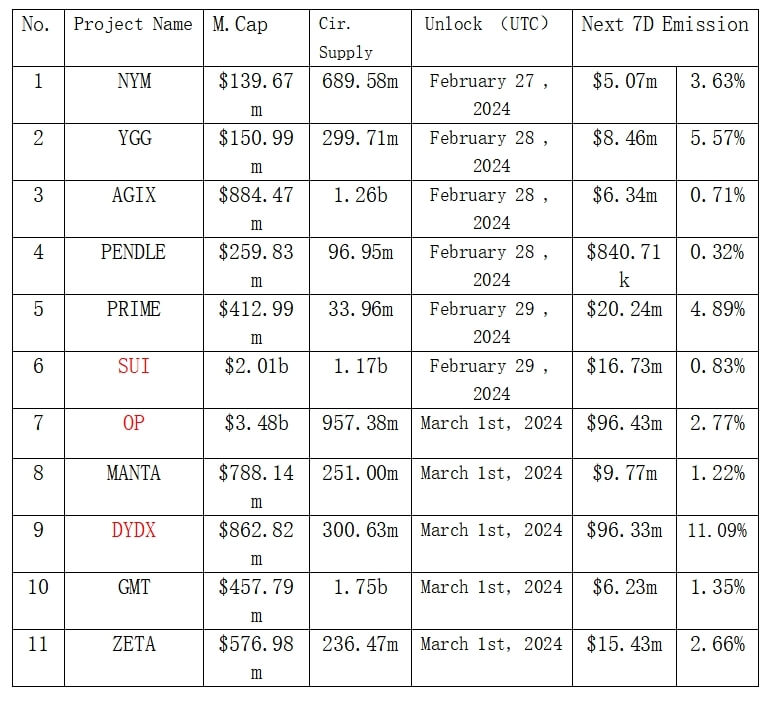

2. Projects to be unlocked next week:

3. Key events next week:

February 26 (Monday)

U.S. new home sales in January (10,000 households);

U.S. Dallas Fed Business Activity Index for February;

February 27 (Tuesday)

European Central Bank President Christine Lagarde attended the debate on the European Central Bank's 2022 annual report;

Preliminary month-on-month value of U.S. durable goods orders in January;

U.S. Conference Board Consumer Confidence Index in February;

February 28 (Wednesday)

The annualized quarter-on-quarter revised value of U.S. real GDP in the fourth quarter;

2024 FOMC voting committee member and Atlanta Fed President Bostic attended the meeting;

February 29 (Thursday)

The number of people applying for unemployment benefits for the first time in the United States in the week of February 24 (10,000 people);

U.S. core PCE price index in January year-on-year;

Chicago PMI in February in the United States;

2024 FOMC Voting Committee and Atlanta Fed President Bostic delivered a speech;

March 1 (Friday)

2024 FOMC Voting Committee and Cleveland Fed President Mester delivered a speech on financial stability and supervision;

The final value of the Markit manufacturing PMI in the United States in February;

U.S. ISM manufacturing index in February;