1. Review of hot topics this week:

1.1. MicroStrategy founder Michael Saylor launches a daily stock selling plan, which will be used to buy Bitcoin

On January 3, according to documents filed with the SEC, MicroStrategy founder Michael Saylor will sell 315,000 shares of MicroStrategy stock (code MTSR), worth approximately US$216 million.

Michael Saylor plans to sell 5,000 shares per day starting on January 2, 2024, through April 25, 2024. Saylor explained that this was an option he received in 2014. He originally chose to receive a salary of only $1, and he also explained that he would invest it in his financial planning, including buying Bitcoin.

1.2. SEC will approve spot Bitcoin ETF due to “political needs”

On January 3, investment bank TD Cowen stated that due to "political needs", The U.S. Securities and Exchange Commission will approve a spot Bitcoin ETF before the January 10 deadline.

The TD Cowen Washington Research Group, led by Jaret Seiberg, wrote in the report: "For us, this is a political necessity, Because before Congress considers broader encryption legislation, The agency needs to solidify its role as a cryptocurrency regulator. We also believe that the agency does not want to lose its legal challenge by refusing to approve a Bitcoin ETF. "

1.3. In January, the U.S. government once again faced the risk of shutting down

At the beginning of the new year, as the expiration date of the temporary appropriation bill approaches, the U.S. government is once again facing the crisis of shutting down.

In November 2023, the U.S. Congress passed a temporary appropriations bill to provide short-term funding for government agencies and projects. However, financial support has only been extended to January 19, There are also some grants extended to February 2. The U.S. Senate resumes work on January 8, And the House of Representatives returned on January 9th, If Congress fails to reach a new funding deal by January 19, government agencies and projects that rely on this part of the funds will face a shutdown.

U.S. government departments affected by the January 19 funding deadline include the Departments of Energy, Housing and Urban Development, Transportation and Veterans Affairs. Departments with a February 2 deadline include the Departments of Commerce, Defense, Health and Human Services, Homeland Security and Labor.

1.4. Bitcoin quickly fell by nearly 10%. At the same time, Matrixport issued a bearish report

On January 3, Bitcoin fell from around $45,000 to $40,800. At the same time, Singaporean digital asset company Matrixport released a report predicting that the U.S. SEC would reject all spot applications for Bitcoin ETFs, overturning the January 2 prediction that Bitcoin ETFs would soon be approved and rebound to $50,000.

Matrixport's report provided a catalyst for unwinding overleveraged positions, causing a chain of liquidations that exacerbated the decline. Nearly $560 million in long trading positions in leveraged derivatives — which use borrowed money to bet on more higher prices — have been liquidated, CoinGlass data shows, the highest liquidation amount in at least three months.

Vetle Lunde, senior analyst at K33 Research, said the market is overheated and higher leveraged, making it highly vulnerable to downside effects. The digital asset research company CryptoQuant also attributed the decline to the abnormally high funding rates in the Bitcoin futures market, which increased the selling pressure of Bitcoin miners, as well as the high profit margins of short-term holders.

1.5. The total U.S. debt exceeds US$34 trillion

On January 2, the U.S. Treasury Department released a report showing that the total U.S. debt exceeded $34 trillion for the first time. In less than four months, the debt has increased by another $1 trillion.

The current domestic interest rate level in the United States is at a high level, causing the debt cost of the U.S. fiscal to continue to rise. From the perspective of fiscal revenue, It will be very difficult for the United States to achieve a significant increase in tax revenue in the near future. This leaves the U.S. fiscal system to finance only by increasing the scale of debt. This has resulted in a situation where financing costs and debt scale have risen rapidly at the same time.

1.6. The world’s major financial markets are facing a “opening dark door”, with technology stocks leading the decline.

On January 2, in Asian stock markets, the Hang Seng Technology Index closed down more than 2%; South Korea's Kospi Index fell 2%, with chip stocks plunging, and Samsung Electronics and SK Hynix were dragged down on their valuations.

On the first trading day of 2024, U.S. Treasuries and most U.S. stock indexes "opening dark door." The Nasdaq index, which is dominated by technology stocks, closed down about 1.6%, its largest decline in more than two months.

Apple was downgraded to Low profile by Barclays for the first time since 2019. And the target price was slightly lowered to $160. This means that Barclays expects Apple's stock price to fall 17% in the next year from the previous trading day. It closed down 3.6% on the day.

In addition, Microsoft, Meta, Amazon, Alphabet, Tesla and Nvidia also fell. Among them, Tesla’s quarterly deliveries were higher than expected. Become the best-performing stock among the "Seven Sisters" of technology stocks.

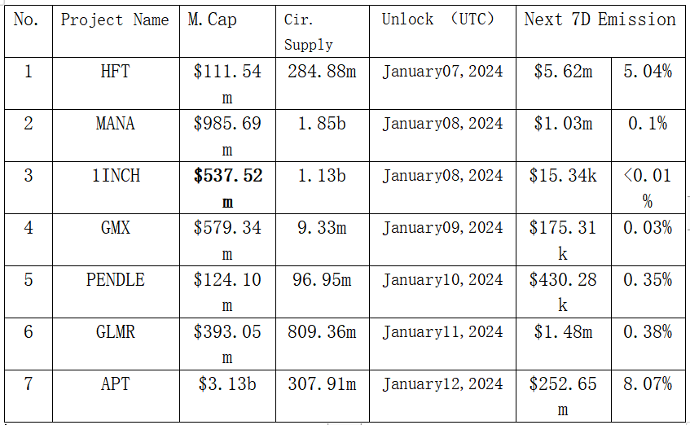

2. Projects to be unlocked next week:

3. Recent key events:

January 9 (Tuesday)

2024 FOMC voting committee member and Atlanta Fed President Bostic spoke on the economic outlook;

January 10 (Wednesday)

EIA releases monthly short-term energy outlook report;

The U.S. SEC announced whether it has approved "BlackRock's Bitcoin spot ETF application";

January 11 (Thursday)

FOMC permanent voting member and New York Fed President Williams delivered a speech on the economic outlook;

The number of people applying for unemployment benefits for the first time in the United States in the week of January 6 (10,000 people);

U.S. December core CPI year-on-year data;

U.S. December CPI year-on-year data;

January 12 (Friday)

US December core PPI year-on-year data;

US December PPI year-on-year data;

FOMC voting committee member and Minneapolis Fed President Neel Kashkari delivered a speech