1. Review of hot topics this week:

1.1. U.S. inflation slightly exceeded expectations and is unlikely to change the Fed’s interest rate cut expectations.

On March 12, data released by the U.S. Bureau of Labor showed that the U.S. CPI rose by 3.2% year-on-year in February, which was higher than the previous value and expected 3.1%, setting a new high since December 2023; the CPI in February rose by 0.4% month-on-month, in line with expectations. However, it was 0.3% higher than the previous value, indicating that U.S. inflation has rebounded and will accelerate again.

U.S. core CPI in February was higher than expected for the second consecutive month, reinforcing the Federal Reserve's caution in cutting interest rates. The inflation data won't change the Fed's plans to keep interest rates on hold, but it will put a spotlight on whether and how officials send signals that this suggests a change in their views on the prospects for rate cuts this year.

After the release of U.S. CPI data, the probability of the Federal Reserve holding steady in March remained unchanged, and the probability of cutting interest rates in June increased to 72.4%.

On Thursday, March 14, data from the U.S. Department of Labor showed that the U.S. PPI increased more than expected in February, rising 1.6% year-on-year, compared with the previous value of 1.2%, far exceeding the expected 0.9%; PPI accelerated by 0.6% month-on-month, twice the expected value and the previous value was 0.3%.

The core PPI, which excludes food and energy prices, rose 2% year-on-year, unchanged from the previous value, exceeding expectations of 1.9%. The core PPI rose 0.3% month-on-month, and the growth rate was lower than the expected 0.5%, but it accelerated from 0.2% last month.

The U.S. PPI in February warm up more than expected, and relay CPI continued to suppress interest rate cut expectations. As the last inflation data before the Federal Reserve's March resolution, the February PPI data further proves that inflation is still high and the road to fighting inflation is bumpy, providing basis for the Federal Reserve's stance that it is "in no hurry to cut interest rates."

1.2. The third test flight of SpaceX Starship, the most successful so far

On March 14, Musk's SpaceX (Space Exploration Technology Company) successfully launched the "Starship" from its own Starship base and successfully reached space, completing the third key test flight of the rocket.

Although the final result of this test flight did not fully meet expectations, compared with the previous two test launches, the performance of this rocket has been improved. The starship not only flew farther, longer, but also successfully completed more Multiple "milestone" test missions are one step closer to SpaceX's goal of sending people to the moon and Mars.

In this test flight, the starship flight lasted about an hour. The only drawback was that the starship did not land on the water of the Indian Ocean as originally planned. In the final stage of the test, it disintegrated while flying over the Indian Ocean, ending this test flight mission ahead of schedule.

1.3. Startup company Figure, Released his first robot demo powered by OpenAI large model

On March 13, star robotics startup Figure released its first robot demo powered by an OpenAI large model.

The company's product, Figure 01, is said to be the world's first commercially viable autonomous humanoid robot. It is 1.5 meters tall, weighs 60 kilograms, can carry 20 kilograms of cargo, and is driven by a motor.

Corey Lynch, senior AI engineer for Figure robot operations, introduced the technical principles of Figure 01. He said that Figure 01 can now do the following: describe its visual experience, plan future actions, reflect on its own memory, and verbally explain its reasoning process.

On March 1, Figure announced the completion of a staggering $675 million in Series B financing, valuing the company at $2.6 billion. Companies participating in the financing include: Microsoft, Intel, OpenAI Startup Fund, Amazon Industrial Innovation Fund, NVIDIA, Bezos, "Mother Wood"'s Ark Investment, Parkway Venture Capital, Align Ventures, etc.

1.4. Swissblock: Bitcoin will face a temporary correction

On March 13, CoinDesk cited a Swissblock report stating that the price of Bitcoin has nearly doubled from US$38,000 at the end of January without any meaningful correction occurs, which means that a correction period may be coming.

Swissblock analysts said: No asset can continue to rise in a straight line, not even Bitcoin. The forecast is based on Bitcoin’s 4-hour RSI technical indicator, which sees a slight increase in Bitcoin, but a bearish divergence as the RSI continues to fall, signaling the possibility of a price decline.

Analyst Henrik Zeberg believes that a correction may occur as soon as within the next few days, but in the larger cycle, the correction will only be temporary. He expects Bitcoin to fall to $58,000 to $59,000 next, a 20% drop from current prices, but then continue to set new all-time highs.

1.5. The U.S. Treasury Department is investigating a $165 million cryptocurrency transaction suspected to be related to Hamas.

On March 13, the U.S. Treasury Department’s department responsible for combating terrorist financing said that multiple financial institutions had reported $165 million in potential cryptocurrency transactions that may be related to Hamas.

The Financial Crimes Enforcement Network (FinCEN) analyzed suspicious activity reports filed between January 2020 and October 2023, according to a letter signed by U.S. Treasury Undersecretary Adewale Adeyemo. FinCEN discovered that more than 200 cryptocurrency addresses may have been used in these transactions.

1.6. Coinbase issues an additional US$1.1 billion in convertible corporate bonds

On March 14, Coinbase, a US-listed cryptocurrency exchange, announced that it would expand the issuance of US$1.1 billion in senior convertible corporate bonds (Convertible Senior Notes), an increase from the US$1 billion issuance announced the day before.

As it enters a cryptocurrency bull market, Coinbase is following a strategy pursued by MicroStrategy over the past few years and issuing corporate debt to fund its cryptocurrency vision. Convertible bonds can be converted into company stocks or cash or a combination of the two according to conditions to avoid diluting the shareholding ratio of existing shareholders through the sale of new shares, resulting in a situation that affects the stock price.

As the listed company holding the largest number of Bitcoins, MicroStrategy has purchased 205,000 Bitcoins so far, currently worth more than $15 billion. Most of the purchase funds came from more than $2 billion of convertible bonds sold by MicroStrategy. The company recently Announced that it will issue an additional US$500 million in convertible corporate bonds to increase its holdings of Bitcoin.

1.7. Musk confirmed that Tesla will soon enable Dogecoin (Doge) payment

On March 13, billionaire Musk said Tesla would soon enable Dogecoin (Doge) payments. However, Musk did not provide a specific integration timeline.

At the "We Are Giga" event in Texas, Musk publicly expressed his support for Dogecoin. He shouted "DogecoinTo the moon" to a cheering crowd of hundreds.

The price of Dogecoin surged after news broke that Tesla might merge with Doge. Doge surged nearly 9% from a 24-hour low of $0.1656 to a high of $0.188.

1.8. The market value exceeded US$80 million within half a day of being online. The launch of BOME coin by Pepe Meme artist exploded

On March 14, BOOK OF MEME (BOME) released by Pepe Meme artist Darkfarm swept all social platforms. In just three hours after it went online, it increased 20 times, with a market value exceeding US$80 million.

Darkfarms is an artist specializing in the creation of Pepe Meme images. His most famous work was previously the Pepe-themed NFT series SMOWL.

On March 13, Darkfarms launched a pre-sale. You can participate by sending SOL to the designated Solana address. There is no fixed price for this pre-sale, and all participants in the pre-sale will be allocated tokens according to the proportion of SOL they donated. The progress of the pre-sale has also far exceeded Darkfarms’ expectations. The original fundraising expectation was only 500-600 SOL, so he opened a community vote to let participants decide how to allocate the pre-sale funds. As of the 14th, according to data disclosed by Darkfarms, a total of 10,131 SOLs have been raised.

On the afternoon of the 14th, Darkfarms added all SOL raised into the LP pool, with the initial price being 0.0{3}496 USDT. Subsequently, the token began to spread widely in the Chinese and British communities. Due to its extremely high depth, it can accommodate the entry of a large amount of funds. A large number of buy orders of more than 100 SOLs continued to pour in, pushing its price to continue to rise; the highest price of BOME rose to 0.0012 USDT. , up approximately 24 times, with a market value exceeding US$80 million.

At present, BOME is still continuing to rise and has reached the second-tier market value of Solana Meme. Whether it can become the next 100 million yuan Meme remains to be seen by the market game.

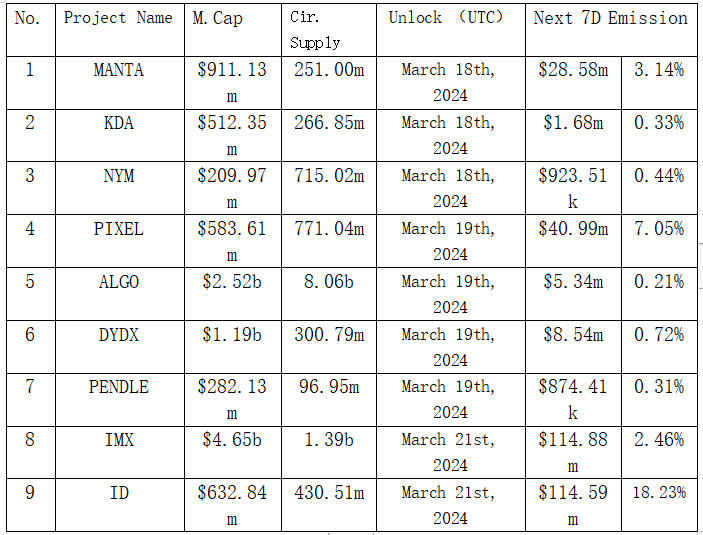

2. Projects to be unlocked next week:

3. Key events next week:

March 19 (Tuesday)

NVIDIA held the GTC2024 conference to release the latest breakthrough results in accelerated computing, generative AI and robotics;

Bank of Japan policy rate;

March 20 (Wednesday)

The Federal Reserve holds an FOMC meeting, And announced the interest rate decision in the early morning of the next day;

March 21 (Thursday)

The Federal Reserve announces interest rate decisions and quarterly economic forecasts;

The British and Swiss central banks announced interest rate decisions;

The number of people applying for unemployment benefits for the first time in the United States in the week of March 16 (10,000 people);

US March Markit comprehensive PMI preliminary value;