Decoding Market Pulse: An Introduction to Trend Lines

In the charts of financial markets, trend lines are like a key that unlocks the overall direction of price movements. It is an inclined line connecting specific price points, revealing the general trend of market prices. This tool is a cornerstone in technical analysis, widely applied in stock, forex, futures, and cryptocurrency markets.

The basic principle of trend lines resembles support and resistance levels but differs in their formation as diagonal lines instead of horizontal ones with both positive and negative slopes. The steeper the slope of a trend line, the stronger the represented trend.

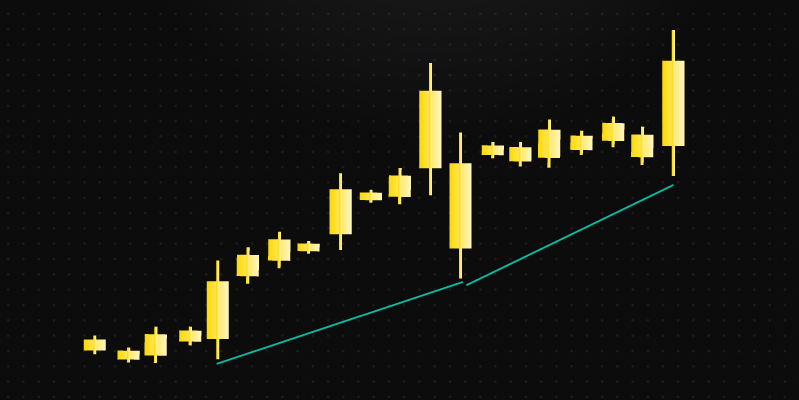

We primarily classify trend lines into two categories: rising trend lines and falling trend lines. As the name implies, rising trend lines extend from relatively low points to higher points on the chart. They connect at least two consecutive lower lows, outlining an upward trajectory of prices.

Conversely, falling trend lines are drawn from high points to lower points, linking a series of higher highs, indicating an overall downward trend in the market.

When drawing a rising trend line, we look for points that form higher lows; when sketching a falling trend line, we search for points that form lower highs. The selection of these points is crucial in determining the direction and significance of the trend line.

Application and Practice of Trend Lines

Trend lines are crucial tools for identifying market trends when observing price fluctuations. On charts, by connecting the highest and lowest prices, we can see that prices often return to favorable positions indicated by trend lines after brief deviations from the main trend. This repeated testing, as long as the critical point is not broken, gives reliability to trend line analysis.

In financial chart analysis, trend lines are particularly common. They reveal the balance of supply and demand in the market: an ascending trend line represents strengthening buying power and sustained price increases; while a descending trend line suggests weakening buying power and declining prices.

However, trading volume should not be overlooked during analysis. For example, if prices rise but trading volume decreases, it may only indicate surface demand, not actual demand.

Another important role of trend lines is to identify support and resistance levels. In an upward trend, prices are less likely to break below the support level indicated by the trend line; while in a downward trend, prices find it difficult to break above the resistance level. Once the stock price breaks through these key levels, the analytical value of the original trend will decrease significantly.

It's worth noting that technical analysis has some subjectivity. Since different people draw trend lines in different ways, to reduce risks, we should combine multiple technical analyses with fundamental analyses to achieve a more comprehensive market judgment.

Decoding Trend Lines: The Art of Points

1. The analytical value of trend lines is not solely derived from connecting two points. Technically, at least three points are needed to confirm its validity. The first two points illustrate the potential trend, while the third point verifies its reliability.

2. When a price touches a trend line three times or more without breaking a critical point, this trend line holds significant analytical value. This is not coincidental but rather the result of the market repeatedly testing it.

3. Connecting three or more points strengthens the conviction in trend lines. This aids investors in identifying and grasping market trends, avoiding misjudgments based solely on price fluctuations.

4. In practical trading, by observing multiple tests of trend lines, investors can make a more objective assessment of price movements, leading to wise investment decisions.

The Importance of Scale Setting

In financial chart analysis, scale setting is a crucial factor in determining the accuracy of trend line analysis. Linear and Logarithmic scales are two common settings.

A linear scale features equal distance changes in price on the Y-axis. This means that whether the price moves from $5 to $10 or from $120 to $125, the distance on the chart remains the same. This type of scale is suitable for representing small price range movements.

Logarithmic scale, on the other hand, displays price changes based on percentage shifts. On a logarithmic chart, a 100% increase from $5 to $10 will take up more space on the chart than a 4% increase from $120 to $125. This type of scale is better suited for displaying large price fluctuations.

In practical use, investors should choose an appropriate scale setting based on the purpose of their analysis and the characteristics of price volatility. Doing so ensures that the trend lines drawn not only have visual continuity but also hold real significance and reference value in analysis.

Improving Trend Line Accuracy with Multiple Indicators

Trend lines, although a powerful tool in technical analysis, are not entirely reliable. Their accuracy is influenced by the points selected during drawing, introducing some subjectivity. For example, some analysts focus solely on the main body of the K-line while ignoring shadows when drawing trend lines; others base their drawings on the highest and lowest prices of the shadows.

To improve the accuracy of trend lines, we should combine them with other technical analysis tools and indicators. Examples include Ichimoku Clouds, Bollinger Bands, MACD (Moving Average Convergence/Divergence), Stochastic RSI (Stochastic Relative Strength Index), RSI (Relative Strength Index), and moving averages. These indicators provide us with more comprehensive market information, enabling us to capture true trends in complex market environments.

Through the integrated analysis of multiple indicators, we can more accurately capture changes in price movements across different market cycles, thereby making more informed trading decisions. In summary, while trend lines are strong, combining them with multiple indicators enhances their practical value in market analysis.

Conclusion

When unraveling the mysteries of market fluctuations, trend lines are an indispensable tool in technical analysis. Through our in-depth discussion in this article, not only have we learned how to draw and interpret trend lines, but more importantly, we understand how to apply trend lines in practical operations to capture market movements and distinguish the persistence of price trends. However, trend lines are not a universal key.

In the face of rapid changes in the current market environment and the impact of future uncertainties, the importance of combining other technical indicators and fundamental analysis becomes increasingly prominent. Looking ahead, with advances in artificial intelligence and machine learning technologies, the accuracy of technical analysis and the convenience of operation will further improve, providing stronger support for investors in the complex and changeable market.