*All on-chain data is dated as of 12:00 a.m. EST on Sunday, December 31st.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Dec.31 - Jan.6).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #Employment #ETF #Layer2

1 Macro Market Overview

U.S. Stocks End Rough Week on High Note After Jobs Report. According to WSJ, major indexes eked out gains Friday, but still ended the first week of 2024 lower after a pullback by big tech stocks. The S&P 500 finished the week down 1.5%, snapping a nine-week winning streak, while the Dow Jones Industrial Average slipped 0.6%. The tech-heavy Nasdaq Composite declined 3.2%. On Friday the latest monthly jobs report showed the U.S. economy added 216,000 jobs in December, more than economists had forecast. At the same time, revisions showed that employers added fewer jobs in October and November than previously estimated. All told, the report did little to clarify when the Federal Reserve is likely to begin cutting interest rates. Central bank officials have signaled that they anticipate lowering rates this year, but with fewer cuts than many investors expect. Investors on Friday also parsed a weaker-than-expected report on the U.S. services sector. The Institute for Supply Management’s services-activity index fell to 50.6 in December, down from 52.7 in November and below economists’ estimates.

Federal Reserve officials meeting in December agreed that the rate-increase cycle that started in 2022 was likely at an end, according to minutes of the meeting released Wednesday. But officials have signaled that the central bank could cut interest rates three times this year while interest-rate derivatives traders have placed bets implying about six cuts in 2024. The minutes released Wednesday didn’t offer a timetable on possible rate cuts. Economic data out Wednesday suggested a gradual cooling of the U.S. economy, keeping with the recent trend. Fresh data from the Institute for Supply Management showed that manufacturing activity fell slightly in December from the month before, albeit less than economists had forecast. The Labor Department said Wednesday there were 8.8 million job openings in November, down from a recent peak of 12 million in March 2022.

In addition, web3-related stocks experienced an overall pullback last week, with COIN falling more than 11%, MSTR remaining relatively stable, and MARA rising by 2.7%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

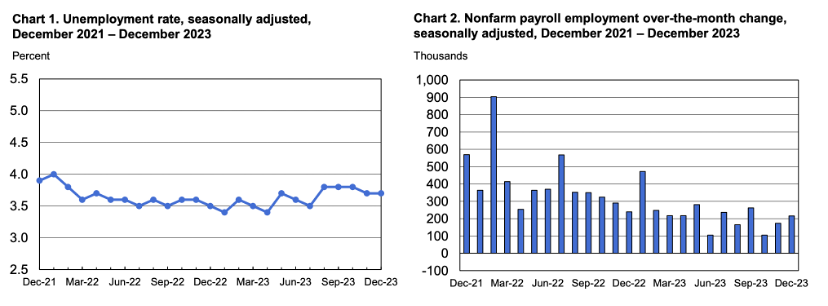

Total nonfarm payroll employment increased by 216,000 in December, and the unemployment rate was unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported last Friday. Employment continued to trend up in government, health care, social assistance, and construction, while transportation and warehousing lost jobs.

(Source: U.S. BUREAU OF LABOR STATISTICS)

The US Dollar Index (DXY) rebounded continuously last week, reaching 102.435 at the close on Friday, reflecting a 1% increase over the seven days. The Dollar Index put an end to its three consecutive weeks of persistent decline, contrary to the performance of the stock market in the first week of the new year. This shift is attributed to the dampening of investor expectations for a Federal Reserve interest rate cut policy.

DXY (Source: TradingView)

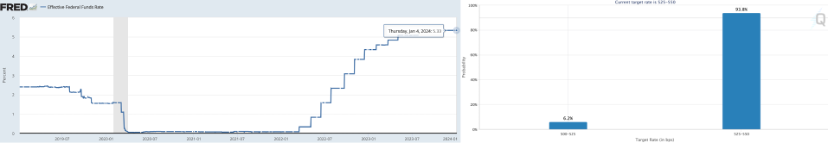

According to the Federal Reserve Watch Tool from the Chicago Mercantile Exchange Group, only 6.2% of traders currently anticipate that the Federal Reserve will adjust the Effective Federal Funds Rate (EFFR) to the range of 500-525 basis points in January of next year. This reflects a decrease of over 10 percentage points compared to last week. Meanwhile, 93.8% of traders expect it to remain between 5.25% and 5.5%.

Left: EFFR, Right: Target Rate Probabilities for 31 January 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

Last Friday, the yield on the benchmark 10-year U.S. Treasury note (US10Y) increased to 4.041%, up from 3.990% on Thursday. Over the past seven days, the US10Y rebounded and rose by 7 basis points.

US10Y (Source: TradingView)

Reuters: U.S. spot bitcoin ETFs could win approval next week after last-minute application updates. Several Bitcoin spot ETF issuers stated on Friday that they expect to receive final approval for their S-1 applications later on Tuesday or Wednesday next week. The SEC is seeking what three issuers referred to as "minor" changes. It is anticipated that some asset management companies will amend their filing documents to disclose the fees or identities of their ETF market makers.

In addition, the head of research at VanEck stated that BlackRock has raised $2 billion and plans to invest in the Bitcoin spot ETF in the first week. These funds are expected to be converted into a spot Bitcoin ETF within the first week. Bloomberg ETF analyst Eric Balchunas commented that if true, this move would set records for the first day/week trading volume and asset management scale for ETFs. Regarding GBTC, according to a tweet from Fox Business reporter Eleanor Terrett, after the quarterly rebalance, the Grayscale Digital Large Cap Fund has included XRP in its portfolio while removing MATIC. As of January 4, 2024, the fund's composition includes 69.15% BTC, 21.90% ETH, 3.65% SOL, 2.54% XRP, 1.62% ADA, and 1.14% AVAX.

(Source: Twitter@EricBalchunas)

2 Crypto Market Pulse

Market Data

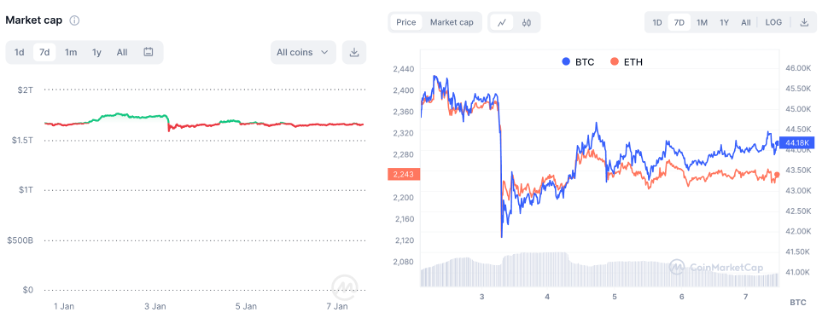

Last week, the cryptocurrency market capitalization remained relatively stable, with the current total market value at $1.65 trillion. Bitcoin and Ethereum experienced significant fluctuations on Tuesday of last week, with Bitcoin briefly falling below $41,000 and then quickly rising to around $43,000. The possible reason for this market volatility was the short-term negative sentiment in the market due to the rejection of the Bitcoin spot ETF. Currently, both BTC and ETH are in a overall downward trend. As of the early morning of January 7th, the spot price of Bitcoin is $44,180, up 4.6% from last week. As the second-largest cryptocurrency, Ethereum saw a retracement compared to last week, falling below $2,300 to the current price of $2,243, a decrease of 2.6%. In addition, Bitcoin's market share has increased by two percentage points, currently at 52%, with a market value of $862 billion. Ethereum's market share remains relatively stable at 17%, with a market value of $270 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

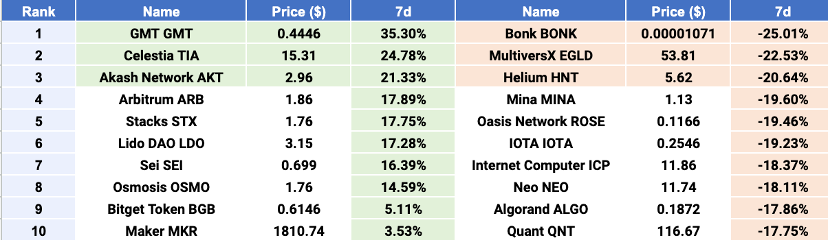

$GMT, $TIA, and $AKT emerged as Top 3 gainers, while $BONK, $EGLD, and $HNT were Top 3 losers. Last week, among the top 100 projects by market capitalization, $GMT became the top gainer. STEP Network (STEPN) is the world's first Move 2 Earn NFT game on mobile devices. Players earn tokens by walking, jogging, or running outdoors while wearing NFT sneakers. The game features a dual-token system, with $GMT as its governance token. MapleLeafCap, the founder of Folius Ventures, tweeted last week that Gas Hero has been launched for 4-5 days, and if Gas Hero can attract over 100,000 users and maintain the current asset price, the FSL ecosystem might lock 15 million $GMT tokens daily. The rise in $GMT may be influenced positively by the ongoing developments in this ecosystem. $TIA, ranking second, is a project named Celestia, a modular blockchain project. $TIA has experienced significant growth since the recent mainnet launch and token distribution, soaring over 460% from its initial price of $2.10 in just over two months. Akash Network ($AKT) is the third-largest gainer this week. Operating on the Cosmos blockchain, Akash Network is an open-source, decentralized cloud computing platform offering unique cloud services. Decentralized Physical Infrastructure (DePIN) projects like $Akash Network have recently gained significant attention.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

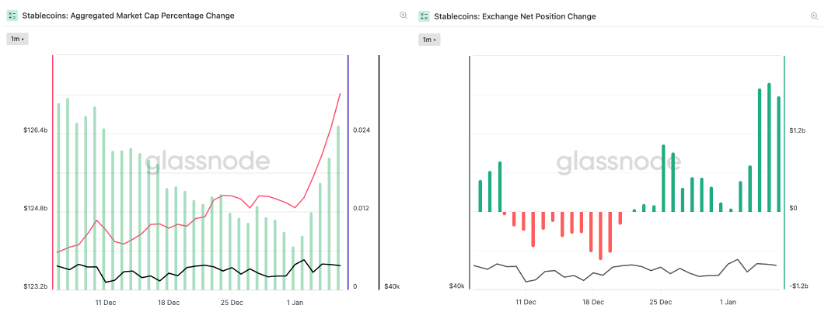

Last week, the total supply of stablecoins continued to show a significant growth trend, exceeding $126.5 billion. In the past few weeks, the total supply of stablecoins has consistently displayed a stable upward trajectory. Furthermore, the rate of net supply growth increased significantly last week, indicating a continued rising demand for cryptocurrency market investments in the near term. Simultaneously, observing the net position data of stablecoins on exchanges over the past week, the overall trend indicates a substantial net inflow, reflecting an increase in the total supply of stablecoins on exchanges in the last seven days. Investor sentiment in the crypto market remains highly active. The overall situation continues to indicate positive prospects for the future development of the market.

Stablecoins Market Cap (Data: Glassnode)

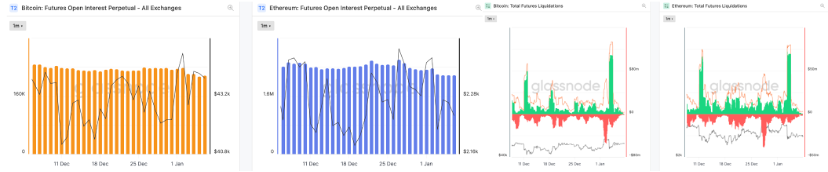

In the derivatives market, the open interest of Bitcoin and Ethereum perpetual futures contracts has experienced a decline. The total open interest in the futures market fluctuated in the past seven days in response to the volatility in the prices of Bitcoin and Ethereum. Particularly, around last Tuesday, there was a significant short-term drop in the prices of Bitcoin and Ethereum, resulting in a substantial liquidation of long positions, with liquidation amounts exceeding $100 million and $7 billion, respectively. Following this, the open interest has significantly decreased, indicating the continued presence of volatile market conditions.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

In the DeFi market, the total locked value (TVL) slightly declined last week, reaching $526 billion. Over the past seven days, the trading volume on decentralized exchanges (DEX) decreased to $32 billion, a 9% decrease from the previous week. The market share gap between decentralized exchanges (DEX) and centralized exchanges (CEX) continues to widen, with DEX now accounting for 13% of the total CEX trading volume. In the past week, the TVL of the top ten mainstream blockchains mostly experienced a decline, with only Tron achieving a marginal net growth of 1.1%. Solana and Cardano, on the other hand, each dropped by over 12 percentage points.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

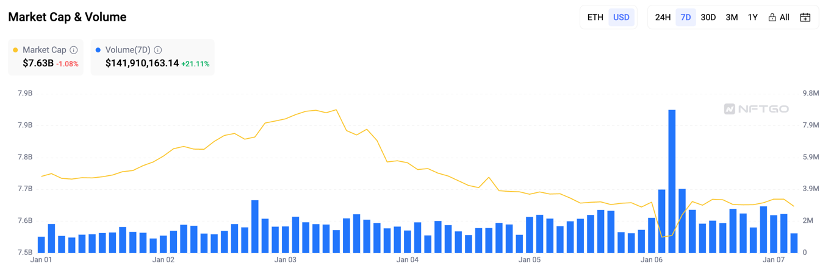

Last week, the NFT market experienced a slight retreat, declining by 1%, with a total value reaching $7.6 billion. However, the total trading volume increased by 21% over the past seven days. In the top NFT collections, both the floor price and average price showed a slight decline overall. The floor price and average price of the Bored Ape Yacht Club (BAYC) both decreased by 1%. While the floor price of the Mutant Ape Yacht Club (MAYC) remained steady, the average price declined by 5%.

Market Cap & Volume, 7D (Data: NFTGo)

Market Cap & Volume, 7D (Data: NFTGo)

LBank Labs Recap

The focal point of market attention this week rested on the Bitcoin ETF decision, a pivotal event that generated anticipation and fluctuations. Profit-taking activities ensued in the preceding week, reflecting a cautious approach among investors amid a robust bull run over the last month. The sudden plunge to $40,750 appears more indicative of manipulative actions by a select group rather than a consensus-driven market correction. Notably, the order book reveals limited bids at $43.5K and nominal asks at $44.5K, suggesting a tentative market sentiment.

In terms of actual liquidity dynamics:

- $42K - $41K exhibits a favorable spot demand scenario, where bids surpass asks.

- $45K - $47K, on the contrary, reflects a spot supply situation, with asks outweighing bids.

BNB -- despite adverse developments involving former Binance CEO CZ, a surge in demand transpired due to a series of launchpad projects. This surge contrasted with heightened short positions on BNB within the top 10 market cap tokens, stemming from concerns related to Binance's interactions with US lawmakers. The resultant liquidation of certain short positions underscored the complexity of BNB's current market dynamics.

PEOPLE -- In the domain of emerging tokens, a TRB-like token experienced a staggering 400% surge amidst broader market turmoil, with a resilient price action following the initial dip to $0.02. Anticipations point to a potential fill of the wick to 0.072 in due course.

JTO, AI, ACE, and NFP -- recently listed on Binance, faced selling pressure from early investors and launchpool participants. Despite this, there is a prevailing belief that the present market conditions offer an opportune time for investment in these projects, contingent upon the sustenance of current levels.

BRC-20 -- liquidity has receded after a prior period of heightened interest. The token exhibits NFT traits, and the diminished enthusiasm in the market could present an advantageous entry point for discerning investors amidst broader sentiments of apprehension.

- BTC price optimistic: $44500 - $48500

- BTC price neutral: $43500-$44500

- BTC price pessimistic: $40500 - $43500

3 Major Project News

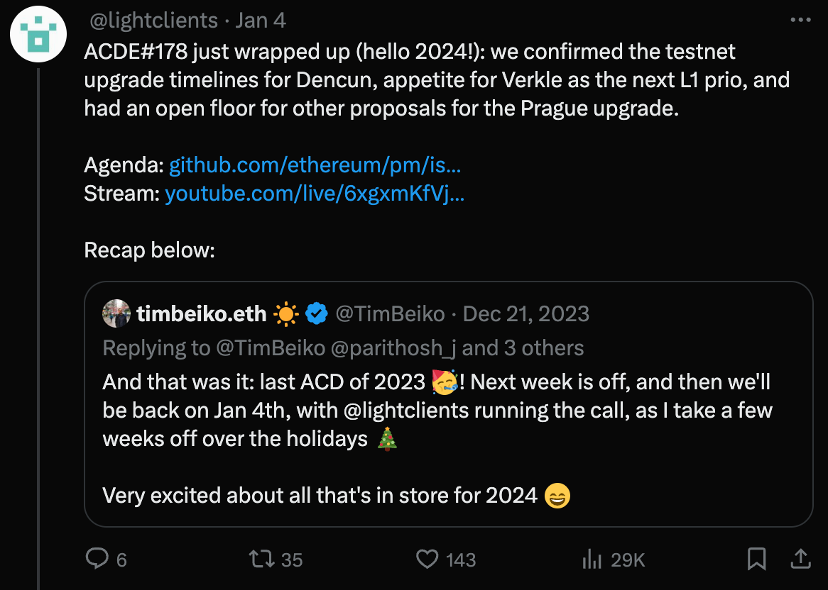

[Ethereum] Ethereum is set to undergo the Cancun upgrade on the Goerli testnet on January 17. On January 5, developer (Twitter@lightclients) from the Geth team announced that the 178th Ethereum All Core Developers Meeting (ACDE) has concluded. During this meeting, the scheduled date for the Cancun upgrade on the Goerli testnet was reaffirmed for January 17, with January 30 and February 7 designated as the upgrade dates for the Sepolia and Holesky testnets, respectively.

Assuming all goes smoothly, developers plan to release Goerli clients next week, followed by the release of Sepolia/Holesky clients on the week of January 22. Additionally, the 179th ACDE meeting is scheduled for January 18. If any issues arise within the first 24 hours after the fork, upgrade timelines will be reassessed.

Developers have also decided that the next Ethereum upgrade will be the Prague/Electra (Pectra) upgrade.

(Source: Twitter@lightclients)

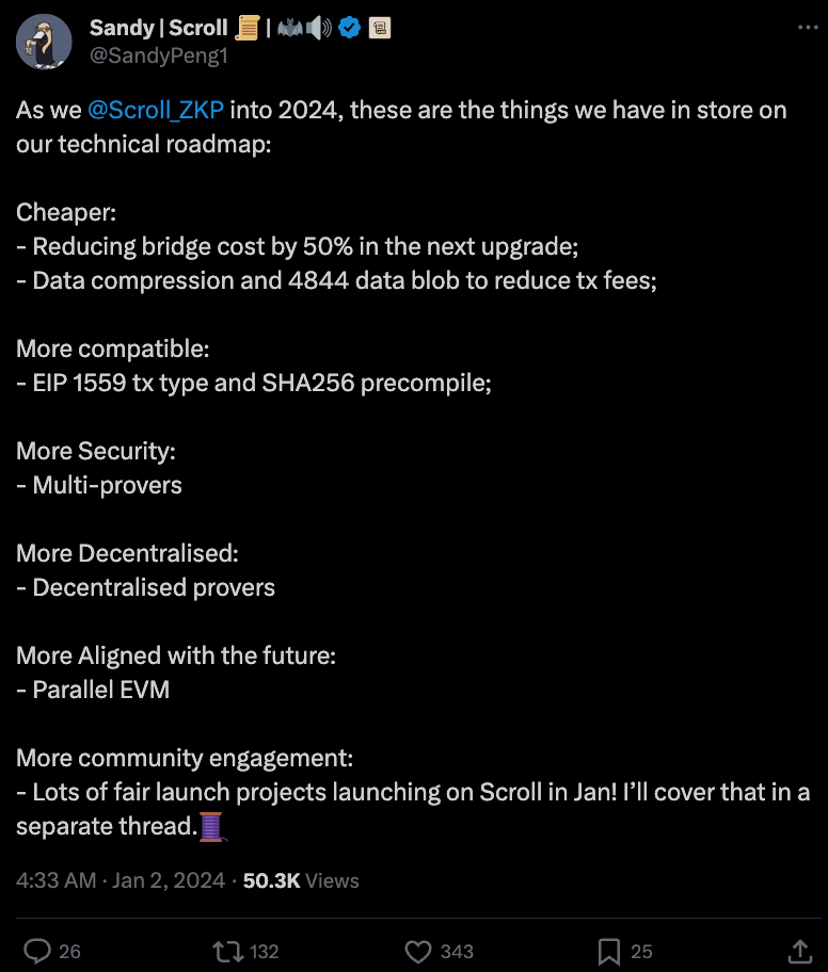

[Layer2] Scroll has released its 2024 technical roadmap, aiming to reduce cross-chain costs by 50%. Based on the ZK Rollup, the Ethereum Layer 2 network Scroll has unveiled its 2024 roadmap. The roadmap indicates that Scroll plans to cut cross-chain costs by 50%, be compatible with EIP 1559 transaction types and SHA256 precompiles, add multiple validators, incorporate decentralized proofs, and introduce parallel EVM. Additionally, Scroll is set to launch some fair launch projects later this month.

(Source: Twitter@SandyPeng1)

[Layer2] Arbitrum Orbit chains can now use select ERC-20 tokens for transaction fees. Arbitrum Orbit Layer3 has added support for custom gas tokens. Arbitrum announced that the development now allows the Orbit blockchain to use selected ERC-20 tokens to cover gas fees on its network. This feature will assist the Orbit chain in creating utility for its own tokens.

(Source: Twitter@arbitrum)

[Layer2] Starknet Roadmap Update: Community voting for the deployment of version v0.13.0 updates on the mainnet will commence on January 10. Starknet has updated its 2024 roadmap, with plans to reduce transaction fees on the v0.13.0 testnet in the first quarter and introduce new transaction types, v3 transactions, allowing users to pay transaction fees using STRK. Additionally, Starknet will initiate community voting on January 10 for the deployment of the mentioned updates on the mainnet. Moreover, Starknet intends to leverage the EIP-4844 upgrade to decrease Ethereum Layer1 data availability costs and aims to introduce a transaction fee market in the v0.14.0 version to accelerate transaction speed.

(Source: Starknet.io)

[Layer2] Manta has announced the airdrop details, and eligibility for claiming rewards is now available for inquiry. According to Manta officials, they have officially launched the Into the Blue airdrop program and disclosed the airdrop details. The initiative aims to expedite the growth of the Manta network. The airdrop retroactively covers the past 3 years. A total of 50 million MANTA tokens will be rewarded to long-term users and supporters of the Manta ecosystem, divided into two categories. Thirty million tokens are allocated for the airdrop rewards, and 20 million tokens are set aside for "The Great Treasure Hunt" activity bonuses. Users eligible to claim the airdrop include Manta Pacific users, Manta Atlantic users, and members of the general community.

Additionally, according to Socialscan data, Manta Pacific has migrated its Data Availability Layer from Ethereum to Celestia. During this process, a total of 2.84 million transactions were generated, resulting in 305.71 MB of data. The migration has cumulatively saved $470,560 in data availability costs, representing a 99.81% reduction compared to the fees associated with using the Ethereum mainnet.

(Source: Twitter@MantaNetwork)

4 Key Fundraising Data

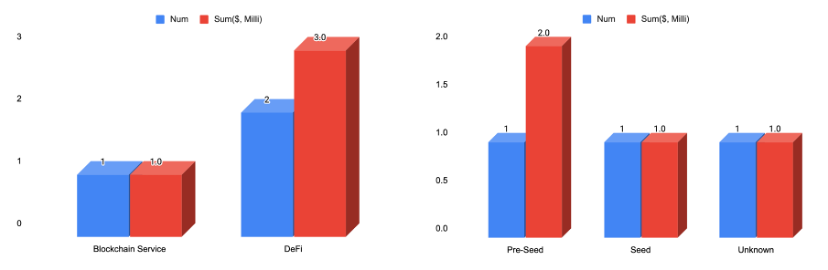

Last week witnessed a total of 8 financing events, raising a substantial amount of over $4 million*.

Compared to last week, financing activities experienced a comprehensive decline in both trading volume and total financing amount, reaching a multi-month low in overall activity. The blockchain infrastructure sector led with the highest number of financing events, totaling three. The decentralized finance (DeFi) sector recorded the highest total financing amount, raising a total of $3 million, constituting 75% of the overall financing amount. The largest financing event was spearheaded by the Bracket Labs project, securing $2 million in funding. Bracket Labs is a project that builds leveraged structured products onchain with simple interfaces. More detailed information is provided below.

*4 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1.[DeFi] Bracket Labs has successfully concluded a $2 million seed funding round.

Bracket Labs has successfully completed a $2 million seed funding round and simultaneously announced the official launch of its volatility market product, Passages, on Arbitrum. Passages, featuring a clean design, provides users with a platform for volatility betting on 2-day prediction markets.

In earlier news, Binance Labs had already invested in five selected projects from its fifth incubation program. These projects include Bracket Labs, focusing on on-chain leveraged structured products, dappOS, a Web3 operating protocol, Kryptoskatt, a Web3 financial project, Mind Network, an entirely encrypted network, and zkPass, a decentralized identity verification solution.

- Official Link: https://www.bracketx.fi/

2. [Service] PowerPod has completed a $1 million seed funding round.

PowerPod recently completed a seed funding round, securing $1 million in financing. The round was led by Waterdrip Capital, with participation from Iotex, Future Money Group, JDI Group, Future3 Campus, Wagmi Venture, and others. The funds raised will primarily be used to strengthen hardware development and testing, validate the minimum closed-loop of the business model, and contribute to community ecosystem building. PowerPod aims to establish a globally open and interconnected charging network to accelerate the achievement of low-carbon emissions in the global transportation sector.

- Official Link: https://www.powerpod.pro/

3. [DeFi] NFT trading platform EZSwap completes a $1 million second-round financing.

According to the official blog of the EOS Network Foundation (ENF), the NFT game DEX and inscription protocol EZSwap completed a $1 million second-round financing last month, with EOS Network Ventures Foundation (ENV) leading the investment with $500,000, and participation from IOBC Capital and Momentum Capital.

The EOS Network Foundation stated that this funding round not only enables EZSwap to expand its technical capabilities and innovate within the field but also enriches the entire EOS ecosystem through its gaming solutions and extended cross-chain functionality.

According to data from the crypto analytics platform RootData, EZSwap is an NFT DEX and inscription protocol that is setting new standards for trading gaming assets and inscription technology. By leveraging an automated market maker (AMM) mechanism, EZSwap provides a seamless and efficient trading environment directly integrated with games.

- Official Link: https://ezswap.io/#/index