*All on-chain data is dated as of 12:00 a.m. EST on Sunday, June 9th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week (June.2-8).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #Employment #ETH Spot ETF #Layer2

Average hourly earnings rose 4.1% from a year earlier. PHOTO: ALLISON JOYCE/BLOOMBERG NEWS

1 Macro Market Overview

U.S. Stock Indexes Slip After Surprisingly Strong Jobs Data. According to WSJ, stock indexes slipped and bond yields rose after a surprisingly strong jobs report prompted investors to dial back expectations for when the Federal Reserve might cut interest rates. The benchmark S&P 500 fell 0.1%, while the tech-heavy Nasdaq Composite edged 0.2% lower. The Dow Jones Industrial Average shed 0.2%, or 87 points. All three indexes logged weekly gains to kick off June, after closing out May higher. For much of the day, stocks moved between gains and losses after the jobs report delivered mixed signals. U.S. employers added 272,000 jobs in May, which was far more than economists expected and indicated the economy has remained strong despite elevated interest rates. But the unemployment rate also edged up to 4%. Stocks edged lower after the report, and traders priced at a roughly 50% chance the central bank would cut rates from their highest levels in more than two decades by its September meeting. That was down from around 70% a day earlier.

Despite last Friday's overheated employment report dragging down the performance of the three major U.S. stock indices, all three indices managed to post gains over the past seven days. The Nasdaq Composite, centered around technology stocks, rose by 2.5%, while the S&P 500 and the Dow Jones Industrial Average increased by 1.5% and 0.5%, respectively. Web3-related stocks also performed relatively well, with COIN and MSTR rising by 8.3% and 4.6%, respectively, although MARA saw a slight decline of 0.9%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

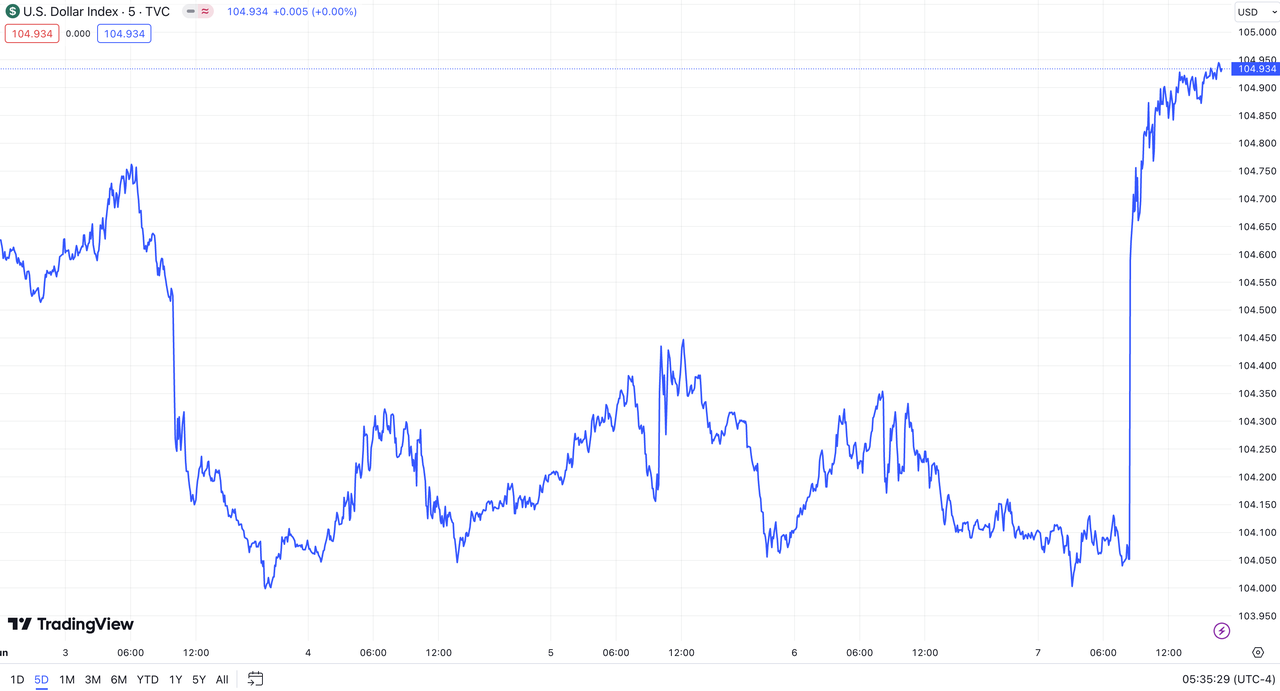

Last week, the U.S. Dollar Index (DXY) reversed its downward trend following the release of an overheated employment report on Friday, closing at 104.934. This marks an increase from the previous week's closing value of 104.625.

DXY (Source: TradingView)

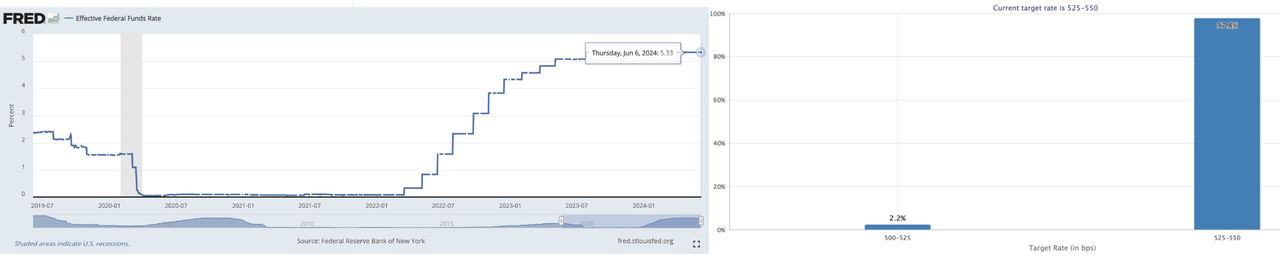

According to the latest data from the Chicago Mercantile Exchange (CME), due to the newly released easing inflation data last week, over 97% of investors believe that the upcoming June Federal Open Market Committee (FOMC) meeting will not see the first interest rate cut of the year. Additionally, nearly 2% of investors remain optimistic about a potential rate cut.

Left: EFFR, Right: Target Rate Probabilities for June 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

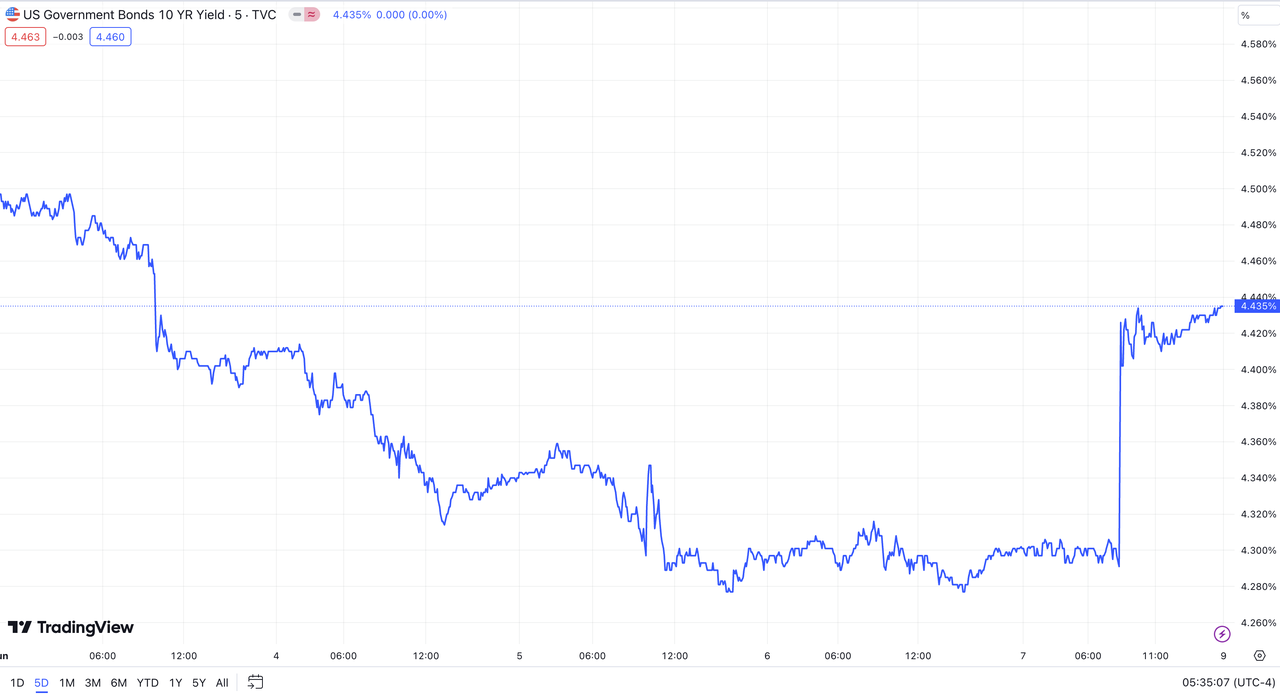

Bond yields rose as investors’ expectations about interest rates shifted. The yield on the 10-year Treasury note (US10Y), a benchmark for mortgages and other borrowing costs, jumped to 4.435% Friday, from 4.280% Thursday—its largest one-day gain in two months.

US10Y (Source: TradingView)

ProShares launches first US -2x ethereum ETF. Last Friday, ProShares rolled out two ETFs offering 2x leveraged and 2x inverse exposure to the performance of ether, respectively. The ProShares Ultra Ether ETF (NYSE Arca: ETHT) and ProShares UltraShort Ether ETF (ETHD). ETHT has an expense ratio of 0.94%, while ETD charges 1.01%. Both funds are tied to the performance of the Bloomberg Ethereum Index. ETHT doubles whatever the index returns on a given day, and ETHD provides the inverse of that.

Additionally, according to CoinDesk, Cathie Wood mentioned at the Consensus conference that the pricing of Bitcoin spot ETFs is so low (0.21%) that the company has not made any profit from this product. In response, professionals such as ETF Store President Nate Geraci have analyzed that due to the intense fee competition, which is far higher than anticipated, Ark decided to withdraw its application for an Ethereum spot ETF.

Ark Invest CEO Cathie Wood at Consensus in Austin, Texas. (Marco Bello/Getty Images, modified by CoinDesk)

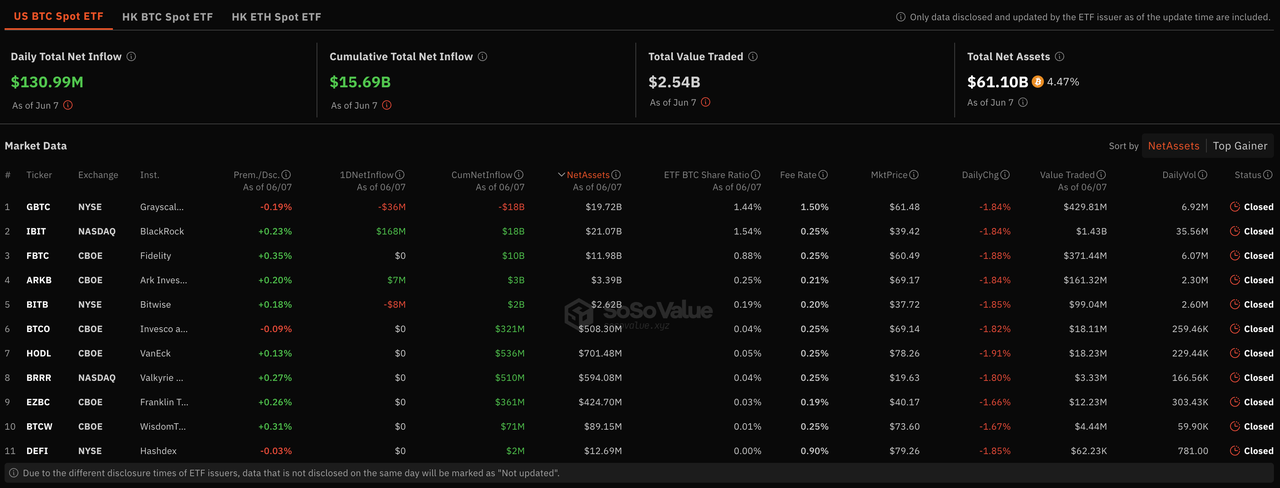

As of last week, the cumulative total net inflow for US BTC spot ETFs was $15.69 billion, with over $1.8 billion inflow over seven days. These ETFs had total net assets of $61.1 billion, representing 4.5% of BTC's market value. Over the past week, BTC spot ETFs experienced significant net inflows for five consecutive trading days. On June 4th, the Daily Total Net Inflow surged to over $886 million. Looking at single-day data from last Friday, Grayscale's GBTC had a net outflow of $36 million, while BlackRock's IBIT had a net inflow of $168 million.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

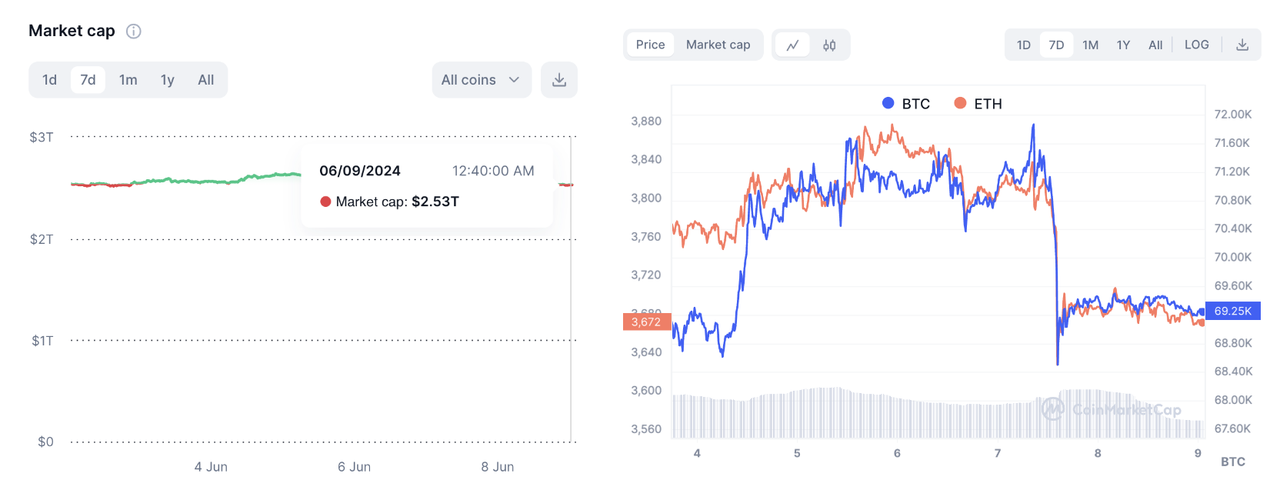

Last week, the total market capitalization of the cryptocurrency market remained stable, currently standing at $2.53 trillion. The progress of the Ethereum spot ETF has brought a new wave of capital into the crypto market. However, in the context of a high inflationary economic environment, crypto assets have yet to fully realize their potential. Particularly after the release of a stronger-than-expected U.S. employment report last Friday, both Bitcoin and Ethereum fell from their short-term highs. As of the early hours of June 9th, the spot price of Bitcoin was $69,253, remaining relatively flat over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,672, down nearly 3% over the same period. Additionally, the market capitalizations of Bitcoin and Ethereum were approximately $1.37 trillion and $441 billion, respectively, accounting for about 54% and 17% of the total market capitalization. The market share gap between Bitcoin and Ethereum has widened compared to last week.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

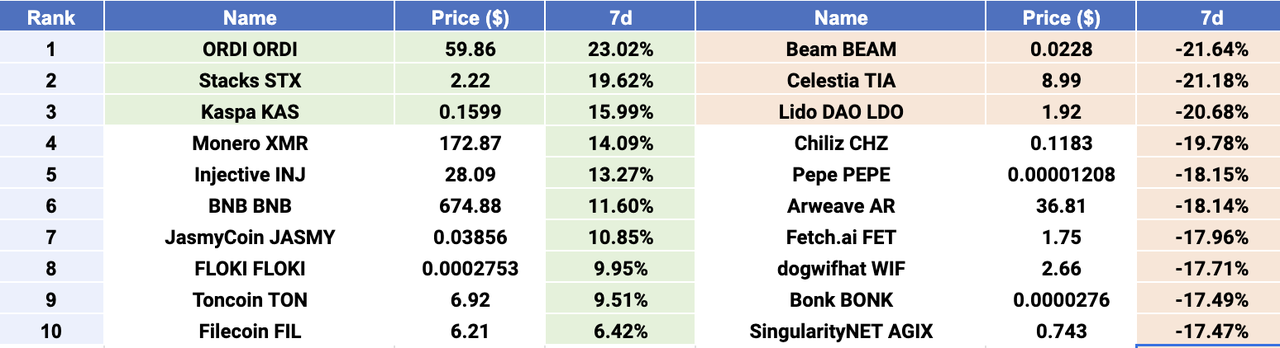

$NOT, $JASMY, and $TIA emerged as Top 3 gainers, while $UNI, $AKT, and $CORE were Top 3 losers. In the top 100 cryptocurrencies by market capitalization last week, projects within the Bitcoin ecosystem showed a positive trend during this sector rotation. Notably, $ORDI saw a nearly 60% increase over seven days, making it the biggest winner. Ordi is a Bitcoin derivative based on the BRC20 token standard. The BRC20 token standard is a new concept built on the Bitcoin Ordinals protocol, similar to Ethereum's ERC20 token standard. The second biggest gainer was $STX, the token of Stacks. As one of Bitcoin's Layer 2 solutions, Stacks enables smart contracts and decentralized applications to use Bitcoin as an asset and settle transactions on Bitcoin. Kaspa ($KAS), a proof-of-work (PoW) cryptocurrency implementing the GHOSTDAG protocol, also saw significant gains. The Kaspa blockchain operates as a blockDAG, a generalization of the Nakamoto consensus that allows secure operation while maintaining very high block rates (currently one block per second, with aims of 10/sec and dreams of 100/sec) and minimal confirmation times dominated by internet latency. Recently, Kaspa's trading volume surged, highlighting the large-scale adoption of $KAS.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

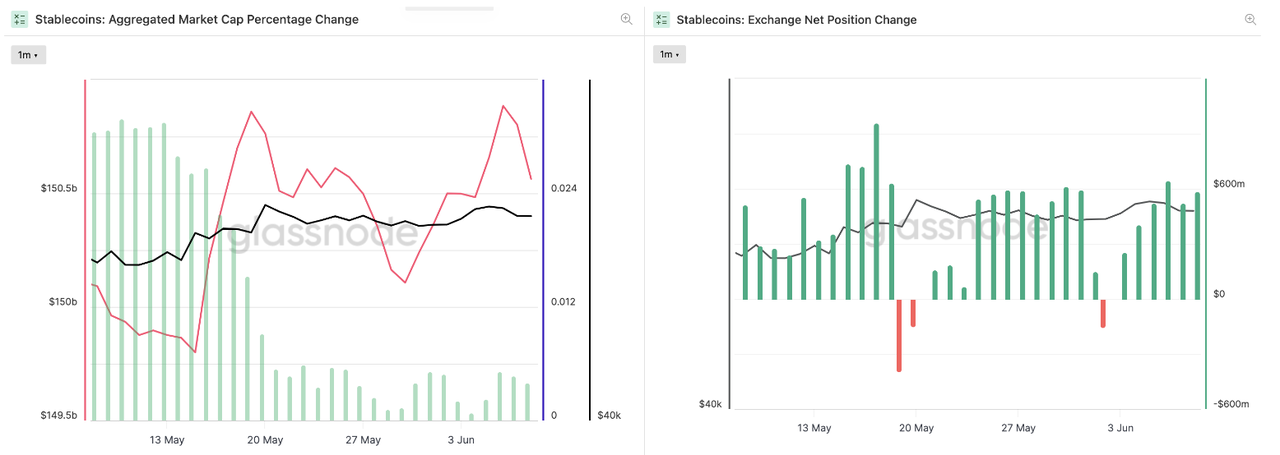

Last week, the total supply of stablecoins slowed in growth, remaining around $150.6 billion. Over the past seven days, the net change in stablecoin holdings continued to show a positive growth trend, although the growth rate has declined. This trend persisted despite a recent rebound in the cryptocurrency market. Furthermore, observing the net holdings of stablecoins on exchanges over the past week, the overall trend turned towards net inflows, indicating a reduced selling pressure on crypto assets and suggesting that the market remains in an upward phase.

Stablecoins Market Cap (Data: Glassnode)

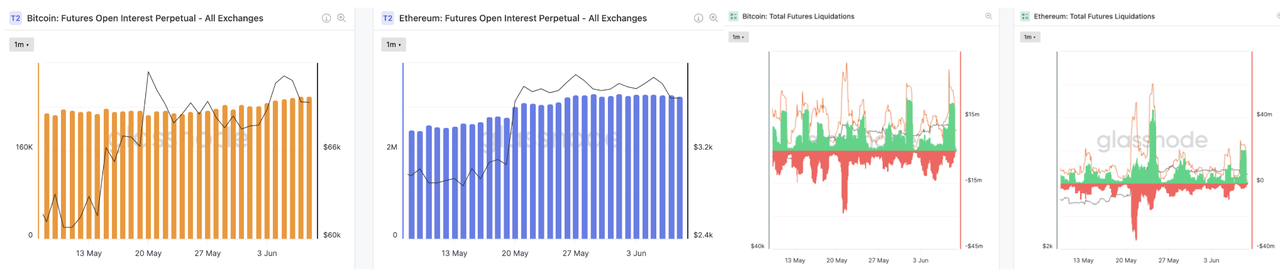

In the derivatives market, the open interest for Bitcoin and Ethereum perpetual contracts remained relatively stable over the past seven days. Despite a brief price drop for both Bitcoin and Ethereum starting last Friday, the capital in the perpetual contracts market did not diminish accordingly. Liquidation data shows that both Bitcoin and Ethereum liquidations were predominantly long positions, with total liquidations exceeding $15 million. This indicates that some investors made incorrect bets based on inflation data that will influence the Federal Reserve's rate adjustment decisions. Nevertheless, the perpetual contracts market remains active, reflecting investor optimism about the current market trend.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

In the decentralized finance (DeFi) market, the total value locked (TVL) held steady last week, breaking the $100 billion mark and reaching $106 billion. Over the past seven days, the trading volume on decentralized exchanges (DEXs) slightly decreased to $36.5 billion, a 23% drop from the previous week. The market share gap between DEXs and centralized exchanges (CEXs) slightly narrowed, with DEXs now accounting for about 20% of the total CEX trading volume. Among the top ten blockchain projects by TVL, performances were mixed over the past week, with no clear winners or losers. Solana, which saw gains in the previous week, fell by 5%, while BSC, which had declined, rose by 5%. Overall, TVL performance across various chains has been marked by volatility.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

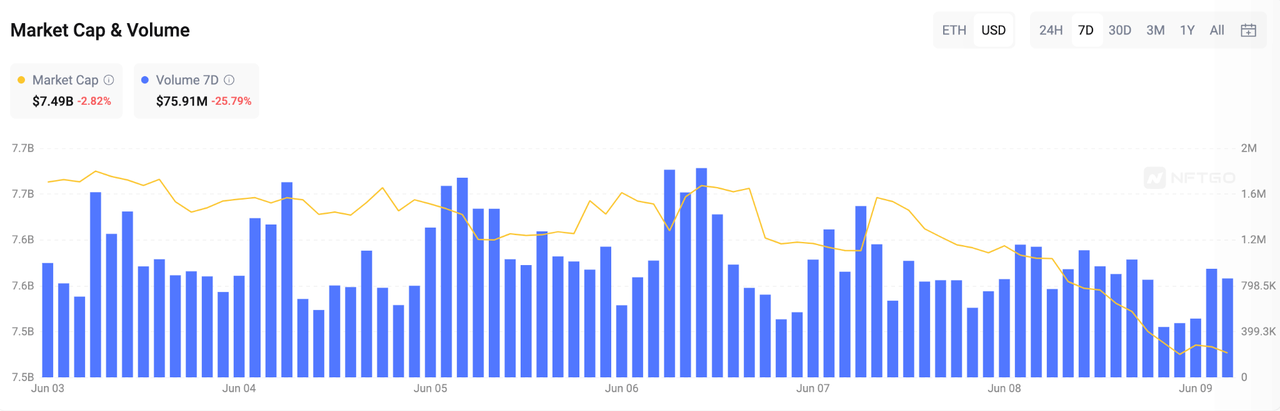

In the Ethereum non-fungible token (NFT) market, the total market value continued to decline by 3%, reaching $7.5 billion. Simultaneously, the total trading volume shrank by 26%, with the past seven days' volume just below $100 million, specifically $76 million. Among Ethereum's leading blue-chip NFT series, CryptoPunks saw a 9% drop in floor price and a 12% decrease in average price. Bored Ape Yacht Club, ranked second, experienced a 2% drop in both floor and average prices. Pudgy Penguins, currently third, saw its floor price decrease by 2% and its average price by 1%.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

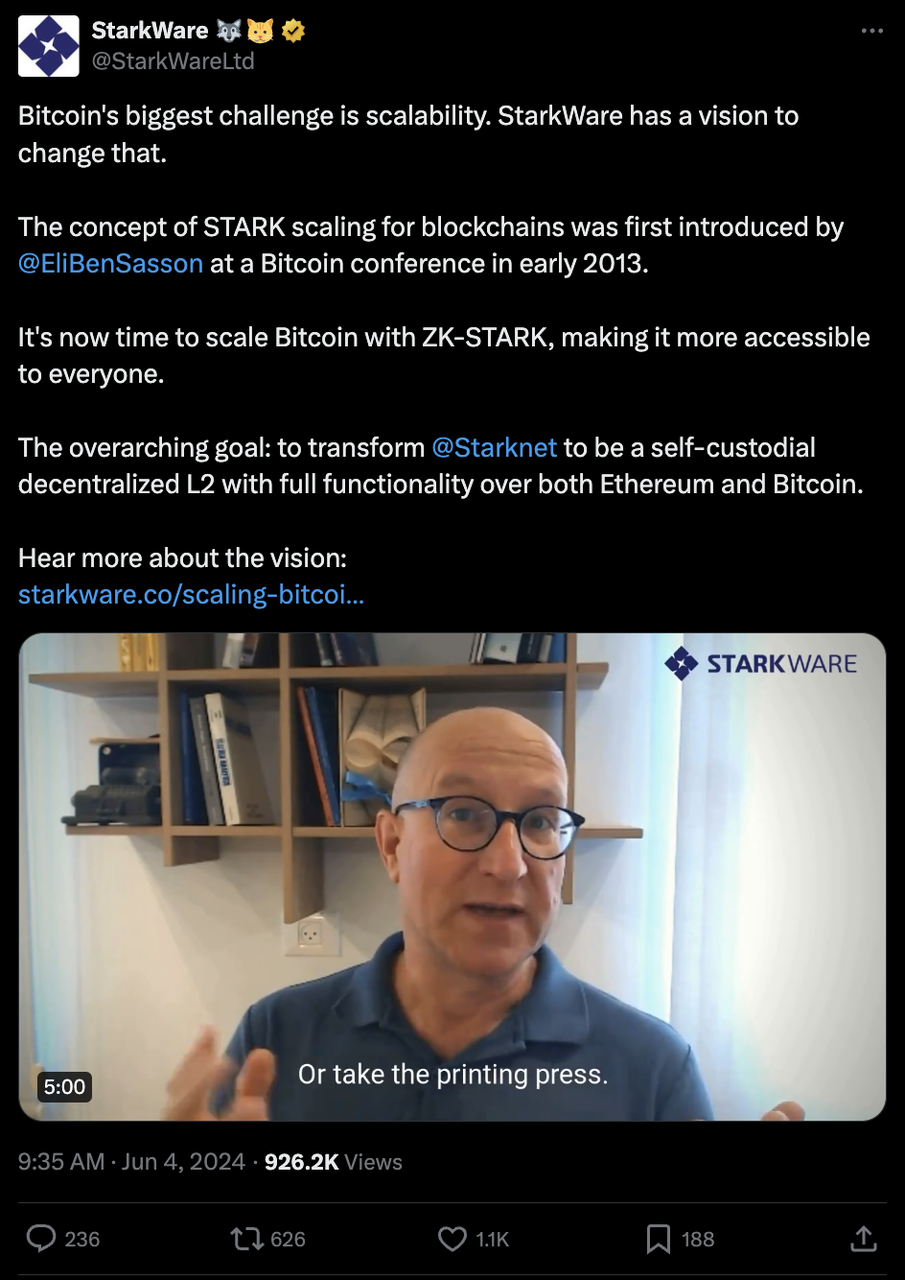

[Layer2] Starkware: Bitcoin's biggest challenge is scalability. StarkWare has a vision to change that. StarkWare has announced plans to support Bitcoin scaling, in addition to its existing support for Ethereum scaling. As part of this initiative, StarkWare will launch a $1 million applied research fund to support researchers and developers working on the OP_CAT proposal and its impact on Bitcoin. StarkWare stated that the OP_CAT technology proposal is sufficient for enabling Bitcoin to support STARK-based scaling solutions, and they publicly endorse OP_CAT.

In a clarification regarding their expansion into Bitcoin, Starknet emphasized that they will continue to focus on scaling Ethereum. Their consistent goal is to develop STARK proofs to enhance the scalability and integrity of the blockchains they support. Starknet clarified that they will not create a new layer or exclusive token for Bitcoin. Instead, they aim to function as an execution layer that scales both Bitcoin and Ethereum, with security, governance, and the ecosystem driven by the STRK token.

(Source: Twitter@StarkWareLtd)

[Layer2] Taiko enables permissionless sequencing and proving after mainnet rollout. Ethereum Layer 2 Taiko has enabled permissionless sequencing and proving following its mainnet rollout and token launch — claiming to become the first rollup to do so. Permissionless sequencing allows anyone to sequence Taiko blocks in a decentralized way, the team said, in contrast to other Ethereum rollups that currently rely on centralized sequencers to order their blocks, introducing various risks. In a process known as based sequencing, block ordering for Taiko is carried out by Ethereum mainnet validators and block builders, the project says. “This type of block ordering, created by Ethereum researcher Justin Drake, inherits liveness and security guarantees from Ethereum base layer,” Taiko said.

In terms of permissionless proving, participants can now spin up a Taiko node and prover to prove blocks and earn token rewards. “We’re super excited to become the first Ethereum rollup that opened up block sequencing to everyone,” Taiko co-founder and CEO Daniel Wang said. “We firmly believe that based sequencing, together with permissionless proving, is how all rollups should work. Having permissionless and decentralized sequencing and proving is an important step in our decentralization path but this is just the beginning.”

(Source: The Block)

[Layer2] zkSync Invites Teams to Advance the Decentralization of zkSync Era’s Prover. zkSync has announced significant milestones for its Prover Network. The roadmap includes: (1) Early Q3: Testing integration. (2) Mid to Late Q3: Completion of Phase 1 for proof verification. (3) End of Q3: Completion of Phase 2 for real-time proof verification. (4) Early Q4: Completion of Phase 3 for live test verification. (5) Q4: Completion of live verification. Additionally, zkSync has invited hardware teams to join the Prover Network.

On June 6th, zkSync also announced the deployment of v24 on the mainnet, enabling withdrawals and deposits through the native zkSync bridge.

(Source: zkSync)

[Layer2] IOTA’s EVM Mainnet Unleashed. On June 4th, IOTA announced the launch of its EVM Mainnet, marking it as a fully EVM-compatible Layer 2 solution on the IOTA network. Since its initial release on Shimmer in September 2023, this version has undergone significant improvements, testing, and audits.

The IOTA EVM introduces several key features, including: (1) Smart Contracts: Enabling complex and automated interactions within the network. (2) Cross-chain Functionality: Facilitating interactions and transactions across different blockchain networks. (3) Parallel Processing: Enhancing transaction throughput and efficiency. (4) Enhanced Security Against Miner Extractable Value (MEV): Implementing measures to improve the security of transactions. This release is a significant step towards integrating DeFi with real-world assets, showcasing IOTA's commitment to advancing blockchain technology.

(Source: IOTA)

[Polygon] Polygon Miden Alpha Testnet v2 is launched. According to an official announcement, Polygon has launched the Miden Alpha Testnet V2. The main updates in this new version include: (1) Added functionalities to make development more convenient. (2) Public accounts and Notes, allowing developers to transparently store account or note data. (3) A simpler and smoother Command Line Interface (CLI). (4) Introduction of SWAP Notes, expanding the range of content developers can create, along with the addition of Notes filters to enhance storage efficiency. (5) Increased data storage capacity and restructured notes.

(Source: Polygon)

[Bridge] Wormhole: Stake For Governance is now live for W token holders. Wormhole announced via Twitter that the "Stake For Governance" feature is now live. W token holders are required to cross-chain their W tokens to an EVM chain and stake them to participate in governance. Additionally, to ensure security, as part of the Wormhole Guardian's functionality, there is a daily transfer cap of 100 million W tokens from Solana to EVM chains.

(Source: Twitter@wormhole)

4 Key Fundraising Data

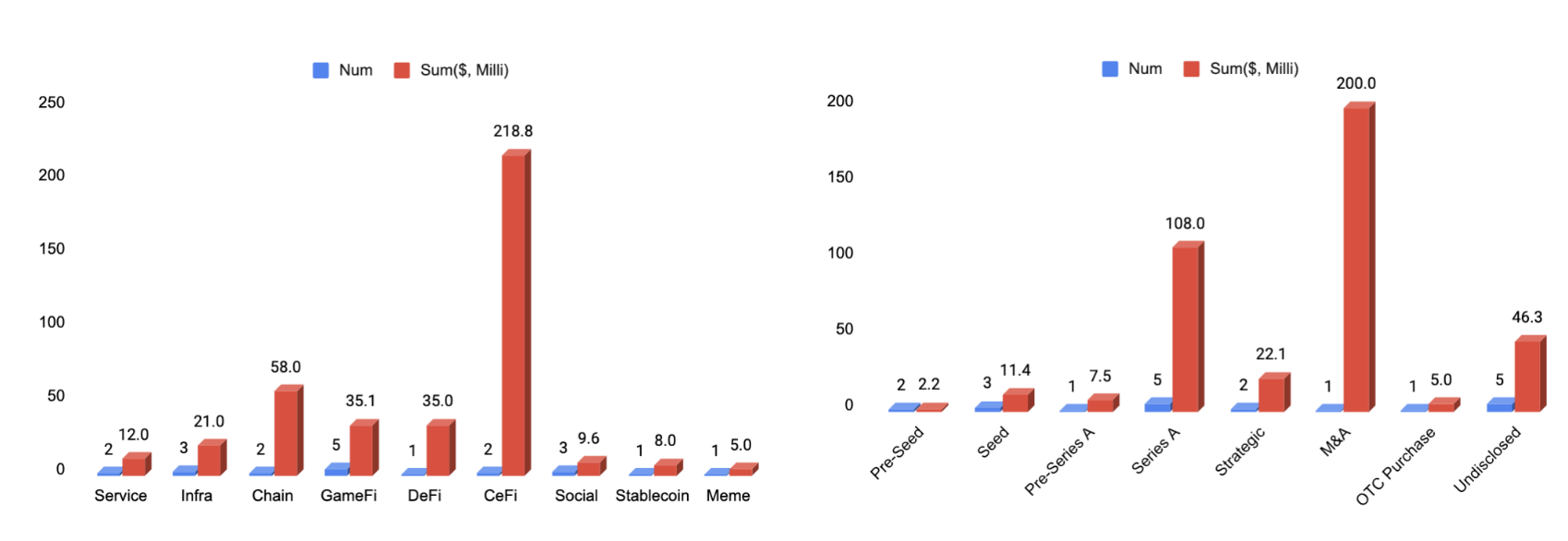

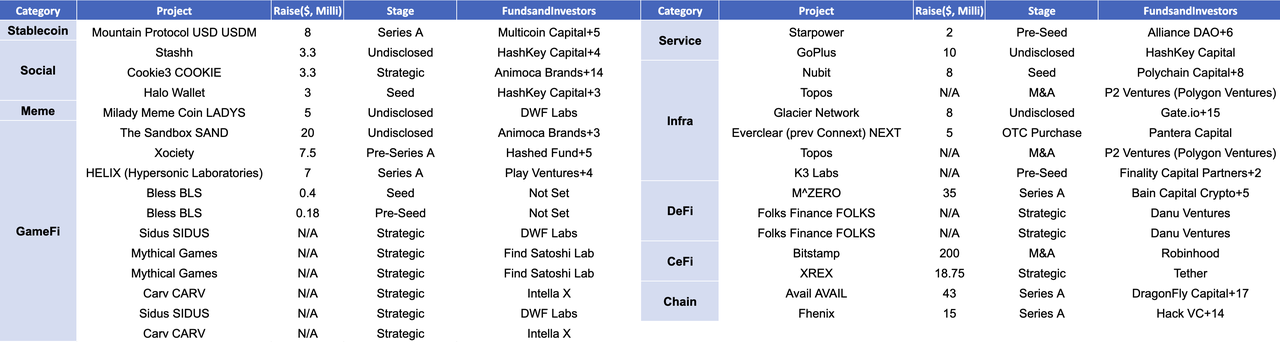

Last week witnessed a total of 31 financing events, raising a substantial amount of over $402.4 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The GameFi sector kept leading with the highest number of financing events, totaling 5. The CeFi (Centralized Finance) sector recorded the highest total funding amount, raising a total of $218.8 million, accounting for 54% of the overall financing. The largest financing event was led by Bitstamp, successfully raising $200 million. Bitstamp owns and operates a digital currency marketplace. More detailed information is provided below.

* 11 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [CeFi] Robinhood to Buy Crypto Exchange Bitstamp in Effort to Expand Outside the U.S.

Trading platform Robinhood (HOOD) has agreed to acquire crypto exchange Bitstamp as it looks to expand its crypto presence globally and attract institutional clients through new product offerings, the company announced Tuesday. The $200 million all-cash deal is expected to close in the first half of 2025, according to the press release. Barclays Capital and Galaxy Digital advised Robinhood and Bitstamp on the sale, the firms said.

“The acquisition of Bitstamp is a major step in growing our crypto business," said Johann Kerbrat, general manager of Robinhood Crypto "Bitstamp’s highly trusted and long standing global exchange has shown resilience through market cycles … Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood.”

Bitstamp is a U.K.-based crypto exchange that was founded in 2011 and quickly became one of the largest crypto exchanges in Europe. It currently offers spot trading of over 85 cryptocurrencies as well as other crypto products including institutional lending and staking, among others. It is one of the most regulated on the market, holding more than 50 licenses and registrations globally, according to the release. It also undergoes regular audits by a global Big Four accounting firm.

- Official Link: https://www.bitstamp.net/

2. [Chain] Polygon Spinoff Avail Raises $43M in Series A Funding.

Avail, a blockchain project known for its data availability network, announced Tuesday that it has raised $43 million in a Series A funding round led by Founders Fund, Dragonfly and Cyber Fund. The news comes three months after Avail, which spun out of Polygon in March 2023, shared it had raised $27 million in seed funding.

Data availability networks like Avail are used to help blockchains store information cheaply and in an easy-to-reference manner. The tech is particularly useful in the context of blockchain scaling, helping layer-2 "rollup" networks manage transaction data and other information without relying on the main blockchain layer. This offloading reduces the burden on the main chain, leading to lower costs for end-users.

The fresh round of capital will go towards building out Avail’s Unification Layer, “a cutting-edge modular technology stack that combines data availability, aggregation, and shared security to enable modular blockchains to scale and interoperate permissionlessly and securely,” Avail said in a press release. The team said the funds will also go towards developing Avail’s “Fusion Security” layer, which will take cryptocurrencies like ether (ETH) and bitcoin (BTC) to contribute to the security of the Avail ecosystem. The team previously said that Fusion is expected to go live in early 2025.

- Official Link: https://www.availproject.org/

M^0 (pronounced "M Zero"), a decentralized stablecoin minting protocol, has raised $35 million in a Series A funding round led by Bain Capital Crypto. Other investors in the round included Galaxy Ventures, Wintermute Ventures, GSR, Caladan and SCB 10X, M^0 said Wednesday. The project began raising for the round in late January and closed it in early May, Luca Prosperi, president of the M^0 Foundation Council.

The round was structured as equity plus tokens, with M^0 issuing its two "governance tokens" — POWER and ZERO — to investors, subject to a lock-in period, Prosperi said. He added that this lock-in period is in line with "prudent business and regulatory practices." He declined to comment on the valuation. M^0's Series A round comes over a year after it raised $22.5 million in a seed funding round led by Pantera Capital in April 2023. The Series A round brings M^0's total funding to $57.5 million. Prosperi noted that the demand for the Series A round was 2.5 times the amount raised.

- Official Link: https://www.m0.org/

4. [GameFi] The Sandbox Raises $20M at $1B Valuation, SAND Rises 4.5%.

Metaverse platform The Sandbox has raised $20 million at a $1 billion valuation as it looks to enhance its user-generated multiplayer gaming platform. Kingsway Capital and Animoca Brands led the funding round, which featured investment from LG Tech Ventures and True Global Ventures, according to a press release. In 2022, The Sandbox looked to raise $400 million at a $4 billion valuation.

A portion of the capital will be used to develop a decentralized metaverse for mobile devices, which is expected to launch in 2025. The Sandbox will also update its Game Maker and 3D editor tools. “McKinsey estimated that by 2030 the metaverse could add $5 trillion to the global economy," Yat Siu, co-founder of Animoca Brands, said. "Today, games like Minecraft and Roblox are some of the most popular titles in the world, but they do not provide their users with digital property rights. The Sandbox represents the evolution of UGC games for the age of digital ownership.” The Sandbox has 5.7 million user accounts connected to crypto wallets, and more than 1,000 user-generated experiences have been created since the Alpha version went live in November 2023.

- Official Link: https://www.sandbox.game/zh-CN/

See you next week! 🙌