*All on-chain data is dated as of 12:00 a.m. EST on Sunday, June 2nd.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(May.26-June.1).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #PCE #GDP #ETF #Layer2

ALEXANDRA CITRIN-SAFADI/WSJ; ISTOCK

1 Macro Market Overview

U.S. Stocks Log Monthly Gains. According to WSJ, a late-day rally drove the Dow up 575 points and helped all three major stock indexes finish May higher despite a recent swoon in technology stocks. Stocks opened Friday higher following the premarket release of the Federal Reserve’s preferred inflation gauge. The personal-consumption expenditures price index broadly matched Wall Street expectations, posting a 2.7% gain in April from a year ago. The Dow Jones Industrial Average added 1.5% to finish May up 2.3%. The S&P 500 gained 0.8% Friday to end the month 4.8% higher. The Nasdaq Composite shed less than 0.1% on Friday, the third straight daily decline for the tech-filled basket of stocks. The Nasdaq led major indexes higher in May, ending the month up 6.9%. In Europe, data showed core inflation accelerated in May. The European Central Bank is expected to start cutting rates next week, but stickier-than-expected inflation could force it to slow down the pace of further cuts. Europe’s Stoxx 600 rose 0.3% to finish May up 2.6%.

All three major U.S. stock indices closed lower last week. The tech-heavy Nasdaq Composite fell by 1.0%, while the Dow Jones Industrial Average and the S&P 500 declined by 0.8% and 0.3%, respectively. Web3-related stocks also performed poorly, with COIN dropping 4.3%, and MARA and MSTR falling by 7.5% and 9.2%, respectively.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

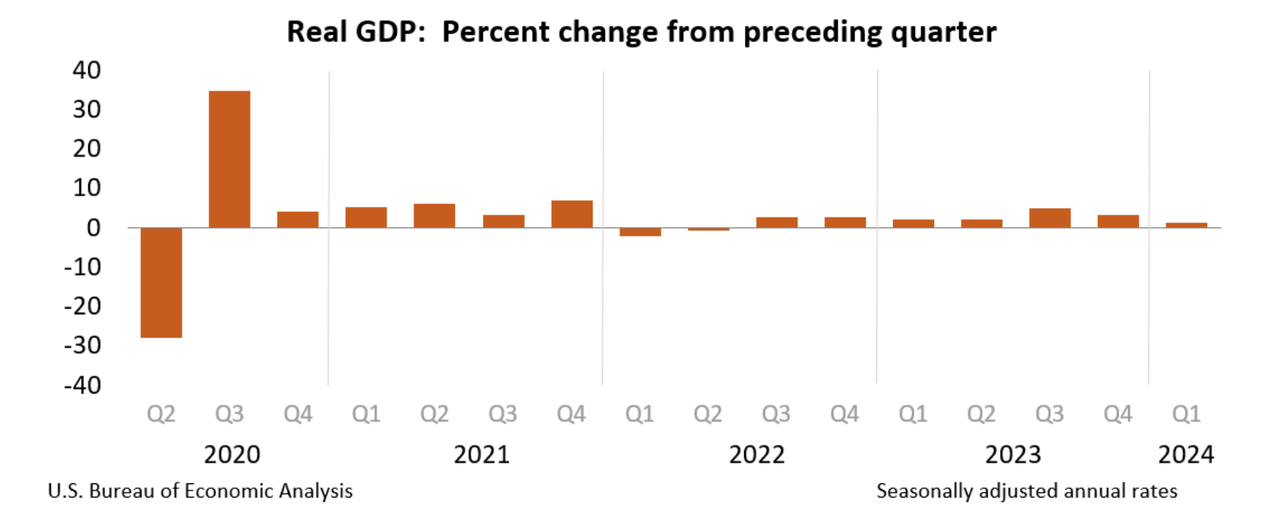

Real gross domestic product (GDP) increased at an annual rate of 1.3 percent in the first quarter of 2024, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent.

The GDP estimate released last week is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 1.6 percent. The update primarily reflected a downward revision to consumer spending.

The increase in real GDP primarily reflected increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

(Source: U.S. Bureau of Economic Analysis)

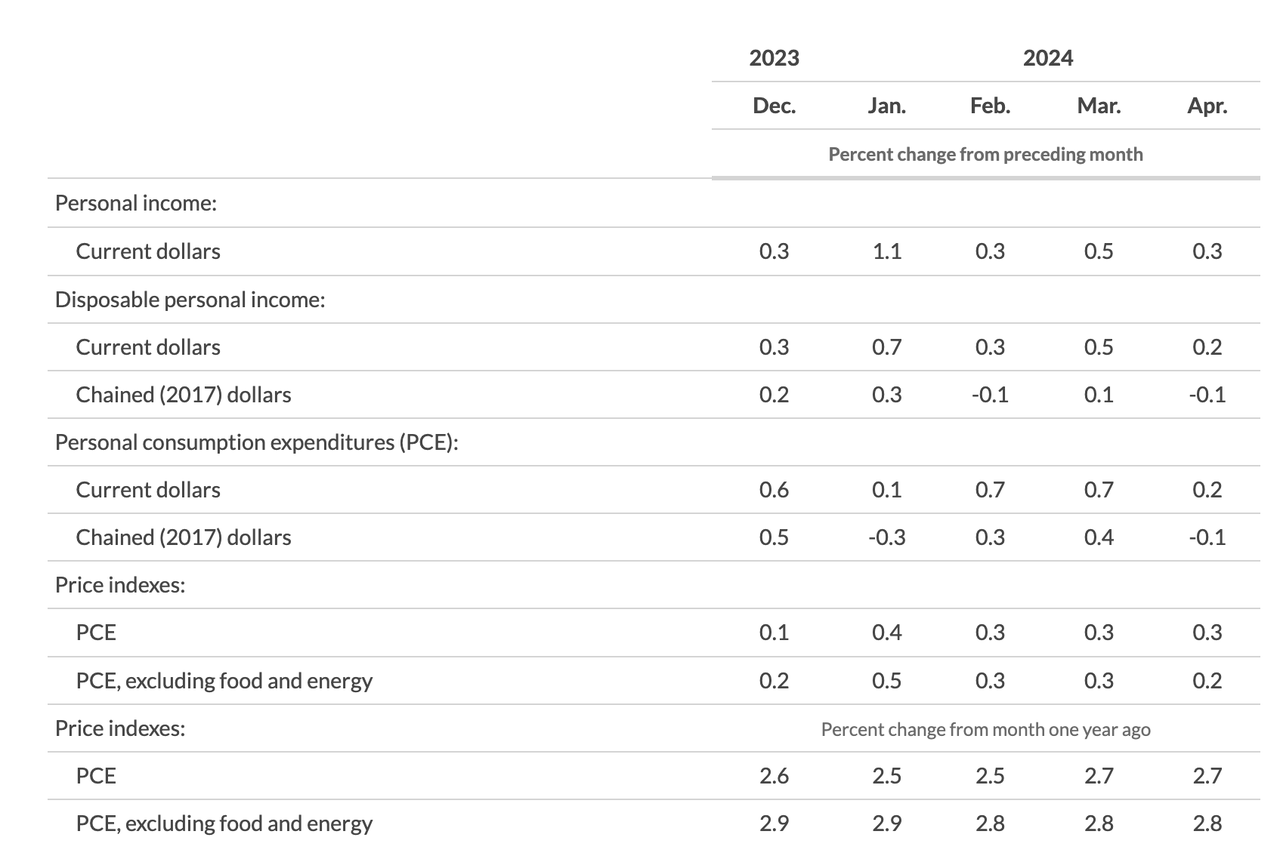

Personal income increased $65.3 billion (0.3 percent at a monthly rate) in April, according to estimates released last week by the Bureau of Economic Analysis. Disposable personal income (DPI) —personal income less personal current taxes—increased $40.2 billion (0.2 percent) and personal consumption expenditures (PCE) increased $39.1 billion (0.2 percent).

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI decreased 0.1 percent in April and real PCE decreased 0.1 percent; goods decreased 0.4 percent and services increased 0.1 percent.

(Source: U.S. Bureau of Economic Analysis)

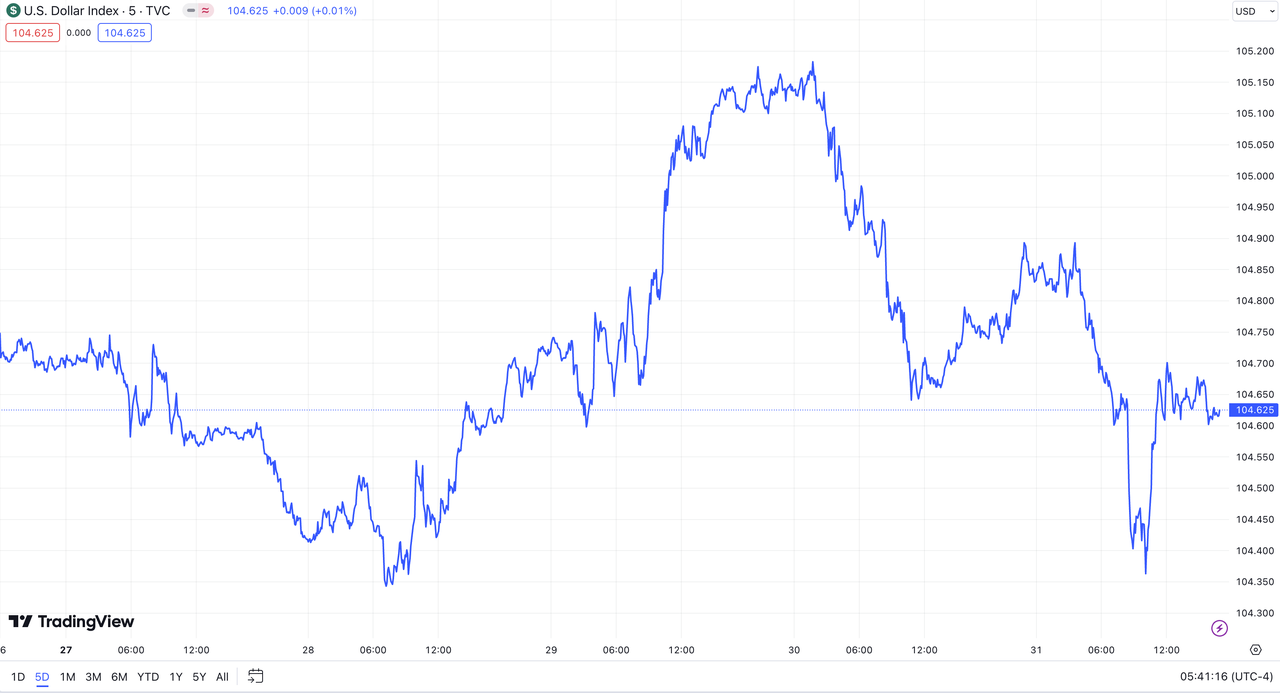

Last week, the US Dollar Index (DXY) showed a volatile downward trend, closing at 104.625 on Friday, lower than the previous week's 104.747.

DXY (Source: TradingView)

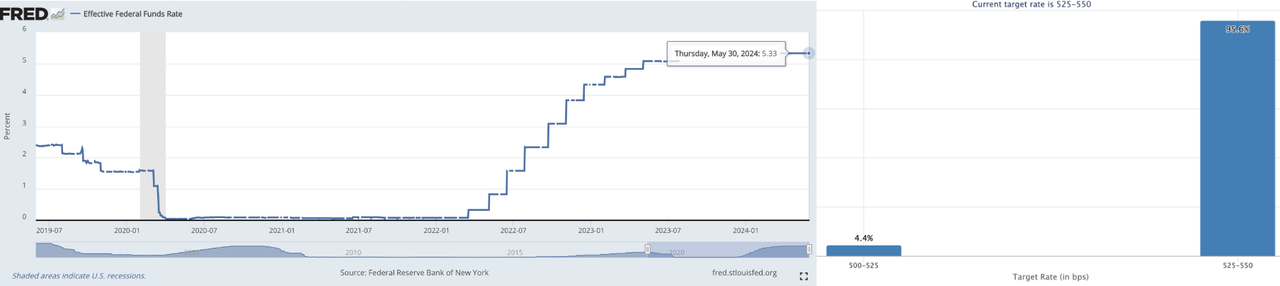

According to the latest data from the Chicago Mercantile Exchange (CME), due to the newly released easing inflation data last week, over 95% of investors believe that the upcoming June Federal Open Market Committee (FOMC) meeting will not see the first interest rate cut of the year. Additionally, nearly 4% of investors remain optimistic about a potential rate cut.

Left: EFFR, Right: Target Rate Probabilities for June 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

Treasury yields declined Friday. The yield on the benchmark 10-year note (US10Y) ended at 4.502%, down from 4.550% Thursday and the year-to-date high of 4.706% hit in late April.

US10Y (Source: TradingView)

BlackRock files amended S-1 registration statement for upcoming Ethereum ETF with more disclosures. BlackRock filed an amended registration statement for its proposed Ethereum fund, marking the latest move as firms work to list and trade their products. The world's largest asset manager filed its amended S-1 registration statement almost a week after the U.S. Securities and Exchange Commission approved 19b-4 forms for eight Ethereum ETFs, including BlackRock's proposed iShares Ethereum Trust. Issuers still need their S-1 statements to become effective before trading can begin. In the amended form, BlackRock disclosed information about its seed capital investor. "On May 21, 2024, the Seed Capital Investor, an affiliate of the Sponsor, subject to conditions, purchased the Seed Creation Baskets, comprising 400,000 Shares at a per-Share price equal to $25.00," BlackRock said in the revised filing, meaning the seed investment was $10 million. The asset manager also said the shares will be listed and traded under the ticker symbol "ETHA."

(Source: The Block)

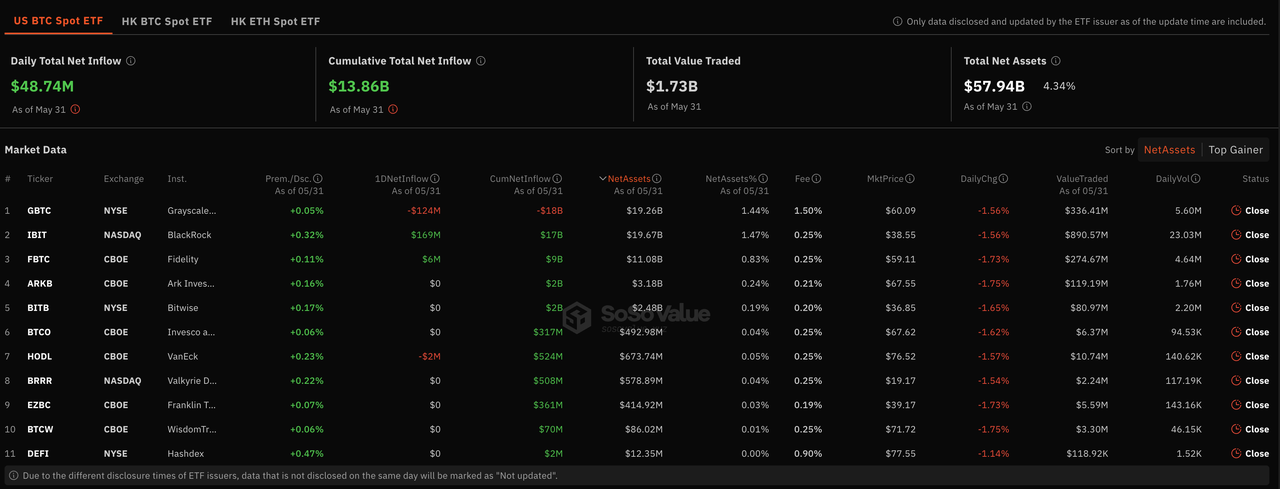

As of last week, the cumulative total net inflow for US BTC spot ETFs was $13.86 billion, with a $170 million inflow over seven days. These ETFs had total net assets of $57.9 billion, representing 4.3% of BTC's market value. Over the past week, BTC spot ETFs experienced significant net inflows for five consecutive trading days. Looking at single-day data from last Friday, Grayscale's GBTC had a net outflow of $124 million, while BlackRock's IBIT had a net inflow of $169 million, and Fidelity's FBTC had a net inflow of $6 million.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

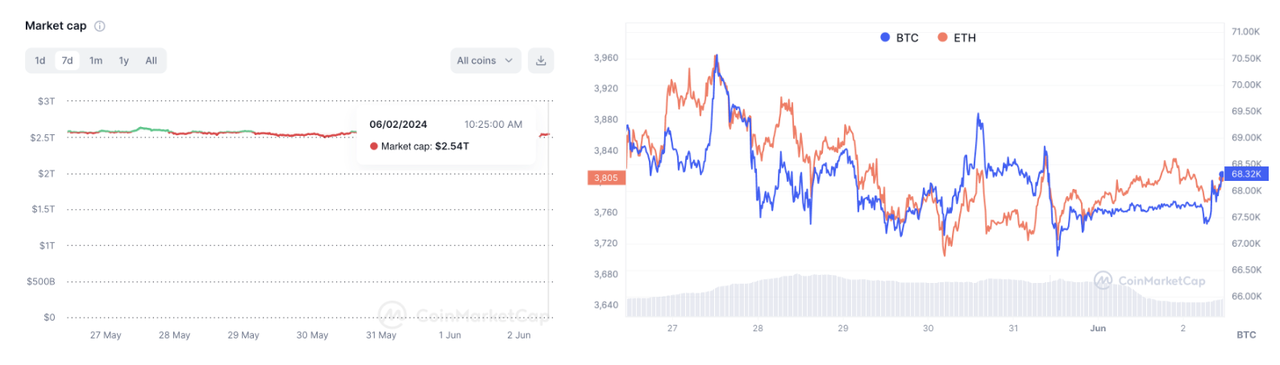

Last week, the total market capitalization of the cryptocurrency market experienced a correction after a rebound, with a net outflow of $30 billion over seven days, bringing the current total market cap to $2.54 trillion. The recent mild inflation data and progress with Ethereum spot ETFs have driven a new wave of capital into the crypto market. However, in the context of a high inflation economy, crypto assets have not yet fully realized their potential. As of the early hours of June 2, the spot price of Bitcoin was $68,113, a decline of nearly 2% over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,800, down nearly 1% in the same period. Additionally, the market capitalizations of Bitcoin and Ethereum were approximately $1.3 trillion and $459 billion, respectively, accounting for about 52% and 18% of the total market cap. The market share gap between Bitcoin and Ethereum is gradually narrowing.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

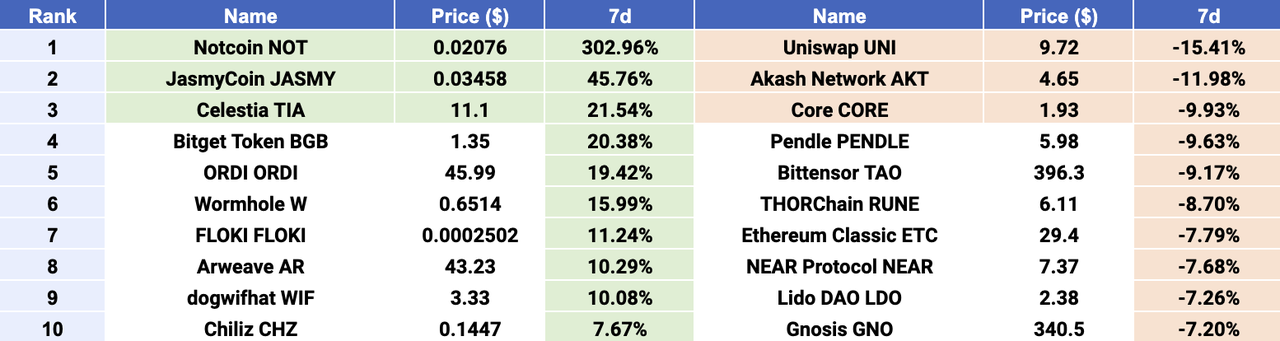

$NOT, $JASMY, and $TIA emerged as Top 3 gainers, while $UNI, $AKT, and $CORE were Top 3 losers. In the top 100 cryptocurrencies by market capitalization last week, the biggest winner, Notcoin, started as a viral Telegram game that onboarded many users into Web3 through a tap-to-earn mining mechanic. The recent surge in $NOT can be attributed to several factors. Firstly, its high traffic, with 5 million daily active users on Telegram, attracts more people to Web3 and has gained market popularity. Another significant factor is Binance's strategic decision to choose $NOT as the altcoin for the $TON ecosystem.

Jasmy is a blockchain project from Japan dedicated to restoring and protecting personal data control. Its native token, $JASMY, is based on Ethereum and is Japan's first legally compliant cryptocurrency. Jasmy combines traditional Internet of Things (IoT) and blockchain technology to provide a platform where users can fully control how and when their data is used. The recent price increase of $JASMY is also due to multiple factors. On one hand, the market has been active recently, with significant trading from previously dormant accounts possibly driving the price up. On the other hand, Jasmy’s combination of IoT and blockchain technology, emphasizing applications like data security and exchange in these fields, has contributed to the price growth.

Celestia ($TIA) is the first modular blockchain network that enables anyone to easily deploy their own blockchain with minimal overhead. Celestia scales by rethinking blockchain architecture from the ground up, introducing a new primitive called data availability sampling, which decouples execution from consensus. This allows developers to define their own execution and settlement environments, unlocking new possibilities for builders and developers. Last Wednesday, the native token $TIA rebounded from its low, increasing by over 30%. This followed an article by Celestia's founder, Mustafa, on the official forum about sovereign blockchains. He discussed how blockchain technology empowers communities to achieve sovereignty through self-organization and collective action. This innovation enables new social and economic models to emerge, and sovereign rollup chains further lower the barriers to community sovereignty.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

Last week, the growth rate of the total supply of stablecoins slowed, remaining around $150.3 billion. Over the past seven days, the net change in stablecoin supply continued to show a positive growth trend, although the net growth rate declined. Despite the recent rebound in the cryptocurrency market, stablecoin data trends typically lag behind. Additionally, observing the net holdings of stablecoins on exchanges over the past week, the overall trend has shifted to net inflows. This indicates that the selling pressure on cryptocurrency assets has decreased, and the market is currently in a rebound phase.

Stablecoins Market Cap (Data: Glassnode)

In the derivatives market, the open interest for Bitcoin and Ethereum perpetual contracts has increased over the past seven days. The strong price rebound of Bitcoin, and especially Ethereum, has attracted more investor capital into the perpetual contracts market. As Ethereum's price has risen recently, the open interest in its perpetual contracts has significantly increased, closely following the upward price trend. Liquidation data shows that Bitcoin's price movement last week failed to maintain the anticipated optimistic rise, resulting in a large number of long positions being liquidated. In contrast, Ethereum's liquidation data was relatively mild. This data indicates that investors remain optimistic about the current market trend, and the market is currently in a rebound phase.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

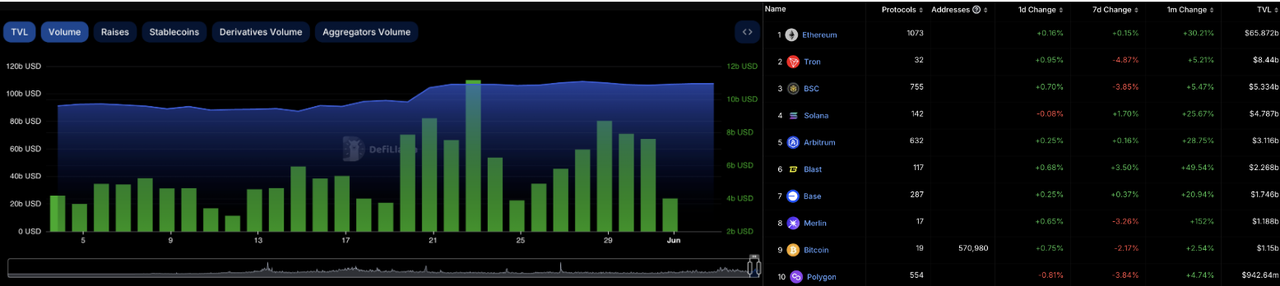

In the decentralized finance (DeFi) market, the total value locked (TVL) rebounded last week, surpassing $100 billion to reach $107 billion. Over the past seven days, the trading volume on decentralized exchanges (DEXs) slightly decreased to $45.8 billion, a 7% decline compared to the previous week. The market share gap between DEXs and centralized exchanges (CEXs) continues to widen, with DEXs now accounting for less than 17% of the total CEX trading volume. Among the top ten blockchain projects ranked by TVL, performance has been mixed over the past week. Notably, Solana and Ethereum's Layer 2 solution Blast showed slight gains, making them the top gainers over the past seven days. On the other hand, Tron and BSC experienced declines of approximately 5% and 4%, respectively, making them the top losers for the week.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

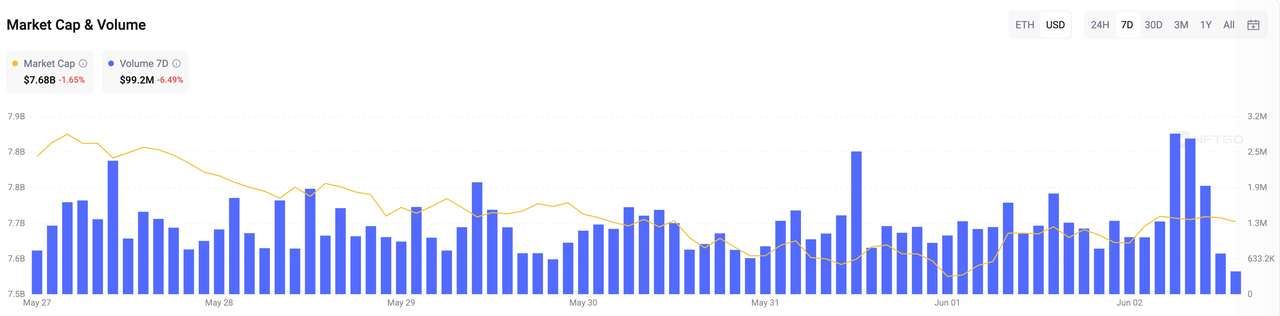

Last week, the market value of Ethereum non-fungible tokens (NFTs) continued to decline by 2%, reaching $7.7 billion. Simultaneously, the total trading volume decreased by 6%, with the past seven days' trading volume falling to just under $100 million. Among the leading blue-chip NFT collections on Ethereum, CryptoPunks saw a 3% decrease in its floor price, while the average price significantly rebounded by 78%. The second-ranked Bored Ape Yacht Club experienced a 3% drop in its floor price and a 2% decrease in its average price. Pudgy Penguins, currently ranked third, had a 2% decrease in its floor price and a 5% decline in its average price.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] Ethereum All Core Developers Consensus Call #134 Writeup. On May 30, Christine Kim summarized the 134th Ethereum Consensus Layer Core Developers Meeting (ACDC). The meeting mainly discussed the experiences and unresolved issues following the release of Pectra Devnet0. Additionally, there were discussions on expanding the Pectra upgrade to include peer DAS and SSZ container code changes.

Based on Pectra's release on Devnet0, client teams have agreed to keep the proof behavior affected by EIP7549 unchanged during the hard fork activation. Subsequently, developers discussed the pending issues of validator deposit finalization under EIP6110. Nimbus developer Etan Kissling suggested making some minor adjustments to the implementation of EIP7549, and no one opposed this change. During this week's call, developers weighed the addition of EIP7688 and PeerDAS in Pectra. Additionally, developers agreed to discuss incorporating EIP7688 into Pectra in the next ACDC call.

(Source: Galaxy)

[Layer2] Ethereum Layer 2 Taiko goes live on mainnet. Ethereum-based rollup Taiko has rolled out its Layer 2 mainnet after being in development since 2022 and undergoing seven testnets. Ethereum co-founder Vitalik Buterin proposed the inaugural block on Taiko’s mainnet, with metadata containing the names of every Taiko core contributor. Taiko is a based rollup — a type of rollup that relies on Ethereum block validators to sequence transactions, benefiting from the liveness and security assurances provided by the underlying layer.

At the initial stage, Taiko’s rollup protocol contracts on Ethereum are controlled by a multisig arrangement. The protocol initially requires SGX proofs, with a plan to transition to requiring 50% of blocks to use ZK proofs as part of its long-term scaling and security strategy.

(Source: Twitter@taikoxyz)

[Layer2] OP Labs launches beta version of Custom Gas Token feature. OP Labs has announced that the beta version of the Custom Gas Token feature is now live on OP Stack. Chain operators can enable this feature when deploying on L2 or L3 chains, allowing the use of ERC20 tokens other than ETH as gas fees. This functionality enables projects to deploy chains using their own tokens or community tokens as gas tokens. Blockchain game developers can also deploy their own chains, using custom gas tokens as in-game currency for players to pay gas fees.

(Source: Twitter@OPLabsPBC)

[Layer2] Scroll: Updated Session Zero Points and Opened Point System for USDC, USDT, wrsETH, and Tranchess Assets. On May 30th, Ethereum Layer 2 network Scroll announced on social media that Session Zero has opened up its points system for assets including USDC, USDT, Kelp DAO's wrsETH, and Tranchess. Users can now transfer assets to Session Zero using any supported bridging tool and begin earning point rewards. Points can be traced back to the genesis. Users can view the new points allocation by visiting the official website.

Earlier reports indicated that on May 16th, Ethereum Layer 2 network Scroll had launched the loyalty program Session Zero points system. Users who participated in the joint cross-chain points activity between StakeStone and Scroll can now query their accumulated points through the Scroll points system. Additionally, accumulated points from DeFi applications will soon be available.

(Source: Twitter@Scroll_ZKP)

[Solana] Solana validators to receive full priority fees as SIMD-0096 proposal gains approval. Solana validators voted in favor of Solana Improvement Documents (SIMD)-0096, a proposal to send all transaction priority fees to validators for the blocks they produce — instead of the previous 50/50 split between burning fees and rewarding validators.

This proposal aims to improve incentives around how validators receive priority fees, helping with network security. SIMD-0096 may also eliminate possible side deals between block producers and transaction submitters, improving incentives within the validator system.

(Source: The Block)

[Sui] Sui has partnered with Atoma Network to launch a verifiable reasoning network aimed at optimizing AI queries off the main blockchain. On May 30, according to official sources, Sui announced a partnership with the decentralized AI protocol Atoma Network to launch a verifiable reasoning network. This initiative aims to optimize AI queries off the main chain, reducing network load while still providing users with the necessary information.

The collaboration will also integrate AI into Sui's API and SDK, reducing the time required to use certain AI-driven applications. This integration could soon assist developers in creating no-code interfaces and AI-based natural language interactions.

(Source: Twitter@SuiNetwork)

4 Key Fundraising Data

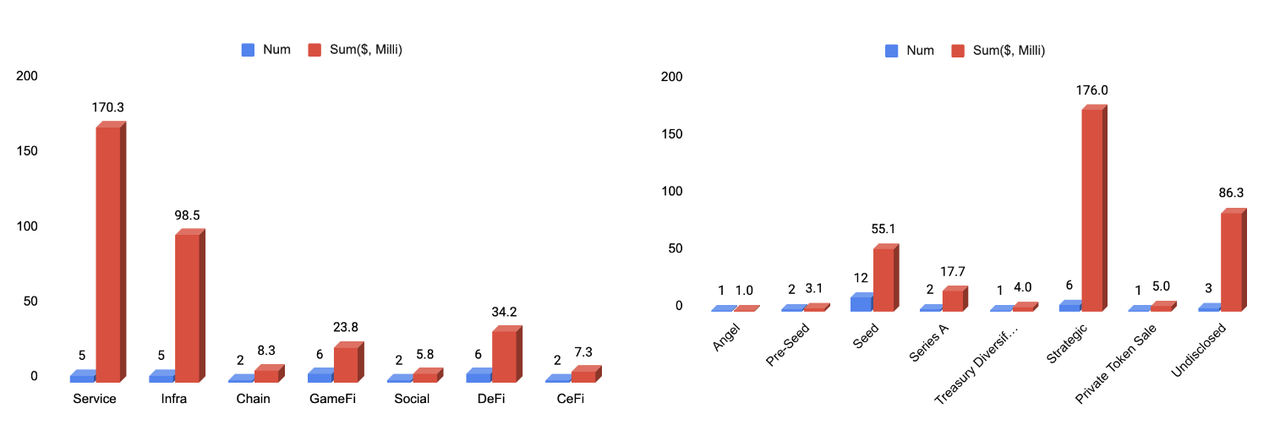

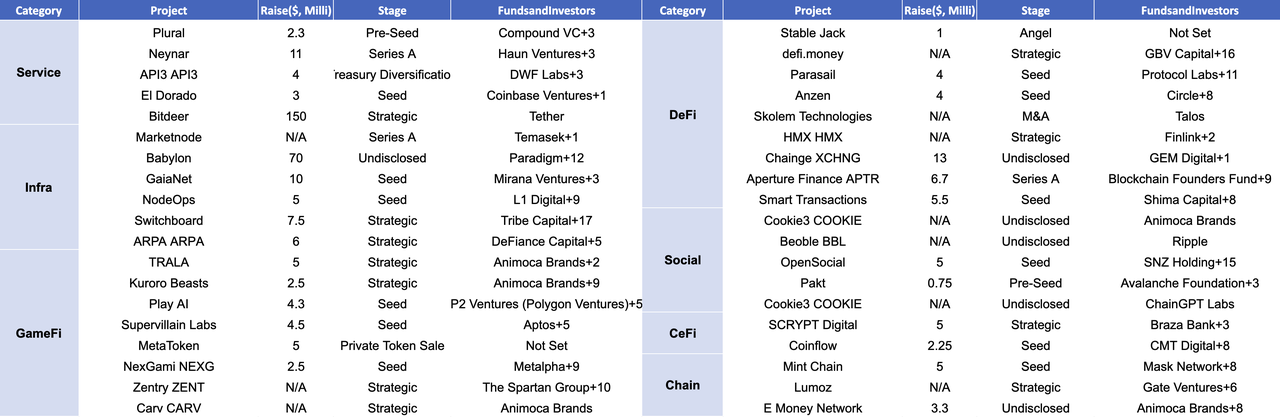

Last week witnessed a total of 38 financing events, raising a substantial amount of over $348.1 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The GameFi and DeFi sector led with the highest number of financing events, totaling 12. The Service sector also recorded the highest total funding amount, raising a total of $170.3 million, accounting for 49% of the overall financing. The largest financing event was led by Bitdeer, successfully raising $150 million. Bitdeer is a provider of digital asset mining services, offering reliable miner-sharing services, compliant global mining infrastructure, and efficient smart mining management. It caters to both experienced and novice users, enabling anyone to start mining with just one click. More detailed information is provided below.

* 10 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

On May 31, according to an official announcement, blockchain and high-performance computing technology company Bitdeer Technologies Group (Nasdaq: BTDR) announced that it has entered into a subscription agreement with Tether International Limited for a private placement. The placement involves 18,587,360 Class A ordinary shares and warrants to purchase up to an additional 5,000,000 shares at $10.00 per share. This private placement was completed on May 30, 2024.

The transaction generated total proceeds of $100 million from the stock issuance, with an additional $50 million possible if all the warrants are exercised. Bitdeer plans to use the net proceeds from this private placement to fund the expansion of its data centers, develop ASIC-based mining machines, and for working capital and other general corporate purposes.

- Official Link: https://twitter.com/BitDeerOfficial

Neynar, a company that provides tools for developers to build decentralized social networks, announced its Series A funding on Thursday. Haun Ventures led the $11 million raise for Neynar, with participation from a16z, CSX, Coinbase Ventures, and Union Square Ventures.

Most developers who currently use Neynar’s services are building social applications on Farcaster, although the company aspires to become the go-to inventory for developing on any social protocol. Farcaster is an open-source protocol with over 378,000 users who own and control their data; for developers, they can use it to build social applications without seeking permission from the network. Last week, it announced it has raised $150 million in funding, with a similar roster of participants to Neynar's.

- Official Link: https://neynar.com/

3. [Infra] Bitcoin Staking Project Babylon Raises $70M Led by Paradigm.

Bitcoin project Babylon has raised $70 million in funding to advance its plans to build a staking on the world's largest blockchain. The funding round was led by Paradigm and included contributions from Polychain Capital and the venture arm of crypto exchange Bullish (also CoinDesk's parent company).

Babylon offers bitcoin (BTC) as a staking asset, allowing proof-of-stake chains to acquire funding from the deep reserves stored in BTC. The aim of the project is to enhance the utility of billions of dollars worth of bitcoin otherwise sitting idle in user's wallets through providing them with yield. The latest funding round follows an $18 million raise in December.

- Official Link: https://babylonchain.io/

On May 27, cross-chain liquidity aggregator Chainge Finance announced that it has completed a $13 million funding round, with participation from GEM Digital, Alpha Token Capital, and others. The company stated that AI-powered intelligent trading and seamless cross-chain transactions for any token on any chain are coming soon. Chinge is dedicated to crafting a future where AI-powered cross-chain trading is not only efficient and secure but also accessible to all.

- Official Link: https://chainge.finance/

See you next week! 🙌