*All on-chain data is dated as of 12:00 a.m. EST on Sunday, May 26th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(May.19-25).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #ETH Spot ETF #Layer2

The Securities and Exchange Commission decision surprised the crypto community.

PHOTO: TIERNEY L. CROSS/BLOOMBERG NEWS

1 Macro Market Overview

U.S. Stock Indexes Book Records After Inflation Eases. According to WSJ, technology stocks helped push the S&P 500 higher Friday, capping off a rocky week in markets. The broad U.S. stock index and the tech-heavy Nasdaq Composite rose for a fifth straight week. The Dow Jones Industrial Average snapped a weekly winning streak that had lasted since mid-April. In daily trading Friday, the S&P 500 gained 0.7%, while the Nasdaq climbed 1.1% to a new record. The Dow added less than 0.1%, or about 4 points. Major indexes were on pace to finish May with their best monthly performances of 2024. The Dow industrials crossed 40000 for the first time last week a day after data showed a key measure of inflation had posted its smallest increase in years, suggesting price pressures haven’t reaccelerated. Looking forward, many investors are feeling upbeat. After a string of inflation reports came in hotter than expected, the report on April consumer prices helped calm investors’ nerves. The economy has remained robust, defying expectations that the Fed’s campaign against inflation would tip the U.S. into a recession.

However, some investors are bracing for the possibility of increased turbulence ahead, especially if price pressures don’t steadily subside. Survey data from the University of Michigan showed Friday that expectations for inflation edged up from a month earlier, remaining above the average from before the Covid-19 pandemic. On Thursday, worries about inflation were rekindled when a business report showed U.S. economic activity picked up pace this month. The S&P Global Flash U.S. Composite PMI—which measures activity in the manufacturing and services sectors—rose to 54.4 in May from 51.3 in April, its highest level in more than two years.

The three major U.S. Stock indices had mixed performances this week. The tech-heavy Nasdaq Composite Index rose by 1.4%, the S&P 500 edged up by 0.1%, while the Dow Jones Industrial Average fell by 2.3%. In contrast, Web3-related stocks performed excellently, with COIN surging by over 14.4% at one point, and MARA and MSTR rising by 9.3% and 6.9%, respectively.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

Last week, the US Dollar Index (DXY) showed a volatile upward trend, closing at 104.747 on Friday, higher than the previous week's 104.497.

DXY (Source: TradingView)

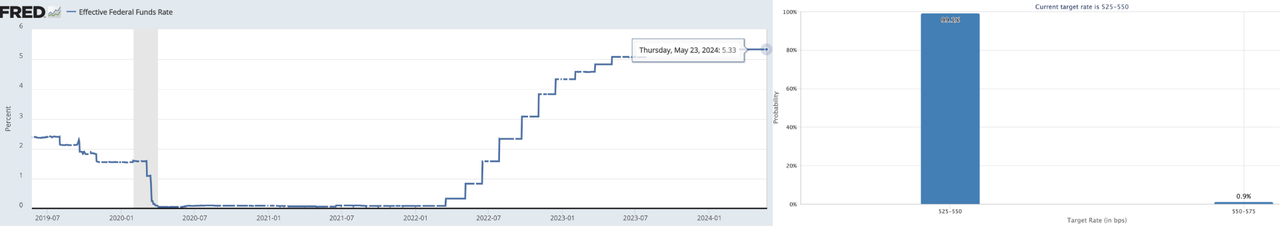

According to the latest data from the Chicago Mercantile Exchange (CME), due to the pressure from last week's new overheated inflation data, all investors believe that the upcoming June Federal Open Market Committee (FOMC) meeting will not see the first rate cut of the year. Additionally, nearly 1% of people believe there will be another rate hike.

Left: EFFR, Right: Target Rate Probabilities for June 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

Yields on government bonds rose for the week. The yield on the benchmark 10-year U.S. Treasury note (US10Y) climbed to 4.467% Friday, from 4.419% one week ago. The 10-year yield ticked down slightly from Thursday. Yields rise when prices fall.

US10Y (Source: TradingView)

SEC Widens Accessibility of Crypto Investing With Approval of ETFs for Ether. According to documents from the U.S. Securities and Exchange Commission (SEC) released on Thursday night, the SEC approved the 19b-4 forms for Ethereum ETFs from eight issuers: BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton. ETF issuers still need to activate their S-1 registration statements before they can start trading. It is currently unclear how long this process will take, but some analysts speculate it could take several weeks. In the meantime, VanEck has promptly submitted a revised S-1 application for an Ethereum spot ETF. BlackRock's spot Ethereum ETF is already listed on the DTCC website under the ticker symbol ETHA.

(Source: Twitter@JSeyff)

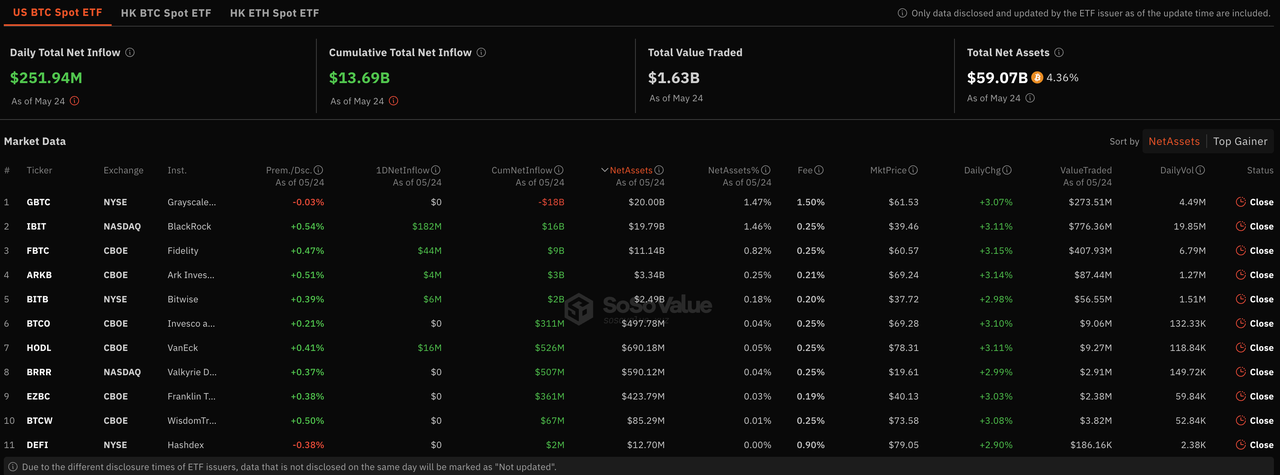

As of last week, the cumulative total net inflow for US BTC spot ETFs was $13.7 billion, with a $1.1 billion inflow over seven days. These ETFs had total net assets of $59.1 billion, representing 4.4% of BTC's market value. Over the past week, BTC spot ETFs experienced significant net inflows for five consecutive trading days, reaching a peak single-day net inflow of $305.7 million on Tuesday. Looking at single-day data from last Friday, BlackRock's IBIT had a net inflow of $182 million, while Fidelity's FBTC had a net inflow of $44 million, ranking second.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

Last week, the total market capitalization of the cryptocurrency market continued to rise, with inflows exceeding $160 billion over seven days, pushing the current total market value to $2.57 trillion. Despite expectations of recent rate cuts by the Federal Reserve being dashed by overheated economic conditions, the approval of an Ethereum spot ETF by the SEC ushered in another wave of gains for the crypto market. As of the early hours of May 26th, the spot price of Bitcoin was $69,215, up nearly 3% over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,870, marking an increase of over 20% during the same period. Additionally, the market capitalizations of Bitcoin and Ethereum were approximately $1.36 trillion and $457 billion, respectively, accounting for about 53% and 18% of the total market value. The gap in market share between Bitcoin and Ethereum has narrowed.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

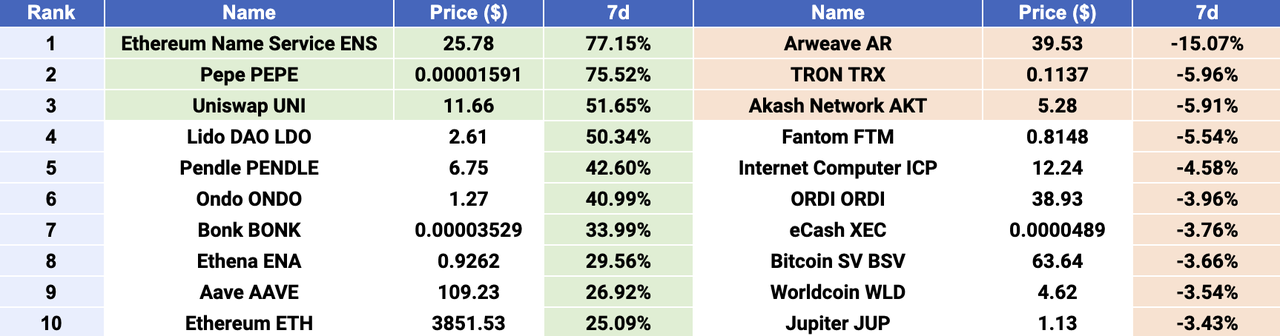

$ENS, $PEPE, and $UNI emerged as Top 3 gainers, while $AR, $TRX, and $AKT were Top 3 losers. In the top 100 cryptocurrencies by market capitalization last week, most winners were closely tied to Ethereum, driven by the positive impact of the ETH Spot ETF. Among them, the biggest winner was Ethereum Name Service ($ENS). ENS is a distributed, open, and extensible naming system based on the Ethereum blockchain. It converts human-readable Ethereum addresses like john.eth into machine-readable alphanumeric codes, similar to those used in wallets like Metamask. The reverse conversion, associating metadata and machine-readable addresses with human-readable Ethereum addresses, is also possible. After Ethereum founder Vitalik Buterin posted positive content related to $ENS on Twitter last week, $ENS saw a surge of over 77% in seven days. The second-place winner, $PEPE, is an Ethereum-based deflationary meme coin inspired by the Pepe the Frog internet meme. It surged over 75% last week, reaching a new high. The third-place winner, Uniswap, is a popular decentralized trading protocol known for facilitating automated trading of decentralized finance (DeFi) tokens. As an example of an automated market maker (AMM), Uniswap launched in November 2018 but gained considerable popularity this year due to the DeFi phenomenon and the associated surge in token trading. The rise in $UNI tokens may be related to the Uniswap Foundation's announcement of a governance dividend vote scheduled for May 31st.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

Last week, the growth rate of the total supply of stablecoins slowed down, remaining at around $150.5 billion. Over the past seven days, the net change in the supply holdings of stablecoins continued to show a positive growth trend, albeit with a decrease in the net growth rate. Despite the positive impact of events such as the approval of the ETH spot ETF on the cryptocurrency market last week, the data trends for stablecoins often lag behind. Additionally, observing the net holdings of stablecoins on exchanges over the past week, the overall trend has shifted from net outflows to net inflows, indicating that the cryptocurrency market has ended its brief consolidation phase and is beginning to rebound once again.

Stablecoins Market Cap (Data: Glassnode)

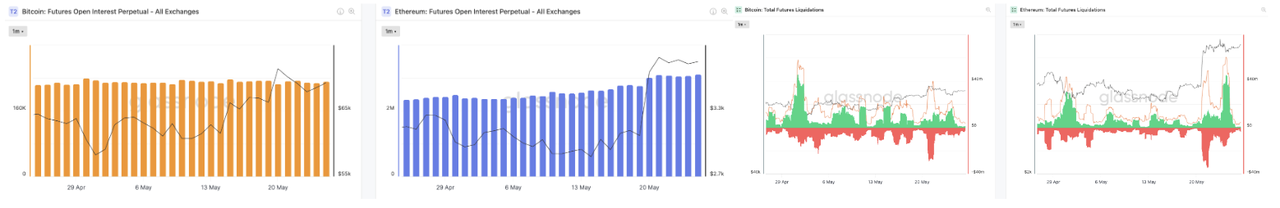

In the derivatives market, over the past seven days, the open interest for Ethereum perpetual contracts saw a significant increase, while the open interest for Bitcoin perpetual contracts remained stable. With Ethereum experiencing a strong rally of nearly 20% last week, the open interest for its perpetual contracts surged. Observing the liquidation data from last week, the short positions for both Bitcoin and Ethereum were heavily liquidated following the initial surge caused by the approval of the ETH spot ETF. However, the subsequent price action did not see the expected further increase, resulting in the liquidation of a significant number of long positions. The data indicates that investors remain optimistic about the current market trend, and the market is currently in a rebound phase.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

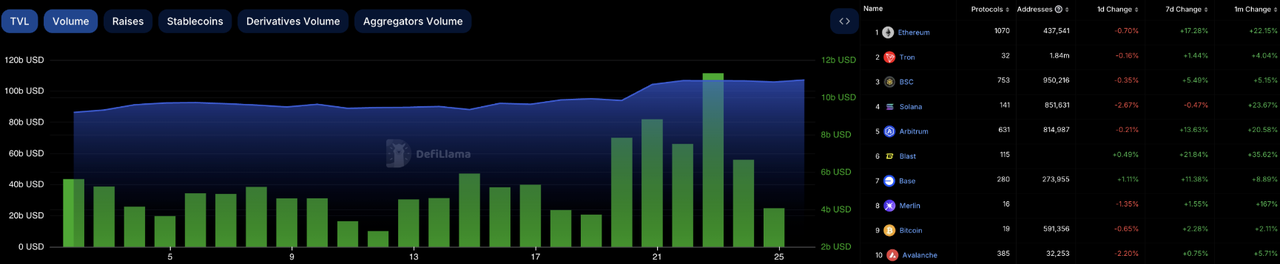

In the decentralized finance (DeFi) market, the total value locked (TVL) rebounded last week, reaching $107.2 billion currently. Over the past seven days, the trading volume on decentralized exchanges (DEXs) saw a slight increase, reaching $49.9 billion, representing a growth of over 54% compared to the previous week. The market share gap between DEXs and centralized exchanges (CEXs) widened, with DEXs now accounting for 17% of the total CEX trading volume. Among the top ten blockchain projects ranked by TVL, most projects saw an increase in TVL over the past week. Particularly, Ethereum-based public chains witnessed significant TVL increases last week, with Ethereum, Arbitrum, Blast, and Base increasing by over 10% respectively.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

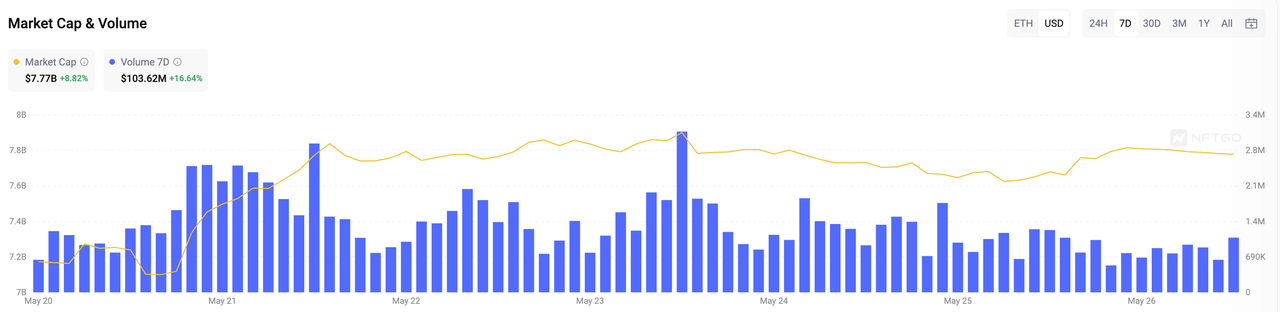

Last week, the market value of Ethereum-based non-fungible tokens (NFTs) rebounded by 9%, reaching $7.8 billion. At the same time, the total trading volume increased by 17%, with a trading volume of $104 million over the past seven days. In Ethereum's leading blue-chip NFT collections, the floor price of CryptoPunks decreased by 8%, while the average price increased by 21%. The floor price and average price of the second-ranked Bored Ape Yacht Club decreased by 10% and 6%, respectively. The floor price of Pudgy Penguins decreased by 6%, with the average price also declining by 6%, currently ranking third.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] The Ethereum Pectra upgrade plan is scheduled for the first quarter of 2025. According to an article by ETH Daily, the Ethereum Pectra upgrade plan is set for the first quarter of 2025, and it is expected to include EOF, PeerDAS, EIP-7702, and other proposals. Pectra comprises the Prague upgrade for the execution layer and the Electra upgrade for the consensus layer. The final scope of the upgrade is still under discussion, with possible changes including the postponement of Verkle to the Osaka hard fork.

(Source: Ethereum Blog)

[Layer2] ZkSync planning on token generation last week with airdrop in middle of June. According to The Block, Two sources familiar with the matter have informed The Block that ZkSync plans to conduct its Token Generation Event (TGE) this week, with token issuance, including airdrops, to occur within 30 days after the TGE. The total token supply is reported to be 21 billion. According to internal screenshots seen by The Block, ZkSync's current target for the airdrop is around June 13th, with the company noting that this will take place before the Blast token airdrop on June 26th.

Cross-chain infrastructure Polyhedra Network has expressed concerns over ZkSync appropriating its intended token name. The Polyhedra Network (ZK) token was launched on OKX spot and OKX Jumpstart in March. Earlier, sources mentioned that ZkSync desired to use ZK as its token name, but encountered issues due to Polyhedra Network already claiming the name. They noted that ZkSync can still proceed with ZK and emphasized that Binance has yet to list Polyhedra's token. Additionally, Bybit has announced changes to Polyhedra Network's token name and declared the listing of ZkSync (ZK) spot trading.

(Source: The Block)

[Layer2] Bitlayer announced the upcoming Mining Gala. The Bitcoin native Layer 2 network, Bitlayer, has announced the upcoming Mining Gala, which will last for two weeks. The event will take place from May 27th to June 10th. According to official statements, this event is initiated by Bitlayer in collaboration with seven other projects, namely Lorenzo, Bitsmiley, Avalon, Bitcow, Pell, Enzo, and Bitparty. It will feature a token airdrop with a total value of $23.24 million, with most projects expected to conduct their Token Generation Events (TGE) within 1-2 months. Additionally, the seven participating projects have committed to distributing 100% of the token rewards obtained from the Bitlayer Dapp leaderboard competition to users.

(Source: Twitter@BitlayerLabs)

[Layer2] Layer-2 Network Starknet Gets Ethereum Virtual Machine With Zero-Knowledge Proofs. StarkWare, the main developer firm behind the layer-2 blockchain Starknet, shared Wednesday plans for its own zero-knowledge rollup compatible with the existing Ethereum infrastructure, a setup commonly known as a zkEVM. The zkEVM, called Kakarot, already in testing, will be available via the Starknet Stack, a set of software tools that make it easier for developers to spin up their own customized application-specific chains.

Starknet already has its own zero-knowledge virtual machine (zkVM), but using a programming language called Cairo. With the zkEVM, developers will instead be able to code with Solidity, the most common programming language for Ethereum smart contracts, making the Starknet blockchain more accessible to a broader array of project builders. Kakarot is currently in a “public whitelist” phase, according to a press release seen by CoinDesk. This means that only a select few developers will have access to the Kakarot zkEVM before it hits the mainnet, to test out new protocol changes.

(StarkWare CEO Eli Ben-Sasson, speaking at ETHDenver last Thursday. (Danny Nelson))

[Solana] Solana eyes 2025 for Firedancer rollout as DePIN activity surges. Solana plans to release a full version of the Firedancer upgrade in 2025, with “pared-down versions” rolling out before then, according to Solana Foundation’s DePIN lead, Kuleen Nimkar. The upgrade aims to increase Solana’s overall reliability and scalability as network activity from decentralized infrastructure protocols continues to grow. “We’re seeing a ton of up-and-coming deep-end projects that are doing everything,” Kuleen said of DePIN activity at DEFICON on May 23.

DePIN, or decentralized physical infrastructure networks, refers to the use of blockchain to manage and operate physical infrastructure systems. According to Kuleen, DePIN use cases in the Solana ecosystem range from protocols working on decentralized energy solutions - with homeowners creating interconnected virtual power plants - to GPU networks and data collection. For example, some projects incentivize users to install browser extensions that crawl the internet and gather data to train large language models. Protocols pumping DePIN activity onto Solana include Helium, Hivemapper, and Render. Data from Dune Analytics shows a surge in Hivemapper’s ‘mappers’ in 2024, from around 30,000 drivers connected to nearly 67,000 in May.

(Kuleen Nimkar, lead of DePIN at the Solana Foundation. Source: DEFICON)

[EOS] The EOS Network Foundation announced on May 22nd that Spring Beta-1 has been launched on testnet. On May 22nd, the EOS Network Foundation announced that Spring Beta-1 has been launched on the testnet. It's reported that Spring 1.0 utilizes the Savanna consensus algorithm to provide instant finality for transactions, leading to over a 100-fold improvement in the speed and efficiency of the EOS network compared to previous versions.

Additionally, Spring 1.0 introduces potential enhancements such as aggregated BLS signatures and the development of zero-knowledge proof systems, collectively enhancing the privacy and security of the blockchain.

(Source: EOS Network)

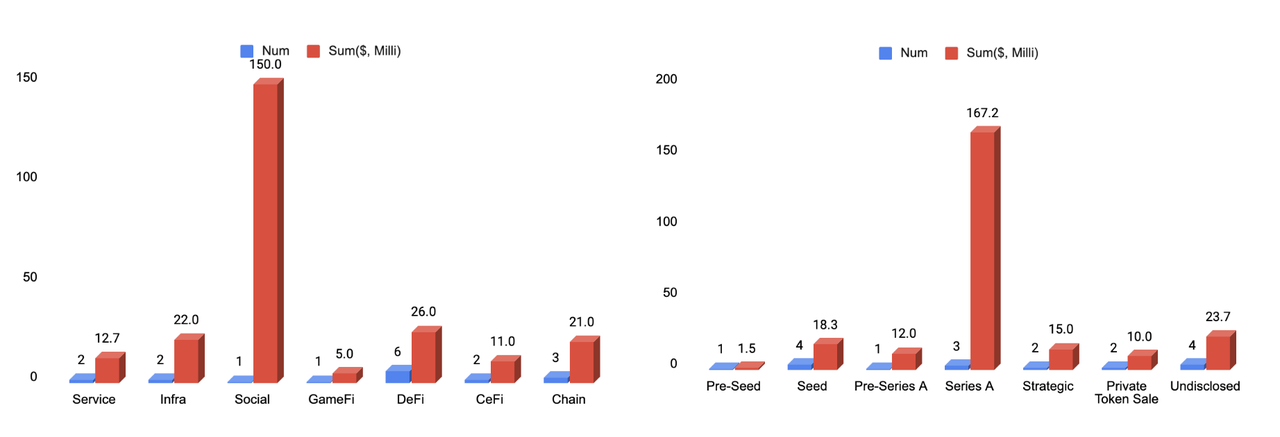

4 Key Fundraising Data

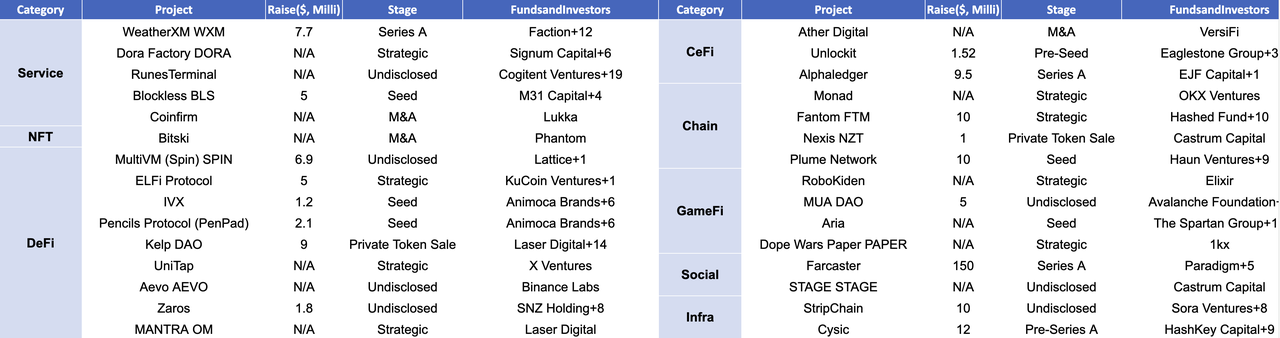

Last week witnessed a total of 30 financing events, raising a substantial amount of over $247.7 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The Chain sector led with the highest number of financing events, totaling 3. The Social sector also recorded the highest total funding amount, raising a total of $150 million, accounting for 60% of the overall financing. The largest financing event was led by Farcaster, successfully raising $150 million. Farcaster is a sufficiently decentralized protocol for building social apps. Sufficient decentralization means that two people who want to communicate can always do so. It also means developers have permissionless access to public data on the network. More detailed information is provided below.

* 13 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [Social] Farcaster recently completed a $150 million Series A funding round led by Paradigm.

Recently, the star product in the decentralized social media sector, Farcaster, completed a $150 million Series A funding round led by the established Web3 investment firm Paradigm, achieving a valuation of $1 billion. In addition, several well-known crypto investment firms, including a16z crypto, Haun Ventures, USV, Variant, and Standard Crypto, also participated in the funding round.

According to Rootdata, this investment in Farcaster marks Paradigm's latest bet in the SocialFi sector following its seed round investment in friend.tech. This also represents a16z's first investment in a decentralized social network.

- Official Link: https://www.farcaster.xyz/

2. [Chain] Fantom developers introduce foundation for Sonic, close $10 million strategic round.

The Fantom Foundation announced its plans to establish the Sonic Foundation and Sonic Labs ahead of the rollout of its Sonic blockchain. Associated with this new chain, the Sonic Foundation will manage governance and treasury, while Sonic Labs will focus on the development of decentralized applications across the network. Still under development, Sonic is designed to be a high-performance blockchain with sub-second finality. It represents the next evolution of the existing Opera network by Fantom.

Additionally, the Fantom Foundation closed a strategic funding round of $10 million — led by Hashed — to support the Sonic Foundation. This round included participation from UOB Ventures, Signum Capital, Aave Foundation, and several angel investors including Stani Kulechov, Robert Leshner, Michael Egorov, Fernando Martinelli, Tarun Chitra, and Sam Kazemian.

- Official Link: https://fantom.foundation/

3. [Chain] RWA Layer 2 Plume Network raises $10 million seed round led by Haun Ventures.

Plume Network, a modular Layer 2 network focused on bringing real-world assets (RWAs) on-chain, has raised $10 million in a seed funding round led by Haun Ventures. Other investors in the round included Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures, Plume said Thursday. Angel investors, including Anthony Ramirez of Wormhole Labs, Calvin Liu of Eigenlayer, Ezaan "Zon" Mangalji of Initia, Andrew Kang of Mechanism, Jeff Feng and Jayendra Jog of Sei Network also participated.

Founded earlier this year, Plume Network previously raised $2 million, co-founder and CEO Chris Yin told The Block. The startup then began talks with investors in April to raise more funds and ended up raising four times more than planned, closing the round earlier this month, Yin said.

- Official Link: https://www.plumenetwork.xyz/

4. [Infra] Stripchain raises $10M to simplify blockchain user experience.

Stripchain allows developers to create commands called intents to perform actions like transferring data between blockchains. Based on a system called stripVM, it will enable applications to communicate and coordinate with different protocols. Sora Ventures led the Stripchain funding round, which included angel investors Santiago Santos, Frontier Research’s Stephane Gosselin, Messari’s Ryan Selkis, as well as venture capital firms Hyperithm, Shima Capital, Hypersphere, Mechanism and Ascensive Assets.

User experience (UX) continues to be a big challenge in the crypto industry, posing a barrier to adoption across different generations. For many crypto users, the ability to perform on-chain transactions without worrying about which network is used would be a valuable UX upgrade — and some crypto startups want to answer this call. The idea that users should not realize when using blockchain, or chain abstraction, is one of the promises for a better Web3 experience. This concept drives Stripchain, an interoperability protocol that recently raised $10 million to enable chain abstraction at scale.

- Official Link: https://twitter.com/Stripchain

See you next week! 🙌